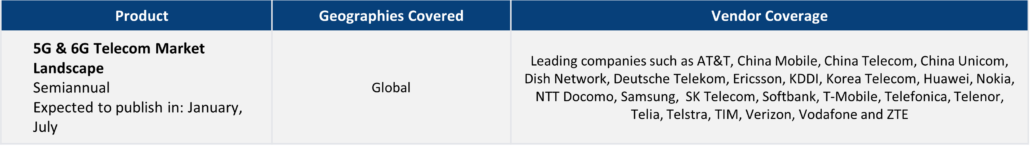

With TBR’s Telecom market and competitive intelligence research, examine telecom operator and telecom vendor markets as well as key industrywide trends and developments, such as 5G, edge computing, private networks, and the encroachment of hyperscalers into the telecom industry.

Understand operator business models, capital expenditure, subscriber metrics and next-generation technology adoption, with coverage spanning wireless, wireline, cable and enterprise markets. Access vendor customer demand analysis, portfolio analysis and competitive benchmarking.

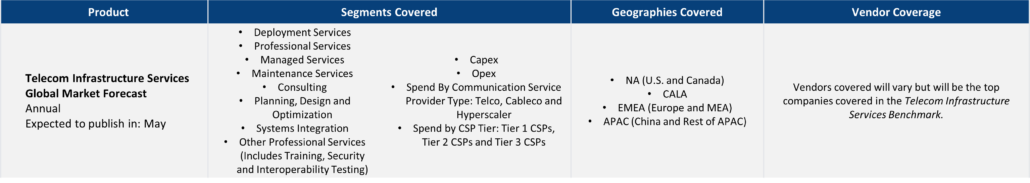

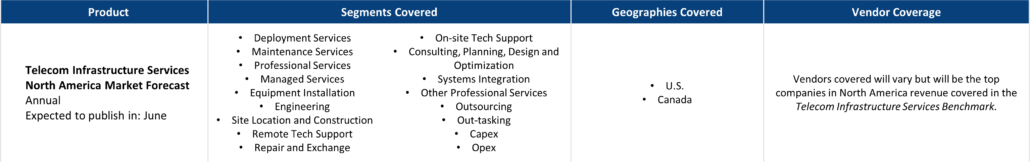

Additionally, we are the leading resource for telecom infrastructure services (TIS) market research.

A free trial of TBR’s Insights Center platform gives you access to our entire Telecom research portfolio and the ability to customize and curate reports detailing our analysis based on your company’s specific needs. Start your free trial today!

Trends we’re watching in 2026:

- Impact of K-shaped economy on telecom market

- Why a price war is coming to the broadband market

- How telcos will adjust to meet AI’s timetable

- Ways in which the network needs to adjust for the AI economy

Explore TBR Telecom Coverage

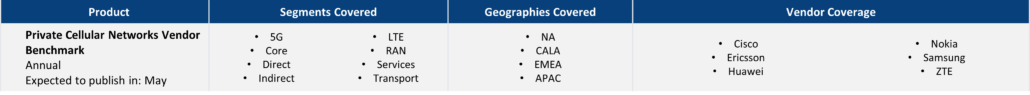

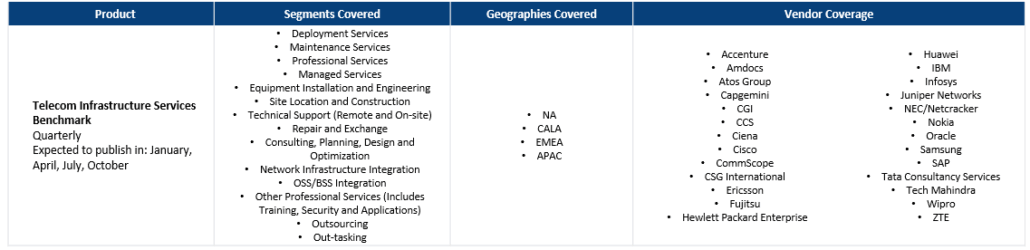

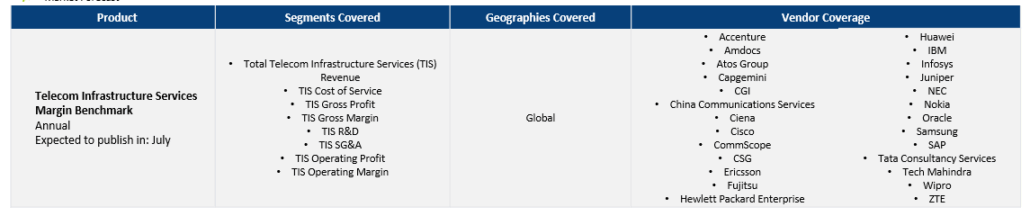

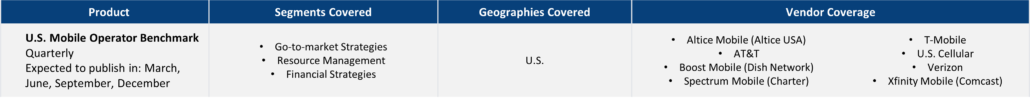

Market and competitor benchmarks provide a comparison of vendor performance in a market, including analysis on vendor strategies, financial performance, go-to-market and resource management. The research graphically portrays comparisons of vendors by myriad metrics, calling out leaders, laggards and business models. Defensible, data-informed views of market opportunity and operational best practices are highlighted in each publication. TBR also provides benchmark data in Excel pivot tables.

