How Will Advanced AI Impact Pricing, Labor Practices and Client Expectations?

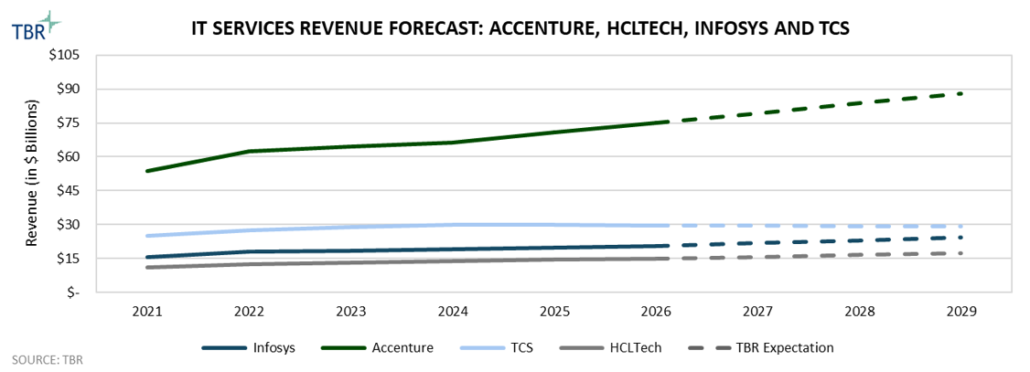

TBR FourCast is a quarterly blog series examining and comparing the performance, strategies and industry standing of four IT services companies. The series also highlights standouts and laggards, according to TBR’s quarterly revenue projections and geography estimates. This quarter, we look at Infosys, Tata Consultancy Services, HCLTech and Accenture and compare how their advanced AI and labor strategies position them for revenue growth.

Advanced AI may be front and center in IT services strategy, but execution challenges remain a familiar story. Despite ongoing hype around unlocking new efficiencies and nonlinear growth, IT services firms continue to grapple with the reality of needing labor arbitrage in the short term and meeting client expectations. The distance between strategic intent and operational reality is less about reluctance to adopt AI and more about IT services companies’ timing, risk management, and the need to protect revenue streams today while betting on the future potential of advanced AI.

AI-first in strategy, labor-arbitrage in practice

Although all IT services companies aim to leverage advanced AI to improve margins and propel revenue growth, in the short term some are still relying on headcount growth to execute on deals. For example, even though advanced AI remains core to HCLTech’s delivery strategy and in February the company announced a goal to double revenue with half the number of employees, HCLTech has added a total of 10,032 freshers over the past three quarters.

Similarly, Infosys has increased headcount in preparation for executing on large deals, as evidenced by its announcement of hiring a total of 12,000 freshers over 2Q25 and 3Q25. In contrast, Tata Consultancy Services (TCS) and Accenture experienced headcount declines in 4Q25, marking the first drop for Accenture since 2010. Yet the quarterly decrease for both companies may reflect the worsening macroeconomic conditions rather than decisions to downsize headcount. If anything, companies are preparing for ongoing demand fluctuations as clients remain cost-conscious.

According to TBR’s 3Q25 IT Services Vendor Benchmark, offshore and nearshore headcount continues to grow among the 30 covered vendors, increasing 1.2% in 3Q25 as opposed to a 1% decline in onshore headcount in the same period, indicating the labor arbitrage model is alive and well, at least for now. Accenture, HCLTech, Infosys and TCS are all expanding their reliance on global delivery centers, including for in-demand skills such as AI, causing increased demand for highly skilled workers. Most companies have reported some AI training numbers, such as TCS stating that 159,000 of its more than 580,000 employees have been trained on AI. However, the reported numbers reflect a significant portion of companies’ employee base, raising questions about the depth of knowledge. TBR believes the training is just deep enough to lend credibility to the marketing.

BPO companies are the first to face a transformative wave of AI delivery implications: Can they impress clients while keeping them happy?

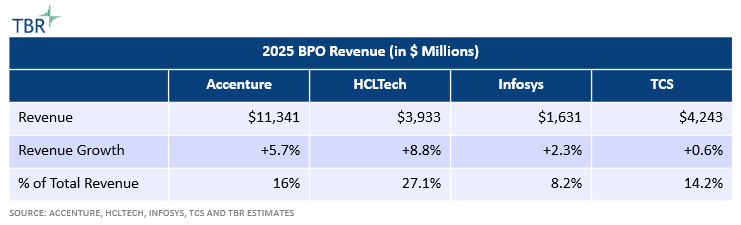

The four covered IT services companies are all top contenders in the business process outsourcing (BPO) space, making advanced AI essential for these companies right now. CEO of HCLTech C Vijaykumar stated on the company’s CY3Q25 earnings call, “As mentioned on Investor Day, the biggest impact will be in the BPO business, where productivity gains could reach 40 to 50%.” According to TBR’s estimates (see Figure 1), Accenture has the largest BPO segment, followed by TCS, HCLTech, and Infosys. With BPO having the most initial risk of cannibalization to traditional revenue, these companies will be the first to test how to adapt their commercial models. Although delivery remains largely time-and-materials-based, IT services companies such as Accenture are moving to a fixed-price model, a potential bridge to outcome-based pricing.

