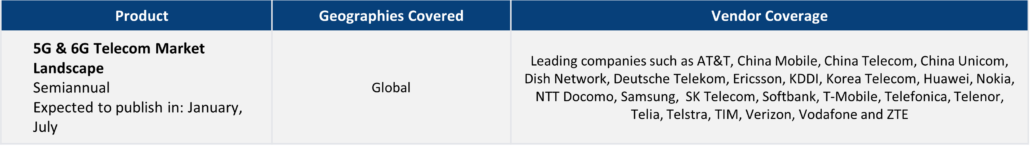

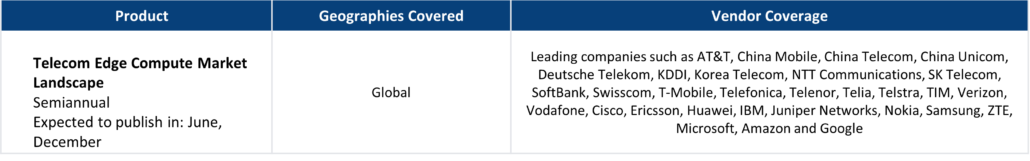

With TBR’s Telecom market and competitive intelligence research, examine telecom operator and telecom vendor markets as well as key industrywide trends and developments, such as 5G, edge computing, private networks, and the encroachment of hyperscalers into the telecom industry.

Understand operator business models, capital expenditure, subscriber metrics and next-generation technology adoption, with coverage spanning wireless, wireline, cable and enterprise markets. Access vendor customer demand analysis, portfolio analysis and competitive benchmarking.

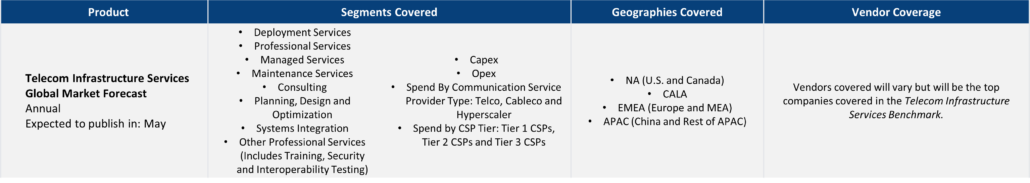

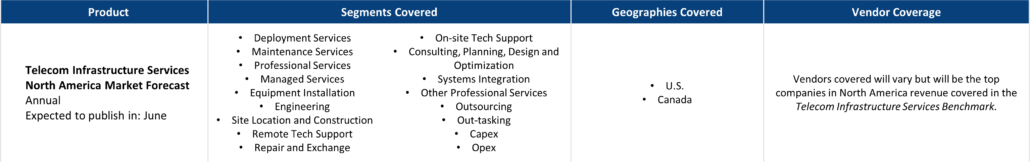

Additionally, we are the leading resource for telecom infrastructure services (TIS) market research.

A free trial of TBR’s Insights Center platform gives you access to our entire Telecom research portfolio and the ability to customize and curate reports detailing our analysis based on your company’s specific needs. Start your free trial today!

Trends we’re watching in 2026:

- Impact of K-shaped economy on telecom market

- Why a price war is coming to the broadband market

- How telcos will adjust to meet AI’s timetable

- Ways in which the network needs to adjust for the AI economy

Explore TBR Telecom Coverage

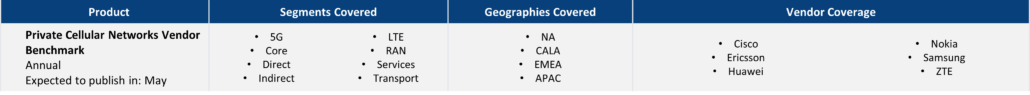

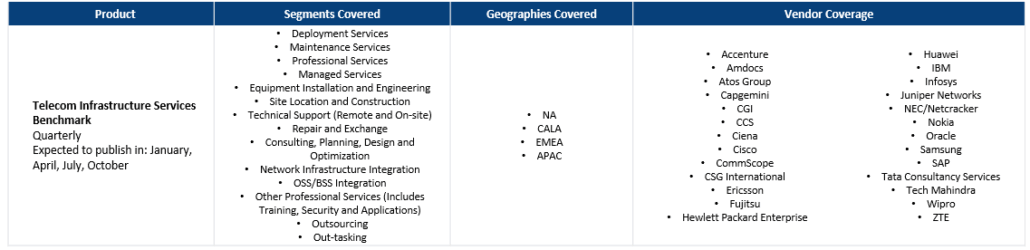

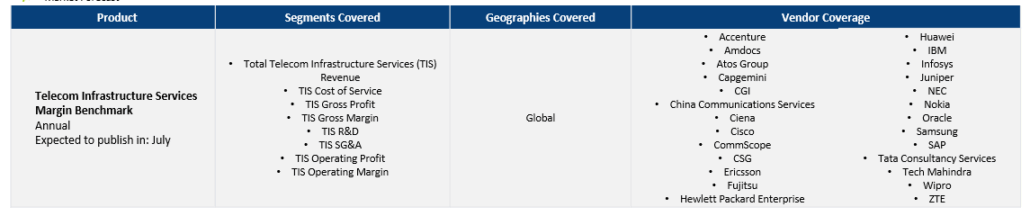

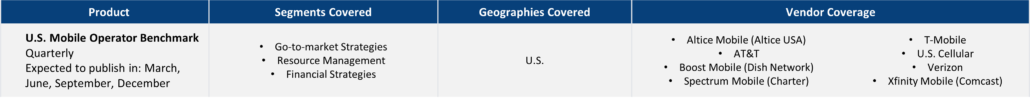

Market and competitor benchmarks provide a comparison of vendor performance in a market, including analysis on vendor strategies, financial performance, go-to-market and resource management. The research graphically portrays comparisons of vendors by myriad metrics, calling out leaders, laggards and business models. Defensible, data-informed views of market opportunity and operational best practices are highlighted in each publication. TBR also provides benchmark data in Excel pivot tables.

Current Market & Competitor Benchmarks:

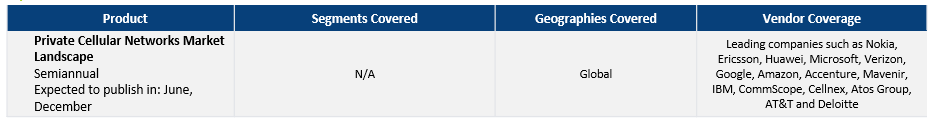

- Private Cellular Networks Vendor Benchmark

- Telecom Infrastructure Services Benchmark

- Telecom Infrastructure Services Margin Benchmark

- U.S. Mobile Operator Benchmark

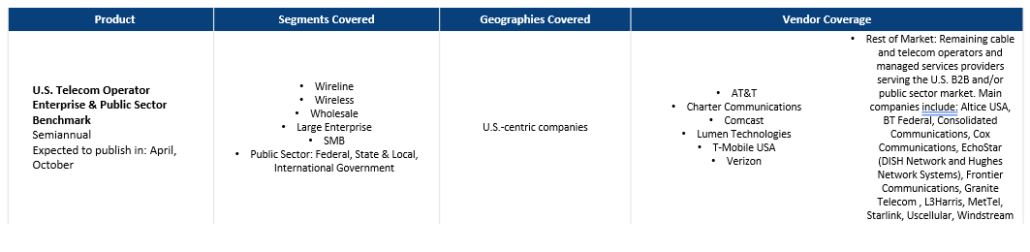

- U.S. Telecom Operator Enterprise & Public Sector Benchmark

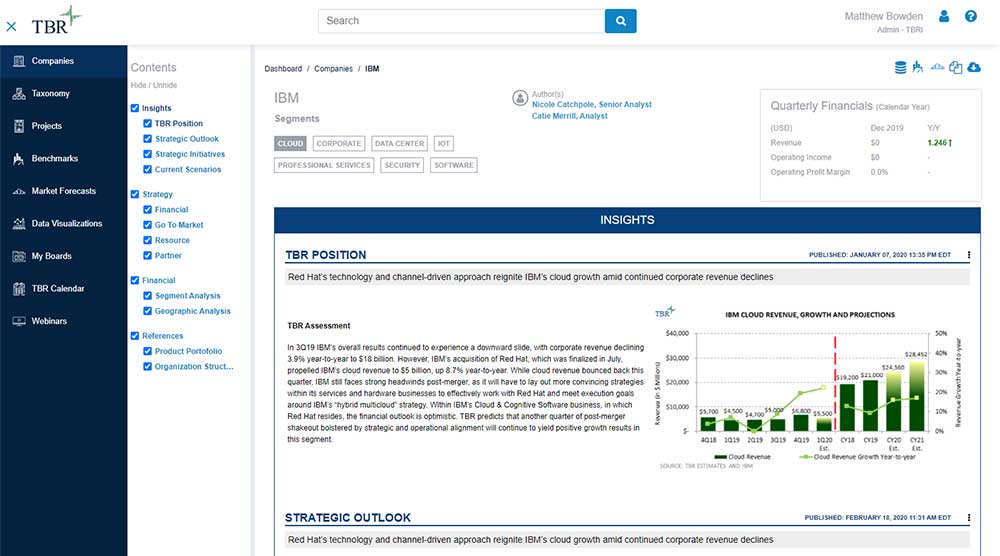

TBR’s vendor reports, snapshots and profiles provide deep-dive analysis of a single vendor across corporate strategies, tactics, SWOT analysis, financials, go-to-market strategies and resource strategies. Vendor performance is put in the context of market opportunity and competitive environment and our assessment shows where a vendor will success and its future market position.

- AT&T

- Cisco Systems

- T-Mobile USA

- Verizon

- Ericsson

- Nokia

Ready to Level Up Your Insights?

