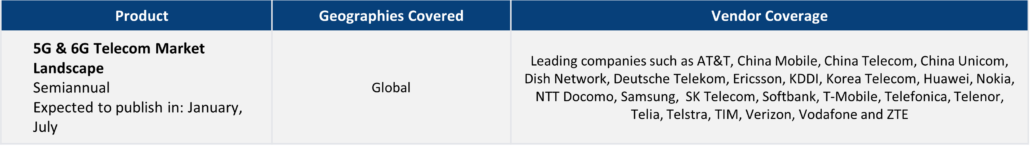

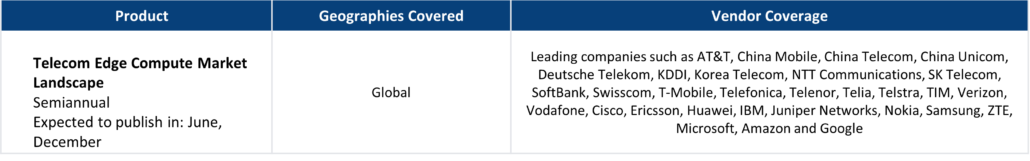

With TBR’s Telecom market and competitive intelligence research, examine telecom operator and telecom vendor markets as well as key industrywide trends and developments, such as 5G, edge computing, private networks, and the encroachment of hyperscalers into the telecom industry.

Understand operator business models, capital expenditure, subscriber metrics and next-generation technology adoption, with coverage spanning wireless, wireline, cable and enterprise markets. Access vendor customer demand analysis, portfolio analysis and competitive benchmarking.

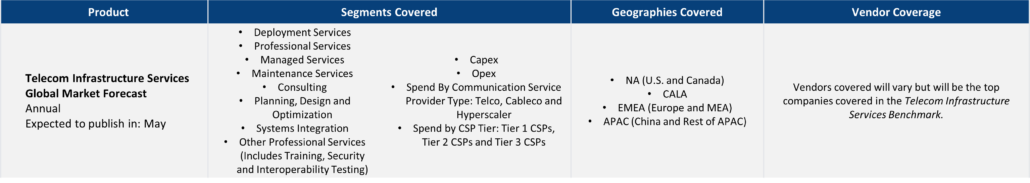

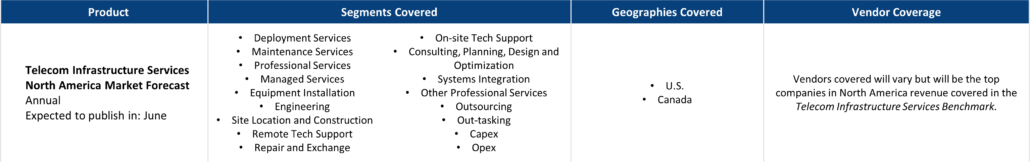

Additionally, we are the leading resource for telecom infrastructure services (TIS) market research.

A free trial of TBR’s Insights Center platform gives you access to our entire Telecom research portfolio and the ability to customize and curate reports detailing our analysis based on your company’s specific needs. Start your free trial today!

Trends we’re watching in 2026:

- Impact of K-shaped economy on telecom market

- Why a price war is coming to the broadband market

- How telcos will adjust to meet AI’s timetable

- Ways in which the network needs to adjust for the AI economy

Explore TBR Telecom Coverage

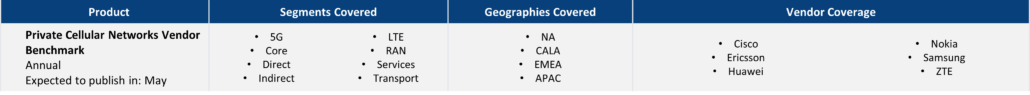

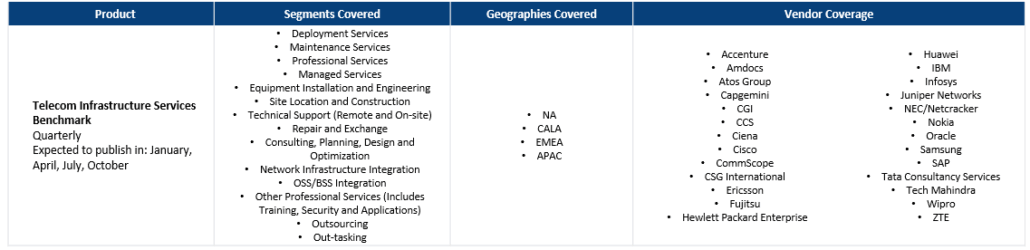

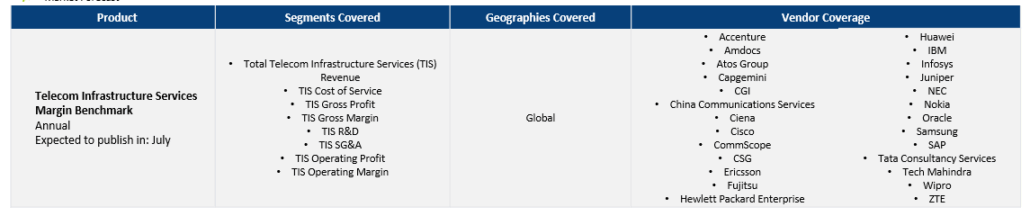

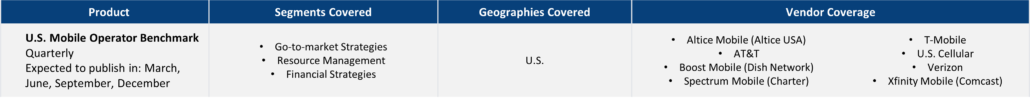

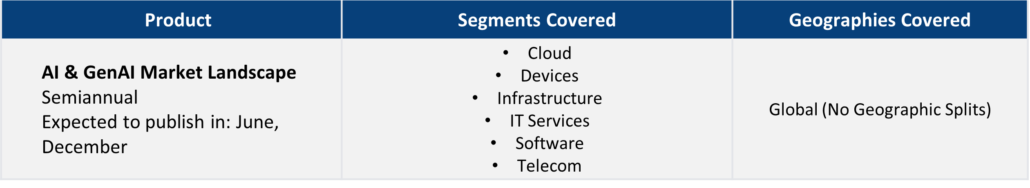

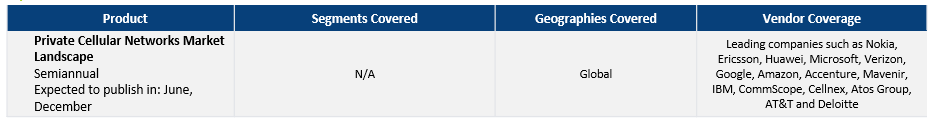

Market and competitor benchmarks provide a comparison of vendor performance in a market, including analysis on vendor strategies, financial performance, go-to-market and resource management. The research graphically portrays comparisons of vendors by myriad metrics, calling out leaders, laggards and business models. Defensible, data-informed views of market opportunity and operational best practices are highlighted in each publication. TBR also provides benchmark data in Excel pivot tables.

Current Market & Competitor Benchmarks:

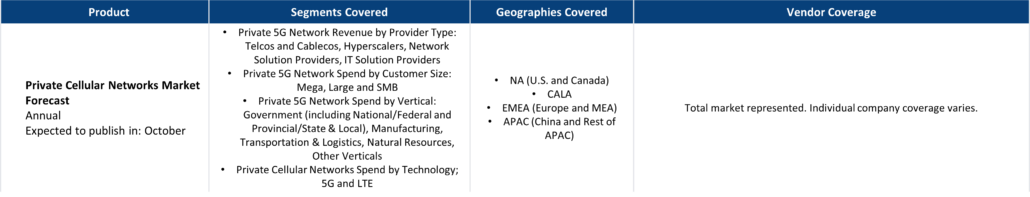

- Private Cellular Networks Vendor Benchmark

- Telecom Infrastructure Services Benchmark

- Telecom Infrastructure Services Margin Benchmark

- U.S. Mobile Operator Benchmark

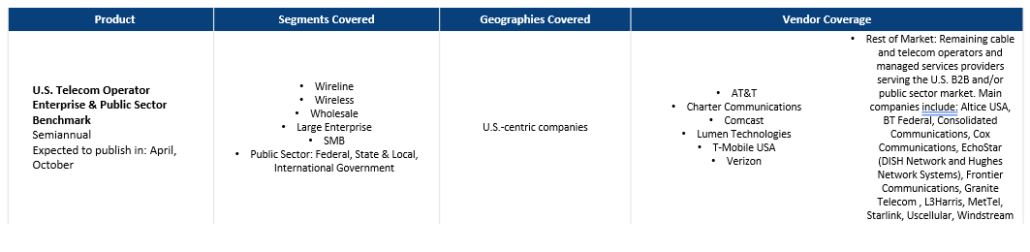

- U.S. Telecom Operator Enterprise & Public Sector Benchmark

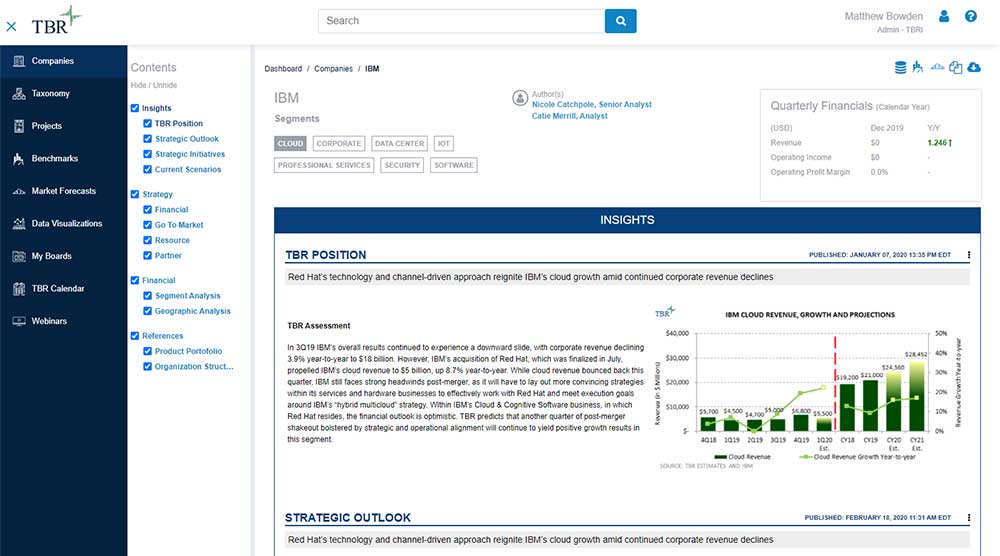

TBR’s vendor reports, snapshots and profiles provide deep-dive analysis of a single vendor across corporate strategies, tactics, SWOT analysis, financials, go-to-market strategies and resource strategies. Vendor performance is put in the context of market opportunity and competitive environment and our assessment shows where a vendor will success and its future market position.

- AT&T

- Cisco Systems

- T-Mobile USA

- Verizon

- Ericsson

- Nokia

Ready to Level Up Your Insights?

