TBR Launches Cloud Go-to-market Benchmark

Technology Business Research, Inc., is pleased to announce the launch of our Cloud Go-to-market Benchmark. Go-to-market strategies are constantly evolving, and as cloud vendors adapt to shifting buyer behavior, expanding ecosystems, and the demands of emerging technologies like AI, they are also updating their sales motions and spending. TBR’s new Cloud Go-to-market Benchmark quantifies these shifts at the financial level, tracking how vendors allocate sales and marketing (S&M) spending across direct and indirect channels.

As numbers alone do not tell the full story, this report layers in strategic context, examining how partner investments align with each vendor’s priorities and how these priorities are changing in the AI era. Whether it is the balance of internal versus partner-led sales or the evolving structures of ecosystem support, the Cloud Go-to-market Benchmark offers data-backed insight into where the cloud leaders are going and what that means for the broader competitive landscape.

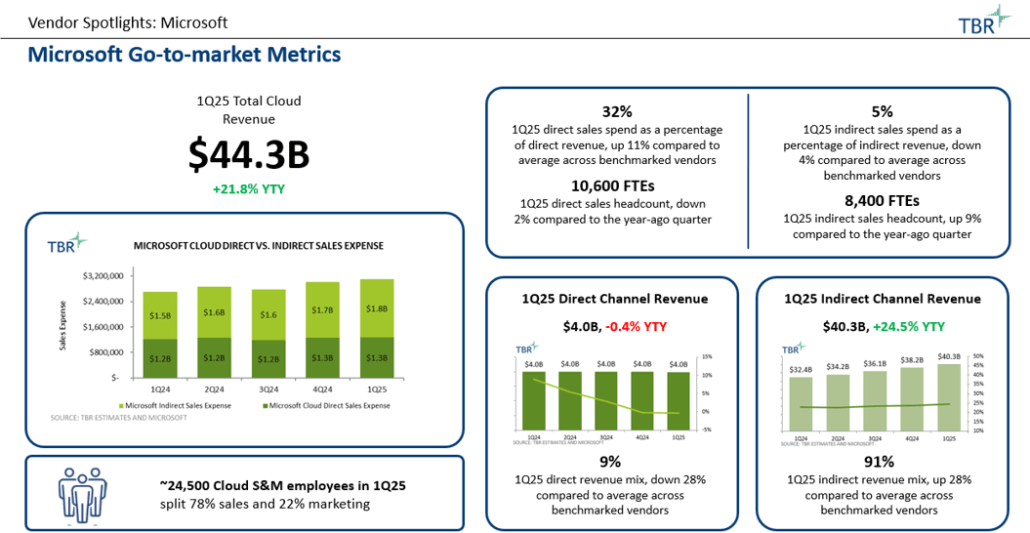

Clients gain access to sales expense data split by direct and indirect sales motions, workforce headcount split by direct and indirect sales teams, and year-to-year growth comparisons for seven of the biggest cloud leaders covered by TBR. Additionally, you’ll find the qualitative backdrop behind these numbers, offering the necessary context for external stakeholders to navigate the changing landscape.

Cloud Go-to-market Benchmark is now available on TBR Insight Center™. Click here to preview the first publication.

Cloud Go-to-market Benchmark Excerpt

Cloud leaders seeking to expand reach and limit internal resource investments prefer indirect sales channels

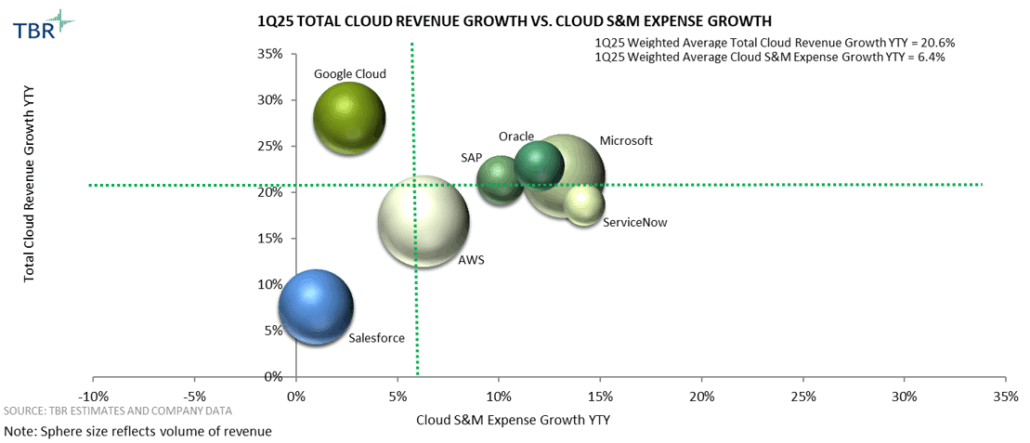

Across nearly all covered vendors, indirect revenue as a percentage of total revenue is growing faster than any other go-to-market metric. Vendors like Microsoft and Google Cloud even have public targets for 100% partner attach on every cloud transaction, turning the ecosystem into the primary growth engine, rather than a complementary route. At the same time, Amazon Web Services (AWS), Salesforce and ServiceNow let field sellers meet their quotas with partner-sourced or partner-transacted deals, a change that removes the historical tension between direct and channel teams. These developments underscore a consensus among cloud leaders that scale, reach and solution depth increasingly reside outside the walls of the vendor’s own organization.

