2Q24 Telecom Infrastructure Services Benchmark

TBR Spotlight Reports represent an excerpt of TBR’s full subscription research. Full reports and the complete data sets that underpin benchmarks, market forecasts and ecosystem reports are available as part of TBR’s subscription service. Click here to receive all new Spotlight Reports in your inbox.

Persistent TIS revenue contraction will cease in 2025 as growth catalysts emerge

While TIS revenue continued to shrink among the vast majority of benchmarked vendors, TIS operating margins continue to recover as the business mix becomes more favorable and India’s coverage builds wind down

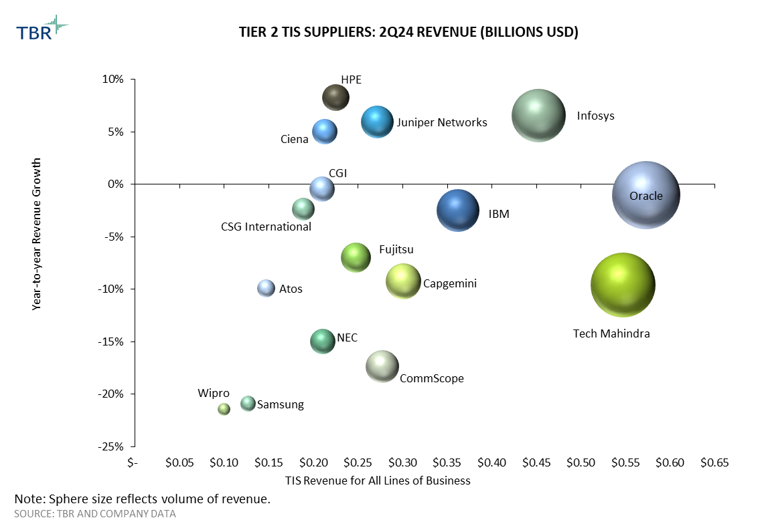

Aggregate telecom infrastructure services (TIS) revenue among benchmarked vendors declined 4.8% year-to-year in 2Q24, falling across all segments and regions. All but six vendors saw TIS revenue decline year-to-year in 2Q24. Several vendors, including Nokia, Ericsson, Samsung and Ciena, are seeing sharply lower revenue in India as 5G RAN rollouts by Reliance Jio and Bharti Airtel have gone post-peak. This will create difficult comparisons for vendors through at least 3Q24. Huawei and ZTE are also seeing their maintenance revenue in India evaporate as their installed bases of LTE and optical equipment is replaced by trusted vendors.

Simultaneously, vendors such as Cisco, CommScope, Fujitsu, NEC, Nokia and Samsung continued to be hampered by U.S. Tier 1 communication service providers (CSPs) significantly reducing or shifting their capex budgets following a peak in spend in 2022. Lower spend on 5G RAN deployments in China, which also peaked in 2022, is impacting a narrow set of vendors, including China Communications Services (CCS), Ericsson, Huawei, Nokia and ZTE, as new deployments in the country are focused on capacity enhancement, which is typically less intense from a TIS perspective.

The shift that is occurring as CSPs wind down their 5G coverage rollouts in the key countries of China, the U.S. and India and focus on densification is helping drive operating margin growth. Declining deployment activity, which tends to carry the lowest margins among TIS segments, in these markets — especially India — is helping to improve operating margin.

In 2Q24 deployment services constituted 17.7% of aggregate revenue, down 110 basis points year-to-year. Benchmarked vendors’ aggregate TIS operating margin increased year-to-year for the third consecutive quarter, following six consecutive quarters of declines. Aggregate operating margin grew from 10.8% in 2Q23 to 11.6% in 2Q24.

TBR attributes the increase in large part to a favorable revenue mix, with maintenance services growing to 34.1% of aggregate revenue, up 100 basis points year-to-year. The 5G gear vendors have built out in the aforementioned countries over the past few years is leading to follow-on support revenue.

With CSP 5G spend post-peak in India, the U.S. and China, RAN-centric vendors universally saw their TIS revenue decline in 2Q24

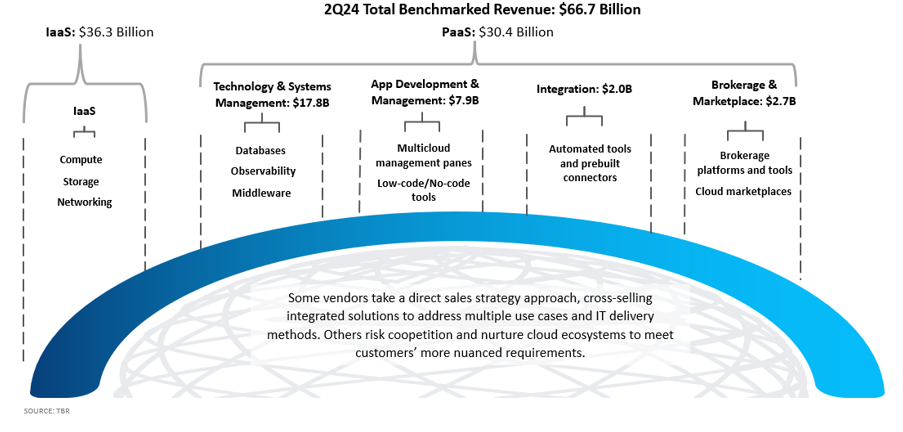

2Q24 Total Benchmarked Revenue for IaaS and PaaS (Source: TBR)India-based IT services firms Tata Consultancy Services (TCS) (a Tier 1 supplier in 2Q24), Infosys, Tech Mahindra and Wipro are winning deals from CSPs to support their evolutions to digital service providers. These vendors are helping customers migrate network and IT applications to the cloud and implement new business models. These firms have recently been hampered in part by lower application integration spend as CSPs in key markets such as the U.S. and Europe adopted a cautious cash flow management posture and paused some digital transformation activity.

