Cloud Ecosystem Report

TBR Spotlight Reports represent an excerpt of TBR’s full subscription research. Full reports and the complete data sets that underpin benchmarks, market forecasts and ecosystem reports are available as part of TBR’s subscription service. Click here to receive all new Spotlight Reports in your inbox.

AI data needs raise expectations about how services vendors and hyperscalers should be thinking about their relationships, with region-specific guardrails further testing joint GTM durability

Key trends

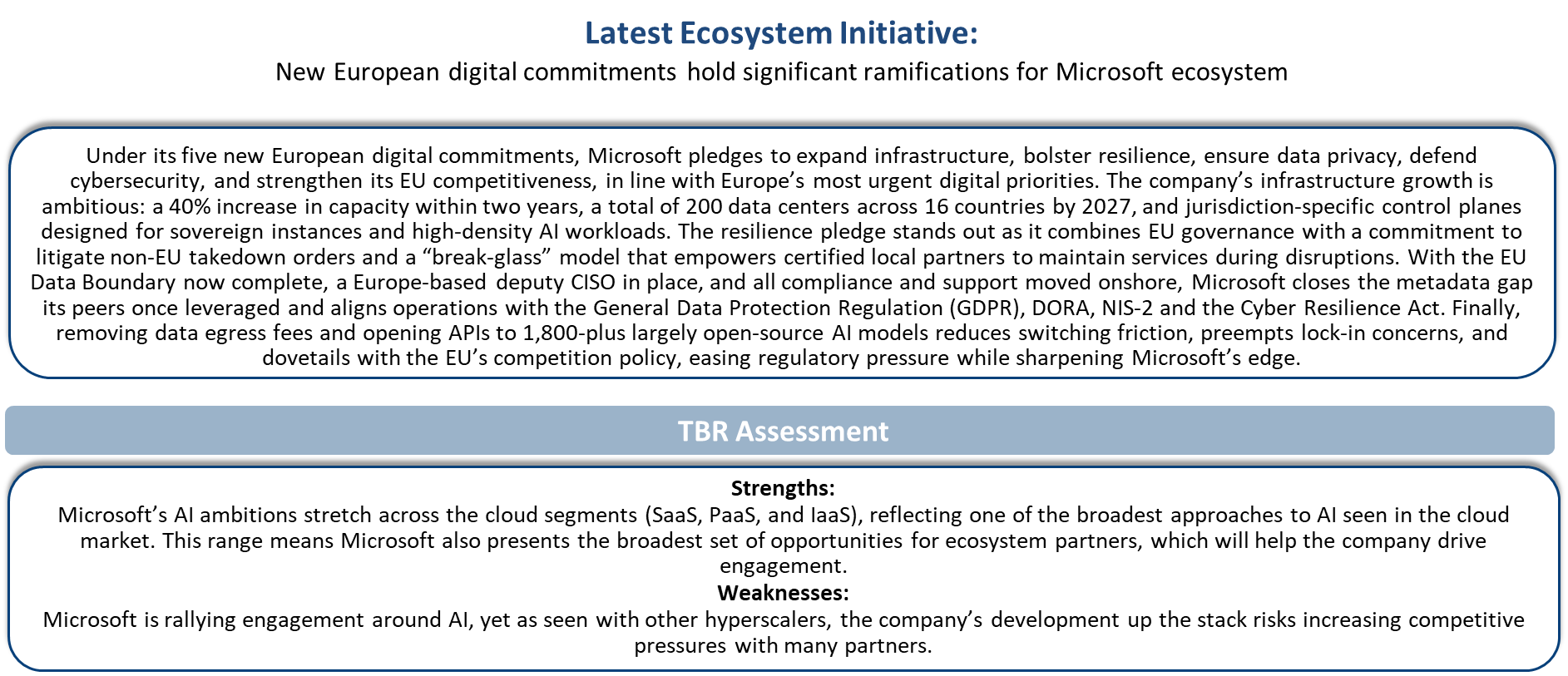

Hyperscalers’ dispersion across the globe requires these vendors, along with their services partners, to carve out new operating models that prioritize both go-to-market success and adherence to local requirements. This balance translates into a case-by-case — or rather, country-by-country — approach with local partnerships being the common thread. This is especially true for hyperscalers competing for local market share — particularly in the European Union (EU) — to the extent of relinquishing operational control (e.g., Microsoft Bleu), creating a direct opportunity for regional system integrators (SIs) and local infrastructure operators. While global SIs (GSIs) are also in contention, they must account for these vendors as they build out local presence, along with their commercial, staffing and partner models. Meanwhile, regional legislation is pushing hyperscalers to commit to investment pledges to ensure business continuity, with implications for services partners and buyers, further testing the limits of their relationships.

