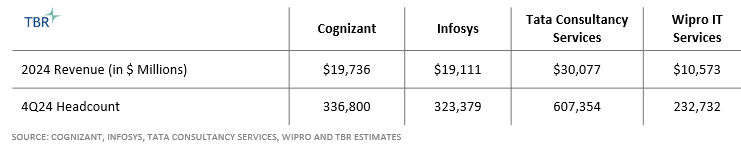

Infosys, Cognizant, TCS and Wipro ITS Double Down on Competitive Pricing Strategy While Trying to Enhance Client Engagement

TBR FourCast is a quarterly blog series examining and comparing the performance, strategies and industry standing of four IT services companies. The series also highlights standouts and laggards, according to TBR’s quarterly revenue projections. This quarter, we look at four India-centric vendors — Infosys, Cognizant, Wipro IT Services (ITS) and Tata Consultancy Services (TCS) — and analyze how investments in portfolios, training and innovation are positioning them for growth.

Although vendors experienced a small rise in discretionary spending among financial services clients in 4Q24, smaller deal wins, particularly those in consulting, remain infrequent, leading IT service vendors to reprioritize resources to align with market demand and invest in innovative and emerging technologies. India-centric vendors are leveraging competitive pricing enabled by largely offshore delivery, capitalizing on clients’ demand for cost optimization and operational efficiency.

According to TBR’s 4Q24 Cognizant report, “Amid an unfavorable sales environment, in which the procurement process is prolonged as IT buyers grapple with smaller budgets and additional layers of executive approval, Cognizant has increasingly relied on its legacy DNA as a low-cost IT services provider to compete on price. This approach is far from exclusive to Cognizant, as other India-centric peers such as Wipro ITS also compete on price. As part of this strategy, Cognizant has been increasingly engaging on a fixed-price basis, relying on automation to maintain margins on net-new accounts.” At the same time, many vendors outside India are executing on localization strategies to enhance client engagement and build signings.

A well-balanced portfolio with industry-specific solutions is key to enhancing client engagement

In addition to leveraging their low-cost pricing models, India-centric vendors will need to focus on deepening relations with clients to grow revenue. Applying emerging technology, such as AI and generative AI, to industry-specific solutions is allowing vendors to remain competitive by demonstrating competency as well as an in-depth understanding of clients’ needs. As localization strategies become more common, leveraging industry-specific solutions will be important for the India-centric vendors’ revenue growth.

All India-centric vendors are forming and expanding partnerships to accelerate the adoption of AI technology and expand client reach within and across verticals. For example, Infosys and NVIDIA released small language models (SLMs) for Infosys Topaz BankingSLM and Infosys Topaz ITOpsSLM, enabling enterprise data to be used over prebuilt SLMs, which help to facilitate the development of industry-specific use cases.

Similarly, TCS established the AI.Cloud business unit, highlighting the importance of integrated solutions that combine AI and cloud capabilities to maximize client value. This is further demonstrated by the creation of a dedicated NVIDIA unit within AI.Cloud to accelerate AI adoption across industries through tailored solutions leveraging NVIDIA’s technology.

Although partners are key to a strong go-to-market strategy, especially when introducing emerging technologies and deepening client reach, it is important for the India-centric vendors to differentiate their offerings. Partnering with leaders in AI and cloud, such as NVIDIA and ServiceNow, is vital to remaining relevant; however, developing proprietary solutions internally will be important to distinguish the India-centric vendors from each other. Infosys’ recent portfolio additions will support the company’s revenue growth.

For example, the company launched the Finacle Data and AI Suite for banking clients to use AI to improve the customer experience and IT systems. Since July, Cognizant has been diligently building out its Neuro suite, which supports the adoption of automation and AI. Cognizant launched Neuro edge, which is an update to Neuro AI and includes Cognizant Neuro Cybersecurity and a multi-orchestration agent; Neuro Stores 360; and a Neuro AI Multi-Agent Accelerator and Multi-Agent Service Suite.

Similarly, TCS is focusing on internal development alongside strategic partnerships, notably establishing the TCS GoZero Hub, a center researching net-zero carbon emissions solutions for Australian clients, and the TCS Responsible AI Framework. Proprietary portfolio offerings around in-demand technology, namely AI, cloud and security, provide vendors with credibility among buyers seeking a third party that can solve their current and future problems.

