2026 Predictions Series | Alliances & Partnerships

2026 Will be a Pivotal Year as AI Momentum Drives Deeper Ecosystem Alliances

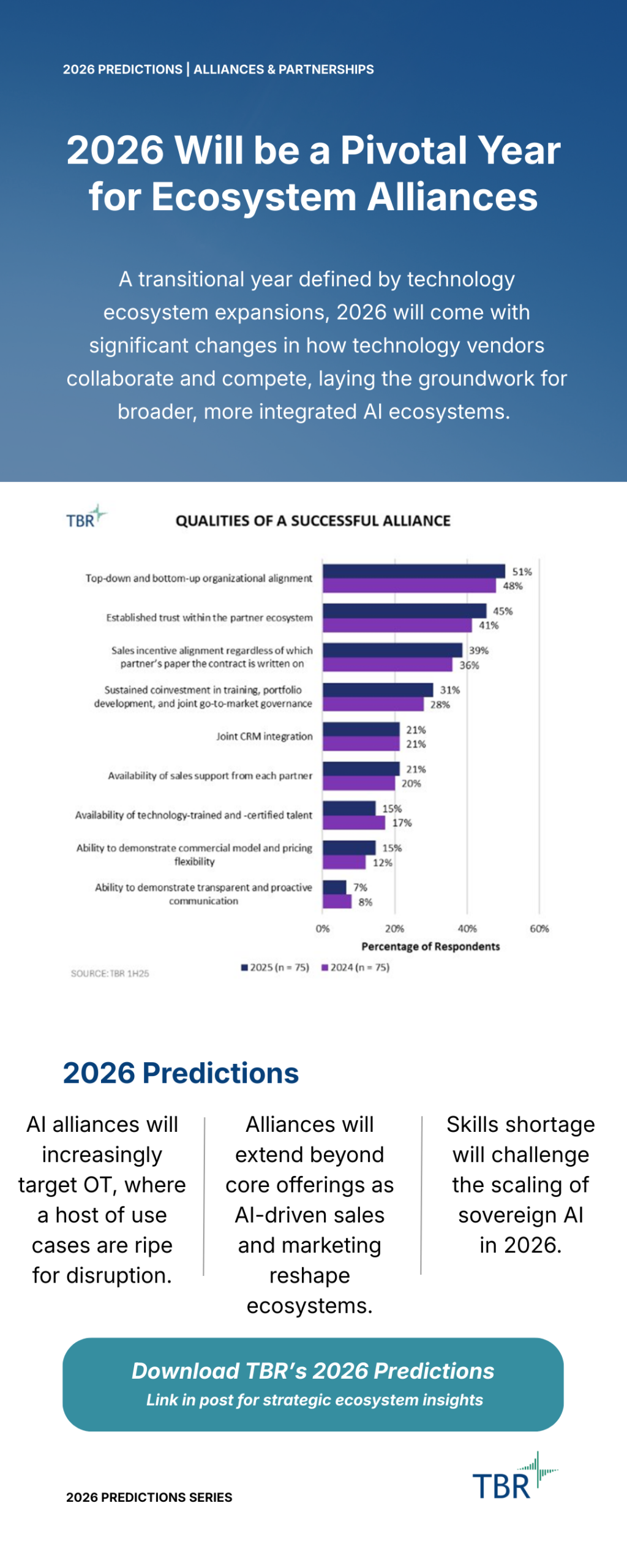

2026 will be a transitional year defined by technology ecosystem expansions — multiparty alliances spanning IT, OT, devices, edge and silicon; industrial/physical AI acceleration, especially at the edge and in manufacturing; and strategic bottlenecks as skill shortages and infrastructure gaps slow sovereign AI adoption. TBR expects significant changes in how technology vendors collaborate and compete, which lays the groundwork for broader, more integrated AI ecosystems.

This is an optimistic prediction. Multiparty alliances require exceptional leadership, shared understanding of commercial models and transparency among partners, and AI aids only the last of these. The human component remains the most significant roadblock. IT-OT convergence and a surge in connected everything have been a TBR (and broader market) prediction for years, and while “signs point to yes,” as the Magic 8 Ball says, 2026 could be another year of disappointing progress, as hype around physical AI could far outpace reality.

Lastly, TBR may be underestimating the AI skills shortages and the potential for enterprise buyers to dial back their AI spend, creating new pressures on tech companies across the ecosystem to show ROI on the billions invested in AI since ChatGPT launched. On balance, TBR anticipates accelerated AI adoption and even tighter ecosystem alliances will lead to another Magic 8 Ball answer, “Outlook good.”

2026 Alliances & Partnerships Predictions

Prediction: Alliances will extend beyond core offerings as AI-driven sales and marketing reshape ecosystems

Trend: Traditional one-plus-one alliances expanding into multiparty alliances create new growth opportunities.

Driver: AI adoption, particularly in sales and marketing, reduces the costs of expanding alliances, introducing new portfolio offerings and reaching new clients.

Result: Tighter alignment between companies across the technology ecosystem leads clients to expect more seamless integrations and improved commercial terms.

Prediction: AI alliances will increasingly target OT, where a host of use cases are ripe for disruption

Trend: New and expanding partnerships will target the convergence of IT and OT, with system integrators partnering with OEMs, manufacturing ISVs and at the silicon level.

Driver: High-tech manufacturing has significant growth potential for firms building solutions that increase accuracy, efficiency and safety. These solutions do not rely on the massive rack-scale compute systems housed in neoclouds and Tier 1 clouds, as these workloads can be powered on-site using less-demanding resources.

Result: AI has long existed at the edge, but new and expanding partnerships will accelerate both the sophistication of AI-based use cases and the velocity of solution framework development.

Prediction: Skills shortage will challenge the scaling of sovereign AI in 2026

Trend: AI-related skills will remain in short supply for both buyers and ecosystem partners.

Driver: The pace of innovation in AI and the layers of highly complex technology that are needed to enable sovereign AI are daunting obstacles to adoption.

Result: Actual investment and implementation of sovereign AI will be limited in 2026 due to a combination of sovereign customers lacking clear and compliant use cases, gaps in sovereign cloud infrastructure availability, and partners in the ecosystem grappling with a steep learning curve for all things AI, sovereign being the most challenging.

Technology Business Research, Inc.

Technology Business Research, Inc. Saitharn, Getty Images via Canva Pro

Saitharn, Getty Images via Canva Pro