Go-to-market strategy

Enterprise buyers are becoming increasingly conflicted in their expectations of how vendors can best support their technology needs. When it comes to interoperability, many customers look to leverage third-party vendors, and a smaller percentage expect their cloud vendors to address these concerns directly. At the same time, buyers continue to identify technology expertise as a key skills gap in vendors’ value proposition across regions. These dynamics are further amplified in vendors’ regional go-to-market strategies, especially when it comes to accounting for the role of AI and niche vendors that bring specialized knowledge. In a nutshell, vendors cannot rely on a one-size-fits-all AI ecosystem strategy across regions. Success will require region-specific approaches: IP-led initiatives in APAC, orchestration frameworks in Europe, and startup-centric marketplaces in the Americas. All must be underpinned by interoperable APIs and strong governance to help IT services providers capture and monetize local demand. Executing against such expectations while continuing to rely on a traditional labor-arbitrage model will test professional services firms’ readiness to transform their own operations while maintaining trust with hyperscalers, which continue to explore the opportunity to drive professional services revenue by simplifying the sales process and marketplace through the use of agentic AI.

Vendors

In addition to launching bespoke operating models and investing in local infrastructure, hyperscalers are investing at the infrastructure layer to support workload portability and management capabilities that help customers adhere to sovereignty regulations. Google Distributed Cloud is probably the most sovereignty-forward example, but similar comparisons can be made for both Microsoft and Amazon Web Services (AWS). Security is another critical area hyperscalers are investing in, whether it is Microsoft’s new deputy chief information security officer (CISO) role for Europe or Google’s continued effort to expand Mandiant’s assets to prevent breaches. Orchestrating these evolving offerings into a cohesive IT estate will be an opportunity for services vendors, especially when deciding how to configure them in a way that is suitable for country-specific needs. Services — including migration, implementation, consulting and advising — all play a role in navigating the increasingly complex regulatory and security environment, requiring broad hiring in the EU, where the opportunities are the greatest.

Data location will remain a leading barrier to cloud adoption, but interoperability and breaking down data barriers across platforms will present the bigger opportunity for services vendors

As highlighted in TBR’s 2H24 Cloud Infrastructure & Platforms Customer Research, data location ranked as the second-highest cloud pain point after security, with 40% of respondents expecting their cloud vendors to directly address these concerns — largely due to vendors doing a better job of making customers aware of the various data center hosting and encryption options. Conversely, when it comes to interoperability, many customers will leverage third-party vendors, and a smaller percentage expect their cloud vendors to address these concerns directly. This speaks to both the skills that services-led firms have amassed across multiple technology platforms and the high degree of lock-in the hyperscalers still create across their infrastructure. That said, from a technology perspective, vendors are doing a better job of integrating their offerings, particularly in the area of agentic AI, which necessitates more robust data sharing. As more open frameworks, including Google’s A2A (Agent2Agent), mature and become enterprise-ready, they could create a needed level of standardization that GSIs can leverage to build new agents alongside their ISV partners. Deloitte’s partnership with Google Cloud to build ServiceNow-specific agents on A2A is a good example.

“It [sovereign cloud] helps, significantly helps. A completely separated, air-gapped environment different from the regular public cloud itself. And Switzerland, by the way, is a great example. AWS put up two regions in Switzerland. It’s a tiny country. But even then, they had two regions to satisfy this condition of resilience, etc.” — Managing Director (Firmwide) & Chief Data Architect, Financial Services

Cloud vendor insights excerpt

Microsoft’s Cloud Services & Ecosystem Strategy

Technology Business Research, Inc.

Technology Business Research, Inc.

Technology Business Research, Inc.

Technology Business Research, Inc. Technology Business Research, Inc.

Technology Business Research, Inc.