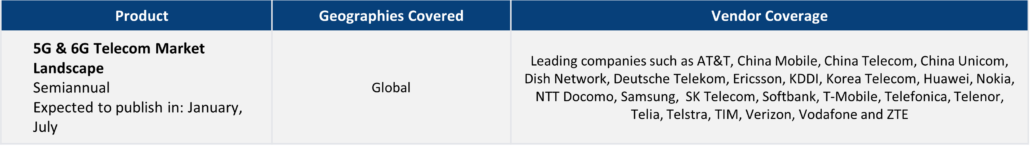

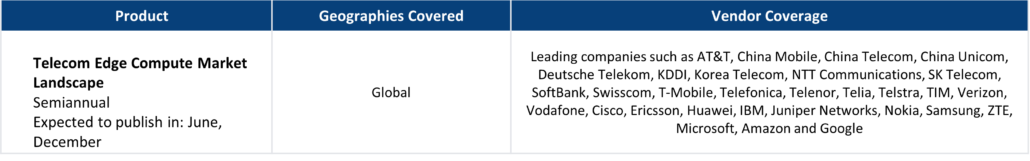

With TBR’s Telecom market and competitive intelligence research, examine telecom operator and telecom vendor markets as well as key industrywide trends and developments, such as 5G, edge computing, private networks, and the encroachment of hyperscalers into the telecom industry.

Understand operator business models, capital expenditure, subscriber metrics and next-generation technology adoption, with coverage spanning wireless, wireline, cable and enterprise markets. Access vendor customer demand analysis, portfolio analysis and competitive benchmarking.

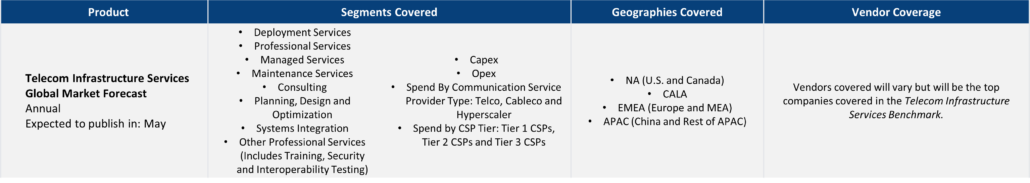

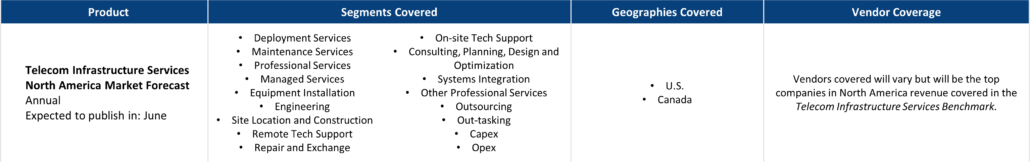

Additionally, we are the leading resource for telecom infrastructure services (TIS) market research.

A free trial of TBR’s Insights Center platform gives you access to our entire Telecom research portfolio and the ability to customize and curate reports detailing our analysis based on your company’s specific needs. Start your free trial today!

Trends we’re watching in 2026:

