Channel Partner Market Landscape

TBR Spotlight Reports represent an excerpt of TBR’s full subscription research. Full reports and the complete data sets that underpin benchmarks, market forecasts and ecosystem reports are available as part of TBR’s subscription service. Click here to receive all new Spotlight Reports in your inbox.

Channel partners continue to invest in the expansion of services capabilities to bolster margins and win AI deals

Portfolio key trends

- Channel partners across the industry continue investing in the expansion of their services capabilities and cloud marketplace platforms to increase their hardware-adjacent revenue streams. While this initiative is driven in part by recent softness in the hardware market, software and services margins also tend to skew higher than hardware margins, and by taking a solutions-led approach, channel partners can drive deeper customer engagements and a higher level of differentiation in the market.

- TBR expects channel partners will increase go-to-market messaging around AI in 2025 as more industry-specific use cases develop, including by emphasizing that AI is built into their own service delivery platforms and by becoming certified to deploy and manage partners’ AI-based solutions.

Operations key trends

- As channel partners remain focused on growing their services revenue mix, they will continue to strategically rebalance headcount in roles such as sales and services delivery to expand their capabilities while maintaining profitability.

- Streamlining operations through digital transformation remains a key priority as channel partners seek to build a more agile business and buying experience while reducing costs. Examples include the proliferation of e-commerce portals, cloud marketplaces and analytics-based solution configuration. In growth areas, including cloud and services, digital transformation helps solution providers manage complex, multicloud environments and easily aggregate multivendor solutions.

Financial key trends

- Despite pockets of demand strength, such as in AI infrastructure, the overall channel partner hardware market has faced challenges over the past two years tied to cautious commercial spending and increasing competition for deals from both OEM partners as well as global systems integrators (GSIs) that are becoming increasingly interested in the resale of hardware to support the delivery of full-stack AI solutions.

- Multiple trends will likely help improve customer spending in 2025 including PC refresh in the commercial space and improving enterprise server demand.

M&A key trends

Acquisitions continued to be driven by channel partners’ desires to expand skill sets in cloud, cybersecurity and advisory services. TBR believes industry consolidation remains a pervasive trend among channel partners and will help companies acquire niche services capabilities. Additionally, channel partners will continue to target strategic acquisitions to expand their geographic footprints.

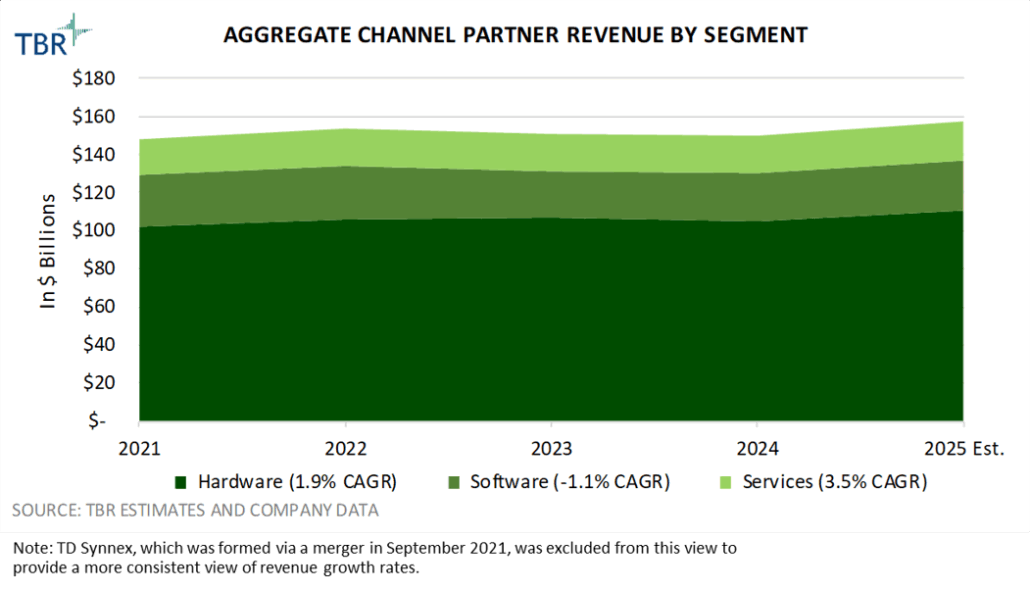

Services revenue is expected to see the most robust growth among all segments of the channel partner market

Segment trends

Relatively soft hardware demand acted as a headwind for most channel partners in 2024. However, looking ahead to 2025, TBR sees the continued ramp of the next major commercial PC refresh cycle synergizing with rebounding enterprise infrastructure spend, leading to forecasted aggregate growth of 4.1% among covered channel partners.