Like Tier 1 vendor Amdocs, Tier 2 vendor CSG is a SaaS-centric, primarily BSS-focused, company offering revenue management and digital monetization products in a scalable managed services model. CSG has expanded account share among key clients in the U.S. over the last several years — namely, cable operators Charter and Comcast — and abroad, particularly in APAC and with an unnamed client in CALA, where CSG is ramping up a relatively large BSS contract. CSG’s TIS revenue declined in 2Q24 due to lower revenue from an unnamed global telco in Europe.

Samsung has executed on significant 5G work for CSPs that are based primarily in the U.S., India, South Korea and Japan. Samsung’s TIS revenue declined year-to-year in 2Q24 due to slowing spend at Verizon, which is Samsung’s largest customer by revenue, as well as in India, where Samsung participated in 5G RAN rollouts for Bharti Airtel and Reliance Jio, though at lower levels than Ericsson and Nokia.

Like RAN vendors in India, Ciena’s TIS revenue in the country declined significantly as 5G-adjacent projects wound down. Ciena offset this decline with strong software-related services revenue growth in developed countries.

Vendor SL&C revenues largely declined as large-scale 5G and greenfield rollouts wound down and new network business models and arrangements proliferated

Site location and construction (SL&C) work is often subcontracted to local vendors (such as CCS) with better access to resources in a given area. The SL&C market is in decline as temporary gains driven by 5G deployments in China and the U.S. as well as some greenfield deployments have concluded.

Pockets of growth include fiber rollouts for broadband access, backhaul and/or fronthaul, and the deployment of small cells. However, the relative volume of spend on these tasks is significantly lower than that for traditional SL&C for macro cell sites.

TBR has a negative long-term outlook for the SL&C market as CSPs shift their focus to adding incremental capacity to their existing macro sites, partially offset by growing CSP investment in small cell sites. This densification primarily consists of software upgrades and/or requires adding new radios to existing sites. CSP consolidation also weighs on the SL&C market.

New network architectures and business models, including network-sharing arrangements, neutral host providers, satellites to provide coverage for rural and/or remote locations, and third-party infrastructure owners such as tower companies increasingly owning cell sites and promoting the colocation of operator equipment, also reduce the need for net-new sites.

North America TIS revenue continued to decline in 2Q24, but at an improving rate as growth catalysts begin to emerge, including in Canada, where recent M&A and vRAN investments are driving growth

Benchmarked vendors logged a 1.4% year-to-year decrease in aggregate TIS revenue growth in North America in 2Q24, a dramatic improvement from an 8% decline in 1Q24 as year-to-year comparisons turned more favorable and Ericsson began to receive meaningful revenue from its Cloud RAN rollout for AT&T.

Still, revenues declined due to numerous factors, including Verizon’s and AT&T’s C-Band rollouts being post-peak as well as T-Mobile’s build-out of its 2.5GHz spectrum being post-peak. In addition, CSPs are awaiting government funding before expanding their fiber footprints, and DISH drastically reduced spending in 2H23 and 1H24 after it reached a key coverage milestone in June 2023 and it neared bankruptcy before receiving new funding in 2H24.

TIS spend in the region is positioned to grow in 2025 as comparisons become more favorable and CSPs focus on building out fiber access, including by leveraging the BEAD Program, through which CSPs will receive federal funds that are currently being disbursed to states to bring broadband to the unserved and underserved.

The BEAD Program has seen numerous delays and will likely run through the mid-2030s, later than the original 2028 time frame. The program will benefit a somewhat different slate of vendors compared to the midband 5G build-out, as fiber will be the primary technology deployed. Nokia will be one of the biggest beneficiaries due to its embrace of Build in America requirements. Ciena will also benefit, due in part to its 4Q22 acquisitions of Benu Networks and Tibit. Meanwhile, Ericsson and Samsung will have no role in BEAD-related fiber deployments, though they could participate in fixed wireless access (FWA) build-outs.

5G development continues in Canada through measures including builds in the 3.5GHz spectrum band, BCE’s capital investment acceleration program, Telus’ vRAN build leveraging HPE and Samsung, and the replacement of equipment from China-based vendors. Tier 2 operators in Canada are also advancing their 5G strategies.

Canada CSPs are focused on deploying fiber across their footprints and will expand 5G services to new spectrum bands, including the 3.8GHz band, which Bell Canada began deploying in 1H24. Rogers’ acquisition of Shaw Communications is also driving spend due to investment commitments made by the merged entity and Videotron, which acquired a piece of Shaw.