- Impact of K-shaped economy on telecom market

- Why a price war is coming to the broadband market

- How telcos will adjust to meet AI’s timetable

- Ways in which the network needs to adjust for the AI economy

Explore TBR Telecom Coverage

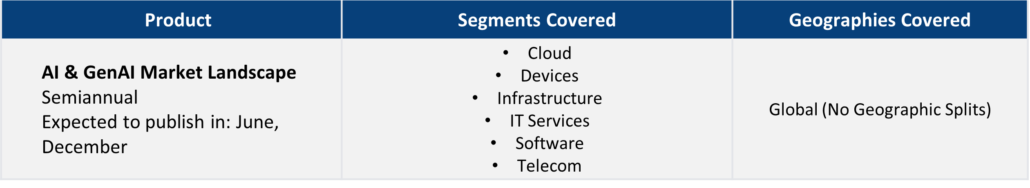

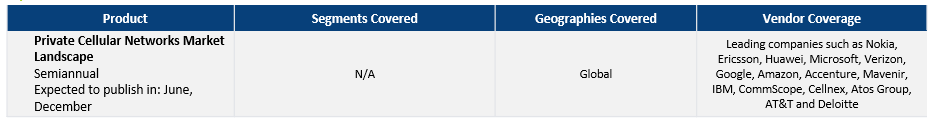

Market and competitor benchmarks provide a comparison of vendor performance in a market, including analysis on vendor strategies, financial performance, go-to-market and resource management. The research graphically portrays comparisons of vendors by myriad metrics, calling out leaders, laggards and business models. Defensible, data-informed views of market opportunity and operational best practices are highlighted in each publication. TBR also provides benchmark data in Excel pivot tables.

Current Market & Competitor Benchmarks:

