PaaS Revenue Will Outpace SaaS Revenue for Cloud Software Vendors

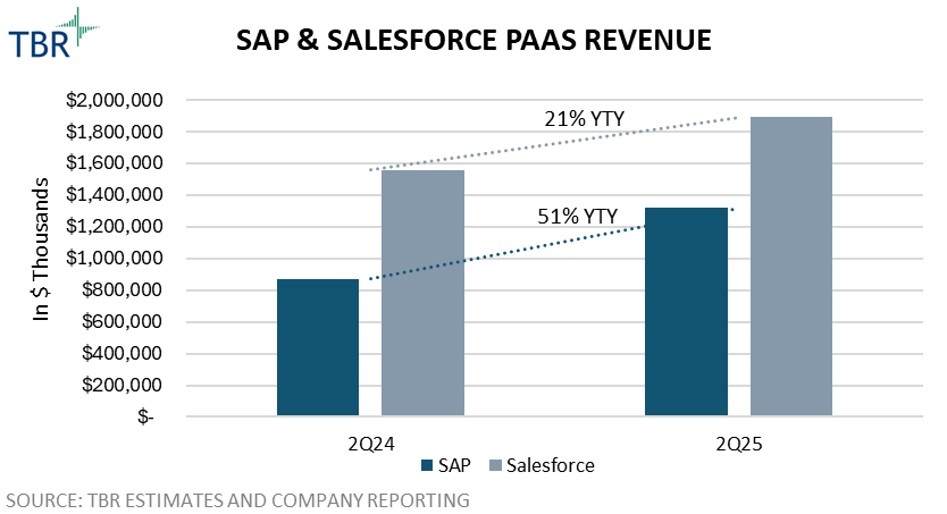

Enterprise customers are prioritizing the modernization of their existing SaaS estates rather than adding new applications, driven by market saturation, accumulated technical debt, and a growing imperative to become AI-ready. As IT buyers shift their focus toward modern platforms, traditional SaaS leaders should expect their PaaS segments to continue significantly outperforming their core SaaS businesses in revenue growth.

A clear inflection in SaaS momentum emerges

SAP’s trajectory is tied to Business Technology Platform (BTP) becoming the architectural anchor of RISE programs. BTP is no longer an optional add-on but rather the control plane for process mining, metadata management and event-driven extensions. Attach rates above 80% in RISE cycles reflect SAP’s ability to position BTP as mandatory for modernization rather than discretionary middleware. The addition of Signavio and LeanIX broadened the portfolio, giving SAP a modern platform that starts with process intelligence and ends in a coherent data and extension strategy.

Salesforce is following a data-first path. Data Cloud has become the centerpiece of modernization discussions as the company works to consolidate fragmented CRM data models and unify cross-cloud metadata.

MuleSoft remains critical in stitching legacy systems into Salesforce’s AI-ready architecture, and early Data Cloud wins indicate customers view it as the foundation for copilots, agentic workflows and future small language model integration.

Both vendors benefit from a status as a highly trusted incumbent and deep process ownership, enabling them to sell platform capabilities not as adjacent tools but as prerequisites for becoming AI-ready.

Explore more SaaS predictions for 2026 in our special report Will AI be the Death of SaaS in 2026?

Alemedia.ID via Canva Pro

Alemedia.ID via Canva Pro