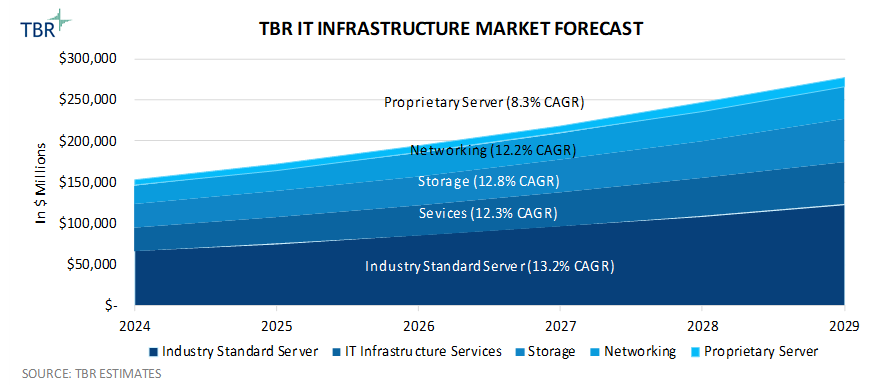

IT Infrastructure Market Forecast

TBR Spotlight Reports represent an excerpt of TBR’s full subscription research. Full reports and the complete data sets that underpin benchmarks, market forecasts and ecosystem reports are available as part of TBR’s subscription service. Click here to receive all new Spotlight Reports in your inbox.

Organizations will continue to prioritize spending on AI infrastructure

Growth drivers

- Investment in, renewed focus on and adoption of enterprise AI are increasing demand for high-performing infrastructure.

- Private and hybrid cloud deployments increase demand for hyperconverged infrastructure form factors.

- Organizations are prioritizing investments in denser and more energy-efficient infrastructure solutions to make way for AI.

- Edge deployments are creating new-new workload opportunities for OEMs.

Growth inhibitors

- The enterprise and SMB spend environment remains cautious and fragile as trade wars erupt.

- ODMs are largely capturing cloud growth as they produce low-cost, custom, commoditized hardware for hyperscalers.

- Commodity hardware and the popularity of software-defined infrastructure reduce OEMs’ pricing power.

- Heightened demand for InfiniBand threatens traditional Ethernet-based networking solutions providers.

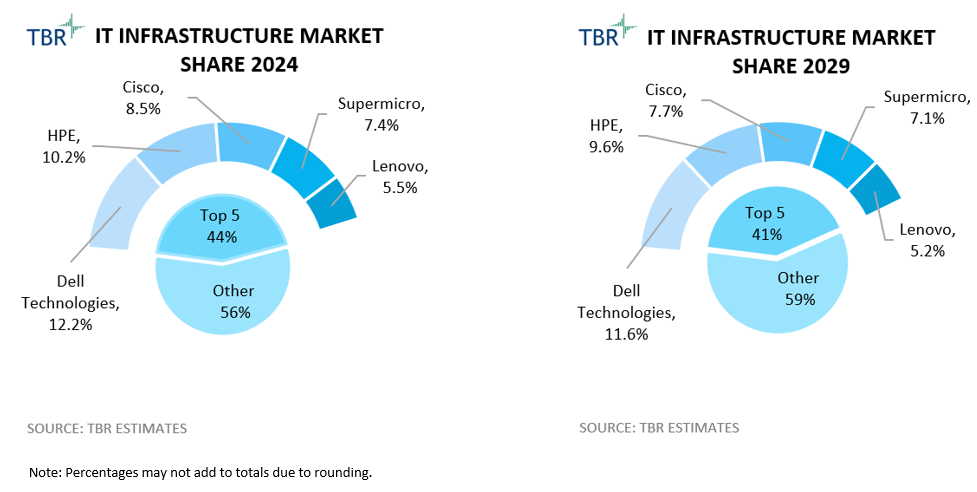

TBR predicts that the top 5 covered IT infrastructure OEMs will achieve double-digit revenue growth from 2024 to 2029 but their respective market shares will decline

Despite shipping over $11B in Blackwell products in 4Q24, NVIDIA is racing to increase production to meet the market’s seemingly insatiable demand for AI servers

Within the OEM market, AI server demand continues to be driven primarily by services providers and model builders, but sovereigns are showing increased interest in OEMs’ AI infrastructure solutions, presenting the OEMs with a major opportunity. Additionally, although enterprise demand for on-premises deployments of AI infrastructure remains soft, especially for the most powerful and thereby highest-revenue-generating systems, the industry expects enterprise AI demand will accelerate throughout 2025 and 2026 as customers pursuing tailored AI solutions increasingly transition from the prototyping phase to the deployment phase.