Demand for AI solutions remains elevated, and VARs are competing with both OEMs and GSIs to develop and deliver end-to-end AI solutions to customers. However, TBR believes VARs’ recent services and portfolio investments, coupled with the sheer scale of the AI opportunity, will allow all parties to benefit from the industry trend in 2025.

As VARs continue to invest in the expansion of their services capabilities to drive solutions-led engagements and as distributors further develop their cloud marketplace platforms, TBR believes channel partners’ margins will gradually expand over the next few years.

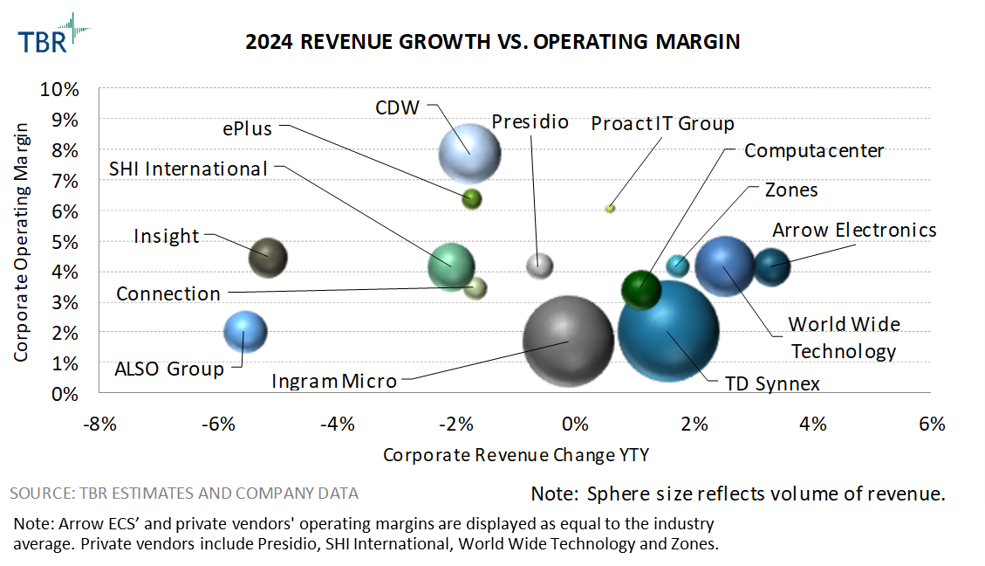

Generally speaking, channel partners with greater services emphasis fared best in 2024 amid softness in the hardware market

2024 corporate trends

Estimated aggregate corporate revenue among covered channel partners remained flat on a year-to-year basis in 2024 as soft commercial hardware demand offset growing software and services segment revenues. However, the industry’s performance represented an improvement over the group’s results in 2023, when estimated aggregate corporate revenue contracted approximately 4.6% year-to-year.

Among all covered companies, Arrow Electronics’ ECS segment delivered the strongest growth in 2024 due to the rising success of its ArrowSphere platform, which drove industry-leading software segment revenue growth during the period.

Behind Arrow Electronics’ ECS business, TBR believes WWT delivered the second-strongest revenue growth rate in 2024 due to the company’s ability to leverage its labs and integration centers to help customers develop and validate their own AI solutions. Looking ahead, TBR expects WWT’s labs and integration centers to act as a significant tailwind to the company as an increasing number of enterprise customers adopt AI solutions.

Technology Business Research, Inc.

Technology Business Research, Inc.

Technology Business Research, Inc.

Technology Business Research, Inc.