U.S. Federal Cloud Ecosystem Report

TBR Spotlight Reports represent an excerpt of TBR’s full subscription research. Full reports and the complete data sets that underpin benchmarks, market forecasts and ecosystem reports are available as part of TBR’s subscription service. Click here to receive all new Spotlight Reports in your inbox.

Key IT Services Takeaways

Federal systems integrators (FSIs) are under mounting pressure to bring to market a broad portfolio of cloud offerings underpinned by a robust network of commercially centric cloud partners

TBR estimates the total available market in federal cloud was roughly $17 billion in FFY24, and we believe this figure is set to rise to between $20 billion and $21 billion in FFY25. We anticipate total federal cloud spending will expand by between $13 billion and $15 billion to surpass $30 billion by FFY28. Modernizing legacy IT infrastructures remains a paramount, strategic objective for civilian, defense and intelligence agencies that are actively migrating IT systems to the cloud and/or replacing outdated and monolithic IT networks with cloud-native technologies. The advent of AI, generative AI (GenAI) and agentic AI, and the mandatory adoption of zero-trust security infrastructures are also accelerating cloud adoption. The Pentagon maintains a robust pace of cloud implementation, and the next iteration of the $9 billion Joint Warfighting Cloud Capability (JWCC) is in development. DOGE’s actions will upend civilian IT spending patterns through the remainder of FFY25, with disruption likely extending into the first half of FFY26. Federal IT vendors have struggled with budget cuts, headcount reductions, and delayed procurement and project delivery cycles at many civilian agencies since DOGE began reviewing budgets in January 2025. In the long run, TBR believes DOGE will prompt a resurgence in demand for cloud-based solutions as civil agencies and departments are vigorously pushed to outsource increasingly larger shares of IT functions (particularly tasks once provided by now dismissed government employees), migrate to multicloud and hybrid cloud environments, secure their IT networks with zero-trust architectures, and digitally enable mission-critical systems.

Key Cloud Takeaways

Leading vendors look for ways to extend commercial products and go-to-market motions to the U.S. federal space as cloud opportunities increase

