Cloud Data & Analytics Market Landscape

TBR Spotlight Reports represent an excerpt of TBR’s full subscription research. Full reports and the complete data sets that underpin benchmarks, market forecasts and ecosystem reports are available as part of TBR’s subscription service. Click here to receive all new Spotlight Reports in your inbox.

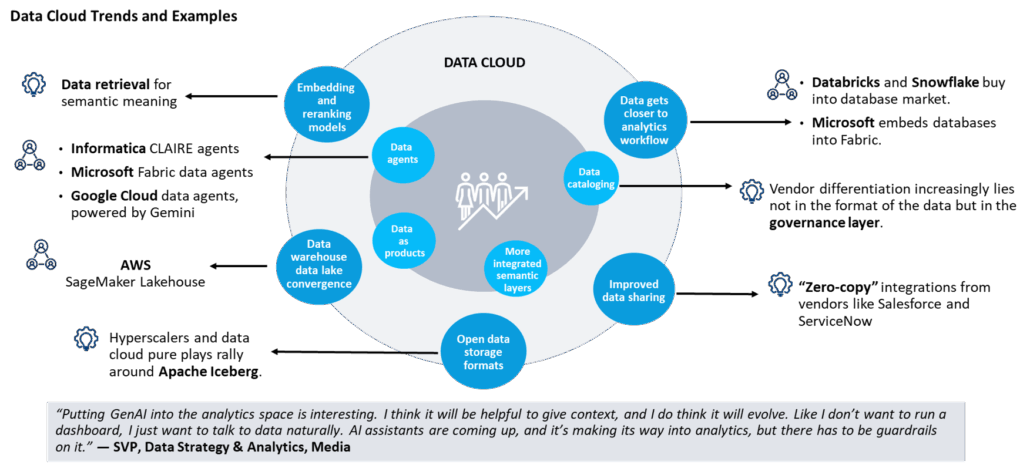

To better enable AI, vendors reevaluate architecture and take big steps to bring operational data closer to the analytics workflow

New AI applications will drive near-term growth in the data cloud market, while SaaS vendors’ need to pivot as GenAI disrupts will be a defining trend in the coming years

Key takeaways

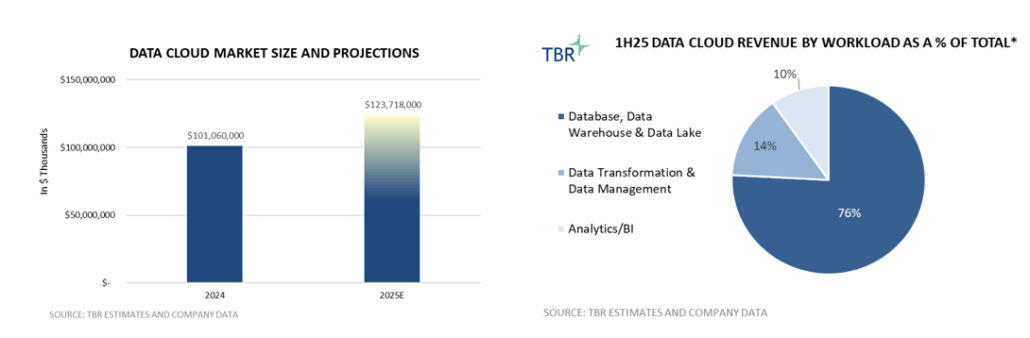

The data cloud market, which we expect will reach $124 billion in 2025, up 22% from 2024, remains driven by foundational workloads that support the storage and querying of data. While most of the data science and engineering efforts — and associated IT spend — are tied to moving data across systems and preparing it for transformation, the pressure to abstract insights and deliver business value from data is increasing. In the coming years, customers’ expectations around analytics will increase and drive a greater need for tools that can effectively bridge the gaps between technical and business personas within an organization.

