TBR Launches Cloud Voice of the Partner

Technology Business Research, Inc., is pleased to announce the launch of our Cloud Voice of the Partner report.

Major cloud platforms Amazon Web Services, Microsoft Azure and Google Cloud are positioning themselves at the center of the new cloud-centric ecosystem. With billions of dollars and significant growth at stake, it is critical for hyperscalers, ISVs and systems integrators/managed service providers to improve the effectiveness of their alliance strategies.

The Cloud Voice of the Partner report deep dives into the current state of the ecosystem from each participant’s perspective and highlights winning strategies for capitalizing on the growing opportunity. Analysis is segmented by cloud vendors, ISVs and SIs/MSPs. Covered vendors include Accenture, Alibaba, Amazon Web Services, Boston Consulting Group, Capgemini, Cognizant, Databricks, Deloitte, DXC Technology, EY, Google, HCLTech, IBM, Infosys, KPMG, McKinsey & Co., Microsoft, Oracle, PwC, Red Hat, Salesforce, SAP, ServiceNow, Slalom, Snowflake, Tata Consultancy Services and Wipro.

The first publication of Cloud Voice of the Partner is now available on TBR Insight Center™. If you believe you have access to the full research via your employer’s enterprise license or would like to learn how to access the full research, click here.

Cloud Voice of the Partner Excerpt

The emerging GenAI opportunity is exacerbating the challenges of partnering within the hyperscaler ecosystem

There is still company in alliances

- The value of multiparty alliances is clearly resonating within the ecosystem and with end customers. The prospect of more deals, higher close rates and greater go-to-market efficiency is compelling for all categories of IT providers. And for customers with services, hyperscaler and ISV solutions, the track record of successful implementations is of tremendous value.

- Despite that clear value for all stakeholders, managing multiparty alliances remains challenging, and most vendors struggle to consistently take this type of joint go-to-market approach. This episodic approach to multiparty alliances will likely persist.

The ecosystem is busily preparing for the GenAI opportunity

- For the majority of IT providers, the generative AI (GenAI) opportunity has yet to be realized. Hyperscalers, through alliances with model leaders like OpenAI, have already seen some tangible growth benefit of GenAI, though the bulk of the opportunity still lies ahead following large investments.

- Professional services providers and ISVs are busily adding GenAI capabilities and widely marketing skills in the area but are still struggling to fully capitalize on the opportunity in a meaningful way.

- The stifling hype around and slow monetization of GenAI are not stifling investment, however, and 57% of respondents believe AI and GenAI will be the leading area of growth over the next three years. Hyperscalers view partnering with vendors that offer service capabilities and GenAI solutions as the best way to capture that opportunity.

Commercial models are in flux, but monetization remains the most important ecosystem metric

- Across all partner types in the ecosystem, measurements of opportunity, deals and revenue are the most important partnerships metrics. The current AI-related state of flux as well as shifts in customer investment patterns are stressing the traditional commercial models.

- With a limited number of GenAI best practices, end customers are leery of engagements with uncertain ROI, leading to a desire for outcomes-based pricing models or hyperscaler funding of services delivered by systems integrators (SIs).

- Even hyperscalers and ISVs are struggling with commercial models that properly align the monetization of core underlying offerings with new AI and GenAI technologies. In this environment, flexibility is the most critical aspect of pricing strategies as best practices emerge.

Partners remain hopeful about GenAI opportunity but still need to build trust through monetization

Key takeaways

1) Although GenAI is dominating partnership activities, the technology’s actual revenue contribution remains insignificant.

“Executives are obsessed with GenAI. If you are not articulating how GenAI will be used in a project, you’re not even in the conversation. It has become the elephant in the room with customers, partners and hyperscalers alike.” — Senior Partner Sales Leader, Hyperscaler

“I haven’t seen it [GenAI] significantly shift anything. I think we’ve probably added more partners just because the OpenAI and Perplexities of the world are becoming more relevant, but none of the old legacy systems are going away, because there’s still you know, 99.9% of companies have a lot of legacy systems in place that are going to continue to need support and maintenance and migration in the future.” — Director, Client Partner, SI

2) Cloud providers have done a better job of reducing competition with partners, but it still happens, particularly at the field level.

“Hyperscalers officially say they don’t compete with partners, but at the field level you still see bad behavior. A [AWS] ProServe team or a sales rep can undercut a partner, and when it happens it creates a lot of noise and frustration.” — [Hyperscaler] GTM Lead, GSI

3) Everyone believes trust and transparency are key to a successful alliance, but cloud vendors place a lot of weight on more tangible factors, like pricing and coinvestment.