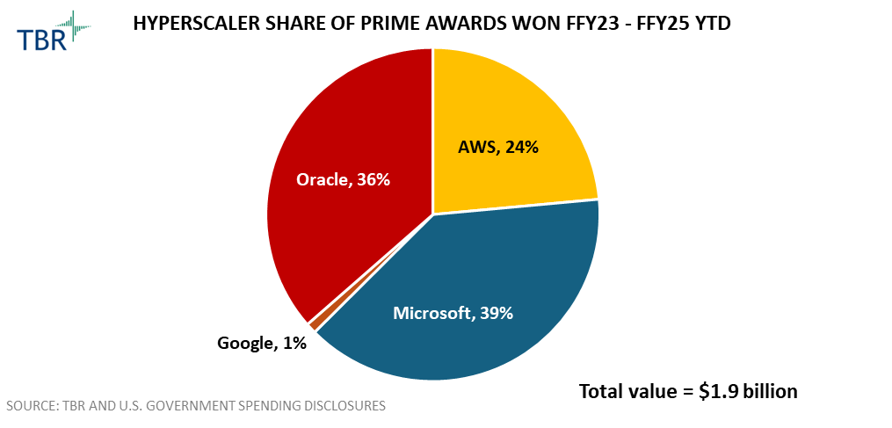

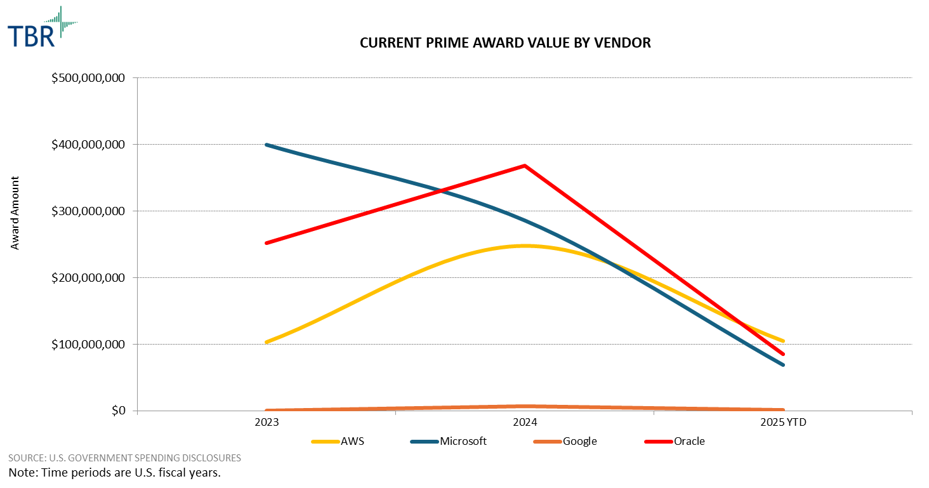

The JWCC contract continues to represent the single biggest opportunity for the cloud market’s leading players within the U.S. federal government: Amazon Web Services (AWS), Microsoft, Google Cloud and Oracle. As of 1Q25, roughly $2 billion in task orders have been allocated to these four vendors, with Oracle securing the biggest award to date, after the U.S. Army — with support from Accenture Federal Services (AFS) — migrated its legacy PeopleSoft deployment to Oracle’s Government Cloud. This win highlights the advantages of being rooted in legacy software and partnering with commercial SIs like Accenture that have experience modernizing business applications. JWCC is still in its early days — and an extended contract dubbed JWCC Next is under development — but Google’s recent IL6 (Impact Level) accreditation for Google Distributed Cloud (GDC), available as an air-gapped solution, should be a big step forward for not only Google but also JWCC, as all participating vendors can now deliver at the highest accreditation levels. That said, as the Department of Defense (DOD) starts to more actively leverage infrastructure from distinct cloud providers, it raises the question of interoperability; buying cloud services from multiple providers and leveraging multicloud environments are two different things. It will be interesting to see how agencies work to overcome integration challenges, which could include enlisting more PaaS vendors as part of JWCC Next, and if the four hyperscalers can deliver joint solutions that work with each other. Civilian spend remains strong, with the impacts of DOGE seemingly starting to fade, though defense spending will outpace civilian in the near term. AI opportunities within the sector are also increasing, namely for agencies that already have their infrastructure and applications in the cloud and are best positioned to take advantage of AI.

Cloud technologies are the foundation for digital transformation across the federal market; overall demand and opportunities for IT modernization remain prevalent

How do IT services vendors view the cloud opportunity?

Despite the growth in cloud spending outlined earlier in this report, large swaths of the federal government’s IT infrastructure remain in dire need of updating to cloud to accommodate the implementation of various AI technologies, advanced zero-trust security solutions, and other emerging technologies (e.g., quantum computing). DOGE disrupted federal IT spending in 1H25, but federal IT vendors remain undeterred in their pursuit of cloud-based digital modernization opportunities. Vendors and their federal customers are collaborating closely to map out future cloud migration and consolidation programs that will increasingly leverage commercially sourced cloud technologies, such as shifting federal data centers to cloud-based architectures to enhance data accessibility.

What do vendors need to develop or deploy to tackle the cloud opportunity?

The Trump administration is prioritizing enhancing data security, availability and cost-effectiveness via cloud technologies as a cornerstone of its federal IT strategy, and vendors are pivoting to align with the administration’s IT vision. FSIs must showcase their successful deployments of mission-enhancing cloud infrastructures that improve agencies’ operating efficiencies while crafting strategies for agencies to reinvest savings from DOGE-driven budget cuts and for the eventual implementation of next-generation technologies to support future missions. FSIs are adjusting marketing messaging to emphasize their ability to deliver innovation at speed within outcome-based cloud deployment engagements. Possessing the scale to deploy cloud infrastructures across agencies is still important for vendors. Equally critical are offering customers the broadest possible suite of partner-enhanced cloud solutions and having a vendor-agnostic approach to migrating federal IT workloads to cloud environments. Agency IT decision makers prefer not to be restricted to using products or services from a single vendor or a small cadre of IT providers. FSIs believe federal agencies will continue leveraging the cloud as the principal destination for legacy systems and for modernizing those systems and fully expect to accelerate adoption of SaaS and PaaS solutions, as reflected by federal IT contractors’ M&A, alliance and joint venture-related activities in 2024 and 2025.

Microsoft’s and Oracle’s hold on the U.S. government is unwavering, but AWS’ early IaaS lead and defense ties are elevating its standing in JWCC and the broader market

Unsurprisingly, Microsoft and Oracle are driving the bulk of prime awards, with the overwhelming majority stemming from traditional license and support contracts. Prime award value for Microsoft dipped in 2024, as large support renewals from the Department of Justice (DOJ) and Department of State that occurred in 2023 and have since expired. Meanwhile, Oracle’s jump in 2024 almost entirely reflects Cerner-related services for the Department of Veterans Affairs (VA). Though AWS does not have the legacy software ties that Microsoft and Oracle do, the company is very competitive in the market. In 2024 AWS saw a big jump in defense-related wins, including those associated with the Defense Information Systems Agency (DISA) and the JWCC contract. Other notable prime awards for AWS during this time include the National Nuclear Security Administration, within the Department of Energy, which is leveraging S3 and other IaaS services.

Technology Business Research, Inc.

Technology Business Research, Inc.

Technology Business Research, Inc.

Technology Business Research, Inc.