Spotlight: 2Q24 Cloud Infrastructure & Platforms Benchmark

TBR Spotlight Reports represent an excerpt of TBR’s full subscription research. Full reports and the complete data sets that underpin benchmarks, market forecasts and ecosystem reports are available as part of TBR’s subscription service. Click here to receive all new Spotlight Reports in your inbox.

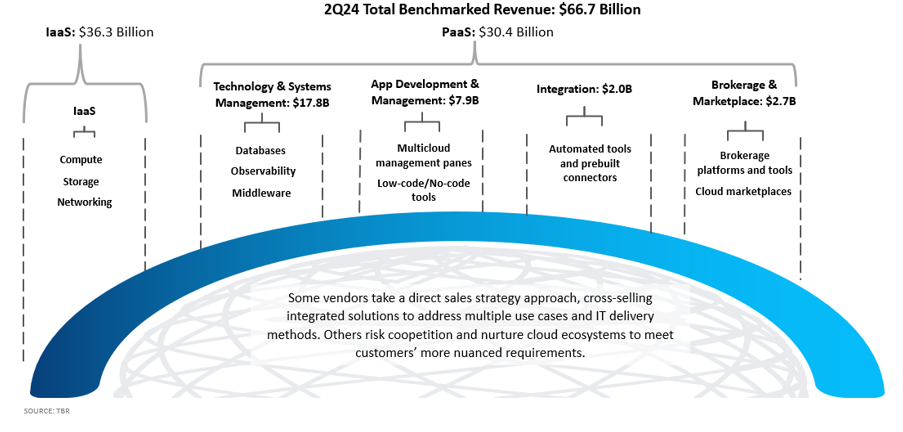

Acquiring to fill portfolio gaps and deliver complete end-to-end solutions at any layer of the PaaS stack is a top strategy for IT’s biggest players

Enterprise migrations and large-scale M&A are influencing the IaaS & PaaS market, as is GenAI, but disillusionment is coming and may cause customers to re-evaluate their IT priorities

IaaS Market

Among benchmarked IaaS vendors, average revenue growth increased 21% year-to-year in 2Q24, marking the fourth consecutive quarter of acceleration. There are two primary factors at play: enterprise IT modernization activity, which is much stronger now than it was this time last year, and generative AI (GenAI). Top hyperscalers Amazon Web Services (AWS) and Microsoft are capturing legacy Oracle and SAP workloads as customers continue to migrate to the cloud to not only outsource their IT operations but also drive lasting business value.

Though the geopolitical outlook is increasingly uncertain, we expect customers will continue to prioritize more traditional “lift and shift” migrations, and steps vendors are taking to deliver more integrated solutions could help. For instance, by the end of 2024, Oracle’s database services will officially be available on AWS, Microsoft Azure and Google Cloud Platform (GCP), which could be a big growth tailwind for these vendors. For context, converting Oracle’s remaining database support install base to the cloud represents a roughly $18 billion incremental revenue opportunity for these hyperscalers, including Oracle itself.

Regarding GenAI, investments in AI compute and new data centers are translating into top-line growth. Most vendors report they have multibillion-dollar AI and GenAI businesses, though this is minuscule compared to the tens of billions of dollars these vendors are investing. Vendor capex guidance for 2025 suggests that the level of investment will only increase, although we do expect this is when GenAI fatigue will hit and many customers may begin to re-evaluate their IT priorities.

PaaS Market

The PaaS market is similarly growing behind GenAI adoption, as many customers who still have a fear-of-missing-out mentality are spinning up new workloads natively in the cloud with services like Amazon Bedrock, Microsoft Azure OpenAI and Google Vertex AI. The PaaS market will similarly be impacted by GenAI disillusionment, but we believe this trend will also cause customers to focus more on the data layer, prompting them to take a second look at strategies around governance, data quality and integration for long-term AI success.

Another key trend driving PaaS market growth is M&A. IT leaders are acquiring to enter new markets and access IP they can ultimately sell as part of an entire end-to-end suite of offerings, as customers continue to crave more simplified, integrated solutions. By far the best example is Cisco’s acquisition of Splunk, which added $960 million to Cisco’s top line in 2Q24 and is quickly making Cisco a rising force in PaaS with its observability portfolio. IBM’s proposed acquisition of HashiCorp, which is expected to close by the end of 2024, would be another transformative deal that would put IBM squarely into the Terraform space and deliver synergies with Red Hat that will be attractive to unsatisfied VMware customers.

