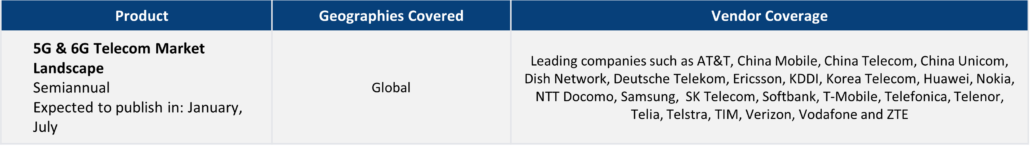

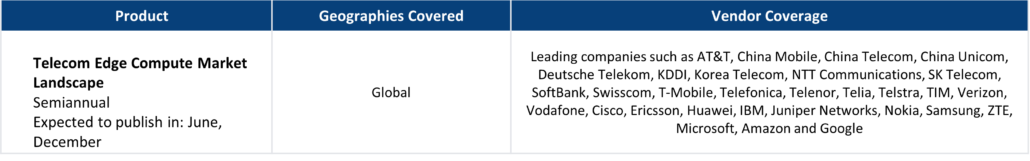

With TBR’s Telecom market and competitive intelligence research, examine telecom operator and telecom vendor markets as well as key industrywide trends and developments, such as 5G, edge computing, private networks, and the encroachment of hyperscalers into the telecom industry.

Understand operator business models, capital expenditure, subscriber metrics and next-generation technology adoption, with coverage spanning wireless, wireline, cable and enterprise markets. Access vendor customer demand analysis, portfolio analysis and competitive benchmarking.

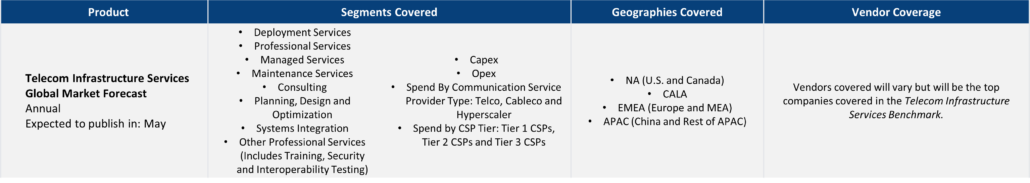

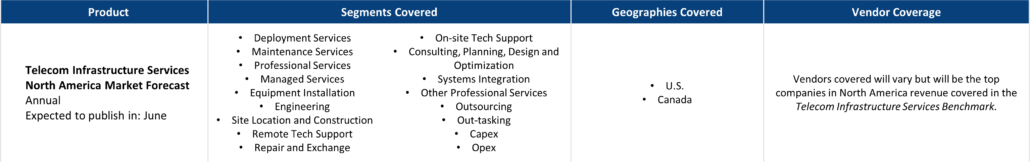

Additionally, we are the leading resource for telecom infrastructure services (TIS) market research.

A free trial of TBR’s Insights Center platform gives you access to our entire Telecom research portfolio and the ability to customize and curate reports detailing our analysis based on your company’s specific needs. Start your free trial today!

Trends we’re watching in 2026:

- Impact of K-shaped economy on telecom market

- Why a price war is coming to the broadband market

- How telcos will adjust to meet AI’s timetable

- Ways in which the network needs to adjust for the AI economy

Explore TBR Telecom Coverage

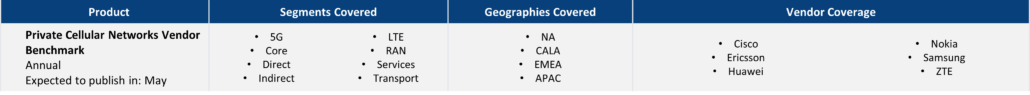

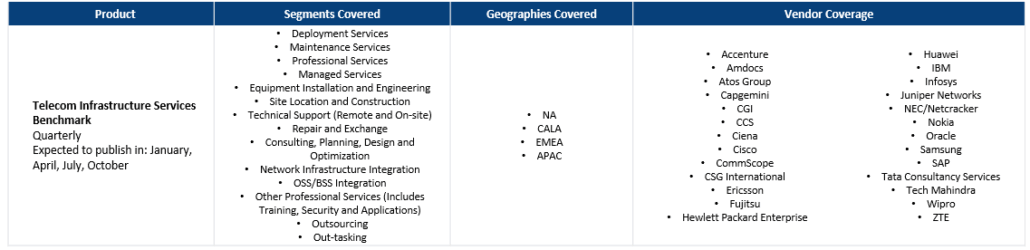

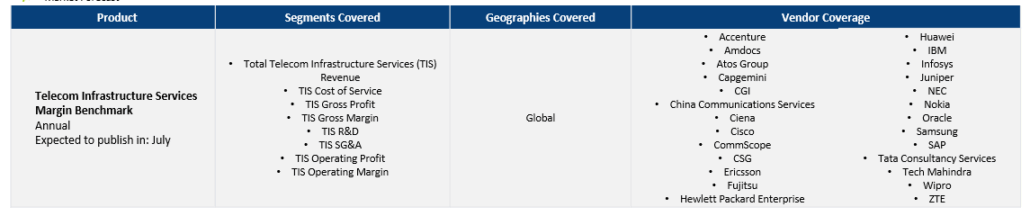

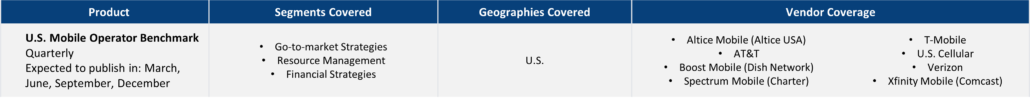

Market and competitor benchmarks provide a comparison of vendor performance in a market, including analysis on vendor strategies, financial performance, go-to-market and resource management. The research graphically portrays comparisons of vendors by myriad metrics, calling out leaders, laggards and business models. Defensible, data-informed views of market opportunity and operational best practices are highlighted in each publication. TBR also provides benchmark data in Excel pivot tables.

Current Market & Competitor Benchmarks:

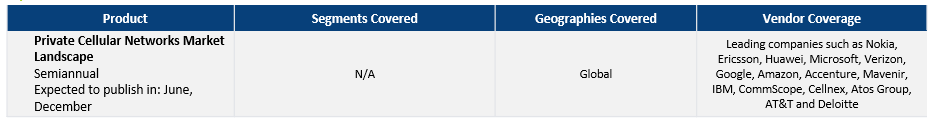

- Private Cellular Networks Vendor Benchmark

- Telecom Infrastructure Services Benchmark

- Telecom Infrastructure Services Margin Benchmark

- U.S. Mobile Operator Benchmark

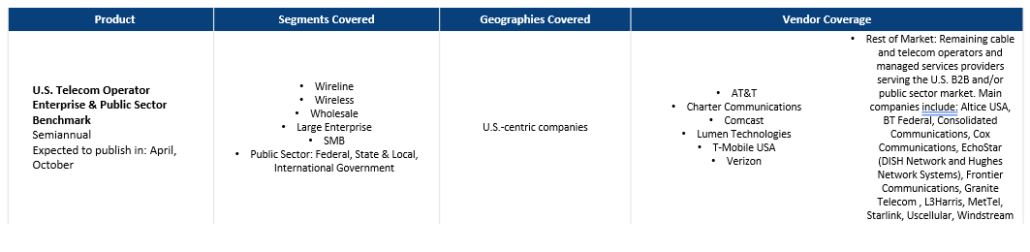

- U.S. Telecom Operator Enterprise & Public Sector Benchmark

TBR’s vendor reports, snapshots and profiles provide deep-dive analysis of a single vendor across corporate strategies, tactics, SWOT analysis, financials, go-to-market strategies and resource strategies. Vendor performance is put in the context of market opportunity and competitive environment and our assessment shows where a vendor will success and its future market position.

- AT&T

- Cisco Systems

- T-Mobile USA

- Verizon

- Ericsson

- Nokia

Ready to Level Up Your Insights?