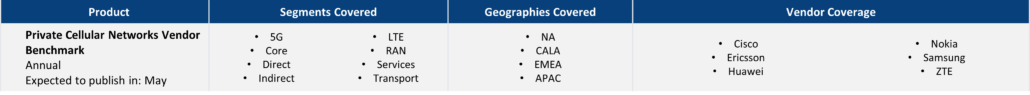

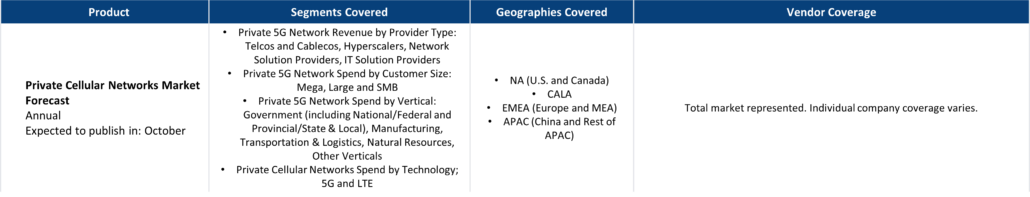

- Private Cellular Networks Vendor Benchmark

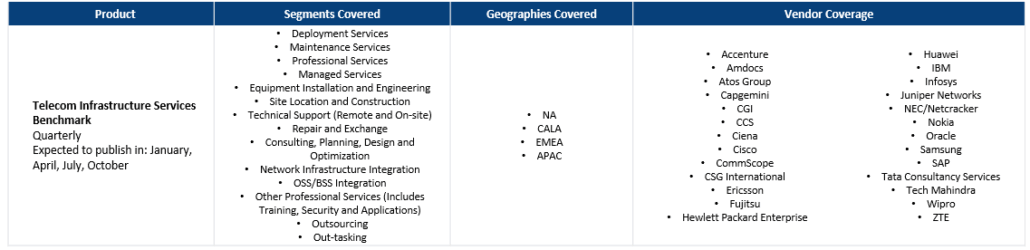

- Telecom Infrastructure Services Benchmark

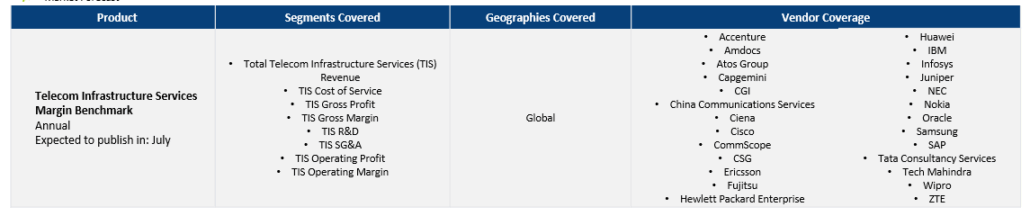

- Telecom Infrastructure Services Margin Benchmark

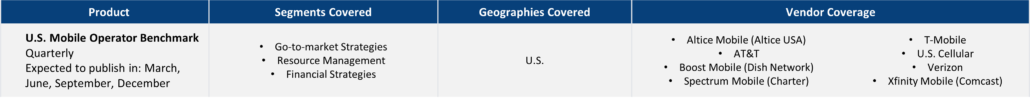

- U.S. Mobile Operator Benchmark

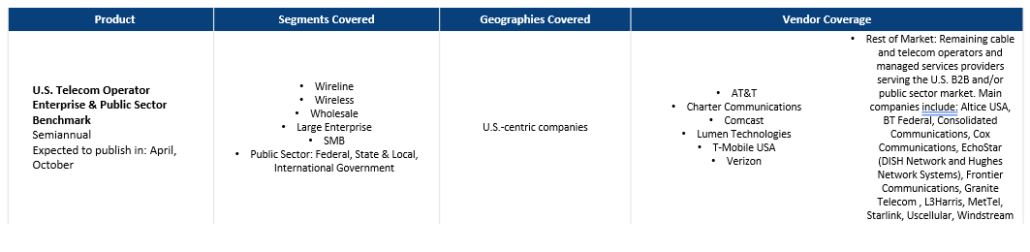

- U.S. Telecom Operator Enterprise & Public Sector Benchmark

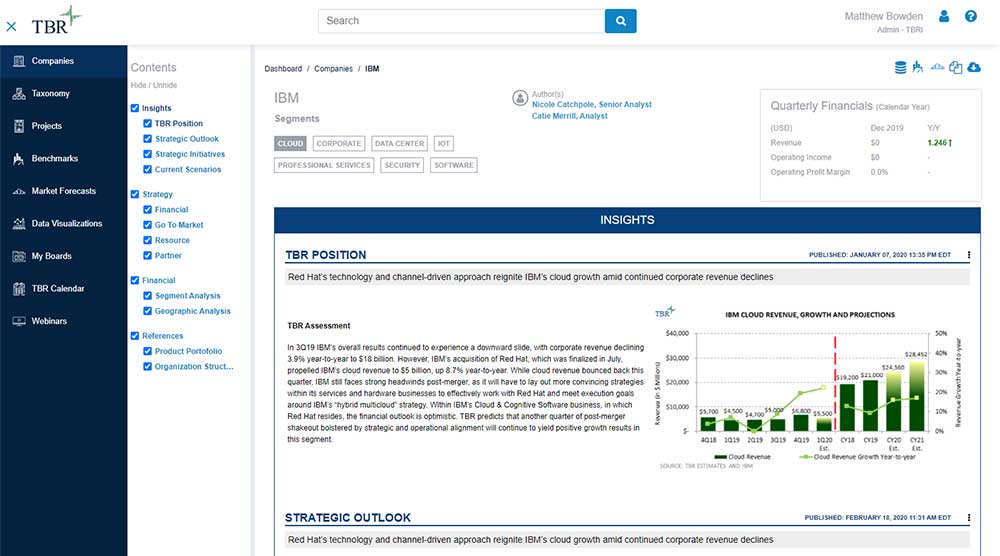

TBR’s vendor reports, snapshots and profiles provide deep-dive analysis of a single vendor across corporate strategies, tactics, SWOT analysis, financials, go-to-market strategies and resource strategies. Vendor performance is put in the context of market opportunity and competitive environment and our assessment shows where a vendor will success and its future market position.

- AT&T

- Cisco Systems

- T-Mobile USA

- Verizon

- Ericsson

- Nokia

Ready to Level Up Your Insights?

TBR’s digital-first competitive intelligence platform, TBR Insight Center™, allows for configured & customized views into IT markets, vendors, alliances and ecosystems.

Benefits delivered through TBR Insight Center™ include:

