Deployment Services in Telecom Face Post-5G Slowdown, Shifting Market Dynamics and Growth in Fiber Expansion

Current state of deployment services in the telecom industry

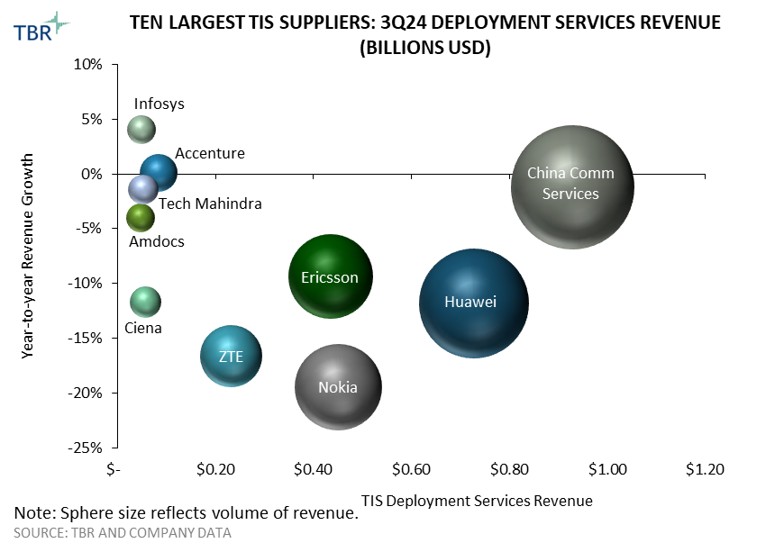

With deployment services growth tied to 5G rollouts in large markets — notably India, China and the U.S. — most vendors in TBR’s Telecom Infrastructure Services Benchmark saw segment revenue decline in 3Q24 as these markets are in post-peak 5G spend territory. The pace of India’s aggressive 5G build has decelerated since 4Q23. Ericsson outperformed its closest peers due to its Cloud RAN deployment for AT&T.

The deployment services market faces growing headwinds, including communication service provider (CSP) consolidation, open vRAN’s lower installation costs, and reduced demand for site location and construction (SL&C), offset somewhat by hyperscaler spend and 5G rollouts in select developing markets. Hyperscaler investments provide incremental volume to the market, and TBR notes these companies are increasing their investments in access technologies (e.g., Google Fiber).

Over the past few years, Ericsson, Nokia and Tech Mahindra have deemphasized deployment services to improve telecom infrastructure services (TIS) margins, and other vendors have similarly reduced their own exposure to labor-intensive deployment, especially as wage inflation accelerates. Ericsson outsourced field services in the U.S. to Authorized Service Providers effective Oct. 1, 2023. This could drive more field installation work to third-party construction firms, such as Dycom and MasTec.

5G RAN projects drive investment in optical transport for fronthaul, midhaul and backhaul, as well as the core network. Ciena, most notably, has capitalized on this trend. Part of the rationale for Nokia’s acquisition of Infinera is to gain greater exposure to this domain.

CSPs have deferred 5G core investment in general because they do not see a clear path to ROI and standards that would enable new features for the network, especially those that pertain to B2B, have been delayed. The ability to deploy 5G-Advanced services will spur only incremental growth in this area of the market.

TBR expects fiber deployment will increase in 2025 and 2026 as broadband services are extended to unserved and underserved areas globally, with government funds supporting CSP efforts in this area, especially in the U.S.

China-based leaders’ TIS revenue declined as domestic 5G RAN rollouts slowed; Nokia’s revenue decreased due to reduced activity in India and lower market share in the U.S.

Deployment services leaders

Revenue leader: China Communications Services (CCS)

CCS derives most of its deployment services revenue from the network infrastructure domain but is increasing its exposure to data center deployments to diversify. The supplier is taking market share from smaller competitors in China as well as Huawei and ZTE. CCS is aligned with and has benefited from the Chinese government’s Belt and Road Initiative, which supports international revenue.

