With TBR’s Professional Services market and competitive intelligence research, understand the vendor strategies that are resulting in market-leading performance.

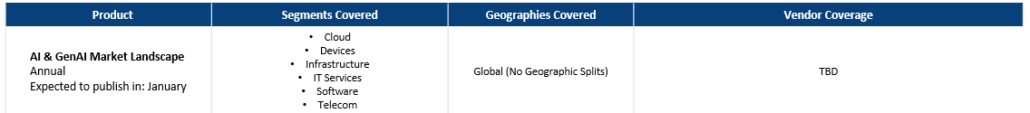

Examine portfolios, go-to-market strategies, services delivery, and revenue and profitability around IT services; strategy, operations, technology and organizational practices of management consulting firms; and vendor investment, divestment and portfolio repositioning of public sector vendors, focusing on professional, technical and IT services.

A free trial of TBR’s Insights Center platform gives you access to our entire Professional Services research portfolio and the ability to customize and curate reports detailing our analysis based on your company’s specific needs. Start your free trial today!

Trends we’re watching in 2026:

- Talent structures and human resource management models shifting significantly across IT services and consulting as GenAI and agentic AI adoption increases

- Clients asking for outcomes-based pricing as AI adoption increases transparency across enterprises and their IT services and consulting vendors

- Alliances expanding into three- and four-way partnerships as joint go-to-market motions evolve

Explore TBR Professional Services Coverage

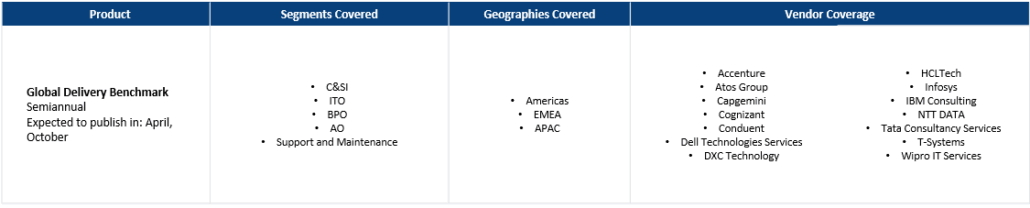

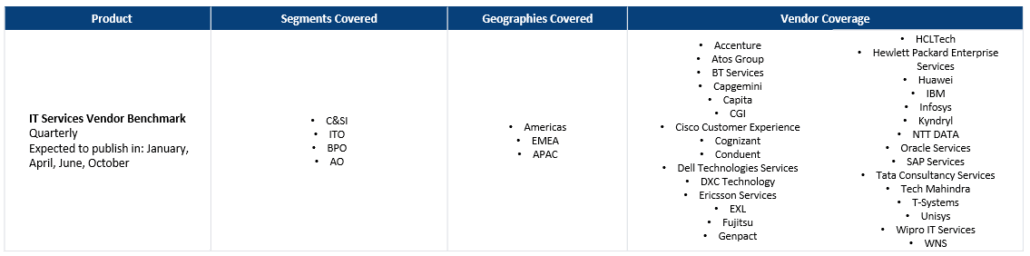

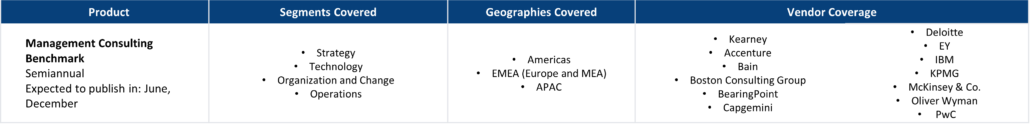

Market and competitor benchmarks provide a comparison of vendor performance in a market, including analysis on vendor strategies, financial performance, go-to-market and resource management. The research graphically portrays comparisons of vendors by myriad metrics, calling out leaders, laggards and business models. Defensible, data-informed views of market opportunity and operational best practices are highlighted in each publication. TBR also provides benchmark data in Excel pivot tables.

