Enterprise Systems Integrators Market Landscape

TBR Spotlight Reports represent an excerpt of TBR’s full subscription research. Full reports and the complete data sets that underpin benchmarks, market forecasts and ecosystem reports are available as part of TBR’s subscription service. Click here to receive all new Spotlight Reports in your inbox.

Attributes related to vendors’ ability to execute on DT promises reflect changing buyer priorities from a year ago and send a strong message that vendors should not take relationships for granted

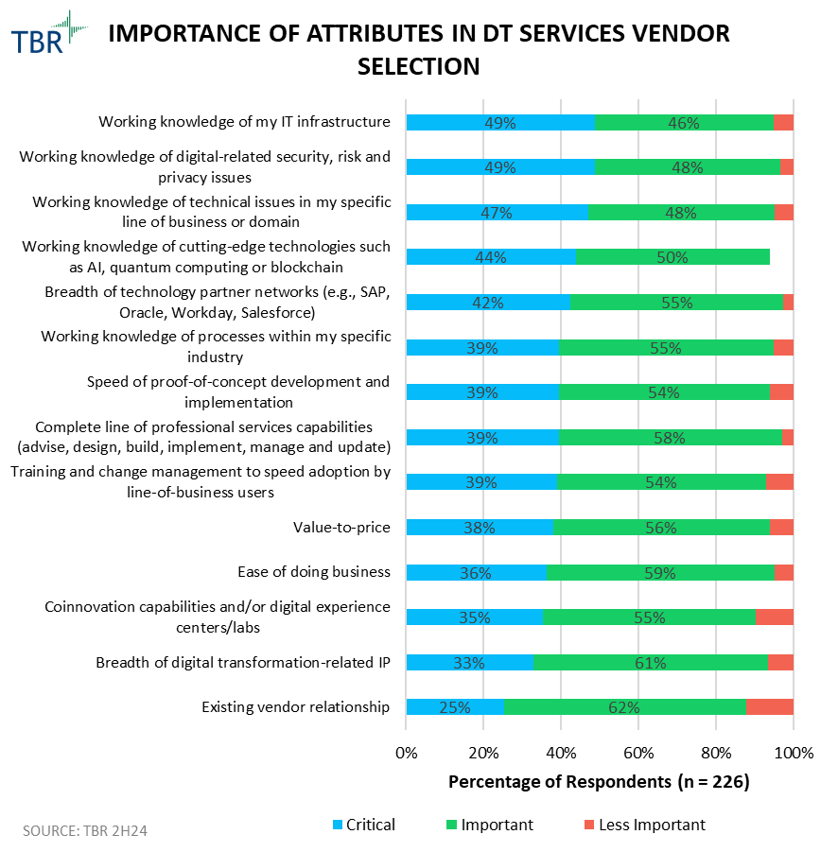

Main criteria for selecting digital transformation (DT) services vendors

Working knowledge of buyers’ IT infrastructure, digital-related security and privacy issues, and specific line of business or domain ranked as the top three attributes for vendor selection. The ranking was a major reshuffling from 2023, when industry knowledge, value-to-price, and complete line of professional services ranked as the top attributes. The change highlights buyers’ evolving priorities. While a year ago the attributes were oriented toward convincing stakeholders to spend on DT programs, this year it appears as though buyers are looking for vendors that can execute on the programs, aligning with the increase in overall DT spend. Existing vendor relationship remained the least critical attribute for vendor selection, underscoring that no single vendor’s position is guaranteed and that vendors must account for evolving stakeholder expectations.

Addressing common gaps such as technical expertise could help vendors build a foundation around scale and quality as GenAI adds another layer of complexity that has to be tied to business outcomes

