With TBR’s Digital Transformation market and competitive intelligence research, gain insight into how technology and services firms are investing, going to market, partnering and more as they help enterprises transition to digital solutions.

Learn how IT and business buyers approach digital applications, platforms and services within the context of disruptive market trends and emerging opportunities. Additionally, examine and dissect IT vendors’ ecosystem management as well as investments, performance and go-to-market strategies in both mature and emerging areas, including blockchain, Industrial IoT, analytics, customer experience and innovation centers, and cloud.

A free trial of TBR’s Insights Center platform gives you access to our entire Digital Transformation research portfolio and the ability to customize and curate reports detailing our analysis based on your company’s specific needs. Start your free trial today!

Trends we’re watching in 2025:

- Digital transformation is back in fashion

- GenAI upends pyramids, even as enterprises slow their AI roll

- Ecosystem intelligence becomes a strategic advantage

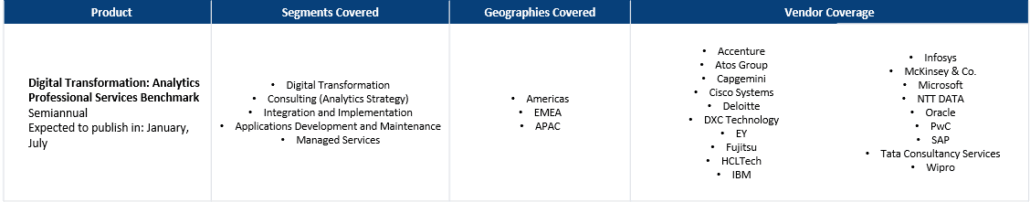

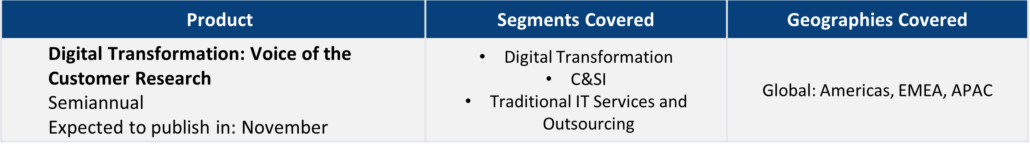

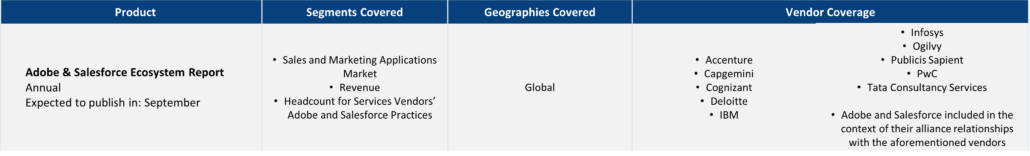

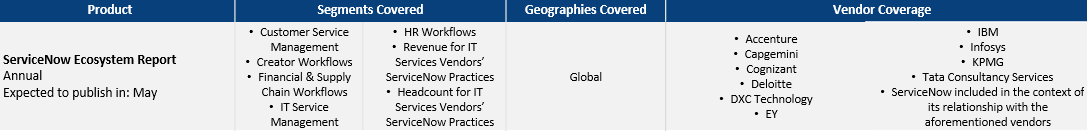

Explore TBR Digital Transformation Coverage

Ready to Level Up Your Insights?

