Cloud Components Benchmark

TBR Spotlight Reports represent an excerpt of TBR’s full subscription research. Full reports and the complete data sets that underpin benchmarks, market forecasts and ecosystem reports are available as part of TBR’s subscription service. Click here to receive all new Spotlight Reports in your inbox.

Behind healthy server backlog and new software IP, hardware vendors drive the cloud components market, particularly as software pure plays prioritize entirely public cloud migrations

Hardware-centric vendors continue to make their move into software

Over the past several years, the cloud software components market has shifted. Microsoft and Oracle are no longer dominating the market as they prioritize their native tool sets and encourage customers to migrate to public cloud infrastructure. Driven largely by weaker-than-expected purchasing around Microsoft Windows Server 2025, aggregate revenue growth for these two software-centric vendors was down 3% year-to-year in 3Q24. Over the same compare, total software components revenue for the benchmarked vendors was up 14% and total cloud components revenue was up 8%. In some ways, this dynamic has made room for hardware-centric vendors such as Cisco and Hewlett Packard Enterprise (HPE) to move deeper into the software space, particularly as they buy IP associated with better managing orchestration infrastructure in a private and/or hybrid environment.

Backlog-to-revenue conversion for AI servers fuels market growth

Though revenue mixes are increasingly shifting in favor of software, driven in part by acquisitions (e.g., Cisco’s purchase of Splunk), hardware continues to dominate the market, accounting for 80% of benchmarked vendor revenue in 3Q24. Industry standard servers being sold to cloud and GPU “as a Service” providers are overwhelmingly fueling market growth, more than offsetting unfavorable cyclical demand weakness in the storage and networking markets. This growth is largely driven by the translation of backlog into revenue, but vendors are still bringing new orders into the pipeline, which speaks to ample demand from both AI model builders and cloud providers. However, large enterprises are increasingly adopting AI infrastructure as part of a private cloud environment to control costs and make use of their existing data.

Ample scale and strong demand from both CSPs and enterprises extend Dell’s lead in the cloud components market

Cloud components vendor spotlights

Dell Technologies [Dell]

From a revenue perspective, HPE and Cisco once threatened Dell’s cloud components leadership, but the company has been able to distance itself from its nearest competitors. This is largely due to Dell’s performance over the past year, with strong server demand, particularly from Tier 2 cloud service providers (CSPs), propelling the company’s corporate and cloud components revenue growth rate to the double digits. Meanwhile, in 3Q24 Dell shipped $2.9 billion worth of AI servers while backlog reached $4.5 billion, reflecting 181% year-to-year growth during the quarter and indicating strong future revenue performance.

Hewlett Packard Enterprise

Like its peers, HPE is benefiting from AI-related server demand, and in 3Q24 the company reported $1.5 billion in total AI systems revenue. HPE continues to benefit from its ongoing efforts to shift the sales mix in favor of software and services via GreenLake. In 3Q24 HPE completed its acquisition of Morpheus Data, officially equipping HPE with a suite of infrastructure software that allows customers to take core hypervisors, such as KVM and VMware, and use them to build complete private cloud stacks.

Cisco

With its acquisition of Splunk, Cisco has emerged as the leader of the software components market, even surpassing Microsoft in related revenue. But networking still accounts for the bulk of Cisco’s components business, and, as evidenced by a 32% year-to-year decline in total hardware revenue for 3Q24, Cisco is facing headwinds in the core networking business. That said, the company is actively taking steps to build out its portfolio, particularly by integrating more security components into the networking layer, which is where most cyberattacks originate, to boost its long-term competitiveness in the market.

Infrastructure agnosticism and flexible cloud-enabled delivery are core attributes of the service delivery market, cementing IBM’s leadership

Dedicated orchestration tools continue to have their place in the market, both in on-premises and cloud environments, but growth is largely driven by application lifecycle management and orchestration tools that span multiple environments. IBM has a rich history in this space and remains a revenue leader. Cisco used to have a foothold in the market but no longer sells its CloudCenter suite.

Vendor spotlight: IBM

After taking steps to bring watsonx into Maximo in 2Q24 for greater process automation, IBM strengthened its commitment to the asset performance management space with the acquisition of Prescinto. Prescinto offers AI tools and accelerators designed for asset owners and operators with a focus on renewable energy and operators. This deal is designed to support IBM’s play in certain verticals, particularly energy and utilities.

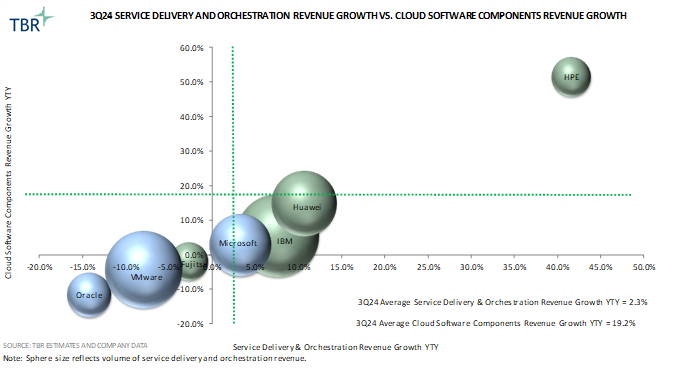

Service Delivery and Orchestration Revenue Growth vs Cloud Software Components Revenue Growth for 3Q24 (Source: TBR)

Technology Business Research, Inc.

Technology Business Research, Inc.

Technology Business Research, Inc.

Technology Business Research, Inc.