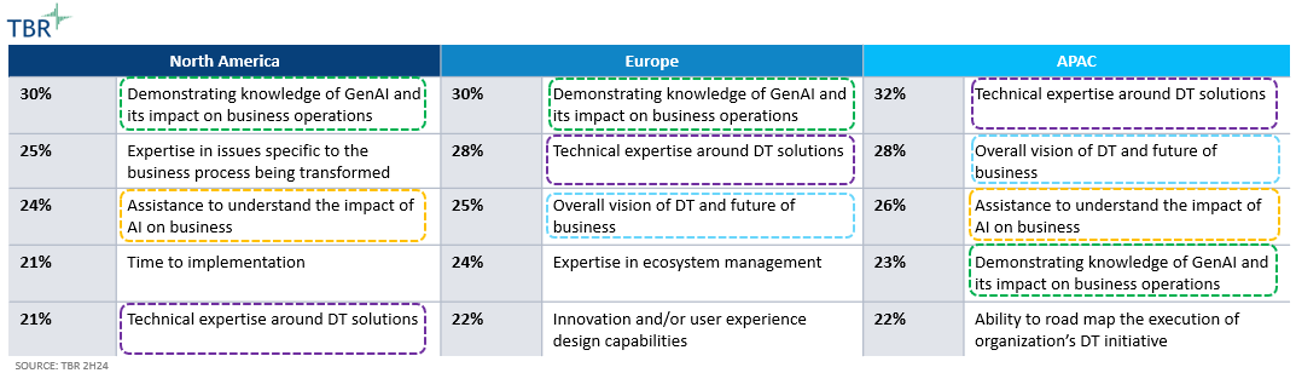

Customer recommendations for DT services vendors by region

Improving technical expertise remained among the top recommendations across regions for vendors to consider, which reflects the IT fluency of DT buyers and illustrates portfolio and skills gaps vendors struggle with despite ongoing investments. Other common recommendations, such as GenAI knowledge tied to business operations, also underscore the need for vendors to find a way to balance their technology-led discussions with business process knowledge, especially as the majority of buyers’ budgets are shifting back to business and tech advisory services. Supporting and taking responsibility for enterprises’ IT environments cannot be done in a vacuum, and vendors need to account for the impact of broader stakeholder ecosystems, especially as the adoption of emerging technologies increases the level of complexity. This is particularly the case among EMEA buyers, who ranked vendors’ expertise in ecosystem management within the top five recommended improvements, highlighting the importance of collaborating with regional vendors as a critical link in otherwise fragmented European-sourced opportunities. In comparison, APAC and North American buyers see a gap in vendors’ ability help them understand the impact of AI on the business, creating an opportunity for providers with strong consulting skills that can also demonstrate business outcomes through proven use cases.

ESIs and acquisitions — strategies that work

Successful M&A strategies follow one of two cadences in TBR’s research: constant or infrequent. In-between approaches or inconsistent cadences fail to deliver expected returns on investment and do not support sustained revenue growth.

Most ESIs that have doubled their revenues post-pandemic have acquired at an Accenture-like pace, adding complementary capabilities and/or expanding into new geographies (e.g., Persistent and Stefanini). In contrast, some ESIs have maintained high revenue-per-employee results in part by eschewing frequent acquisitions in favor of more organic growth (e.g., Ensono and Protiviti).

Why are these two opposite approaches successful? Evaluating, financing, acquiring, absorbing and bringing to market new assets requires experience that builds muscle memory. Do it often and get good at it or do it rarely so you are not wasting time and money. Inconsistency leads to uncertainty and inefficiencies.

Increasingly, according to TBR’s research, an approach favored by some global systems integrators (GSIs) and consultancies appears appealing to ESIs: invest, do not buy. Most ESIs cannot match GSIs’ dollars invested in corporate venture capital funds or startup incubators, but ESIs can emulate the business model. Investing in niche technology or complementary services providers demonstrates differentiation in a crowded field and potentially provides additional revenue streams.

Increasingly, ESIs will invest in startups and boutiques, expanding their portfolios without the costs of acquisitions and realizing new revenue streams.

ESIs and technology partners — ESI perspective

In TBR’s research, successful SI partnerships with technology vendors require the SI to understand and align with the technology vendor’s sales team. Clear incentive and compensation structures lead to smoothly functioning go-to-market initiatives.

ESIs, by their nature, can be more flexible than GSIs and can benefit from being named the best SI partner in their particular country or for their particular skills. GSIs can compete for global accolades while ESIs show their technology partners the benefits of more local recognition.

Of cloud and software respondents, 33% said, “We use niche providers for small and midsize clients as they offer better pricing flexibility and domain expertise.”

“I want to work with all the major technology companies, but I work with smaller niche companies too. So, when we were rationalizing who to work with and who not to work with, ultimately, it comes down to the TAM [total addressable market]. I want some revenue potential behind any new partners, and any new go-to-market offerings. So that’s what kind of the think tank is deciding behind the scenes.” — Senior Manager of Global Channels and Alliances, Cloud—TBR’s Summer 2025 Voice of the Partner Ecosystem Report

ESIs face core challenges similar to GSI, namely how to differentiate and get technology partners to recommend and even sell an ESI’s services. Without expecting technology partners’ sales teams to be fluent in an ESI’s offerings and value propositions, ESIs can sell themselves in three ways:

- Offer flexible and responsive commercial models that play to tech partners’ metrics and compensation models

- Provide access to personas and buyers that tech partners cannot reach, such as enterprise business line leaders or wholly new logos

- Augment with highly specialized and responsive talent when tech partners’ own professional services teams are stretched too thin

Technology Business Research, Inc.

Technology Business Research, Inc.

Technology Business Research, Inc.

Technology Business Research, Inc. Technology Business Research, Inc.

Technology Business Research, Inc.