Bad Debt Expenses Will Rise for CSPs in 2026

The telecom industry will adapt to a K-shaped economy in 2026

In a K-shaped economy that increasingly separates financial winners from losers, the majority of households and businesses on the lower arm of the “K” are under mounting financial strain and are finding it more difficult to pay their bills. As these economic pressures persist, communications service providers (CSPs) should expect bad debt expenses to continue rising, with the potential to meet, or even exceed, levels experienced during the Great Recession.

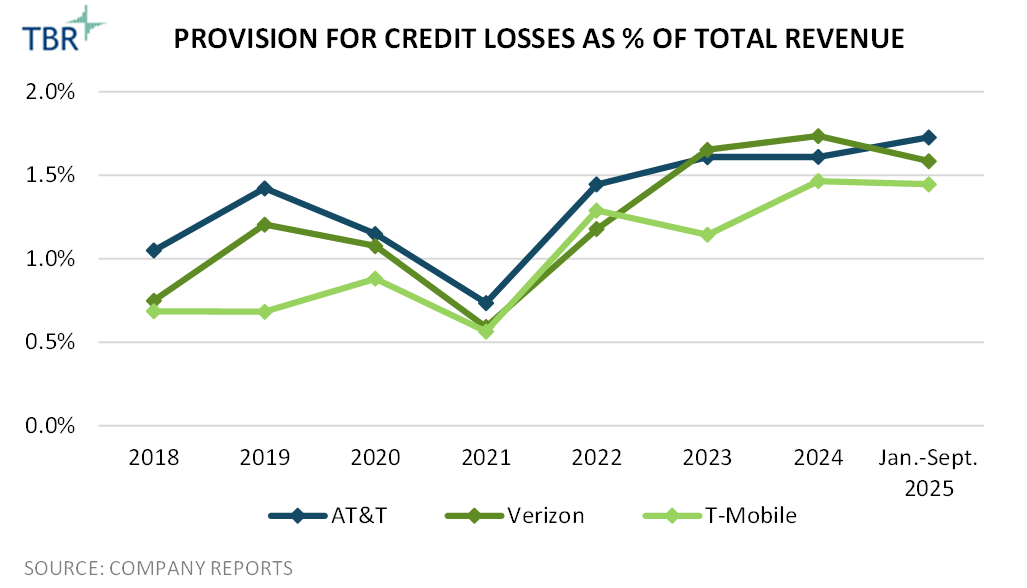

CSPs’ expenses related to bad debt have been steadily increasing since plunging to record lows during the height of the COVID-19 pandemic in 2021, when an unprecedented amount of government stimulus provided a financial windfall to households and businesses across the U.S. (and in many other countries through their respective stimulus programs), enabling many to improve their debt situations.

CSPs’ bad debts have now exceeded the mean of pre-pandemic, normal levels and are likely to reach levels unseen since the Great Recession. A key leading indicator of bad debt expense is what some operators report and refer to as “provision for credit losses,” which is the amount of money owed to CSPs that they expect to write off.

Several headwinds are occurring concurrently, which will push bad debt expenses higher for CSPs

- The resumption of student loan payments as of June 2025, which has made it more difficult for households to manage their finances, evident in the stark increase in subprime car loan delinquencies and a spike in home foreclosures

- Inflation increasing costs of basic life necessities and business needs

- Tariffs impacting consumers and businesses, feeding inflation and forcing tough financial decisions

- Job losses and a generally anemic job market (directly and indirectly, due to AI and general business restructurings and bankruptcies)

- Immigration policy changes — deportations and voluntary emigrations lead to unpaid bills, including phone and internet bills

- Interest rates remain high relative to the post-Great Recession new-normal level, making it more challenging to pay back interest-bearing loans

- Paring back of social safety nets — SNAP, WIC and other food security benefits, and government-provided or subsidized healthcare programs

- Bankruptcies surging across the business spectrum; bankruptcies can lead to restructured debt loads or partial or full nonpayment if the entity liquidates

Overall, most households and SMBs are increasingly struggling to pay their bills, as evidenced by essential expenses like car and mortgage payments becoming harder to manage. Because cars, homes, phones and internet service are essentials, bad debt expense is likely to continue rising through 2026, and telecom providers will feel the impact.

Explore additional predictions for the telecom industry in 2026 in our special report The Telecom Industry Will Aapt to a K-shaped Economy in 2026.

Technology Business Research, Inc.

Technology Business Research, Inc.