With TBR’s Digital Transformation market and competitive intelligence research, gain insight into how technology and services firms are investing, going to market, partnering and more as they help enterprises transition to digital solutions.

Learn how IT and business buyers approach digital applications, platforms and services within the context of disruptive market trends and emerging opportunities. Additionally, examine and dissect IT vendors’ ecosystem management as well as investments, performance and go-to-market strategies in both mature and emerging areas, including blockchain, Industrial IoT, analytics, customer experience and innovation centers, and cloud.

A free trial of TBR’s Insights Center platform gives you access to our entire Digital Transformation research portfolio and the ability to customize and curate reports detailing our analysis based on your company’s specific needs. Start your free trial today!

Trends we’re watching in 2026:

- Customer experience becomes the battleground of AI for growth

- Data as the new (old) currency

- How vendor portfolio offerings evolve to avoid the GIGO (garbage-in-garbage-out) effect when on clients’ site

- Discretionary spend takes a new shape as IT buyers continue to shoulder more risk than the business, presenting an opportunity for vendors to deliver on service-level outcomes enabled by agents

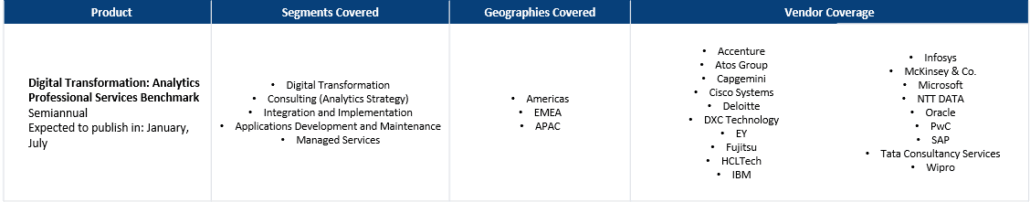

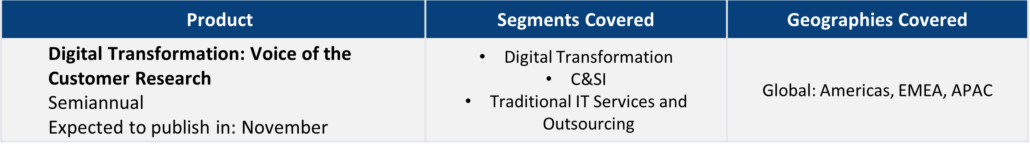

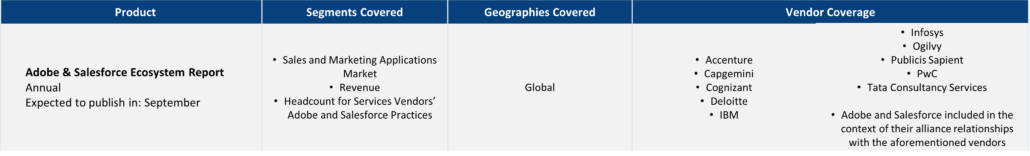

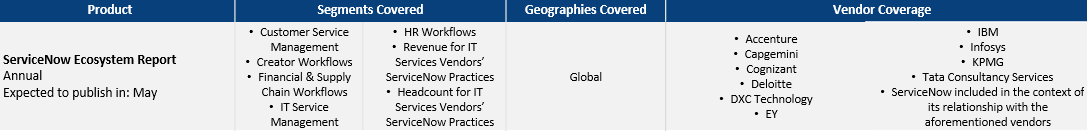

Explore TBR Digital Transformation Coverage

Ready to Level Up Your Insights?

