U.S. Telecom Enterprise Operator Benchmark

TBR Spotlight Reports represent an excerpt of TBR’s full subscription research. Full reports and the complete data sets that underpin benchmarks, market forecasts and ecosystem reports are available as part of TBR’s subscription service. Click here to receive all new Spotlight Reports in your inbox.

Post updated: Nov. 15, 2025

Growth in areas including mobility, FWA, IoT, MEC, PCN and public sector is only partially offsetting erosion in operators’ B2B legacy services

Revenue growth drivers

- Wireless customer additions for smartphones and other connected devices

- Customers migrating to higher-tier service offerings

- Higher public sector revenue driven by first responder initiatives such as AT&T FirstNet as well as from large-scale federal task orders

- Fixed wireless access (FWA) subscriber additions

- Price increases

- Adoption of value-added services in areas including SD-WAN, cybersecurity and unified communication to augment operators’ core broadband and mobility offerings

- IoT, mobile edge computing (MEC) and private cellular network (PCN) deployments

Revenue growth inhibitors

- Businesses reducing spending due to macroeconomic challenges including inflationary impacts related to tariffs

- Legacy data solution customer disconnects, which is resulting in businesses switching to other service providers and/or lower-priced service offerings

- Customers disconnecting from fixed voice services to use wireless offerings exclusively

- Asset divestments and operators retiring certain legacy solutions including copper-based services

- Public sector agencies reducing spending due to Department of Government Efficiency (DOGE)-related cuts

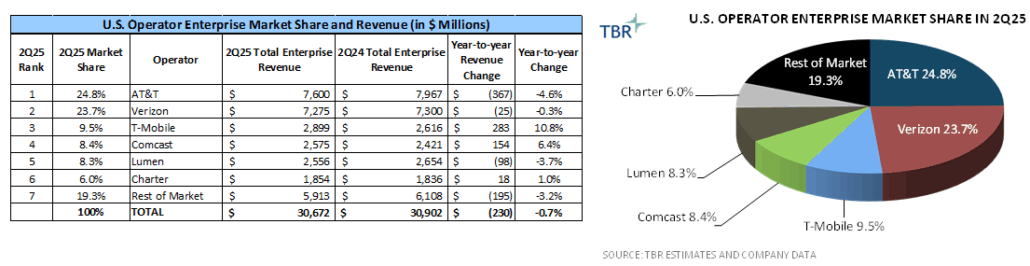

U.S. Enterprise Operator Market Share and Revenue (Source: TBR)

Company profiles excerpt

AT&T’s enterprise wireless revenue growth was driven by FirstNet, which gained nearly 400,000 new connections in 2Q25 and partially offset continued wireline revenue declines

TBR’s assessment of AT&T’s enterprise strategies

AT&T’s total enterprise revenue decreased 4.6% year-to-year in 2Q25 to $7.6 billion, mainly as a result of AT&T Business Wireline revenue declining 9.3% year-to-year to $4.3 billion due to lower demand for legacy voice and data solutions as well as AT&T deemphasizing noncore services within its portfolio. Lower Business Wireline revenue was also attributed to the sale of AT&T’s cybersecurity business to LevelBlue in May 2024, a joint venture between AT&T and WillJam Ventures. Additionally, TBR believes AT&T’s lower Business Wireline revenue in 2Q25 was impacted by disconnects within federal agencies related to the activities of DOGE. Lower Business Wireline service revenue in 2Q25 was partially offset by fiber and advanced connectivity services growing 3.5% year-to-year, driven by higher fiber and fixed wireless revenue in the quarter.

AT&T’s enterprise wireless revenue grew 2.3% year-to-year to $3.3 billion, aided by over 398,000 FirstNet connection additions in 2Q25 to grow to a base of 7.5 million total connections.