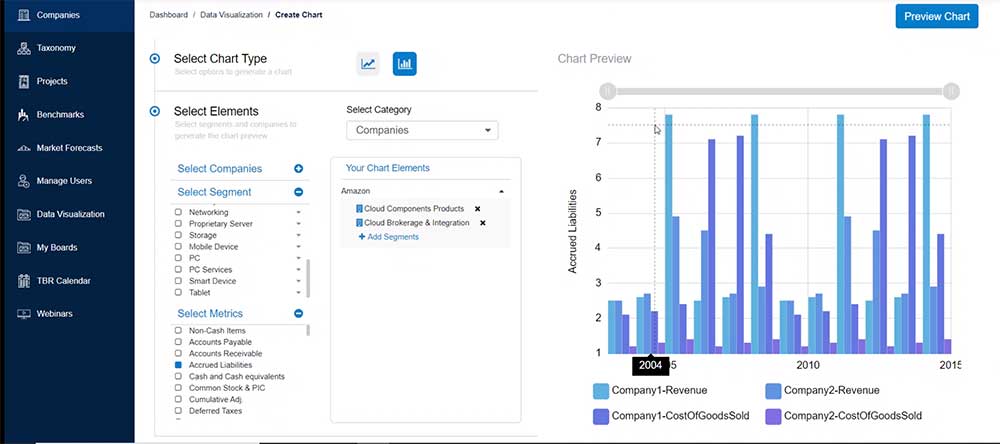

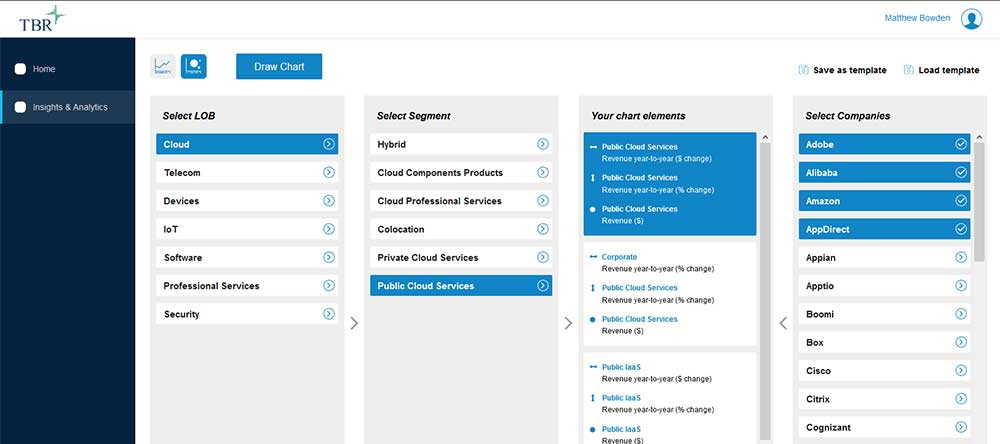

TBR’s digital-first competitive intelligence platform, TBR Insight Center™, allows for configured & customized views into IT markets, vendors, alliances and ecosystems.

Benefits delivered through TBR Insight Center™ include:

- Dynamic, configurable platform for TBR’s objective, independent and validated data and analysis

- Customizable views of millions of data points to match your specific needs

- Simple download functionality for customized views of analysis and feeds of data, saving staff dozens of hours per month

- Updates for market disruptions and emerging trends

Already a TBR Classic client but don’t have access to TBR Insight Center yet? Request access today.

Robots Protecting Themselves From Robots: The Future of AI Security and Vendor Differentiation

/by Bozhidar Hristov, Principal AnalystDemand for analytics services has reached an inflection point, with new opportunities around the development and implementation of secure, industry-aligned agentic AI solutions refueling growth.

B2B Strategic Advantage: Ecosystem Intelligence

/by Patrick Heffernan, Practice Manager and Principal AnalystVendor consolidation and enterprise optimization of existing digital stacks have compelled IT services companies and consultancies as well as their ecosystem partners to think strategically about who to partner with and how to secure and expand their position within the ecosystem. As a result, aligning business priorities with alliance partners will allow IT services companies and consultancies to develop a more empathetic approach to technology-fatigued buyers. Additionally, understanding pricing and commercial structures backed by common knowledge management programs will elevate the value of joint services and appeal to enterprise buyers’ appreciation of a separation of labor, supported by greater transparency and accountability.

KPMG Shifts Focus to Legal Services and AI-driven Strategy Consulting

/by Bozhidar Hristov, Principal AnalystEarlier in January news reports surfaced that a subsidiary of KPMG, KPMG Law US, had applied to operate in Arizona under a state program allowing nonlawyers to operate law firms and provide legal services in the state. KPMG is leaning toward legal services and AI-infused strategy consulting offerings to bolster sales as the firm navigates choppy market conditions within core deal advisory.