Global IT talent: Accelerated hiring for IT services counters persistent attrition

In the most recent edition of TBR’s Global Delivery Benchmark, one particular number leapt out as both surprising and indicative of the sustained battle for technology talent: 500,725

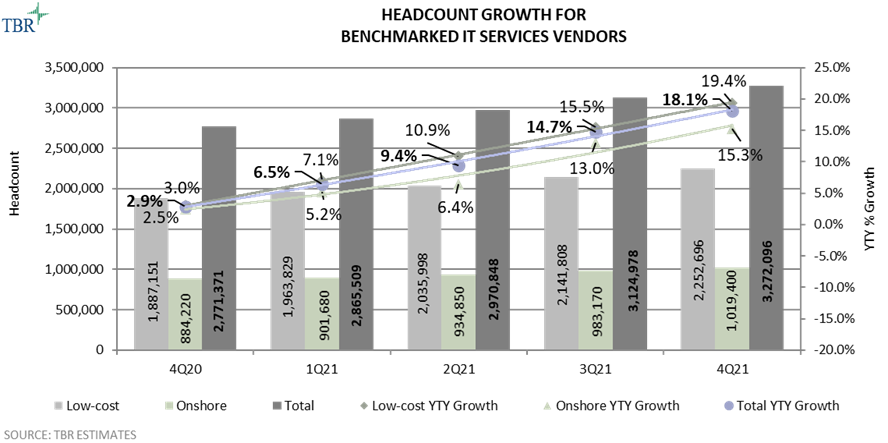

Almost one-third of over 1.7 million hires happened in the last 12 months

The 14 benchmarked IT services vendors have added a total of 1,706,755 workers since the inception of the Global Delivery Benchmark in 4Q11, with 500,725 of these additions occurring in the last 12 months. The aggressive expansion occurred across regions as vendors raced to compete for talent to meet demand and ensure they are not leaving money on the table. The fairly even pace of hiring in onshore versus low-cost locations suggests vendors are trying to reconfigure their staffing pyramids to strike the right balance between in-person, hybrid and fully remote work as they aim to appeal to a broader pool of recruits with different values.

While vendors still invest in low-cost hubs to capitalize on the pricing arbitrage, rapidly increasing wages diminish initial benefits, compelling vendors to either seek alternative countries outside well-known destinations or scout for talent in Tier 2 and Tier 3 cities. Working in HR for an IT services giant has never been harder.

With most countries now reopened, vendors are once again investing in local resources to rekindle interests around new portfolio offerings through face-to-face interactions, resulting in an uptick in onshore headcount additions. With the war in Ukraine raising concerns around globalization, we expect vendors to double down on their localization programs to demonstrate culture affinity and build trust.

As central banks increase interest rates to combat inflation, this could result in a global recession, thus stalling hiring. The value of cloud-enabled business models lies in the ability to lower total cost of ownership. A potential recession could put that promise to the test. In either scenario, vendors’ resource strategies will face a new set of challenges.

Who did all that hiring?

Accenture and Tata Consultancy Services (TCS) led in terms of net-new headcount in 4Q21 compared to 4Q20, with the former adding 160,040 employees and the latter adding 87,725. While a slew of acquisitions — 46 transactions in FY21 — influenced Accenture’s total headcount, TCS stuck to its organic approach to expand its resource base. While each strategy seemed to work for the respective vendor, given strong revenue performance momentum, Accenture’s scale and pace of skills rotation often raise questions around execution quality. At the same time, TCS’ organically built culture pressure-tested the company’s innovation and portfolio modernization readiness.

Capgemini came off high growth in 4Q20, which was largely fueled by the purchase of Altran, but the company does not shy away from taking advantage of market consolidation opportunities to fill portfolio gaps. The purchase of U.S.-based VariQ added 200 employees to Capgemini’s roster and expanded its software development, cybersecurity and cloud capabilities for the U.S. government sector. At the same time, the acquisition of Australia-based Empired Limited, which had 1,100 employees, improves the company’s skills in digital, data, cloud and Microsoft technology products. Infosys, HCL Technologies (HCLT) and Wipro continue to balance their localization efforts with aggressive hiring largely focused on freshers. Following its previous announcement of plans to double its workforce to 4,000 in Canada by 2023, Infosys publicized the opening of a 500-seat delivery center in Toronto. HCLT plans to hire 12,000 people in the U.S. over the next five years, most recently opening a 500-seat delivery center in Hartford, Conn.

What is the Global Delivery Benchmark?

TBR publishes a semiannual assessment of 14 leading IT services vendors’ resource strategies, benchmarking headcount and management metrics, highlighting trends across geographies, and contrasting the performances of different vendor types. TBR believes services remains a people-centric business, even as delivery increasingly includes automation, and the Global Delivery Benchmark provides a track record for how leading vendors manage their human resources and where they place their bets for future staffing and delivery demands. To access the latest Global Delivery Benchmark, start your free trial of TBR Insight Center™.