Who Is the Market Leader in IT Services?

IT services leaders navigate choppy macroeconomic waters as discretionary spending tightens

Increased managed services activities around cost optimization and streamlined business processes and the recovering BFSI segment will help vendors alleviate revenue growth pressures in 2025

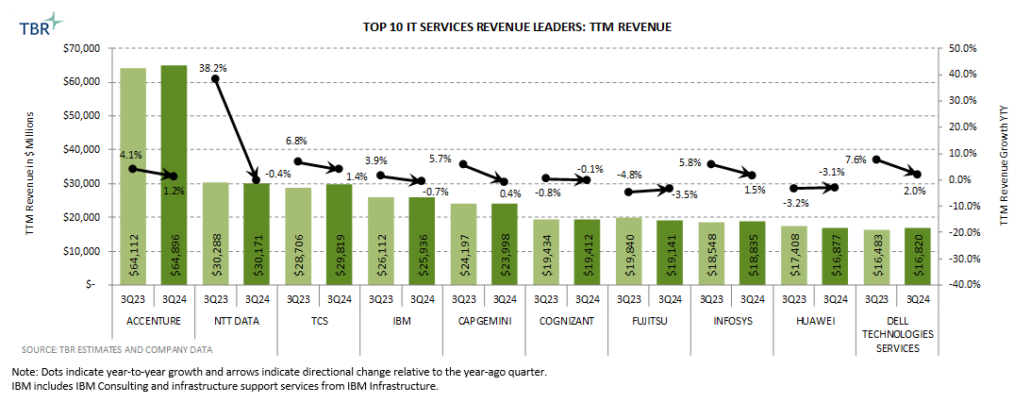

Due to tightened discretionary spending, the top 10 IT services revenue leaders continued to experience decelerating or declining trailing 12-month (TTM) revenue growth year-to-year in U.S. dollars during 3Q24. Accenture’s revenue landed above the midpoint of the company’s guided range, as Accenture leveraged its scale and broad-based functional and technology expertise across service lines to drive sales around helping clients build and manage secure foundations. Accenture’s FY24 total revenue growth of only 1.2% year-to-year — compared to 4.1% in FY23 and 21.9% in FY22 — reflects the choppy macroeconomic environment Accenture has been navigating, particularly in Accenture Strategy & Consulting, as buyers continue to limit discretionary spending.

At the same time, managed services enabled through Accenture Technology and Accenture Operations remains a strategic priority for clients seeking to drive cost optimization and streamline business processes, evidenced by Managed Services growth of 4.6% year-to-year in 3Q24 and 3.9% year-to-year in FY24.

Tata Consultancy Services (TCS), which currently ranks No. 2 in revenue in TBR’s IT Services Vendor Benchmark, has noted that clients remain cautious about spending, but the company’s solid internal execution has led to deal momentum across markets. Banking, financial services and insurance (BFSI), TCS’ largest revenue-contributing segment, is rebounding, which indicates a positive trajectory for the company heading into 2025.

IT services operating margins are stabilizing

Average TTM operating margin contracted for 4 of the top 10 category leaders

Operating margin performance is stabilizing in IT services, as just four of the top 10 margin leaders experienced year-to-year TTM operating margin contractions in 3Q24, compared to eight of the top 10 margin leaders experiencing margin contractions in 3Q23.

Infosys’ TTM operating margin declined 40 basis points year-to-year in 3Q24, landing within the guided range of between 20% and 22%. The use of generative AI (GenAI)-enabled sales automation tools, such as the Navi sales assistant, which accelerates time to insight, will help Infosys further improve utilization and decrease its reliance on sales support personnel. This will bolster the company’s margin, provided Infosys can withstand potential clients’ requests to lower pricing related to the use of automation.

TCS’ TTM operating margin improved 40 basis points year-to-year in 3Q24 as wage inflation appears to have leveled off and overall headcount remains stable. We expect TCS’ operating margin to remain in a similar range for the foreseeable future, as the company’s pricing flexibility, supported by its lower-cost resources, can help offset cost increases.

Wipro IT Services’ (ITS) TTM operating margin increased 10 basis points year-to-year in 3Q24 as the company benefits from operational improvements. While Wipro ITS faces pressures from furloughs and salary increases, it benefits from streamlined operations and a successful sales strategy to drive margin improvements. However, Wipro ITS’ margin performance might worsen as the company executes on training programs to build industry and technology capabilities in an effort to better work with clients, as well as expands its pool of AI experts, which currently consists of 44,000 employees.

IT services market outlook

Average revenue growth for benchmarked vendors will accelerate but also remain pressured due to macroeconomic challenges

TBR estimates IT services TTM revenue will increase slightly in 4Q24 compared to revenue growth of 0.1% in 3Q24 and a deceleration from revenue growth of 3.5% in 4Q23. Demand for greater productivity and lower costs continues to create digital transformation opportunities around finance and supply chain improvement, cloud modernization, and application development. Lingering pressures in discretionary spending negatively affected consulting activities and backlog realization in 3Q24, and this trend will continue in 4Q24. However, managed services activities are picking up speed as clients strive to optimize costs and streamline business processes.

TBR vendor spotlights

Accenture added $785 million in net-new revenue in FY24, the lowest amount since FY09 and FY10, following the financial crisis. We expect Accenture to improve performance and add over $3 billion in net-new sales in FY25. Maintaining a strong household name among IT buyers often comes at a price, with the company accelerating its acquisition activity to protect its turf. While Accenture has added new skills and IP that can help drive long-term organic revenue, the company’s acquisitions have also helped to buy short-term revenue growth as half of the projected expansion in FY25 will be due to inorganic contribution. Additionally, Accenture’s aggressive investment activity within the GenAI space has left partners and rivals wondering why Accenture is making so many acquisitions now when all vendors face similar challenges when it comes to securing the data quality needed to explore the full potential of the technology.

TCS’ core capabilities in integration, application and outsourcing services engagements sustain its healthy revenue growth levels. To reach the upper range of its revenue growth targets, TCS is strategically investing in GenAI capabilities. By initially focusing on lower-risk, high-volume applications like chatbots and virtual assistants, TCS is building a strong foundation of AI expertise. As GenAI matures in the market, the company aims to expand its offerings, positioning TCS to capitalize on the GenAI-related market opportunity and deliver enhanced value to clients. The company’s continued development of proprietary software and platforms aims to attract clients and support engagements as a foundational framework.

Access up-to-date IT services and consultancies data and analysis with a TBR Insight Center™ free trial. Try the platform today!

Kentoh, Getty Images Signature

Kentoh, Getty Images Signature

Technology Business Research, Inc.

Technology Business Research, Inc. Getty Images Signature

Getty Images Signature