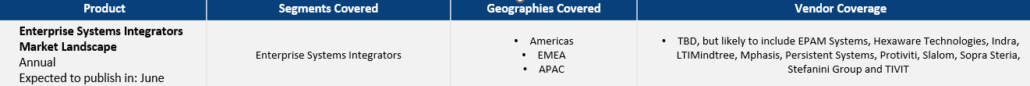

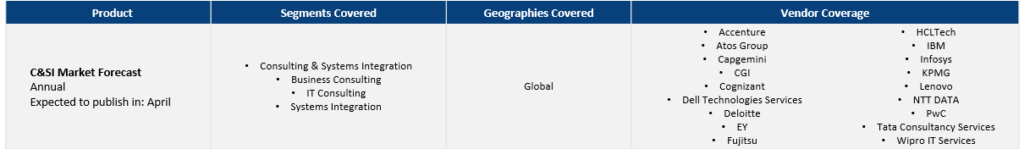

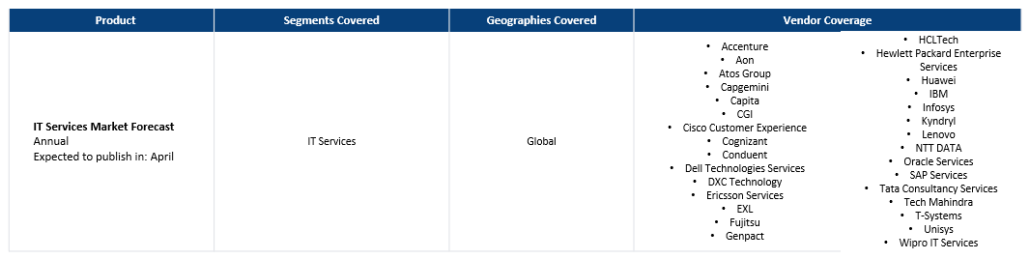

Current Market & Competitor Benchmarks:

- Global Delivery Benchmark

- IT Services Vendor Benchmark

- Management Consulting Benchmark

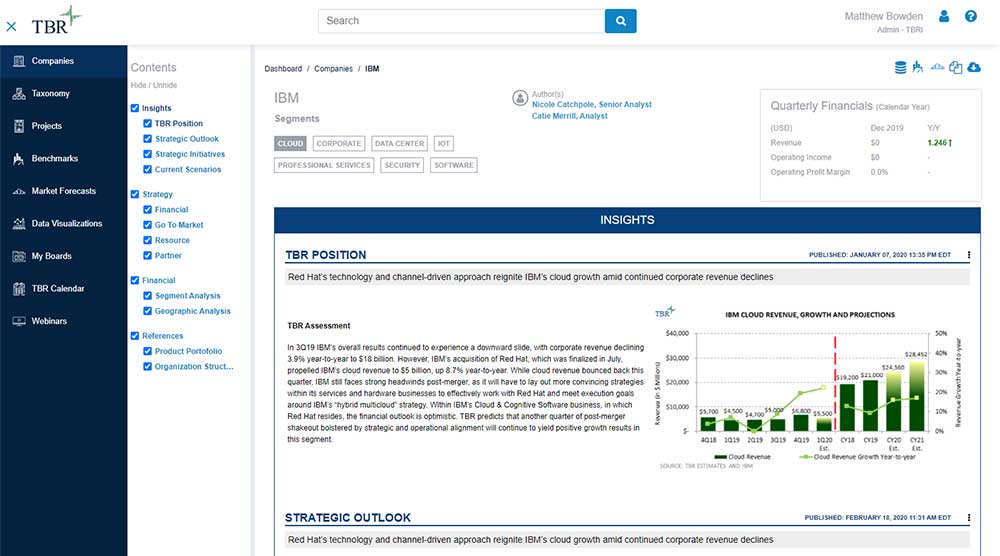

TBR’s vendor reports, snapshots and profiles provide deep-dive analysis of a single vendor across corporate strategies, tactics, SWOT analysis, financials, go-to-market strategies and resource strategies. Vendor performance is put in the context of market opportunity and competitive environment and our assessment shows where a vendor will success and its future market position.

Ready to Level Up Your Insights?