As of July AT&T’s 5G RedCap (Reduced Capability) technology reached over 200 million POPs across the U.S. AT&T’s 5G RedCap technology enables clients to lower the cost of deploying IoT solutions by allowing devices to operate at reduced battery consumption and processing power levels while running over AT&T’s 5G SA network. AT&T also announced the certification of the Franklin Wireless RG350, its first commercially approved 5G RedCap mobile hotspot on AT&T’s network. The RG350 is designed to provide connectivity to support scenarios including remote work and travel.

In June AT&T launched AT&T Business Voice, an all-in-one VoIP solution that enables businesses to replace legacy analog systems with a modern digital platform. The service supports multiple business lines, including fax machines, fire alarms, security systems, elevator phones and public safety phones. AT&T Business Voice provides a seamless transition from traditional copper line infrastructure to a robust digital network, allowing businesses to retain their existing phone numbers and equipment while adding new lines as needed. Designed specifically for small and midsize businesses, the solution includes key features such as 24/7 monitoring, built-in battery backup, optional wireless failover to maintain service during broadband interruptions, spam-call protection, and advanced telephony management capabilities.

Following the launch of the consumer-focused version of AT&T Turbo in May 2024, the company released AT&T Turbo for Business in June 2025. The offering ensures businesses maintain reliable and fast mobile connectivity, even during times of high network congestion. Turbo for Business prioritizes the treatment of data for business-critical applications, delivering the highest level of data priority currently available on AT&T’s wireless network. AT&T’s Business Unlimited Premium 2.0 with Turbo plan is available for $15 more per line per month compared to its standard Business Unlimited Premium 2.0 plan.

In June AT&T announced advanced upgrades to its AT&T ESInet emergency communications platform. The new capabilities include native picture and video messaging to Public Safety Answering Points (PSAPs) and automatic crash alerts from select 2026 Toyota vehicles equipped with AT&T’s Connected Car technology. These enhancements enable first responders to access critical data in real time, improving situational awareness and decision making. Although AT&T is currently the only nationwide provider offering these features, the standards-based design allows other wireless carriers to integrate them into their networks. The upgraded features will be available to new AT&T ESInet customers starting in October.

Segment performance excerpt

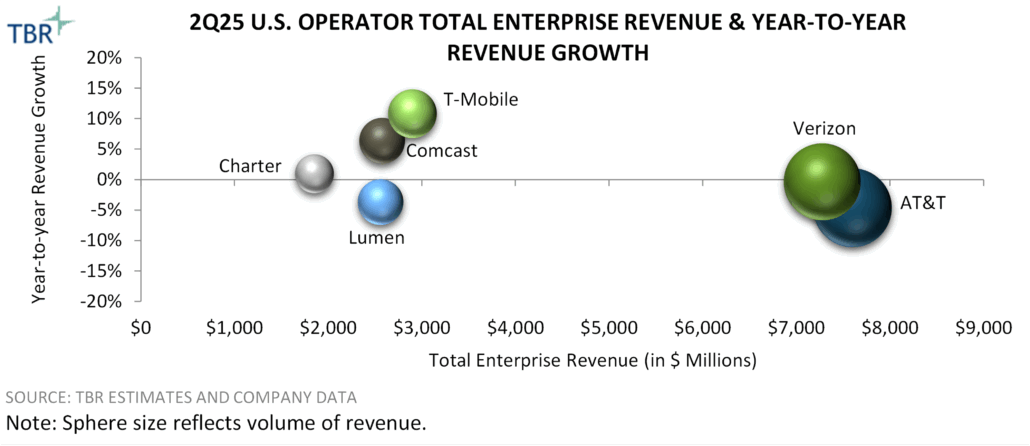

T-Mobile continued to outperform rivals in total enterprise revenue growth in 2Q25

AT&T and Verizon remain the largest incumbent operators in the U.S. B2B market by revenue due to the companies’ established client relationships and reputations. However, AT&T and Verizon reported total enterprise year-to-year revenue declines of 4.6% and 0.3%, respectively, in 2Q25 as the companies remain challenged by disconnects from customers on legacy wireline solutions.

