IT Service Vendors Shift Focus to Operational Efficiency and GenAI Investments Amid Economic Uncertainty

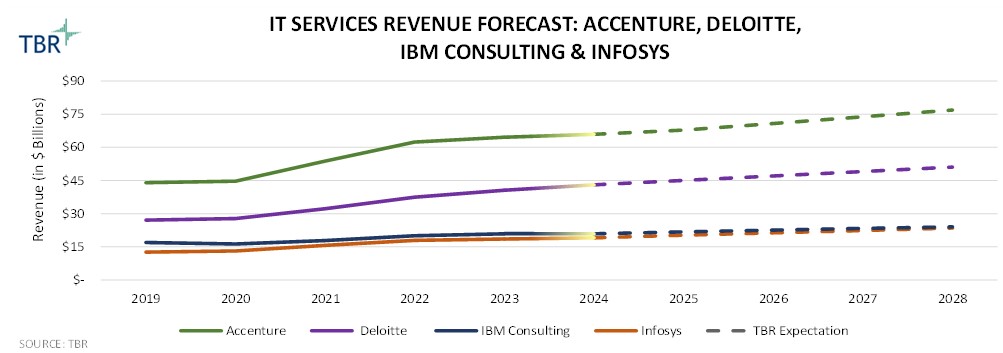

TBR Fourcast is a quarterly blog series examining and comparing the performance, strategies and industry standing of four IT services companies. The series also highlights standouts and laggards, according to TBR’s quarterly revenue projections. This quarter we are looking at Accenture, Deloitte, IBM Consulting and Infosys, including Accenture’s extensive investment in GenAI and IBM Consulting’s and Infosys’ risk of falling into a downward trajectory.

Vendors Ramp Up Optimization and Operational Efficiency Projects Amid Revenue Deceleration from Tight Client Discretionary Spending

IT services vendors currently face client discretionary spending headwinds, resulting in increasingly long decision cycles. According to TBR’s IT Services Vendor Benchmark, year-to-year revenue growth for the 31 vendors decelerated from 13.8% in 1Q19 and 8.6% in 1Q22 to 2.1% in 1Q24.

In response to these headwinds, Deloitte, IBM Consulting and Infosys are slowing their hiring pace and focusing on reskilling and upskilling existing professionals. Accenture will likely follow suit, although it currently maintains its skills-based hiring approach. A closer look shows that Accenture has started slowing organic hiring, but acquisitions are helping the firm offset some of the headcount growth deceleration. As part of its resource management strategy, Accenture is rotating the skills composition of its workforce with the goal of maintaining a large enough bench to meet booked demand while ensuring quality (bookings increased 22.1% year-to-year to $21.1 billion in FY3Q24, putting Accenture on track to reach $80 billion during FY24).

As discussed in detail in TBR’s quarterly reports, Accenture and Deloitte are expected to have uneven revenue growth through the remainder of 2024. Amid persistent macroeconomic uncertainty, every IT services company and consultancy is reporting greater customer interest in digital transformation and projects centered on cost optimization and operational efficiency. According to TBR’s December 2023 Digital Transformation: Voice of the Customer Research, “Improving IT operations remains the top DT [digital transformation] initiative for most buyers, but this objective is reaching maturity as more buyers are in the true Transformation stage and are now focusing on extracting benefits from existing assets.”

Investments in Industry Expertise and GenAI Will Position Vendors for Growth in the Market

Not surprisingly, IT services companies are investing in generative AI (GenAI) and industry expertise to capitalize on growth opportunities as they must demonstrate knowledge in both of these areas to stand out among competitors.

In TBR’s view, Deloitte and Accenture have invested extensively in industry expertise and GenAI compared to other vendors and have done well in marketing themselves as leaders, helping them better position for near-term growth in demand for operational efficiency and longer-term opportunities around GenAI governance. Deloitte’s broad portfolio and training investments closely align with many of its IT services peers, which is not surprising, given the firm’s position within the value chain.

To differentiate, Deloitte’s release of industry use cases as a thought leadership platform is a striking contrast to the approach of its most immediate rival, Accenture, suggesting Deloitte will stay true to its industry-wrapped, consulting-led value proposition. Accenture’s release of its useful “switchboard” tool, which helps clients select the best foundational model for their needs, aligns well with Accenture’s technology heritage.

Similar growth pathways are not out of reach for IBM Consulting and Infosys. The former could utilize tuck-in acquisitions to drive specialization and continued collaboration with technology partners and academia to support portfolio build-out and strengthen its position in the market. At the same time, IBM Consulting could leverage hybrid cloud and AI solutions, its incumbency with clients, and its ability to deliver small and large projects at scale to expand wallet share. Meanwhile, Infosys will continue to execute on its strategy to pursue large-scale deals as the company recalibrates and enhances its portfolio offerings to address buyers’ needs. The recent acquisitions of InSemi and in-tech highlight Infosys’ efforts to add skills and capabilities in areas such as chip design and product engineering, supporting the company’s goals of expanding wallet share and capitalizing on its existing relationships while gradually drifting away from commoditized portfolio areas.

If Vendors Fall, They Will Fall for Different Reasons but Will Have Similar Outcomes

What Could Go Wrong?

In the worst-case scenario, IBM Consulting’s and Infosys’ revenue could begin to take a negative trajectory for similar reasons: drifting away from hybrid cloud and AI (IBM Consulting) and away from services in pursuit of GenAI-related software licensing sales (Infosys).

Unsurprisingly, Deloitte could face quality issues related to its overemphasis on growing the firm’s IT services offerings. In contrast, according to TBR’s 2Q24 Accenture report view, an Accenture slide could come from accelerated GenAI adoption, pressuring “Accenture’s legacy applications and business process management services so much that it cannibalizes revenue to a greater extent than originally anticipated.”

For all four vendors, a loss of trust could lead to client retention issues, which would accelerate any downward momentum. To be clear, TBR does not expect any of these companies will experience their worst-case scenarios, but the market pressures and potential for strategic mistakes remain entirely real.

Conclusion

TBR expects IBM Consulting will be the growth leader among this foursome yet will likely continue to trail the overall IT services market, absent a massive GenAI-induced upheaval. Accenture and Deloitte continue to be best positioned to outperform TBR’s projections, although Infosys has been a surprisingly strong player in the market over the last couple of years, reflecting its strong leadership.

To access years of full analysis and proprietary TBR datasets for Accenture, Deloitte, IBM Consulting and Infosys, sign up for your TBR Insight Center™ free trial today!

Liulolo, Getty Images via Canva Pro

Liulolo, Getty Images via Canva Pro

Airdone, Getty Images via Canva Pro

Airdone, Getty Images via Canva Pro Umnat Seebuaphan, Canva Pro

Umnat Seebuaphan, Canva Pro