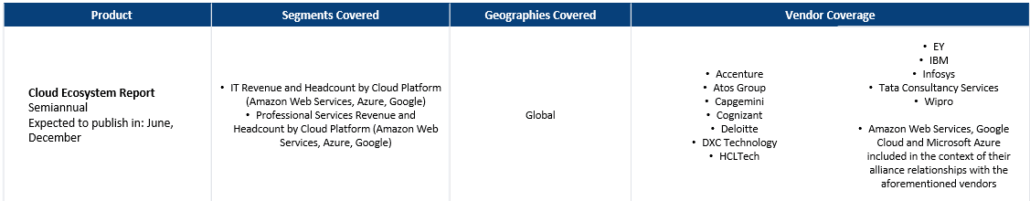

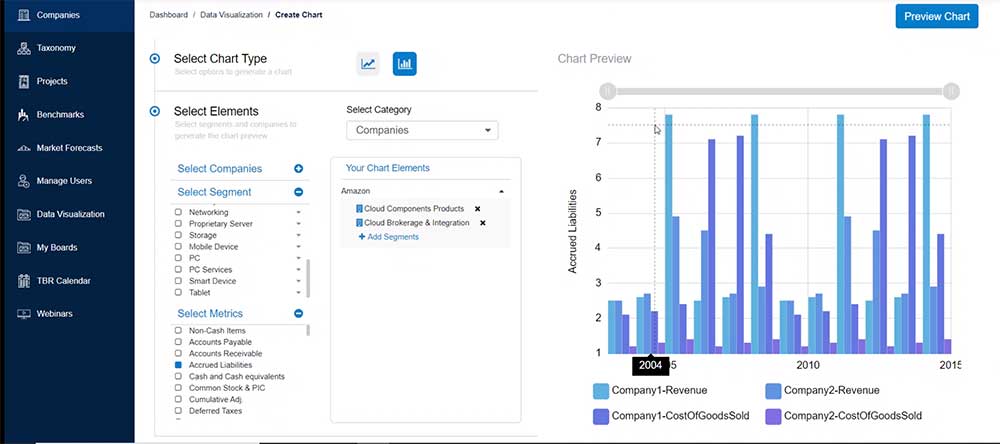

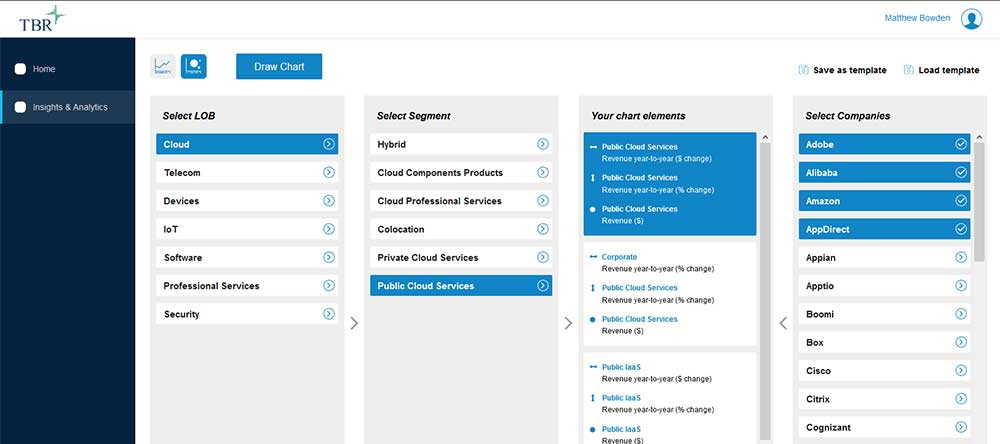

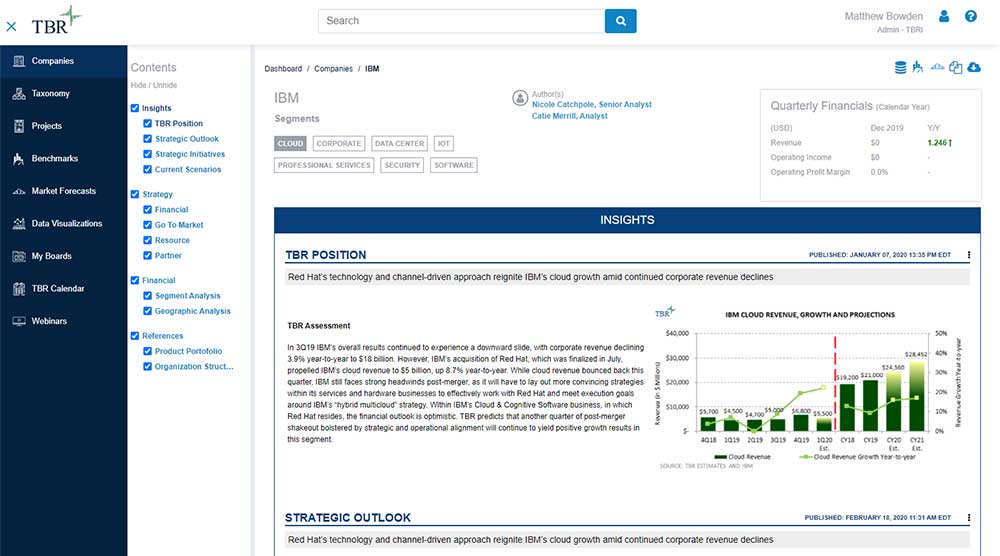

TBR’s digital-first competitive intelligence platform, TBR Insight Center™, allows for configured & customized views into IT markets, vendors, alliances and ecosystems.

Benefits delivered through TBR Insight Center™ include:

- Dynamic, configurable platform for TBR’s objective, independent and validated data and analysis

- Customizable views of millions of data points to match your specific needs

- Simple download functionality for customized views of analysis and feeds of data, saving staff dozens of hours per month

- Updates for market disruptions and emerging trends

Already a TBR Classic client but don’t have access to TBR Insight Center yet? Request access today.

In Fast-evolving AI Markets, Platform Alignment Determines Who Keeps the Customer

/by Patrick Heffernan, Practice Manager and Principal AnalystThe speed of technology change and challenges adapting to business model changes drive the importance of platforms. The rapid developments in AI, most recently with agentic solutions, illustrate how being a platform company enables vendors to maintain a solutioning role even as technology evolves, and new participants become critical in the eyes of customers. Agentic solutions have also created myriad ways for companies to sustain their business models, acting as a conduit between end customers and the changing vendor landscape.

The Federal Government Shutdown: What It Means for Leading Federal System Integrators

/by John Caucis, Senior AnalystLearn the biggest risks facing federal systems integrators amid the current government shutdown and which contractors are best positioned to minimize shutdown-related disruptions