Data Cloud Revenue and Market Share (Source: TBR)

AI demand remains strong, and extending AI to the workload (as opposed to extending the workload to the AI) underpinned by the database, is often a winning strategy. Vendors continue to closely integrate their services to promote data sharing and access — meeting customers where their data is — to support AI development.

Though responsible for vast amounts of critical business data, SaaS applications are not driving the storage of the data, which will be important as the rise of agentic AI causes disruption to the application layer. In the coming years, the data cloud market will be influenced by vendors trying to adapt to the disruption caused by generative AI (GenAI). For instance, SaaS vendors may increasingly buy their way into the data cloud space (i.e., Salesforce and Informatica), while existing data cloud players will explore new growth opportunities. Another big example is Databricks’ recent entry into the database market with Lakebase to bridge the gap between Online Transaction Processing (OLTP) and Online Analytical Processing (OLAP) systems.

Overall PaaS market growth will be fueled by AI offerings, such as Amazon Bedrock, Azure OpenAI and Google Vertex. Even so, the relationship between data and AI is symbiotic, and as customers build and deploy more AI apps using these services, adoption of database offerings will increase.

Customer scenario excerpt

Oracle’s ability to provide robust interconnectivity with other hyperscalers proves highly strategic, as legacy Oracle Database customers modernize on other clouds

Customer scenario: A distributed architecture leveraging Oracle and Microsoft Azure drives heavy cost savings

- A company with a large legacy footprint, including both Microsoft and Oracle databases, leveraged a distributed architecture enabled by Oracle’s interconnectivity agreement with Microsoft Azure. Although this distributed architecture may not be as high-performing as hosting the associated applications in the cloud, its performance was still deemed better than that of the legacy data center.

- To entice the customer to stay with their Oracle databases, significant savings were offered. The customer ultimately retained their Oracle databases, highlighting the value of Oracle’s partnership with Microsoft. Oracle is also expanding its interconnectivity with other cloud providers, including through its multicloud database strategy.

- This particular customer decided to ultimately migrate applications to Oracle Cloud Infrastructure (OCI), highlighting the role OCI plays in supporting the apps business.

“We ran a lot of performance tests to say, if we have this whole application in Azure, what does that performance look like? And what’s interesting is that Oracle actually has very strong interconnectivity that they’ve built with Azure. And, and when we ran the performance test, it turns out that, you know, the performance is actually better when you go to the cloud, for many use cases, but not all the use cases, right? The application issues are better, but sometimes the data may not be as optimized because now it’s inside Azure. And so we also knew Oracle came to us and said, ‘If you pay a certain amount of money for your on-premises databases, let’s say that money is $3 million, we’ll knock off your rates by 30%. So we’ll save you a million dollars. If, instead of moving all these to the Azure cloud, you move them to our cloud.’ And we thought they were crazy, but they showed us that is technically feasible, they have this high-speed interconnect. And we did that. And we realized that’s a lot of money to save, right? If you can save a couple million dollars, which otherwise I’m stuck in these legacy systems, you know, I’m there for the system for at least a couple of years. And so, it made sense for us to put our databases therefore, in Oracle, and we saw it was giving us better performance than we were in the data center. But slightly, not as great a performance as the whole application was in Azure itself. So we took a little bit of performance hit with this distributed architecture, but it was still better than a data center. And the cost savings were very significant. Were in millions of dollars. And so after we ran all the performance tests, security tests, and all of these pieces, we’ve sort of decided that one of the applications, we’re going to migrate completely, to OCI itself.” — CTO, Manufacturing

Ecosystem developments excerpt

Maturing data cloud companies invest in programmatic partner initiatives, which is critical to improving engagement, accountability and alignment within the ecosystem

Sales & marketing staffing

- Collective sales and marketing headcount across the seven data cloud pure plays in this report reached roughly 16,600 in CY2Q25, up 24% year-to-year. Snowflake has been particularly focused on hiring more technical sales roles, including sales consultants who can identify new use cases and migration opportunities.