Several forces explain the shift. First, customers prefer bundled outcomes over raw technology, especially as generative AI (GenAI) and industry-specific regulations complicate deployments. Partners supply integration skills, compliance assurances and managed services that vendors cannot replicate economically with their own staff. Second, marketplace private offers and cloud credits have shortened buying cycles, decreased legal overhead and preserved list-price integrity, making indirect transactions faster and less price-erosive than many direct pursuits. Third, partner economics are attractive to finance chiefs. Paying a rebate equivalent to 3% to 5% of incremental consumption costs far less than hiring, onboarding and retaining another account executive whose compensation may run well above $250,000 annually.

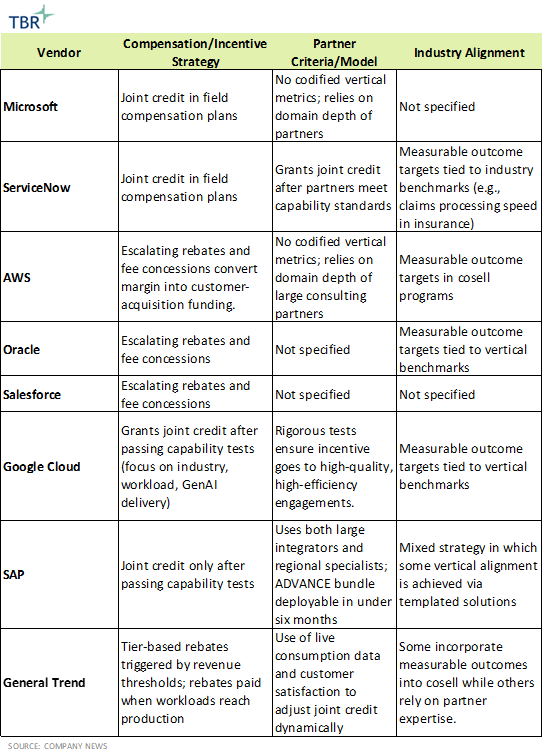

Cloud leaders overwhelmingly shift their go-to-market efforts toward partner-led engagements, investing in rebates and milestone-based incentives to ensure alignment

Cloud vendors now place global and regional IT services firms at the beginning of the deal cycle. These partners work with the customer and vendor account executive early to custom-build solution architectures, rather than waiting for the contract to close. Most programs use tier-based rebates that increase as the partner’s booked revenue crosses fixed thresholds. Cash arrives only after the workload reaches production, shifting delivery risk to the services team while allowing the vendor to keep its own headcount focused on product engineering and cost discipline. The result is shorter sales cycles and larger contract values because implementation details are ironed out early and customer confidence rises.

Each vendor fine-tunes the model differently. Microsoft and ServiceNow both offer joint credit in their field compensation plans, giving partners a transparent path to quota completion and naturally channeling complex transformations toward their clouds. AWS, Oracle and Salesforce take a margin-based route. They use escalating rebates and fee concessions that convert a slice of gross margin into customer-acquisition funding without changing payroll. Google Cloud and SAP occupy the middle ground. Both grant joint credit only after partners pass rigorous capability tests that cover industry focus, workload expertise, and verified proficiency in GenAI delivery. The tighter filter aims to make sure incentives land on engagements that reduce ramp time rather than pad service hours.

The efficiency upside is real, yet it comes with downside risks. Overly strict entry criteria limit geographic reach. Loose standards inflate payouts faster than revenue. To take a balanced approach, most vendors feed live consumption data and customer satisfaction scores into quarterly scorecards that can raise or lower joint credit automatically. A partner that speeds adoption keeps 100% credit toward their quota on future deals. A partner that misses milestones reverts to standard terms until performance improves. Vendors that refine these feedback loops and respond quickly to the data are likely to preserve a cost advantage as AI workloads expand. Maintaining that edge will depend on constant calibration of incentives, clear communication with partners, and disciplined use of real-time data.

Technology Business Research, Inc.

Technology Business Research, Inc.

Getty Images Signature, via Canva Pro

Getty Images Signature, via Canva Pro