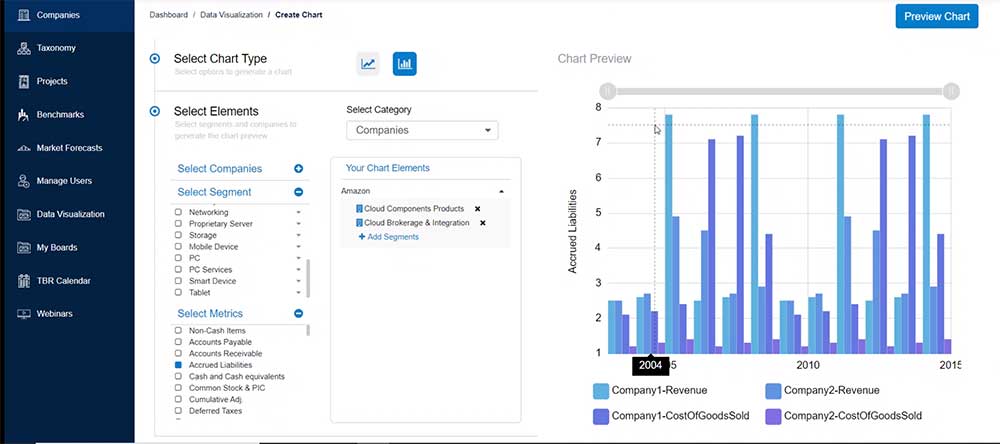

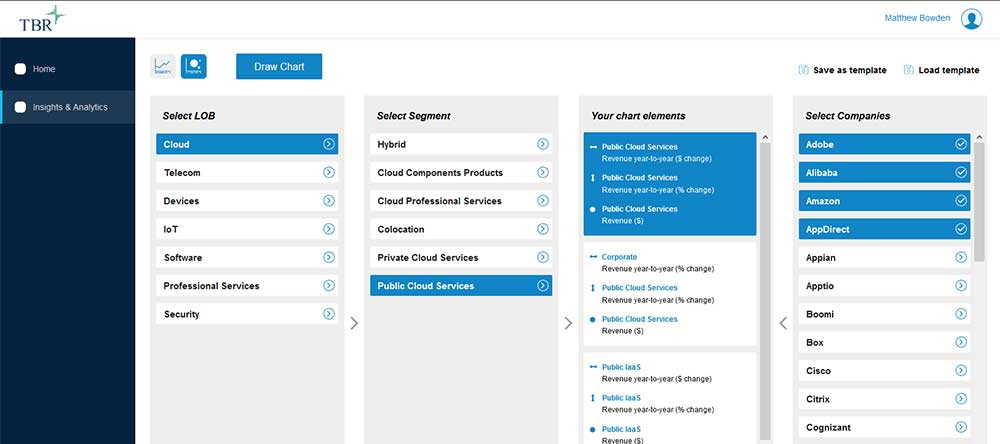

- Dynamic, configurable platform for TBR’s objective, independent and validated data and analysis

- Customizable views of millions of data points to match your specific needs

- Simple download functionality for customized views of analysis and feeds of data, saving staff dozens of hours per month

- Updates for market disruptions and emerging trends

Already a TBR Classic client but don’t have access to TBR Insight Center yet? Request access today.

Will the U.S. Government and Hyperscalers Push the Mobile Industry to the Forefront of 6G?

/by Chris Antlitz, Principal Analyst2025 Brooklyn 6G Summit, Brooklyn, New York, Nov. 5-7, 2025 — More than 300 in-person attendees and 1,600 virtual attendees from academia, technology standards bodies, the public sector, industry analyst firms, network infrastructure and device vendors, communication service providers (CSPs), satellite network operators, semiconductor firms, hyperscalers and other stakeholders of the broader wireless technology ecosystem […]

Oracle’s Full-stack Strategy Underscores a High-stakes Bet on AI

/by Catie Merrill, Senior AnalystThough not immune to the risks and uncertainties of the AI market at large, Oracle is certainly executing, with the bulk of revenue from AI contracts already booked in its multibillion-dollar remaining performance obligations (RPO) balance. And yet, as OCI becomes a more prominent part of the Oracle business, big opportunities remain for Oracle, particularly in how it partners, prices and simply exists within the data ecosystem.

Lenovo Aims to Become a Global Solutions Provider through Strategic Partnerships and AI-driven Innovation

/by Ben Carbonneau, Senior Data AnalystWhile Lenovo’s portfolio and go-to-market strategy may differ slightly by geography, the company’s pocket-to-cloud and One Lenovo initiatives remain the same around the world and are the basis for the company’s differentiation in the market — a theme during every session of the conference. From smartphones to servers, Lenovo is vying for share in every segment, and by investing in the unification and openness of its portfolio, whether it be through the development of homegrown software or new ecosystem partnerships, the company is positioning to grow in the AI era. Changing its perception from a PC powerhouse to a solution provider remains one of Lenovo’s largest challenges, but the company’s work in sponsoring and supporting FIFA and F1 with its full-stack technology capabilities demonstrates its willingness to invest in overcoming this hurdle.