T-Mobile outpaced benchmarked operators in total enterprise revenue growth in 2Q25. According to the company, T-Mobile for Business led in areas including U.S. business postpaid net additions, business postpaid phone net additions, business 5G FWA net additions and business postpaid churn performance. T-Mobile is attracting clients via the improved reputation of its wireless network as well as its expanded portfolio offerings in advanced services areas such as IoT, MEC and PCN. T-Mobile for Business projects it will generate a double-digit service revenue CAGR from 2023 to 2027.

Lumen’s total enterprise revenue declined 3.7% year-to-year to $2.6 billion as the company generated lower revenue for services including traditional VPN, Ethernet, legacy voice services, and other legacy products and services. Lumen does not compete in the wireless market, which is presenting a challenge as all other benchmarked operators sustained wireless revenue growth in 2Q25 and leverage wireless for bundling with wireline services.

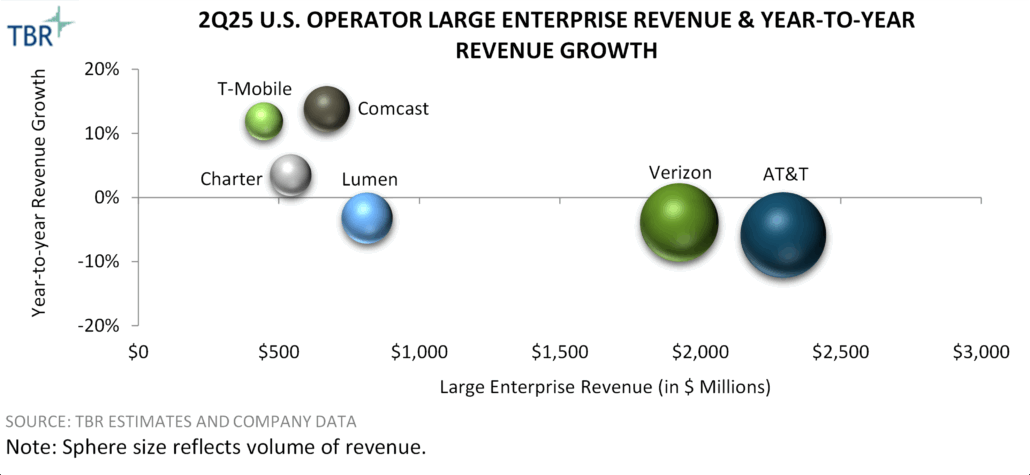

AT&T and Verizon continued to lead the U.S. in large enterprise revenue due to their deep footing among Fortune 500 companies, while Comcast and T-Mobile had the highest growth rates

AT&T and Verizon are significantly outpacing competitors in large enterprise revenue due to the operators’ deep entrenchment among Fortune 500 companies. However, smaller operators are positioning to gain market share among larger businesses. For instance, T-Mobile for Business is trailing other benchmarked operators in large enterprise revenue but is gradually gaining share in the segment as T-Mobile is attracting large enterprises via the competitive pricing of its unlimited data 5G plans; increased advertising; and time-to-market advantage in deploying 5G SA, which enables T-Mobile to offer B2B-specific offerings such as T-Priority.

Comcast’s acquisition of Nitel, which closed on April 1, bolstered the company’s large enterprise revenue in 2Q25. The purchase enables Comcast to expand its footprint in the midmarket and enterprise customer segments, and adds Nitel’s 6,600 clients across the U.S. in verticals including financial services, healthcare and education. Acquiring Nitel also enables Comcast Business to expand its channel distribution strategy to more effectively target new sales opportunities within the midmarket and enterprise segments. Comcast Business is gaining AI and software tools from the Nitel acquisition that will enable it to enhance its sales and customer service capabilities. These benefits include robust orchestration capabilities, an instant quoting tool that makes it easier to price and establish deals across multiple vendors and sites, and a digital dashboard that offers a single-pane-of-glass view of deployments.

Technology Business Research, Inc.

Technology Business Research, Inc.

Technology Business Research, Inc.

Technology Business Research, Inc. Bilobaba Vladimir via Canva Pro

Bilobaba Vladimir via Canva Pro