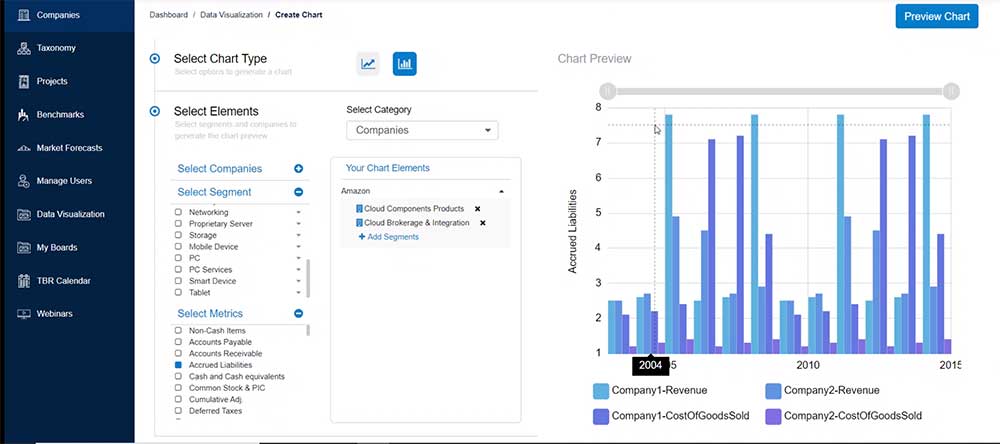

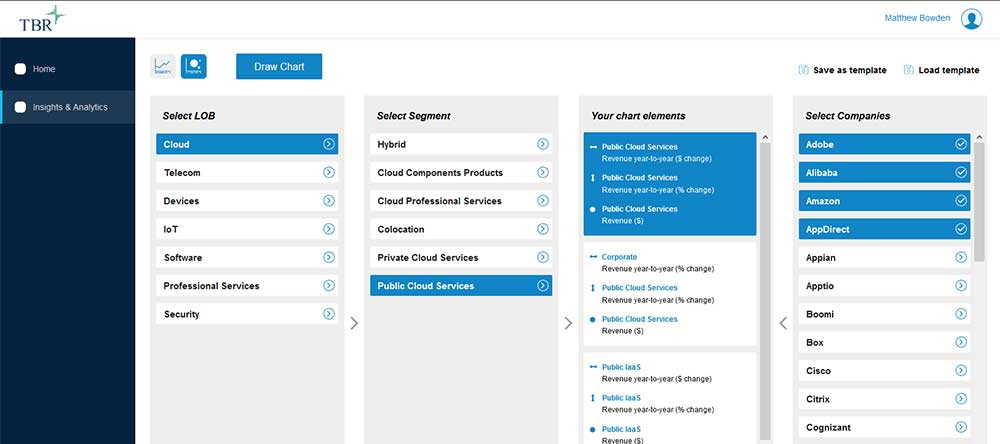

TBR’s digital-first competitive intelligence platform, TBR Insight Center™, allows for configured & customized views into IT markets, vendors, alliances and ecosystems.

Benefits delivered through TBR Insight Center™ include:

- Dynamic, configurable platform for TBR’s objective, independent and validated data and analysis

- Customizable views of millions of data points to match your specific needs

- Simple download functionality for customized views of analysis and feeds of data, saving staff dozens of hours per month

- Updates for market disruptions and emerging trends

Already a TBR Classic client but don’t have access to TBR Insight Center yet? Request access today.

Will bitcoin become the next gold?

/by adminCryptocurrency for trading: Speculation or disruption? A recent article in the Economist has triggered a new round of questions about cryptocurrency in general and bitcoin very specifically. This comes on the heels of the EY Global Blockchain Summit where more detailed parsing out of the specifics around decentralized finance, or DeFi, brings greater clarity to […]

EY maintains track record of accurately forecasting and then delivering on the future of blockchain

/by adminPaul Brody reiterates past predictions and paints the picture of what he sees on the horizon It is difficult not to come away from a Paul Brody dissertation on blockchain more excited and optimistic about the transformative power of the technology than when you went in. Compounding the difficulty with taking a contrarian view of […]

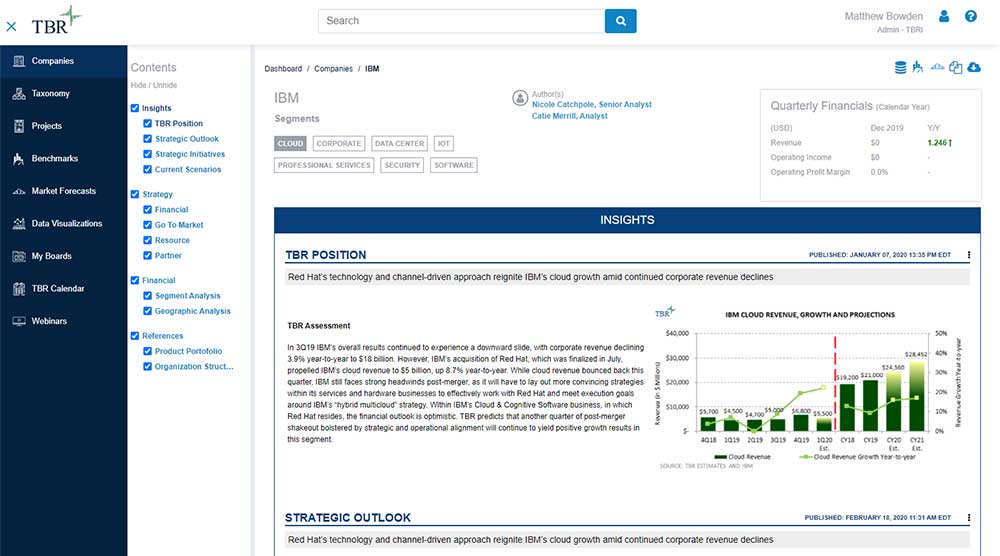

Think Digital 2021: IBM brings AI to hybrid cloud

/by Catie Merrill, Senior AnalystIntegration of AI into open architecture positions IBM hybrid cloud as ideal platform for mission-critical workloads Since acquiring Red Hat, IBM has undergone a major strategic shift to accommodate for hybrid cloud, abiding by the philosophy that the hybrid model — whether it consists of core or edge infrastructure and/or multiple public clouds — captures […]