“Gone are the days where partners were able to just get by on a handshake relationship. These companies are really investing in resources and teams to ensure that their sellers are being the most effective and working with the right partners that are making an impact on the business.” — SI Partner Program Lead, ISV

4) When three parties are involved, win rate and deal size potential increase, but orchestrating these relationships remains a challenge, largely from a sales perspective.

“A triparty-type opportunity pulled off successfully, it’s typically a much larger deal size, but because of the complexity of operating between those several entities, you don’t see as many of them happening unless it’s something that’s been, you know, very plug-and-play, you know, easy licensing.” — Partner Development Manager, ISV

Trust built on delivery, alignment and collaboration enables vendors and partners to present unified strategies and win complex enterprise deals

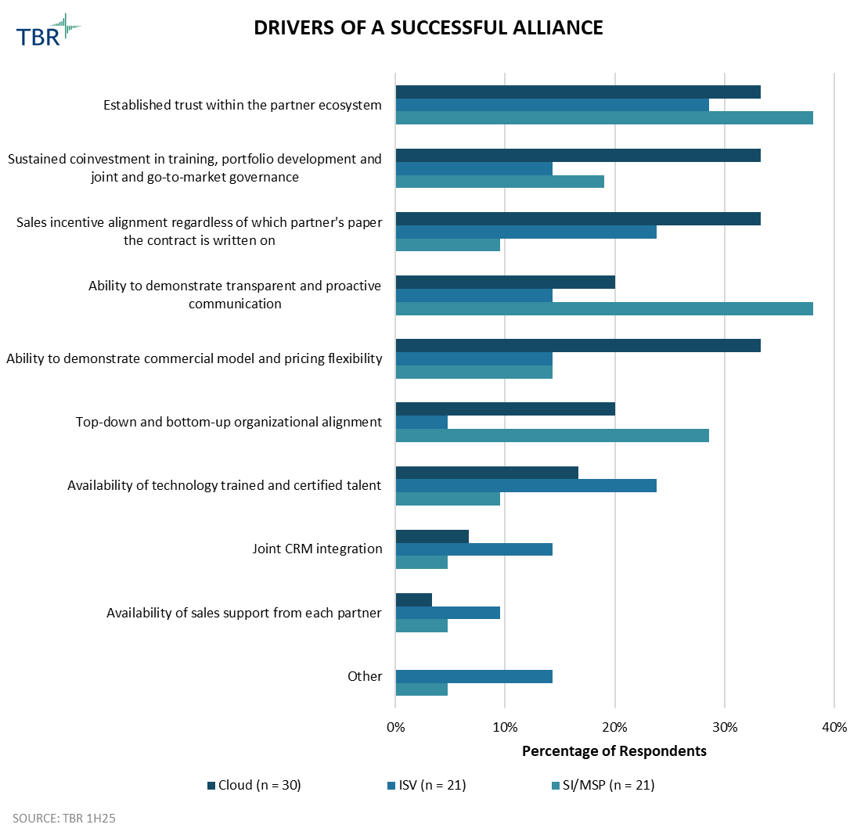

Drivers of a successful alliance

- Across all vendors types, trust was deemed the most important attribute of a successful alliance. That said, compared to ISVs and SIs, cloud vendors value measurable drivers such as willingness to coinvest, alignment of sales incentives, and pricing model flexibility.

- Services vendors are leading the charge with outcome-based pricing, though these vendors are far from delivering this model at scale. Although we expect some SaaS vendors will continue exploring outcome-based pricing, at least as part of a hybrid model, the infrastructure vendors are not equipped to implement a similar strategy, suggesting a potential challenge ecosystem participants will need to navigate.

“They [SI partners] have experience doing successful implementations. They’ve got a bench of certified individuals who are ready to go and have the most up-to-date enablement on the product itself to ensure successful delivery. They’re actively looking at where has joint work happened, who are some of those joint customers? What does their regular consumption as well as contract value actually look like? And so those are some of a few data points that help round out that story to go and develop trust.” — SI Partner Program Lead, ISV

Technology Business Research, Inc.

Technology Business Research, Inc.

JLGutierrez, Getty Images via Canva Pro

JLGutierrez, Getty Images via Canva Pro Getty Images via Canva Pro

Getty Images via Canva Pro