With TBR’s Federal IT Services market and competitive intelligence research, understand and build strategies around industry trends to maximize addressable opportunity and minimize disruption as a core industry undergoes unprecedented change.

Gain insight into how defense contractors are going to market, forming alliances, planning for the future and more as they provide solutions and services tailored to customer objectives ranging from night vision goggles and underwater sensors to F-35s and Low-Earth Orbit satellite constellations.

Learn how federal contractors are approaching Joint All Domain Command and Control (JADC2), hypersonic technology, the new age space race, digital engineering and the evolving international defense scene.

A free trial of TBR’s Insights Center platform gives you access to our entire Federal IT Services research portfolio and the ability to customize and curate reports detailing our analysis based on your company’s specific needs. Start your free trial today!

Trends we’re watching in 2025:

- The impact of president-elect Donald Trump’s second term on federal IT spending

- The impact of pesident-elect Trump’s proposed DOGE on federal IT contractors

- How the adoption of AI/GenAI technologies will proceed in federal fiscal 2025 (FFY25)

- The federal IT M&A market

- Whether the bull market that has characterized federal technology spending over the last three to four years will continue in FFY25

- Whether the federal IT labor market will continue to cool in 2025 i competition for talent

- The continuing evolution of alliance relationships between federal systems integrators and commercially focused providers of cloud, analytics and other emerging technologies

Explore TBR Federal IT Services Coverage

Market and competitor benchmarks provide a comparison of vendor performance in a market, including analysis on vendor strategies, financial performance, go-to-market and resource management. The research graphically portrays comparisons of vendors by myriad metrics, calling out leaders, laggards and business models. Defensible, data-informed views of market opportunity and operational best practices are highlighted in each publication. TBR also provides benchmark data in Excel pivot tables.

Current Market & Competitor Benchmarks:

- Federal IT Services Benchmark

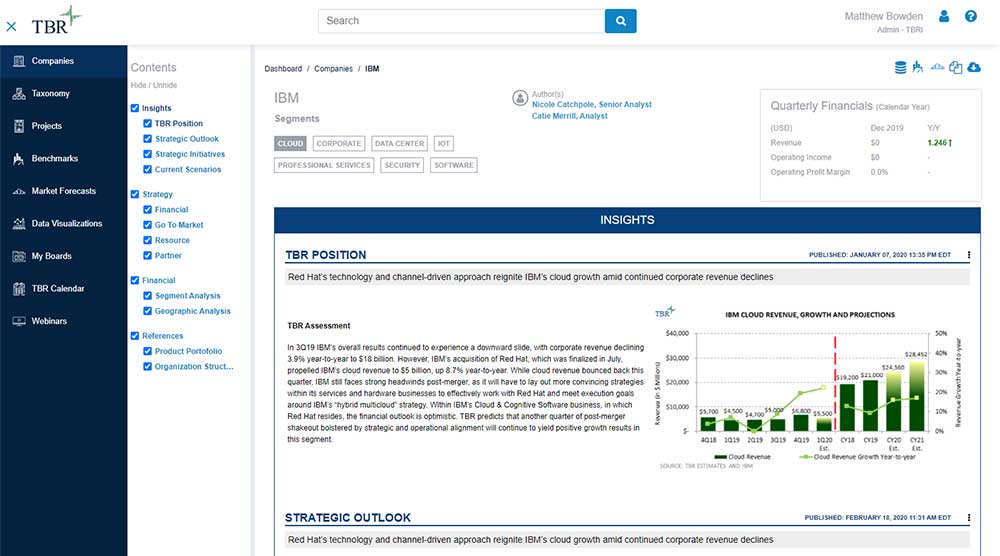

TBR’s vendor reports, snapshots and profiles provide deep-dive analysis of a single vendor across corporate strategies, tactics, SWOT analysis, financials, go-to-market strategies and resource strategies. Vendor performance is put in the context of market opportunity and competitive environment and our assessment shows where a vendor will success and its future market position.

Ready to Level Up Your Insights?

TBR’s digital-first competitive intelligence platform, TBR Insight Center™, allows for configured & customized views into IT markets, vendors, alliances and ecosystems.

