Enterprise Edge Compute Market Landscape

TBR Spotlight Reports represent an excerpt of TBR’s full subscription research. Full reports and the complete data sets that underpin benchmarks, market forecasts and ecosystem reports are available as part of TBR’s subscription service. Click here to receive all new Spotlight Reports in your inbox.

Edge adoption will be supported by GenAI, including through the use of SLMs, but it will take time for new use cases to develop

The rise of SLMs could drive new opportunities at the enterprise edge

As highlighted in TBR’s AI and GenAI Model Provider Market Landscape, small language models (SLMs) are gaining traction and offer the greatest long-term opportunity to improve capabilities for enterprise use cases while limiting compute needs. These models typically employ up to 10 billion parameters, which, when compared to their frontier counterparts, reduces their ability to perform a broad range of tasks. That said, with techniques like fine-tuning, SLMs can often outperform larger models on very specific use cases while leveraging fewer compute resources, two major factors in enterprise edge adoption. We expect the rise of AI inferencing and the role SLMs play in offering faster inference times will drive new use cases to the edge over time. AI leaders, such as Microsoft and Google Cloud, may benefit from considering the role of SLMs more broadly to target more tangible enterprise use cases that exist outside the central cloud. IBM is a strong example of a vendor leading with an SLM strategy, via Granite models, which IBM is actively extending to the edge in partnership with infrastructure providers like Lumen.

AI use cases at the edge already exist

AI has been a foundational technology in enterprise edge computing for years and continues to support growth of the enterprise edge market, which TBR expects will expand to $144 billion in 2029. TBR’s enterprise edge spending forecast has not increased significantly from our previous guidance in 2024, which already incorporated our long-standing assumption that AI will propel market growth. TBR expects that the industrywide focus on generative AI (GenAI) will likely lead to increased adoption of edge computing but that the bulk of enterprises embarking on these projects in 2025 will focus on piloting and adoption of cloud and centralized AI resources.

Compared to other deployment methods, edge expansion still lags

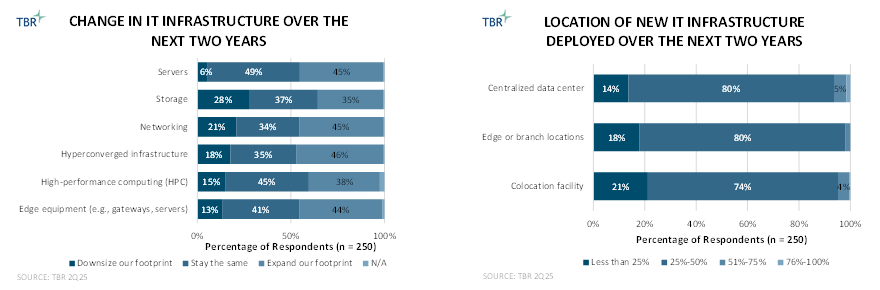

According to TBR’s 2Q25 Infrastructure Strategy Customer Research, 34% of respondents expect to expand IT resources at edge sites and branch locations over the next two years. But this is noticeably lower than the 55% who plan to expand IT resources within centralized data centers, while the central cloud and managed hosting are also gaining more traction. The possibility of large capital outlays and an unclear path to ROI remain the biggest adoption hurdles to edge technology, with some customers exploring other alternatives that have a clearer ROI road map.

GenAI will not have a significant impact on enterprise edge market growth, at least in the near term, as customers prioritize their investments in the IT core and cloud

Forecast assumptions

TBR continues to revise its enterprise edge forecast to account for changes in the traditional IT and cloud markets, including the advent of GenAI. Although the enterprise edge market benefited from the hype surrounding AI in 2024, many pilot projects may not enter production and more concrete use cases around edge AI need to be developed.

The enterprise edge market is estimated to grow at a 19.9% CAGR from 2024 to 2029, surpassing $144 billion by 2029. Professional and managed services will remain the fastest-growing segment, followed by software, at estimated CAGRs of 22.4% and 19.3%, respectively.

Servers, networking, hyperconverged infrastructure and edge equipment were identified by respondents as the foundational infrastructure components enabling more advanced edge use cases

For most IT organizations, the amount of physical hardware under management will stay the same or grow in the coming two years. Servers, networking equipment, hyperconverged infrastructure and edge equipment all had similar levels of expected expansion, while storage and high-performance computing were least likely to expand.

TBR believes AI is somewhat responsible for expected increases in server and networking footprints, compared to two years ago.

Storage was reported as the area that was most likely to expand. Balancing of public cloud spending may also be contributing to the expansion of server footprints.

Expectations to deploy infrastructure at edge locations increased, with 80% of respondents in 2025 indicating between 25% and 50% of new infrastructure purchases will be deployed at edge or branch locations compared to 68% in 2024.

Change in IT Infrastructure Over the Next Two Years (Left) and Location of New IT Infrastructure Deployed Over the Next Two Years (Right) (Source: TBR)

Scenario discussion excerpt

Though cloud vendors still say edge partners will drive new growth opportunities, their optimism is shifting toward other technologies, namely GenAI

When TBR first launched the Voice of the Partner Ecosystem Report, which includes survey results from alliance partnership decision makers across three groups of vendors — OEMs, cloud providers and services providers — cloud respondents said edge computing was a top technology area that would drive growth. But a year later, the results have changed, and cloud vendors’ optimism in partner-led growth surrounding edge solutions seems to have waned, largely in favor of other technologies, namely GenAI. These results are not surprising given how much the GenAI market has evolved in the last 12 months.

OT stakeholders understand the edge but are not necessarily thinking about IT solutions through the lens of their own processes. Because of this, edge hardware vendors and cloud providers benefit from partnering with edge-native software vendors that have permission from OT buyers and can help edge incumbents sell solutions, including attached software and services. The dynamics between IT and OT departments reinforce the importance of the vendor ecosystem in the enterprise edge market.

Vendor profiles excerpt

Lightweight versions of Gemini help Google Cloud target AI edge use cases, but when it comes to Gemini on GDC, the IT core will likely be more relevant than the edge

TBR Assessment: Over the past several quarters, Google Cloud has done much work building out GDC, turning it into a robust, cloud-to-edge solution for enterprises. Expanding work with local operators to deliver GDC as a sovereign solution and making GDC available as an air-gapped solution (fully disconnected from the internet) has helped GDC scale and become relevant with more sensitive workloads. The biggest recent development pertaining to GDC is AI, with Google announcing that Gemini will be made available on GDC, a big step forward in helping customers run AI outside the central cloud, underpinned by NVIDIA’s AI-optimized GPUs. Given that the Gemini family consists of large-scale, frontier models, local, on-premises deployments for Gemini in GDC may be the most likely use case, as SLMs are generally better suited at the edge. Of course, customers can fine-tune and develop smaller models with Vertex AI, which is also supported on GDC, but such efforts would require a certain maturity and experience level from the customer. Google also continues to target the AI edge opportunity with more tailored versions of Gemini, such as Gemini Nano, which is designed to run on devices.

Key Strategies

- Offer a range of partner solutions based on Google Cloud Platform rather than participating in the IoT market directly.

- Use Distributed Cloud Edge to target telcos’ Core 5G solutions and RAN functions.

- Target key edge use cases like computer vision and AI edge inferencing.

Technology Business Research, Inc.

Technology Business Research, Inc.

Technology Business Research, Inc.

Technology Business Research, Inc.