Current Market & Competitor Benchmarks:

- Private Cellular Networks Vendor Benchmark

- Telecom Infrastructure Services Benchmark

- Telecom Infrastructure Services Margin Benchmark

- U.S. Mobile Operator Benchmark

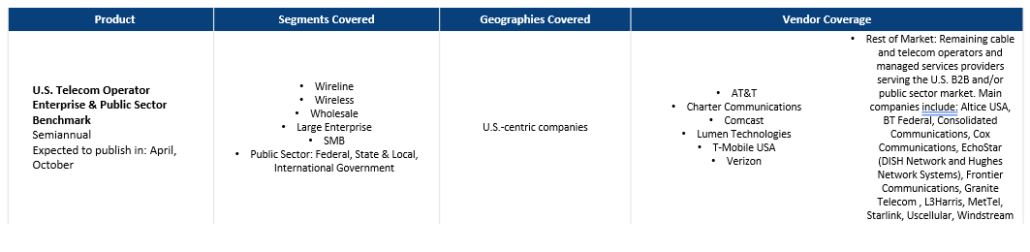

- U.S. Telecom Operator Enterprise & Public Sector Benchmark

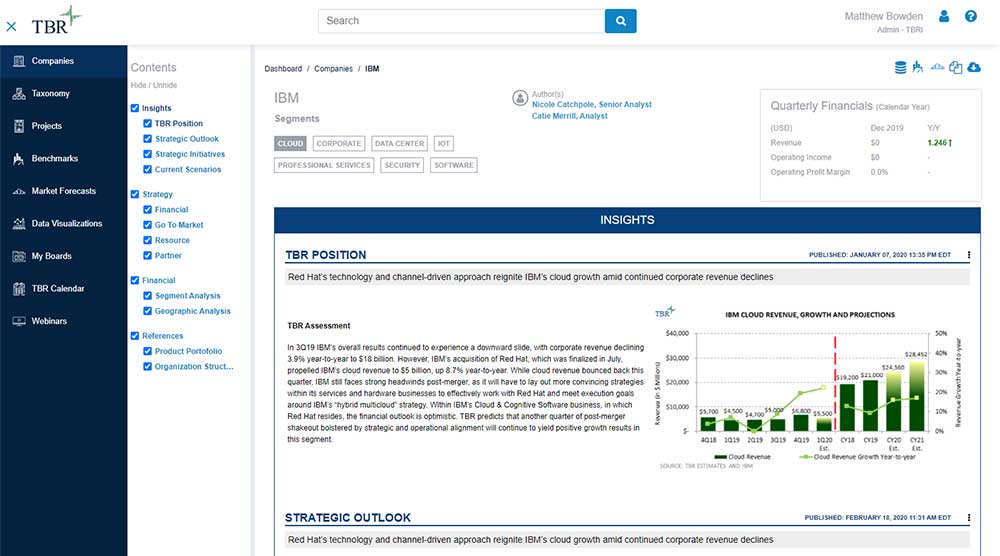

TBR’s vendor reports, snapshots and profiles provide deep-dive analysis of a single vendor across corporate strategies, tactics, SWOT analysis, financials, go-to-market strategies and resource strategies. Vendor performance is put in the context of market opportunity and competitive environment and our assessment shows where a vendor will success and its future market position.

- AT&T

- Cisco Systems

- T-Mobile USA

- Verizon

- Ericsson

- Nokia

Ready to Level Up Your Insights?

TBR’s digital-first competitive intelligence platform, TBR Insight Center™, allows for configured & customized views into IT markets, vendors, alliances and ecosystems.

