TBR Launches Enterprise Systems Integrators Market Landscape

Technology Business Research, Inc. (TBR) is pleased to announce the launch of the Enterprise Systems Integrators Market Landscape, which examines business models, trends and challenges for IT services companies with fewer than 100,000 employees and less than $5 billion in annual revenues. This new research is an extension of TBR’s current research around the business models, strategies and performances of companies in IT services, consulting and professional services, including IT outsourcing, business process outsourcing, management consulting, systems integration, managed services and applications outsourcing.

The initial publication is a close-up look at the ESI market midway through 2025 and includes performance analysis of Ensono, TIVIT, Globant, Hexaware Technologies, Persistent Systems, Protiviti, Stefanini Group, EPAM, Indra Group and LTIMindtree.

“What smaller IT systems integrators lack in scale they make up for with closeness to clients, flexible financial models, and innovation opportunities for cloud and software alliance partners. TBR’s newly launched Enterprise Systems Integrators Market Landscape uses a representative sample of these ‘Tier 2’ consultancies and SIs to answer TBR’s clients’ questions around value proposition, strategy, differentiation and partnering,” said TBR Principal Analyst & Practice Manager Patrick Heffernan. “With additional context, data and analysis from other TBR reports, such as the Voice of the Partner Ecosystem Report, readers of this new market landscape get an informative snapshot of a highly volatile market and can begin extrapolating trends, strategies and lessons learned across the broader IT services and technology ecosystem.”

Enterprise systems integrators (ESIs) traditionally need to focus on a country or region, a select few industries or a technology niche, at least in their early stages. To capture some of the changing dynamics in the ESI space, TBR’s research focuses on companies as small as 3,000 employees and as large as 80,000, as well as pure IT services companies and those with more diversified portfolios, with TBR estimates and company-reported figures included in the data.

The first publication of this annual report is now available. If you believe you have access to the full research via your employer’s enterprise license or would like to learn how to access the full research, click here.

Highlights from the Summer 2025 Enterprise Systems Integrators Market Landscape

Addressing common gaps such as technical expertise could help vendors build a foundation around scale and quality as GenAI adds another layer of complexity that has to be tied to business outcomes

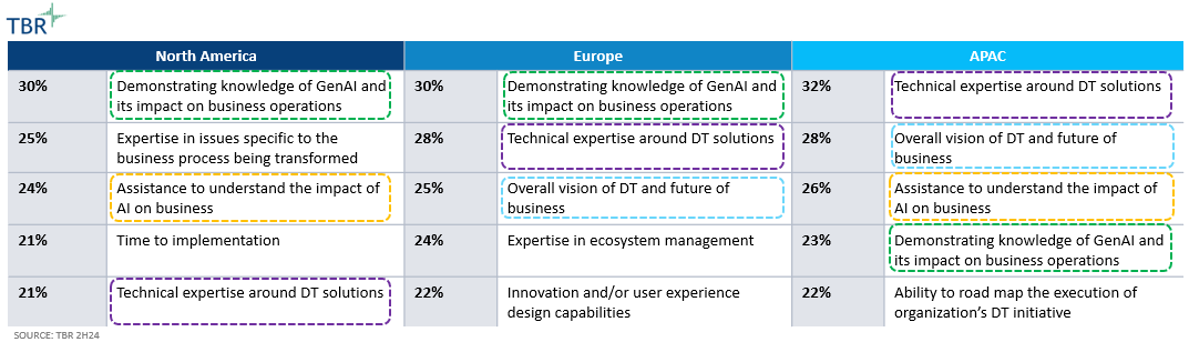

Customer recommendations for digital transformation (DT) services vendors by region

Improving technical expertise remained among the top recommendations across regions for vendors to consider, which reflects the IT fluency of DT buyers and illustrates portfolio and skills gaps vendors struggle with despite ongoing investments. Other common recommendations, such as generative AI (GenAI) knowledge tied to business operations, also underscore the need for vendors to find a way to balance their technology-led discussions with business process knowledge, especially as the majority of buyers’ budgets are shifting back to business and tech advisory services.