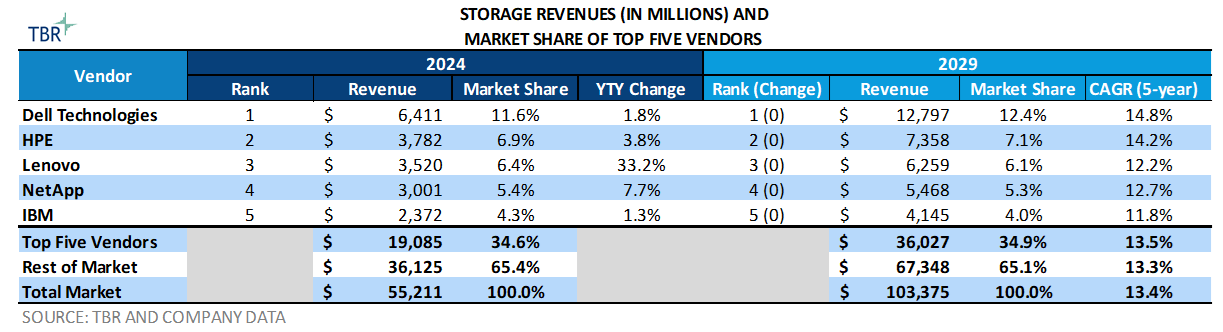

TBR predicts Dell will lead covered vendors in terms of storage revenue growth due in part to increased attached sales opportunities associated with the company’s growing server business

Key takeaways

TBR forecasts the storage market will grow at a 13.4% CAGR from 2024 to 2029 as organizations across a variety of industries invest in modernizing and hybridizing their storage estates to support current and future workloads, including those related to AI. Organizations’ data volumes will continue to grow over the next five years as the rise of AI further underscores the value behind organizations’ proprietary data.

The storage market typically lags trends in the traditional server market, as is presently the case. However, as organizations increasingly transition from prototyping to deploying AI solutions, data management and orchestration has risen toward the top of key customer pain points. Recognizing this, storage OEMs are selling customers on the capabilities of their storage platforms, comprising software, adjacent services and sometimes hardware. Additionally, storage OEMs are forming partnerships with hyperscalers and other ecosystem players, like NVIDIA, to have their storage solutions validated and certified for operability and AI system reference architectures. TBR believes Dell and Hewlett Packard Enterprise (HPE) are well positioned for growth in storage over the next five years due to their strong data management capabilities and increased opportunities around attaching storage sales to server deals.

In 2024 TBR estimates Lenovo overtook NetApp for the third-largest storage market share among covered vendors. The storage market has become more of a priority for Lenovo in recent years due to the segment’s higher margins, evidenced by the company’s recently announced acquisition of Infinidat. TBR forecasts NetApp will outperform Lenovo in five-year storage revenue CAGR, but Lenovo will retain its positioning in the market among covered vendors.

IT infrastructure OEMs are expanding manufacturing capabilities in Saudi Arabia

EMEA market changes and vendor activities

Relative to the U.S., European economies have had more difficulty recovering from the pandemic; however, looking ahead to 2029, TBR forecasts covered vendors’ IT infrastructure revenue derived from the EMEA region will grow at a 12.9% CAGR due in large part to AI. While the EMEA market pales in comparison to that of the Americas, TBR believes the region’s strong growth will be driven both by rising AI adoption — especially among sovereigns — as well as rapidly increasing technology and infrastructure investments in countries like Saudi Arabia.

TBR believes HPE is among the best-positioned covered vendors in the EMEA geography. Sovereigns in the region already have a strong working relationship with HPE due to their legacy investments in high-performance computing based on Cray systems, and the company has made some of the strongest commitments among covered vendors to develop infrastructure manufacturing capacity in Saudi Arabia and the rest of the Middle East.

Technology Business Research, Inc.

Technology Business Research, Inc.

Technology Business Research, Inc.

Technology Business Research, Inc. Technology Business Research, Inc.

Technology Business Research, Inc.