Yet cost-conscious clients are beginning to demand lower pricing due to the use of AI and automation, forcing IT services companies to compete on price even as they look to improve margins. This is creating pressure to realize ROI internally while appeasing clients on price and service quality. According to TBR’s 4Q25 Infosys Earnings Response, Infosys views its agentic AI “as a productivity and monetization lever rather than a growth engine that fundamentally reshapes the revenue mix.” Persistent macroeconomic uncertainties remain both a blessing and a curse for vendors. On the one hand, clients are becoming more curious about the benefits of advanced AI adoption, particularly agentic AI, providing more sales for IT services companies. On the other hand, clients are demanding a growing share of the resulting cost savings as price discounts, negatively impacting vendors’ margins.

Figure 1: 2025 BPO Revenue for Accenture, HCLTech, Infosys and TCS (Source: Company Data and TBR Estimates)

So, what approach should companies take to maximize potential growth, protect margins and ROI, and manage client expectations? Although companies are racing to keep pace with the competition in offering hyperscaler-enabled agentic capabilities as well as large language model-enabled solutions with companies such as Anthropic and OpenAI, establishing proprietary solutions will be important to differentiate and demonstrate advanced AI proficiency. Companies may have difficulty finding a healthy balance between focusing on proprietary solutions that set themselves apart and delivering key partner-enabled solutions that clients have come to expect and trust.

Perhaps more importantly, IT services companies will need a well-thought-out strategy to deepen client relationships while keeping AI top of mind as a value-add rather than a purely cost-conscious tool. Slimming headcount, for example, is undoubtedly an end goal for Accenture, HCLTech, Infosys and TCS, but maintaining the right strategic onshore locations to keep a human touch and not cutting headcount too quickly will be essential to retain employees and institutional knowledge. This will help uphold the company’s service quality, but if IT services companies can leverage AI to augment service delivery rather than market solely as one-size-fits-all stand-alone solutions, this could generate more demand. Further, protecting the value of services will strengthen companies’ contract negotiating power.

Conclusion

HCLTech is among the few IT services companies that have reported advanced AI revenue. In 3Q25 HCLTech announced it received $100 million in advanced AI revenue. On Accenture’s 4Q25 earnings call, the company reported advanced AI revenue of $1.1 billion, but leadership later noted that this metric will no longer be reported because advanced AI has become integrated across much of the company’s operations. This also implies concerns of revenue cannibalization — especially if Accenture cannot introduce fixed pricing fast enough. TBR believes companies need to have a well-planned pricing strategy in addition to a holistic approach to ensure a healthy long-term trajectory.

HCLTech follows this approach in part through its industry- or task-specific solutions that focus on solving a problem. Product launches throughout 2025 reflected this point, including HCLTech Insight, an agentic AI solution built with Google Cloud to support manufacturers with data analytics, and Physical AI with SAP, which enables optimization across warehouse operations, fleet management and 3D reality capture. TBR believes this strategy, although not entirely unique, has contributed to HCLTech’s consistent financial performance and strong bookings.

TCS takes the opposite approach in some ways, using AI to augment existing platforms rather than releasing stand-alone AI solutions. Although this may help TCS navigate revenue disruption in the short term as its client-facing solutions retain their names and functions, over time TCS may need to define its AI strategy better and market a more compelling story about how it can help clients solve problems with innovative solutions. Nevertheless, TCS’ IP-driven AI strategy will undoubtedly be a strength. Infosys may have a better narrative around AI aligning as it shifts its strategy to focus on outcomes.

Additionally, similarly to TCS, according to TBR’s 3Q25 Infosys report, “Successful positioning and usage of industry- and function-aligned proprietary and partner-enabled agents could help Infosys stay grounded, which could strengthen trust with clients and partners and help drive sales rather than entering uncharted territory in a GenAI [generative AI] market that is in a hypergrowth phase.” Importantly, TCS and Infosys have not reported AI revenue numbers. TBR believes the two companies may be withholding this data because it may be less than HCLTech’s and Accenture’s figures. With Accenture no longer reporting the metric, TCS and Infosys may be less likely to provide the information.

How will the three India-centric vendors fare against Accenture, which has vigorously invested in AI IP, particularly in industry-specific solutions such as the AI agents in AI Refinery? Although India-centrics’ clients may not have the same expectation as Accenture’s clients, the vendors will need to make sure they are prioritizing client outcomes and creating a meaningful narrative. Leaning into this approach will be particularly important as Accenture’s undeniable size in BPO provides it with an ideal testing ground for agentic AI. TBR could see Accenture making a similar acquisition as Capgemini did with WNS, such as by acquiring Genpact or EXL, which would sharpen its competitive edge. Ultimately, future success will depend on how effectively IT services companies translate AI adoption into differentiated, outcome-driven offerings without eroding client trust or margins. Those that balance proprietary innovation with partner ecosystems while resetting commercial expectations will be best positioned as AI reshapes cost structures and value creation.

Gustavo Quiroga Gaitan, Canva Pro

Gustavo Quiroga Gaitan, Canva Pro