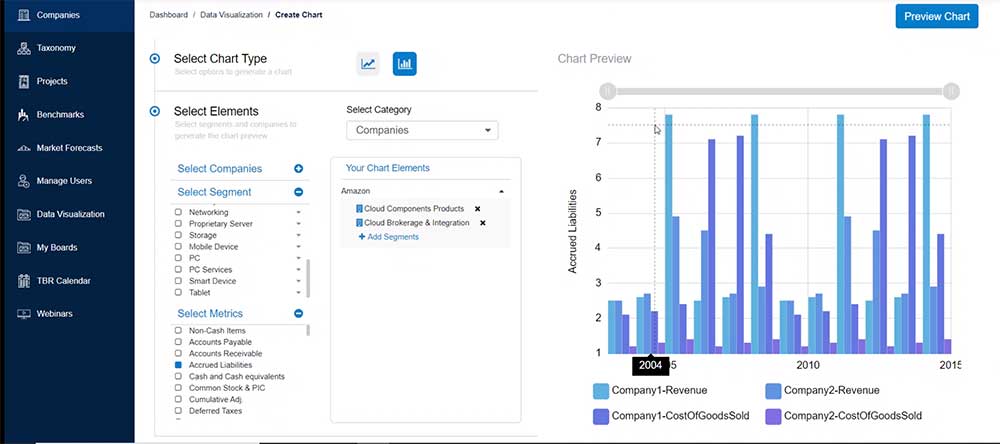

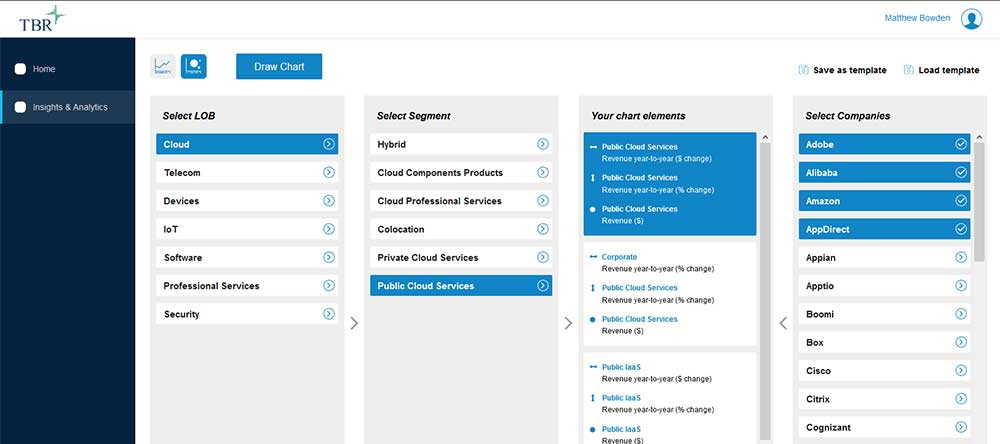

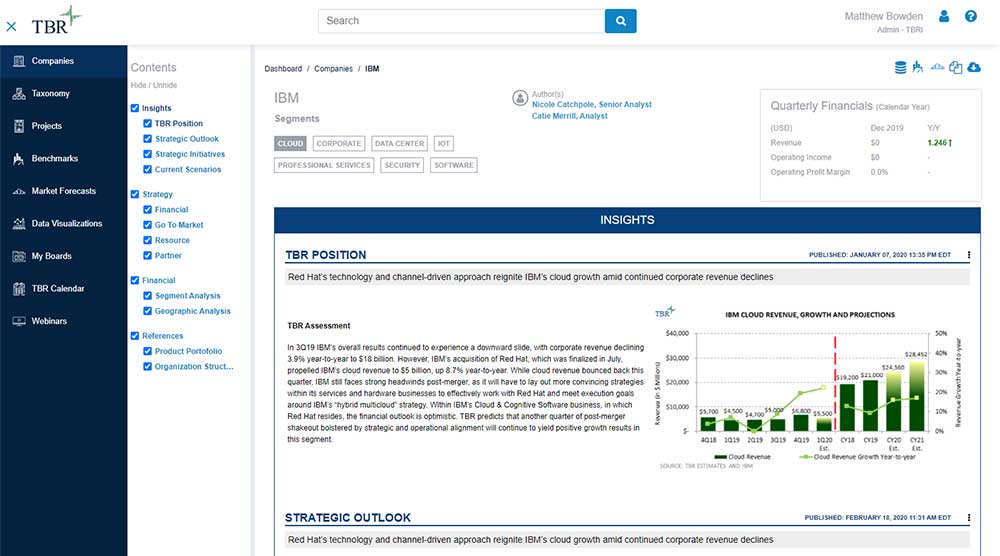

TBR’s digital-first competitive intelligence platform, TBR Insight Center™, allows for configured & customized views into IT markets, vendors, alliances and ecosystems.

Benefits delivered through TBR Insight Center™ include:

- Dynamic, configurable platform for TBR’s objective, independent and validated data and analysis

- Customizable views of millions of data points to match your specific needs

- Simple download functionality for customized views of analysis and feeds of data, saving staff dozens of hours per month

- Updates for market disruptions and emerging trends

Already a TBR Classic client but don’t have access to TBR Insight Center yet? Request access today.

AI Inferencing Takes Center Stage at Red Hat Summit 2025

/by Catie Merrill, Senior AnalystRed Hat Summit 2025 marked the company’s entry into AI inferencing with the productization of vLLM, the open-source project that has been shaping AI model execution over the past two years.

A Challenger Mindset Transforms HCLTech’s Approach to Financial Services to Achieve Success Through AI

/by Kelly Lesiczka, Senior AnalystHCLTech has a long history working with AI, building off its DRYiCE platform, the company’s original automation platform. This heritage equips HCLTech with the background and trusted technical expertise, backed by its engineering prowess. to deliver on clients’ AI transformation needs. Further, HCLTech can pursue larger-scale and more aggressive AI-led transformations, helping the company accelerate ahead of its peers in terms of client engagement and growth.