Benefits delivered through TBR Insight Center™ include:

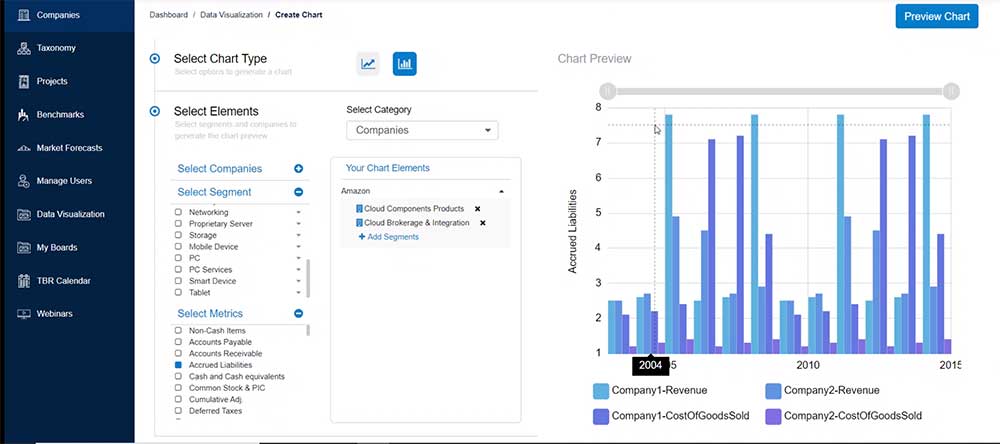

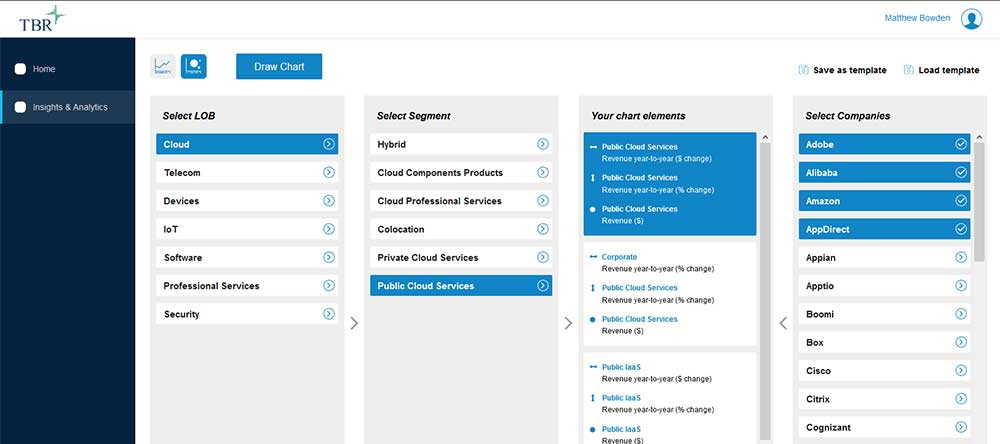

- Dynamic, configurable platform for TBR’s objective, independent and validated data and analysis

- Customizable views of millions of data points to match your specific needs

- Simple download functionality for customized views of analysis and feeds of data, saving staff dozens of hours per month

- Updates for market disruptions and emerging trends

Already a TBR Classic client but don’t have access to TBR Insight Center yet? Request access today.

Agentic AI Adoption Is Pressuring Security Architectures to Converge

/by Bozhidar Hristov, Principal AnalystThe emerging pattern of multicloud security consolidation has direct implications for both Amazon Web Services (AWS) and Microsoft, as enterprises reassess detection pipelines, governance models and operating frameworks heading into 2026. Although AWS remains well positioned in analytics-heavy workloads, the company needs to reevaluate its long-established “building block” approach, especially as peers deliver more integrated platforms. For Microsoft, its strengths will continue to be with organizations where Microsoft 365 already anchors their identity and collaboration strategies.

The U.S. doesn’t have a Spectrum Shortage — It has a Utilization Problem

/by Chris Antlitz, Principal AnalystThe mobile industry continues to beat the drum for more spectrum, but it should instead focus on fully utilizing the spectrum already allocated. TBR notes there are vast tranches of spectrum in the U.S. market that are broadly underutilized, either for technical or economic reasons. And challenges will only worsen as the industry aims to bring upper midband frequencies into the fray, which have greater propagation challenges and are less suited for macro coverage.

2026 Predictions: AI Momentum Drives Deeper Ecosystem Alliances

/by TBR2026 will be a transitional year defined by technology ecosystem expansions — multiparty alliances spanning IT, OT, devices, edge and silicon; industrial/physical AI acceleration, especially at the edge and in manufacturing; and strategic bottlenecks as skill shortages and infrastructure gaps slow sovereign AI adoption. TBR expects significant changes in how technology vendors collaborate and compete, which lays the groundwork for broader, more integrated AI ecosystems. This is an optimistic prediction. Multiparty alliances require exceptional leadership, shared understanding of commercial models and transparency among partners, and AI aids only the last of these. The human component remains the most significant roadblock. IT-OT convergence and a surge in connected everything have been a TBR (and broader market) prediction for years, and while “signs point to yes,” as the Magic 8 Ball says, 2026 could be another year of disappointing progress, as hype around physical AI could far outpace reality.