- Confluent’s transition to a consumption-led GTM model has been supporting productivity, with revenue per S&M employee continuing to grow in the low double digits on a year-to-year basis.

Partner developments

- On the heels of launching new partner programs including the Accelerate with Confluent program for SI partners, Confluent plans to invest $200 million in its global partner ecosystem. This investment will support new engineering efforts and partner enablement resources on the GTM side.

- MongoDB continues to invest in the MongoDB AI Applications Program (MAAP), aligning engineering, professional services and partner resources to help digital natives get started with AI. That said, there is an enterprise component to the program, and GSIs like Accenture and Capgemini are participating members.

Sales motions

- Self-service channel: Currently, 7,300 MongoDB customers are supported through direct sales, which represents just 12% of MongoDB’s nearly 60,000 customers. Naturally, many of MongoDB’s customers are SMBs and midmarket businesses supported through the self-service channel via cloud marketplaces, which act as a great sales productivity lever for MongoDB. As MongoDB continues to look upmarket and focus on capturing wallet share from its largest, most strategic accounts, the number of self-serve customers passed on to direct sales teams will likely continue to decline.

- Consumption-based selling: Confluent has a consumption-based revenue model and has been taking steps to align its go-to-market model accordingly. For instance, the company is now compensating salespeople on incremental consumption and new logo acquisition.

Geo and industry segmentation

- Databricks is rapidly expanding in Latin America and opened a new office in São Paulo, Brazil, in early July. Total headcount in the region is expected to reach over 200 employees by the end of this year. Databricks also recently made its platform available in Google Cloud’s São Paulo region, officially making Databricks available on all major public clouds in Brazil.

- As highlighted in TBR’s 1H25 U.S. Federal Cloud Ecosystem Report, federal cloud spending is expected to surpass $31 billion by FFY28. Data cloud vendors continue to certify their offerings to address this opportunity. For instance, Cloudera has reached some major milestones, including achieving Moderate Provisional Authority to Operate (P-ATO) status for its platform, and recently secured a blanket purchase agreement with the DOD as part of the Enterprise Software Initiative (ESI).

Vendor profiles excerpt

Though still staying true to its iPaaS heritage, Boomi actively repositions as an orchestrator of AI agents to reduce the complexity and sprawl that development platforms are creating

TBR Assessment: Integration Platform as a Service (iPaaS) continues to play a critical role in helping IT departments meet the needs of their business users and, by extension, the end customers. As a key market player, Boomi upholds its long-established position as readily scalable and able to support a low TCO (total cost of ownership). In many ways, Boomi achieved this position by being a cloud-native application — an advantage that not all iPaaS players have. Building on its integration heritage, Boomi is expanding the reach of its platform to support the needs of AI agents, an emerging opportunity as PaaS vendors make it incredibly seamless to spin up an AI agent, indirectly creating more sprawl and complexity. With new tools like Boomi Agentstudio (formerly Boomi AI Studio), which is now generally available, Boomi is giving customers a way to manage, govern and orchestrate agents on a single platform, reinforcing the shift the vendor is making to become more of an agent orchestrator. Though Boomi stays true to its core iPaaS roots, which is a core component of the Boomi Enterprise Platform and Agentstudio, the company clearly recognizes the need to pivot like the rest of the market as a result of GenAI’s emergence.

Customer Insight

“So when we need to integrate through APIs, there are multiple interfaces we need, and we create where we end up transferring the data capture. But at the same time, there are non-APIs where we have connectors and workflows and we’ll be able to transfer the data into multiple applications. Now, when we talk about entire API management, we use Boomi for the entire API management, support and configuration of APIs to ensure that we can centrally test and deploy APIs, and we can enforce contracts and policies with an API gateway.”

— VP Technology, Financial Services

Technology Business Research, Inc.

Technology Business Research, Inc.

Maxim Basinski, Vasabii via Canva Pro

Maxim Basinski, Vasabii via Canva Pro Technology Business Research, Inc.

Technology Business Research, Inc.