Private Cellular Networks Market Forecast

TBR Spotlight Reports represent an excerpt of TBR’s full subscription research. Full reports and the complete data sets that underpin benchmarks, market forecasts and ecosystem reports are available as part of TBR’s subscription service. Click here to receive all new Spotlight Reports in your inbox.

While the 5G PCN ecosystem is maturing, it remains underdeveloped compared to older technologies such as Wi-Fi and LTE, slowing the pace of adoption

Robust Wi-Fi and LTE ecosystems, coupled with an underdeveloped 5G-compatible device ecosystem and relatively higher costs, hinder private 5G adoption

The private 5G network market will see robust growth through this decade as a wide range of industries and governments adopt the technology. However, TBR now projects the market will reach $5.3 billion in 2030, down dramatically from our October 2022 forecast of $15 billion in 2030. TBR still believes the private 5G network market will ultimately be several times larger than the projected peak of the private LTE market, but the market is taking much longer to scale than previously expected.

The private 5G network market is challenged by enterprises viewing Wi-Fi and/or LTE as good enough for most non-mission-critical use cases. 5G (including infrastructure as well as endpoint devices and modules) remains far more expensive than Wi-Fi, and enterprises are more comfortable using Wi-Fi; most enterprises choose Wi-Fi as the primary connectivity medium for their private network, with private cellular typically utilized for internet redundancy, backup and failover. Essentially, enterprises have more clarity around LTE and Wi-Fi and are uncertain about 5G PCN ROI, causing them to lean toward existing options.

The limited selection of 5G-compatible endpoint devices (excluding smartphones) remains one of the greatest impediments to private 5G network adoption among enterprises. Ultimately, the device ecosystem for 5G needs to become broader and more dynamic to more closely resemble the device ecosystems for LTE and Wi-Fi and to provide greater selection and lower costs to adopters.

The slow development of the PCN market is partially due to vendor offerings that are not tailored to the enterprise and require trained resources to manage what are effectively scaled-down versions of communication service provider (CSP) RAN infrastructure. However, firms such as Celona are increasingly coming to market with lightweight, Wi-Fi-like PCN solutions that are built for enterprises and do not require specialized labor resources to roll out and manage. Incumbent telecom vendors are also scaling down their offerings to compete with Celona. These innovations will help alleviate this slow development over the course of the forecast.

U.S. will overtake China as the highest-spending country on 5G PCNs, partially due to maturation of the CBRS ecosystem

China has led the market in 5G PCN spend since the market’s inception, but TBR estimates the U.S. will outspend China in 2026. TBR expects the maturing CBRS ecosystem in the U.S. to contribute to growth. Vendors are increasingly coming to market with CBRS-based solutions to meet demand. In September Ericsson debuted Ericsson Private 5G Compact, its scaled-down CBRS-based solution, which followed Nokia’s October 2023 launch of a scaled-down version of its Digital Automation Cloud (DAC) PCN solution called DAC Private Wireless Compact. These solutions are aimed at small and midsize industrial sites, carpeted office environments, and campuses — areas where the traditional private 5G solutions from these vendors would be unnecessarily large and expensive. Ericsson and Nokia are the suppliers for some of the best reference cases for CBRS-based 5G PCN deployments, including Tesla (Ericsson) and Deere & Co. (Nokia) factories. In carpeted enterprises, Celona has made significant inroads, thanks to its lightweight PCN solutions that aim to make PCNs as easy and cost-effective to deploy as Wi-Fi.

5G CBRS momentum should spur growth for minor players in the market. For example, Samsung’s alliance with Amdocs focuses on PCN opportunities that use CBRS spectrum, with Amdocs providing systems integration (SI) in joint engagements. Although DISH has gained minimal traction in PCN thus far, the vendor will benefit from its vast CBRS PAL (priority access license) spectrum licenses, which cover 98% of the U.S. population; DISH won the most CBRS licenses in the 2020 auction.

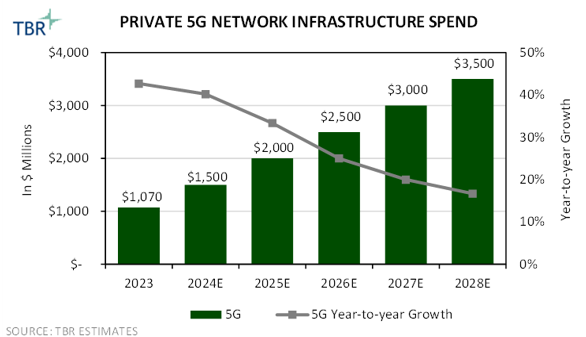

TBR estimates the private 5G network market will grow at a slower rate than the industry originally expected, reaching $3.5B in 2028, due to persistent ecosystem maturity challenges

Private 5G Network Infrastructure Spend for 2023 through 2028 Estimate (Source: TBR)

TBR Assessment: TBR expects the private 5G market to grow at a more gradual rate and take longer to reach maturity than the industry originally expected as compatible endpoint devices and key 3GPP (3rd Generation Partnership Project) standards are slowly commercialized.

Most non-CSP entities are being selective about where and how to use 5G. The more mission-critical the environment, the more likely 5G will be utilized. In instances where reliability, speed and/or security are the top concerns, companies are prioritizing 5G.

Though enterprise and government interest in 5G remains robust, the timing of deployments is contingent on ROI and the availability of compatible endpoint devices. The fact that Wi-Fi remains a legitimate alternative to cellular technologies for private networks, mitigating some of the need for 5G, is also a headwind.

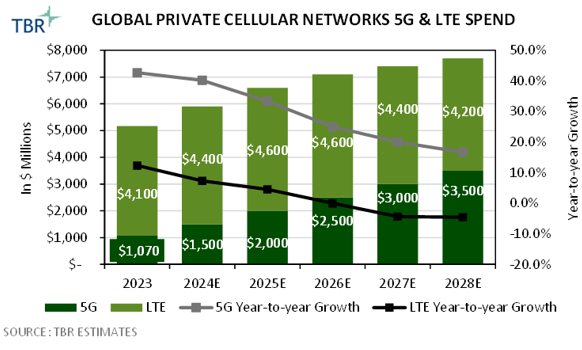

Private 5G spend will lag private LTE spend through the forecast as the market is hampered by a slowly maturing device ecosystem and lack of certainty around ROI

TBR Assessment: TBR expects growth in the private LTE market will slow and then decline during the remainder of the forecast period, but the slowdown will be more than offset by robust growth in private 5G investment as enterprises and governments adopt the next-generation technology for a broad range of use cases.

Private LTE has been in use for over a decade, and there is a robust vendor, device and application ecosystem that underpins this market, which reduces costs. LTE is sufficient in handling many popular and proven use cases for PCN, reducing the need for 5G. Enterprise CIOs who adopt LTE are reassured about achieving ROI, while 5G ROI is unproven.

Another reason LTE remains the dominant technology is that some vendors offer software upgradability of private LTE solutions to 5G. This approach optimizes TCO and entices enterprises to commit to their platforms before they adopt 5G. Due to these dynamics, TBR expects 5G spend to lag LTE spend through the forecast period.

Technology Business Research, Inc.

Technology Business Research, Inc.

Technology Business Research, Inc.

Technology Business Research, Inc.