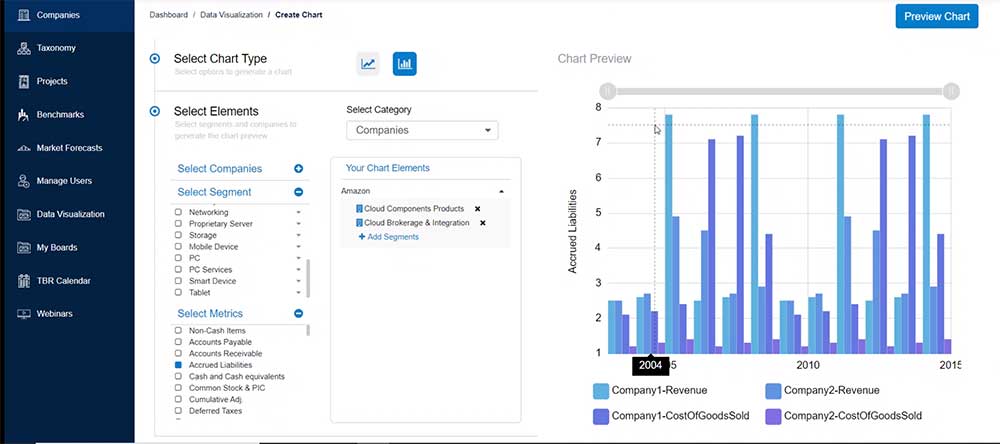

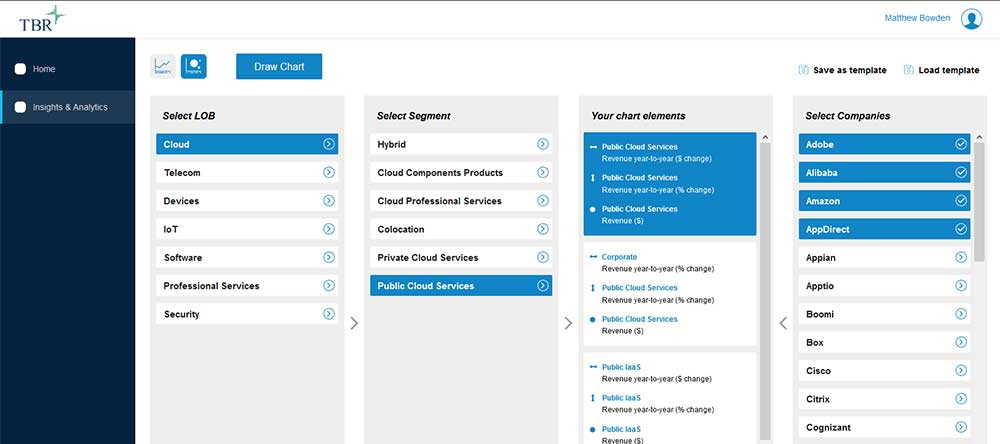

TBR’s digital-first competitive intelligence platform, TBR Insight Center™, allows for configured & customized views into IT markets, vendors, alliances and ecosystems.

Benefits delivered through TBR Insight Center™ include:

- Dynamic, configurable platform for TBR’s objective, independent and validated data and analysis

- Customizable views of millions of data points to match your specific needs

- Simple download functionality for customized views of analysis and feeds of data, saving staff dozens of hours per month

- Updates for market disruptions and emerging trends

Already a TBR Classic client but don’t have access to TBR Insight Center yet? Request access today.

Geopolitics with Purpose: EY-Parthenon Drives Strategy, Not Just Awareness

/by Patrick Heffernan, Practice Manager and Principal AnalystTBR has long maintained that the Big Four firms have an inherent advantage against all competitors when it comes to understanding and advising on geopolitical risk. Perhaps only the U.S. government has the same global spread of talent, with professionals in nearly every country, most intimately aware of local business, economic and even political trends. When EY-Parthenon showed off its Geopolitical Advisory team recently, TBR wanted to know: Is this something special?

Manufacturing Growth Slows, But EMEA IT Services Vendors Find Lifeline in Public Sector Wins

/by Jill CookinhamThis quarter, we look at Accenture, Atos, Capgemini and IBM Consulting in the Europe, Middle East and Africa (EMEA) market, and compare how their industry diversification, portfolios and localization strategies position them for revenue growth. Atos and Capgemini, the two IT services companies whose EMEA revenue makes up over half of total revenue, experienced a steady decline in trailing 12-month (TTM) year-to-year revenue growth in recent quarters. Yet, Accenture and IBM were better able to maintain growth as macroeconomic conditions deteriorated in recent quarters.