Hardware-centric Vendors Continue to Make Their Move Into Software

Hardware vendors are diversifying their portfolios to drive higher software attach rates, while software-centric vendors like Microsoft and Oracle greatly prioritize cloud-native software

Over the past several years, the cloud software components market has shifted. Microsoft and Oracle are no longer dominating the market as they prioritize their native tool sets and encourage customers to migrate to public cloud infrastructure. Driven largely by weaker-than-expected purchasing around Microsoft Windows Server 2025, aggregate revenue growth for these two software-centric vendors was down 3% year-to-year in 3Q24.

Over the same compare, total software components revenue for vendors covered in TBR’s Cloud Components Benchmark was up 14% in 3Q24 and total cloud components revenue was up 8%. In some ways, this dynamic has made room for hardware-centric vendors such as Cisco and Hewlett Packard Enterprise (HPE) to move deeper into the software space, particularly as they buy IP associated with better managing orchestration infrastructure in a private and/or hybrid environment.

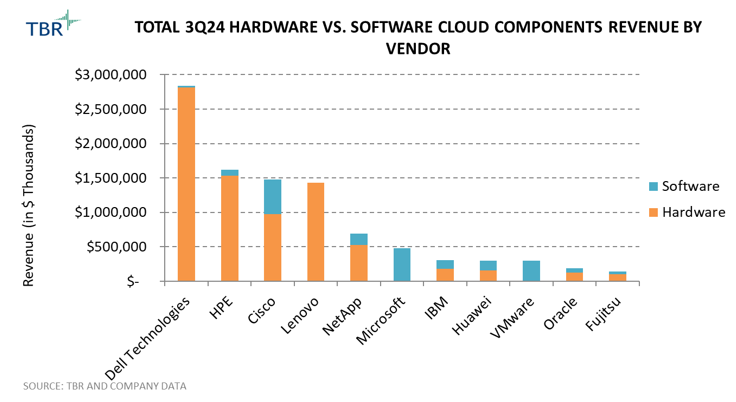

Though revenue mixes are increasingly shifting in favor of software, driven in part by acquisitions (e.g., Cisco’s purchase of Splunk), hardware continues to dominate the market, accounting for 80% of benchmarked vendor revenue in 3Q24. Industry-standard servers being sold to cloud and GPU “as a Service” providers are overwhelmingly fueling market growth, more than offsetting unfavorable cyclical demand weakness in the storage and networking markets.

This growth is largely driven by the translation of backlog into revenue, but vendors are still bringing new orders into the pipeline, which speaks to ample demand from both AI model builders and cloud providers. However, large enterprises are increasingly adopting AI infrastructure as part of a private cloud environment to control costs and make use of their existing data.

Key takeaways

Average cloud components revenue growth among benchmarked vendors accelerated to 26.2% year-to-year in 3Q24. Hardware leaders like Dell Technologies and Lenovo continued to benefit from strong hardware demand.

Cisco’s acquisition of Splunk is greatly bolstering the company’s top line, though it is not enough to offset challenges the company continues to face in its networking business.

Ongoing strength in AI demand from services providers continues to offset relatively weak demand from enterprises; however, enterprise AI demand is expected to grow materially in 2025

Despite ongoing cyclical weakness in the data center networking market, strong demand for cloud services, including those supporting AI and generative AI (GenAI) workloads, drove 28.1% year-to-year growth in benchmarked cloud components hardware revenue during 3Q24. Many organizations have been hesitant to deploy AI infrastructure on premises as they continue to evaluate the optimal methods and architectures to handle workloads tied to the rapidly developing technology.

As such, many organizations have been leveraging cloud services for their AI and GenAI workloads, but as the technology matures and new applications are developed, TBR expects organizations will increasingly embrace hybrid AI, leveraging public cloud services and AI deployments on premises both in the core data center and at the edge, which will continue to drive robust demand for cloud components hardware.

Cloud hardware components segment vendor spotlights

Dell Technologies

Dell Technologies continued to lead all benchmarked vendors in terms of cloud hardware revenue scale in 3Q24. While TBR estimates Dell’s cloud revenue expanded across all three hardware segments in 3Q24, Dell’s growth was most robust in the cloud server segment, where the company remains a leader among its OEM peers due to its brand legacy and its strong relationship with key suppliers, such as NVIDIA, and large-scale buyers, including enterprises and services providers.

Lenovo

With manufacturing facilities around the world and ODM-like capabilities unmatched by its infrastructure OEM peers, Lenovo is uniquely positioned to take advantage of demand from cloud services providers. These types of deals often require custom design and engineering components and are high volume but low margin by nature, driving Lenovo’s near triple-digit year-to-year aggregate cloud hardware growth. It is worth noting these deals with cloud services providers center on Lenovo storage and compute servers.

IBM

While IBM’s proprietary servers, such as the Power lineup, continue to be favored by certain industries for specific mission-critical and data-intensive workloads, such as SAP HANA and S/4HANA, organizations are increasingly prioritizing spend on industry standard infrastructure for both accelerated and traditional computing to support next-generation AI workloads. As such, IBM’s benchmarked aggregate infrastructure and cloud hardware revenues have both suffered due to falling sales.

TBR’s cloud research

TBR’s Cloud & Software market and competitive intelligence research gives clients a true understanding of how technology and business strategies are being used by leading vendors to address the growing desire for cloud-enabled solutions. Our unique research in this space includes financial data that goes beyond just reported data, revenue and growth benchmarks, go-to-market analysis, ecosystem and partnership teardowns, and market sizing and forecasting.

Vendor and market coverage in TBR’s cloud research stream includes, but is not limited to, Accenture, Amazon Web Services, Google, Microsoft, Oracle and SAP as well as cloud and software applications, cloud infrastructure and platforms, cloud data and analytics, and the cloud ecosystem.

Download a free preview of TBR’s latest cloud research: Subscribe to Insights flight today!

Husein Signart

Husein Signart

Doughlas Rising, Getty Images Signature

Doughlas Rising, Getty Images Signature Geopaul, Getty Signatures Image

Geopaul, Getty Signatures Image