Supporting and taking responsibility for enterprises’ IT environments cannot be done in a vacuum, and vendors need to account for the impact of broader stakeholder ecosystems, especially as the adoption of emerging technologies increases the level of complexity. This is particularly the case among EMEA buyers, who ranked vendors’ expertise in ecosystem management within the top five recommended improvements, highlighting the importance of collaborating with regional vendors as a critical link in otherwise fragmented European-sourced opportunities.

In comparison, APAC and North American buyers see a gap in vendors’ ability help them understand the impact of AI on the business, creating an opportunity for providers with strong consulting skills that can also demonstrate business outcomes through proven use cases.

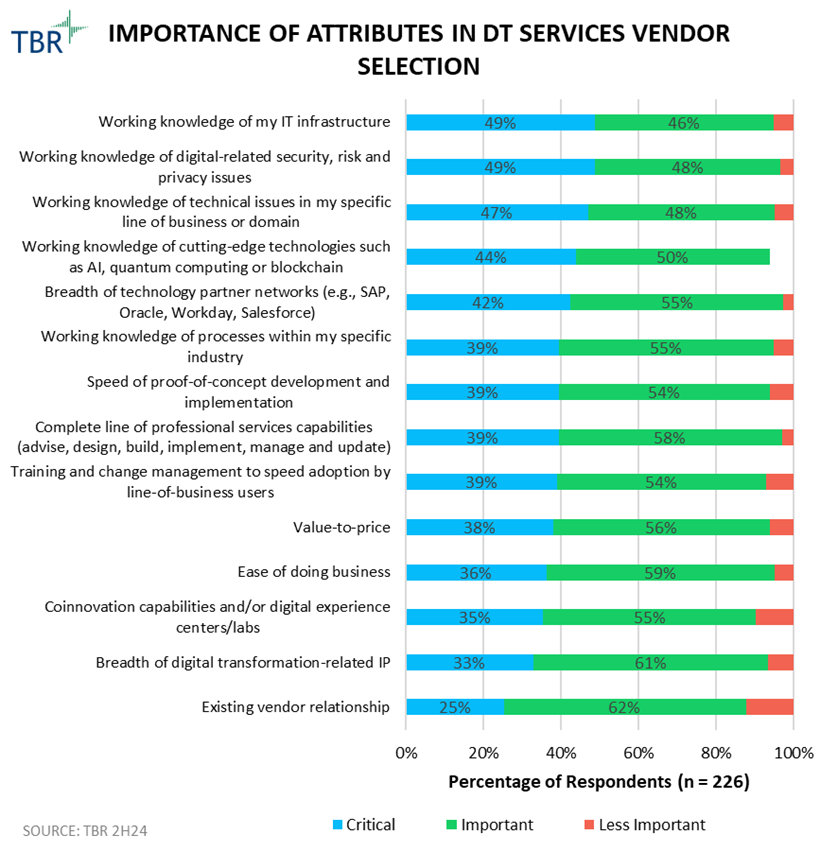

Attributes related to vendors’ ability to execute on DT promises reflect changing buyer priorities from a year ago and send a strong message that vendors should not take relationships for granted

Main criteria for selecting DT services vendor

Working knowledge of buyers’ IT infrastructure, digital-related security and privacy issues, and specific line of business or domain ranked as the top three attributes for vendor selection. The ranking was a major reshuffling from 2023, when industry knowledge, value-to-price, and complete line of professional services ranked as the top attributes. The change highlights buyers’ evolving priorities. While a year ago the attributes were oriented toward convincing stakeholders to spend on DT programs, this year it appears as though buyers are looking for vendors that can execute on the programs, aligning with the increase in overall DT spend. Existing vendor relationship remained the least critical attribute for vendor selection, underscoring that no single vendor’s position is guaranteed and that vendors must account for evolving stakeholder expectations.

“One is, you, that you want a competitive bid. So, nobody should ever feel entitled that this is there, even though it may be a similar project. ‘Hey, I did a cloud migration project last year. I want to do another one of those projects this year.’ You got to win it. You got to bid on it. Yes, the partner that did the work last year probably has knowledge about my environment, etc., etc. That’s of some value, but you still got to win it. You can’t be 20%, 30% more expensive than the other. It’s just not working. But that’s one aspect. The other part, as you said, is if it’s brand new, etc. And then the third is the obvious one, which is you got to be performing. If you’re not performing, you’re going to be out.” — CIO Insurance

Technology Business Research, Inc.

Technology Business Research, Inc.