Revenue declined year-to-year in 3Q24 as 5G deployment activity in China lessened, partially offset by CCS increasing its account share from its largest customer, China Telecom. TBR believes CCS’ installation work as part of 5G RAN builds is transitioning to maintenance. CCS is increasingly deploying gear in international markets such as MEA, particularly Saudi Arabia and CALA, though volumes in this region pale in comparison to the company’s presence in China.

Growth leader: Hewlett Packard Enterprise (HPE)

Deployment is a noncore area of HPE’s TIS business as the company is much more concerned with monetizing maintenance services. HPE largely leaves deployment to its partner base.

TBR believes HPE participates in some server installs for CSP clients adopting its hardware as part of open and/or virtualized RAN deployment, such as for Telus in Canada.

Telecom infrastructure services market overview

TIS revenue continued to shrink outside North America in 3Q24 while operating margins sustained recovery

Aggregate TIS revenue among benchmarked vendors declined 2.8% year-to-year in 3Q24, falling across all segments and regions, with the exception of North America, which grew 1.9% year-to-year. North America growth was largely due to favorable comparisons to 3Q23, when aggregate revenue declined 12.9% year-to-year, but also because of AT&T’s open RAN deployment and hyperscaler investments in optical projects.

Conversely, several vendors, including Nokia, Ericsson, Samsung and Ciena, are seeing sharply lower revenue in APAC as India’s CSPs reduced investment following 5G RAN rollouts by Reliance Jio and Bharti Airtel. Huawei and ZTE are also seeing revenue in APAC decline due to loss of share in India as their installed bases of LTE and optical equipment are replaced by equipment from trusted vendors, as well as lower spend on 5G RAN deployments in China, which peaked in 2022.

As CSPs wind down 5G coverage rollouts in China, the U.S. and India in favor of densification, TIS operating margins are growing. Declining deployment activity, which tends to carry the lowest margins among TIS segments, in these markets — especially India — is the main driver of improving TIS operating margins. In 3Q24 deployment services constituted 18.2% of aggregate revenue, down 120 basis points year-to-year. Meanwhile, maintenance services, which tend to carry the highest margins among the TIS segments, grew to 34.2% of aggregate revenue, up 80 basis points year-to-year.

Benchmarked vendors’ aggregate TIS operating margin increased year-to-year for the fourth consecutive quarter, following six consecutive quarters of declines. Aggregate operating margin grew from 11.1% in 3Q23 to 12.4% in 3Q24. TBR expects aggregate TIS operating margin gains to continue into 2025 despite an anticipated rebound in TIS revenue in India (where margins are typically low) as new RAN agreements that Ericsson, Nokia and Samsung have with Vodafone Idea and Bharti Airtel come online, due to the relatively smaller scale of these contracts compared with initial coverage rollouts by Bharti Airtel and Reliance Jio. In addition, TBR believes the digital transformation market will recover as CSPs receive clarity on M&A, driving high-margin professional services revenue for several IT services vendors. Further, AT&T’s open RAN rollout will peak in 2025, though it will continue through at least 2026, and margins in the U.S. tend to be higher than in other countries.

TBR’s Telecom Infrastructure Services Benchmark

Telecom infrastructure services includes all external spend (capex and opex) on services by communication service providers (CSPs), including telcos, cablecos and hyperscalers, on or related to communications and IT infrastructure. For our Telecom Infrastructure Services Benchmark, TBR categorizes TIS revenue into four main segments: deployment services, professional services, maintenance services and managed services.

Vendor coverage for this research includes, but is not limited to, Amdocs, CGI, Ciena, Ericsson, Fujitsu, Infosys, Juniper, Nokia, Oracle, Samsung, Tech Mahindra and ZTE.

Download a free preview of TBR’s latest telecom infrastructure services research: Subscribe to Insights Flight today!

Numforest, Getty Images

Numforest, Getty Images

Metamorworks, Getty Images Pro

Metamorworks, Getty Images Pro Mozcann, Getty Images Signature

Mozcann, Getty Images Signature