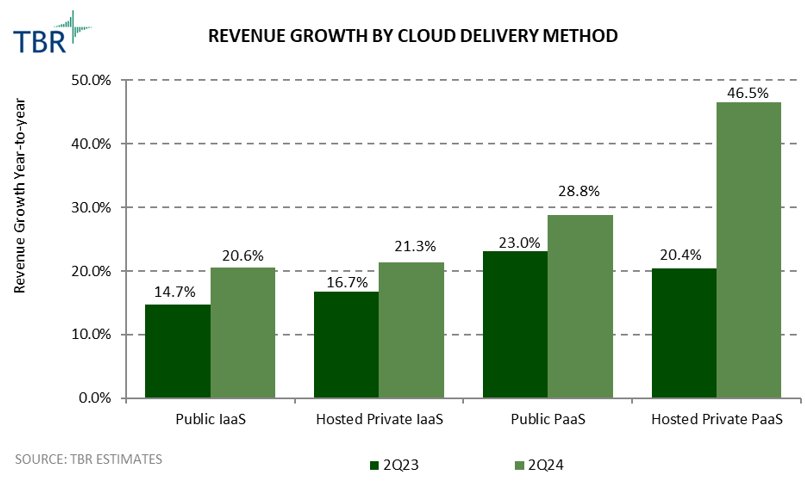

Though often regarded as less secure, public cloud environments offer an array of automated tools, giving customers the opportunity to better secure their assets than they can on premises

Public IaaS: As the cloud market matures, customers are becoming more comfortable with moving to public cloud infrastructure. Security remains a leading barrier to migration; however, many customers recognize that the public cloud offers the opportunity to better secure their infrastructure and data, due to automation and emerging capabilities such as Infrastructure as Code.

Public PaaS: Organically, public PaaS remains the fastest-growing segment as public cloud IaaS capabilities improve and vendors tailor their services to developers.

Hosted Private IaaS: Private IaaS growth is supported by enterprises’ rising acceptance of hybrid-enabling solutions such as AWS Outposts and Azure Stack, although some customers still consider these solutions immature. Customers continue to demand solutions that address data sovereignty, governance and compliance use cases.

Hosted Private PaaS: Single-tenant PaaS is a popular option for customers looking for more customization yet a greater degree of scalability over their on-premises environment. Many enterprises use dedicated clouds as an intermediary step to the public cloud, and as such, segment growth could start to slow. The acceleration in PaaS revenue for 2Q24 is largely influenced by Splunk, which can run in a customer’s environment as both a private and public cloud.

IaaS revenue growth rates will not return to what they once were, while PaaS tells a different story as acquisitions and the modernization of critical workloads fuel growth

AWS retains the majority of mindshare in legacy infrastructure workloads, but Azure and GCP continue to be competitive on net-new AI workloads in the cloud

AWS makes up the majority of IaaS vendor revenue, at an estimated 58% in 2Q24, but this is down over 1,200 basis points from the year-ago quarter. For many legacy customers looking to rehost and/or replatform applications, AWS continues to be top of mind due to its establishment, infrastructure availability and breadth of developer-friendly services. But when it comes to net-new workloads already in the cloud, Microsoft and increasingly Google Cloud, will be competitive.

Though SAP and IBM still offer either dedicated or multitenant IaaS to their customers (see TBR’s Cloud Components Benchmark for IBM’s on-premises cloud infrastructure business), the Big Three, and increasingly Oracle, are consolidating the market. Alibaba’s sluggish growth in the China market caused the company to cede the No. 3 position to Google Cloud. While Alibaba’s growth is rebounding, we do not expect the company to take back the position it once held. At the rate Oracle’s OCI is growing, it will not be long before Alibaba gives up share to Oracle in the IaaS market as well.

Technology Business Research, Inc.

Technology Business Research, Inc.

Technology Business Research, Inc.

Technology Business Research, Inc. Technology Business Research, Inc.

Technology Business Research, Inc.