Telecom Infrastructure Services Operating Margin Climbs as Shift to Maintenance Services Offsets U.S. Market Decline

Shift to Maintenance Services Bolsters Telecom Infrastructure Services Margins Amid 5G Deployment Declines and U.S. Market Contraction

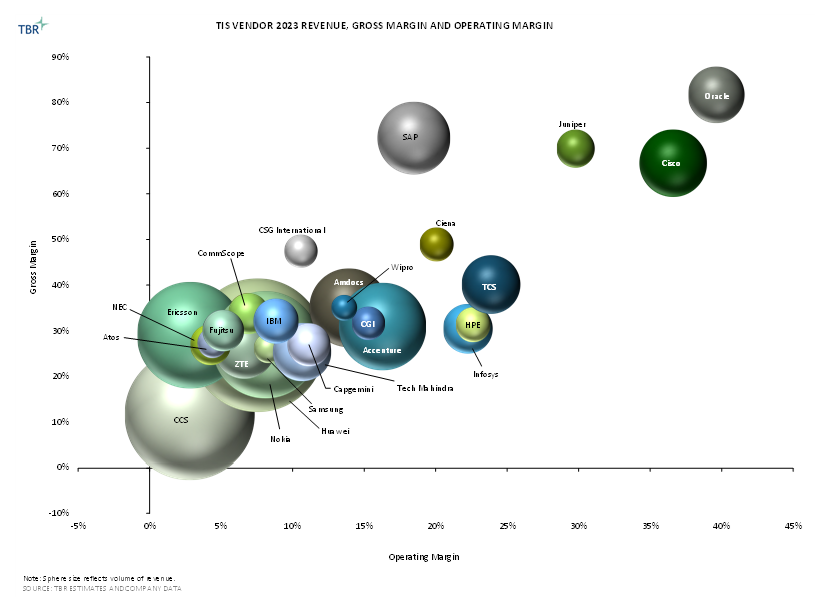

Despite India growing within the telecom infrastructure service revenue mix and the U.S. declining, TBR-benchmarked vendors’ average telecom infrastructure services operating margin increased 20 basis points year-to-year to 14.2% in 2023. TBR attributes the increase in large part to a shift in the telecom infrastructure services revenue mix from deployment services, which typically carry the lowest margins, to maintenance services, which tend to carry the highest margins among telecom infrastructure services segments.

The shift in business mix comes as communication service providers (CSPs) wind down their 5G coverage rollouts in the key countries of China, the U.S. and India and focus on densification. In late 2023 and 1H24, declining deployment activity in India is also helping to improve profitability as margins in the country can be relatively low. The 5G gear that vendors have built out in these and other countries in the past few years is leading to follow-on support revenue, which will enable maintenance services to be a relatively strong-performing segment among TBR-benchmarked vendors despite global decommissioning of legacy infrastructure.

Telecom Infrastructure Services Operating Margin Insights

Leading Vendors Remain Those with Large Bases of Hardware or Software Support Subscriptions and Those that Rely Heavily on India-based Labor

Operating margin leaders derive a smaller percentage of telecom infrastructure services revenue from deployment services, which are often provided at or below break-even margins and/or delivered by third parties. Leaders provide a high degree of support, including repeatable and remote services as well as consulting & systems integration services.

Automation, analytics, AI and machine learning will prove critical to helping vendors improve margins. Examples include portions of Nokia’s AVA (Analytics, Virtualization and Automation) portfolio and Ericsson’s Operations Engine. However, with a significant portion of revenue coming from deployment services, RAN-centric vendors will be unable to expand overall telecom infrastructure services margins significantly.

India-based IT firms such as Tata Consultancy Services and Infosys obtain high telecom infrastructure services margins due to favorable labor rate differentials between India and developed markets as well as the high degree of application development and maintenance services they provide to CSPs in developed markets. With over 40% of its workforce based in India, Accenture also benefits from this market dynamic.

Other IT services firms, such as Atos, have a smaller offshore workforce (about 32% based in India) and obtain lower margins as a result.

To access TBR’s historical and current telecom infrastructure gross margin data, start your free Insight Center™ trial today.

Ogichobanov, Getty Images via Canva Pro

Ogichobanov, Getty Images via Canva Pro

Technology Business Research, Inc.

Technology Business Research, Inc. Metamorworks, Getty Images via Canva Pro

Metamorworks, Getty Images via Canva Pro