Benefits delivered through TBR Insight Center™ include:

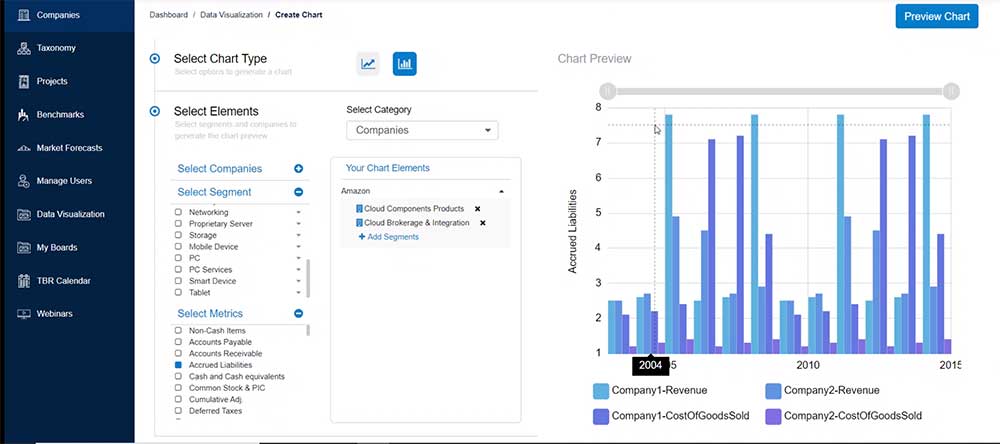

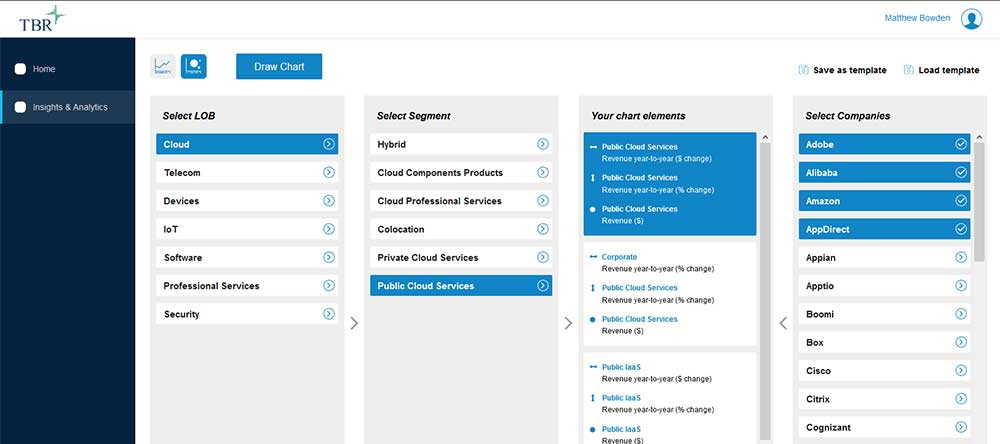

- Dynamic, configurable platform for TBR’s objective, independent and validated data and analysis

- Customizable views of millions of data points to match your specific needs

- Simple download functionality for customized views of analysis and feeds of data, saving staff dozens of hours per month

- Updates for market disruptions and emerging trends

Already a TBR Classic client but don’t have access to TBR Insight Center yet? Request access today.

EY Reinvents Its People Advisory Services, Leaning on a Single Methodology to Drive Successful Change

/by Kelly Lesiczka, Senior AnalystAs workforce and employee experience grow increasingly critical in the era of rapid technological advancement, EY’s refreshed approach within People Advisory Services — centered on a unified methodology and a stronger focus on people experience — helps distinguish the firm from its peers and better aligns with technology-driven transformation initiatives. Further, taking a global approach to retraining and methodology creates a more unified approach within the firm to better engage with clients and navigate market change.

AI Inferencing Takes Center Stage at Red Hat Summit 2025

/by Catie Merrill, Senior AnalystRed Hat Summit 2025 marked the company’s entry into AI inferencing with the productization of vLLM, the open-source project that has been shaping AI model execution over the past two years.