PwC Embraces Business Model Change for Success in Connected Solutions and IoT

In early March, TBR met with Alec Massey, Principal, Connected Solutions, PwC US, to discuss recent developments, the overall state of the technology consulting market, and near-term expectations for Connected Solutions. The following is based on that discussion and TBR’s ongoing research on PwC.

Embracing Partners to Elevate the Value of Connected Solutions

PwC Connected Solutions has evolved in recent years to encompass an unexpectedly — for a Big Four professional services firm — broad set of offerings, ranging from sensors and hardware to network and cloud to dashboard analytics and reporting. Using a managed services business model, PwC Connected Solutions provides physical IoT sensors, using either a third-party’s hardware or a client’s existing technology.

The firm also installs the necessary connectivity for IoT solutions and provides configuration, testing and analytics, rounding out the IoT package. Massey shared extensive details about the firm’s technology capabilities, particularly about PwC’s patented Indoor Geolocation Platform, which has deployed in numerous hotels and casinos currently, and the firm’s Signal Graph analytics platform that uses AI and machine learning tools to draw insights from streaming time-series datasets. The firm has begun expanding its platform IoT solutions to the hospital sector and various opportunities in Mexico.

While TBR cannot evaluate the technological advantages of PwC Connected Solutions, one clear difference between the firm’s IoT practice and those of similar consultancies is PwC’s willingness to embrace the channel partner business model. According to Massey, the “channel partner model is an innovative concept for PwC where large technology firms are licensing our applications to sell and deliver to their clients.”

According to Massey, channel partners allow PwC to accelerate and scale into new markets that the Connected Solutions team has not prioritized. In TBR’s view, PwC’s decision to adopt a business model that is outside of the firm’s traditional approach but is prevalent in the IoT ecosystem reflects a strategic approach to meet technology partners where they are and meet their business model needs.

The Next Necessary Evolution: Operational Optimization

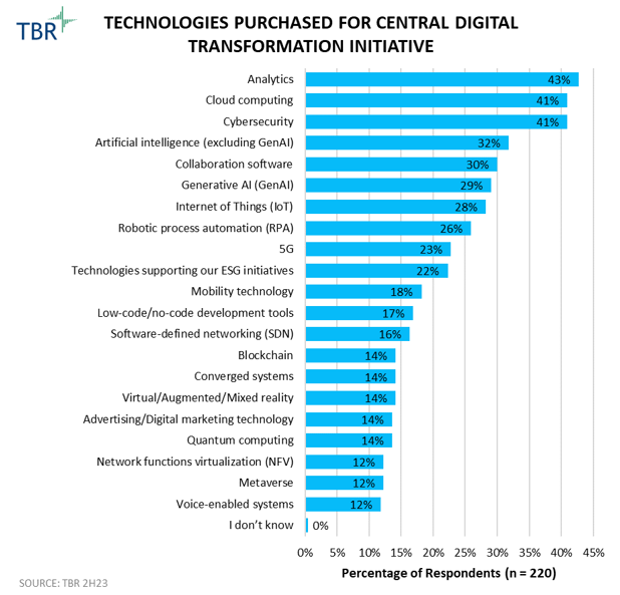

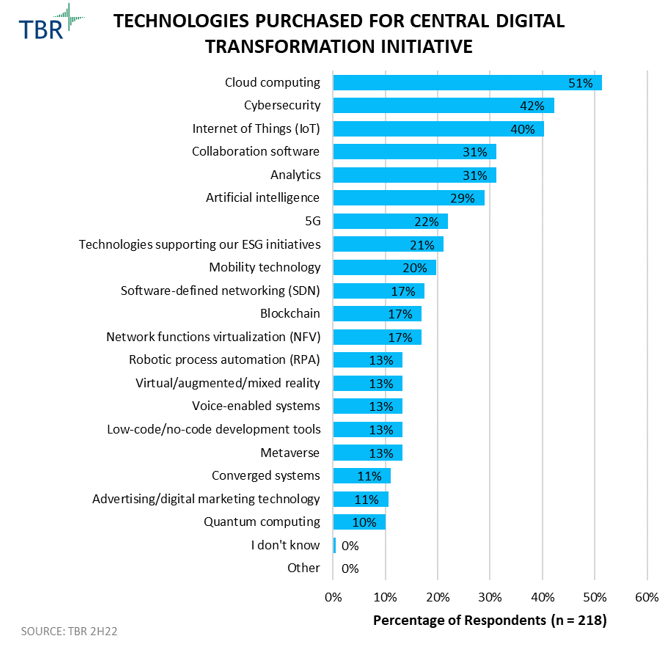

According to data from TBR’s December 2023 Digital Transformation: Voice of the Customer Research, IoT ranked No. 7 as a technology supporting buyers’ digital transformation (DT) initiatives in 2H23 (as shown in Figure 1), down from No. 3 in 2H22 (as shown in Figure 2). While generative AI (GenAI) has pushed down IoT as a priority investment area among enterprise buyers, we believe there is still plenty of potential for the technology to drive opportunities. A new set of stakeholders, including operational technology departments, are becoming comfortable with IoT, and this is particularly the case for more mature enterprises that are further along with their DT programs.

We believe customers and vendors are treating IoT as one of the technologies of DT through which an organization creates and executes a strategy around its current and future data assets. Operational departments plan for IoT to enable operational improvements and to contribute to organizationwide strategic DT plans. Overcoming the dichotomy around the perception of IoT lies in vendors’ ability to build use cases applicable to all ecosystem participants rather than developing pilot projects in a vacuum. Vendors such as PwC need to evolve their approaches and act more as operational optimizers as opposed to just operational visionaries.

Enabling PwC’s Steady Evolution

TBR has closely tracked PwC’s steady evolution from the staid, white-shoe accounting firm with budding consulting capabilities to the multifaceted professional services goliath with capabilities in cybersecurity, cloud, managed services and, increasingly, its own technology solutions.

Through development of its Connected Solutions capabilities and offerings, PwC is quietly expanding how the broader services and technology ecosystem perceives what kind of firm PwC is and what PwC can do. In TBR’s view, public perceptions — and possibly enterprise buyers’ perceptions — may remain mired in an accountancy-centric understanding of PwC, but the firm’s ecosystem partners that are selling, innovating and collaborating with PwC know well that the firm’s technology experience and capabilities extend well beyond previous limitations.

Take just one example from the discussion above: PwC now uses channel partners to extend its technology offerings to enterprises outside the firm’s usual clientele. Through that business model decision, PwC opens itself up to a wider technology ecosystem and extends its reach well beyond the firm’s traditional client base. Connected Solutions remains a relatively small part of the firm’s overall revenues, but PwC’s ongoing willingness to experiment with its business model bodes well for the firm’s continued growth, particularly in a tumultuous consulting and technology market.

TBR’s coverage of PwC includes semiannual profiles of the firm as part of TBR’s Management Consulting Benchmark, special reports, and inclusion of PwC in other TBR reports, such as the AI & GenAI Market Landscape, as appropriate.

themacx from Getty Images Signature

themacx from Getty Images Signature

Getty Images via Canva Pro

Getty Images via Canva Pro