Investments around innovation and training development build credibility and attract more clients

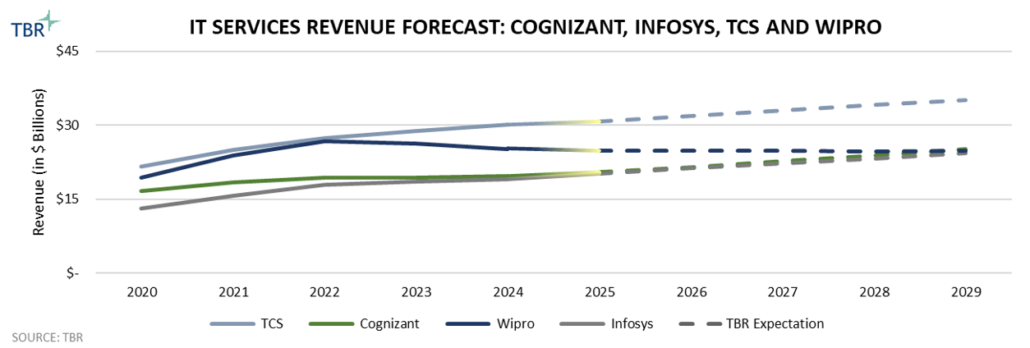

Cognizant, Infosys and TCS have been investing in building portfolios that balance partner-enabled and proprietary solutions. Meanwhile, Wipro ITS has relied heavily on partnerships to build its portfolio. Despite ongoing restructuring efforts, Wipro ITS continues to lag behind its India-centric peers in delivering in-demand and innovative solutions, especially those related to IoT and digital. Ensuring strong proprietary solutions requires vendors to continually invest in training development and innovation. Wipro ITS is investing in talent development to enhance its AI and digital skills and is increasingly hiring staff with skills in emerging technology. TBR believes these investments will boost Wipro ITS’ revenue performance but does not expect Wipro ITS’ performance to exceed that of Infosys and TCS.

Of the four vendors, Infosys provides perhaps the best example of how to invest in talent and innovation. The company is establishing a center in Kolkata, India, and will staff it with employees who have skills in cloud, AI and digital across industries. Beyond training, Infosys has expanded its innovative efforts by establishing an incubator and encouraging employees to bring forward ideas. Infosys’ training and incubator efforts will help propel the company’s growth. Likewise, TCS added freshers to the company in 2024 and will continue to do so in 2025, while remaining vigilant about the company’s cloud and AI training.

Given Infosys’ and TCS’ linear revenue growth models, their future performance continues to rely heavily on how well hiring, training and reskilling initiatives are executed, particularly around cloud and AI. The companies that remain more focused on employees and innovative capabilities can ensure that quality services are delivered to clients, allowing them to stay competitive and expand revenue share. In contrast to Infosys and TCS, Cognizant is ramping up its efforts to retain employees more reactively through rehiring former employees and increasing wages. Cognizant’s less pervasive training and innovation efforts could hurt long-term revenue growth, thereby aiding Infosys in its efforts to surpass Cognizant in revenue size, even with Cognizant’s recent acquisition of Belcan.

Improving revenue performance will depend on proactive go-to-market and resource management strategies

Ongoing and proactive investments in innovation, training around in-demand technology, and a balanced portfolio are key to competing for market share. Further, providing clients with industry-specific solutions from internal developments and having an in-depth understanding of partner-enabled and emerging technologies are vital to fueling revenue growth. In 4Q24 Infosys had the highest revenue per employee of the India-centric vendors, at $59,856, followed by Cognizant at $57,867, TCS at $49,600 and Wipro ITS at $45,812.

Wipro ITS could elevate its standing with investments in innovation and AI, enabling the company to develop more offerings internally and potentially secure more large deal wins. Cognizant and Wipro ITS could continue to trail behind Infosys and TCS in performance if they let service quality slip or do not continue to train employees on relevant skills. In addition to investing in innovation, training and portfolios, in the long term the four vendors would benefit from leveraging heavy India-based resources to help diversify revenue opportunities with local clients.

Aydinynr, Getty Images Signature

Aydinynr, Getty Images Signature

Your Photo, Getty Images Signature

Your Photo, Getty Images Signature Technology Business Research, Inc.

Technology Business Research, Inc.