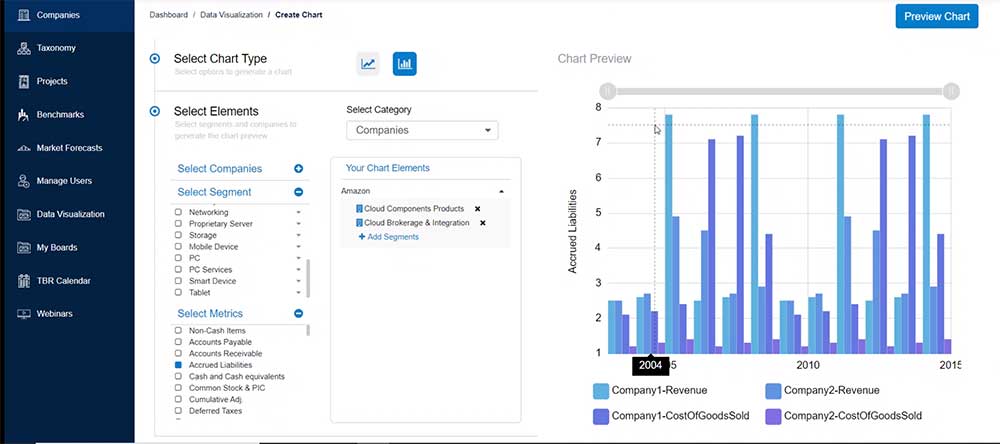

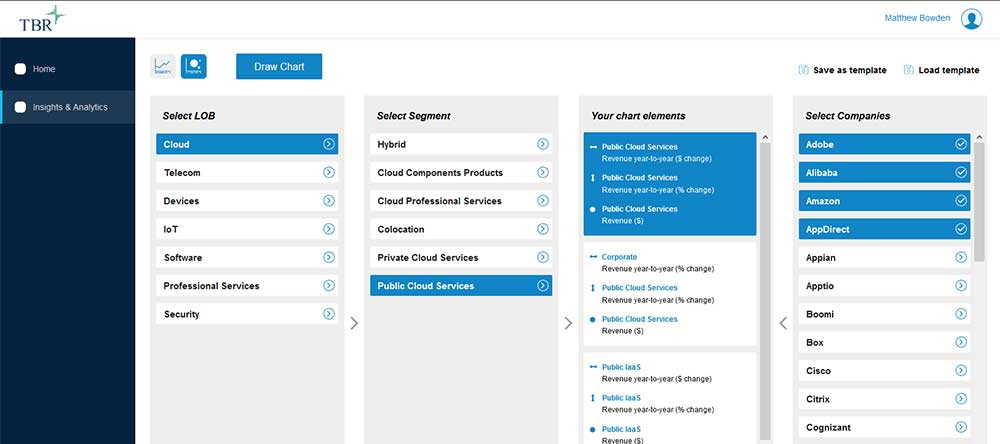

TBR’s digital-first competitive intelligence platform, TBR Insight Center™, allows for configured & customized views into IT markets, vendors, alliances and ecosystems.

Benefits delivered through TBR Insight Center™ include:

- Dynamic, configurable platform for TBR’s objective, independent and validated data and analysis

- Customizable views of millions of data points to match your specific needs

- Simple download functionality for customized views of analysis and feeds of data, saving staff dozens of hours per month

- Updates for market disruptions and emerging trends

Already a TBR Classic client but don’t have access to TBR Insight Center yet? Request access today.

GenAI-related Workload Opportunities Compel NTT DATA to Deepen Ecosystem Relationships

/by Bozhidar Hristov, Principal AnalystNTT DATA understands the need to pivot toward outcome-based services sales. Although it is easier said than done, the company has an opportunity to deliver value to clients provided it relies more on its alliance partners and continues to stick to its core expertise. Additionally, it will be essential for NTT DATA to invest in a partner framework.

Snowflake’s AI Evolution: Scaling Innovation with a Data-first Strategy

/by Gunnar Tache, Research AnalystSnowflake’s evolution reflects its commitment to advancing AI through a data-first approach. By addressing the complexities of modern data ecosystems and aligning its platform with emerging AI trends, Snowflake has established itself as a key player in the AI landscape. This strategic focus not only drives digital transformation but also shapes the competitive dynamics of the market, impacting partners, competitors and technology providers.

Fujitsu Expands Kozuchi AI Platform and Strengthens Partnerships to Drive Digital Transformation

/by Kelly Lesiczka, Senior AnalystFujitsu’s investments in Fujitsu Kozuchi have equipped the company well to appeal to clients’ needs around the technology, providing opportunities to supply analytics with associated text, vision and trust in support of business operations. While AI technology evolves rapidly to include new capabilities, Fujitsu’s approach to developing the platform and leveraging partners and internal capabilities gives it an advantage in offering a wider set of services.