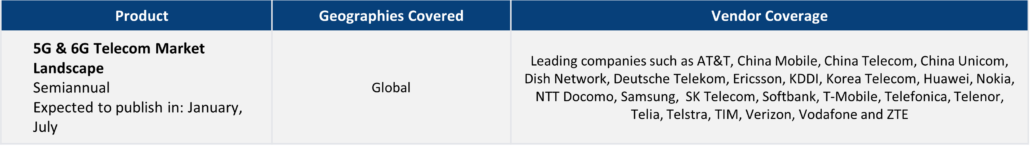

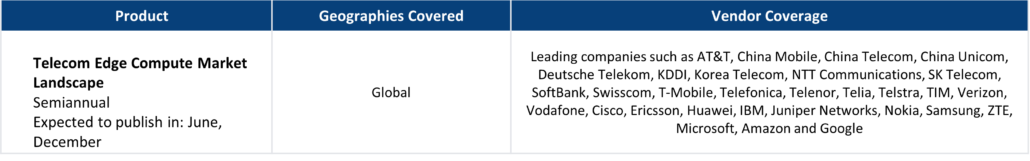

With TBR’s Telecom market and competitive intelligence research, examine telecom operator and telecom vendor markets as well as key industrywide trends and developments, such as 5G, edge computing, private networks, and the encroachment of hyperscalers into the telecom industry.

Understand operator business models, capital expenditure, subscriber metrics and next-generation technology adoption, with coverage spanning wireless, wireline, cable and enterprise markets. Access vendor customer demand analysis, portfolio analysis and competitive benchmarking.

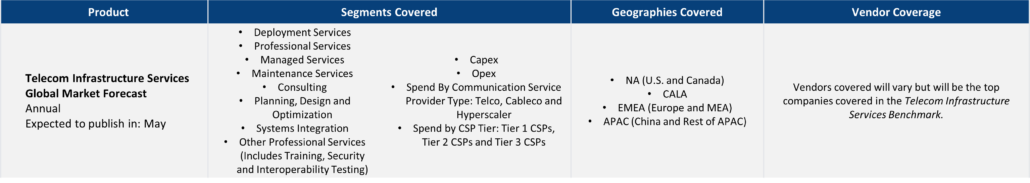

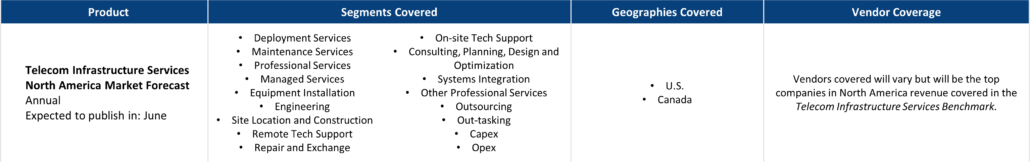

Additionally, we are the leading resource for telecom infrastructure services (TIS) market research.

A free trial of TBR’s Insights Center platform gives you access to our entire Telecom research portfolio and the ability to customize and curate reports detailing our analysis based on your company’s specific needs. Start your free trial today!

Trends we’re watching in 2025:

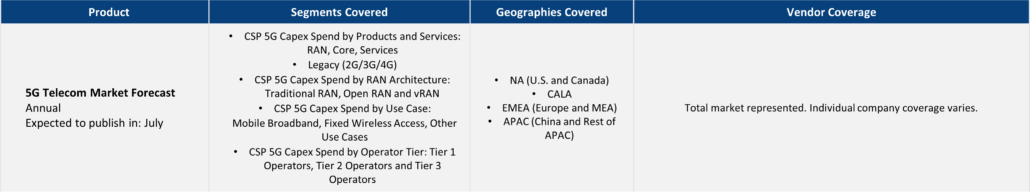

- Evolution of cellular networks to 5G SA (stand-alone) and 5G-Advanced and how communication service providers (CSPs) will adopt these technologies

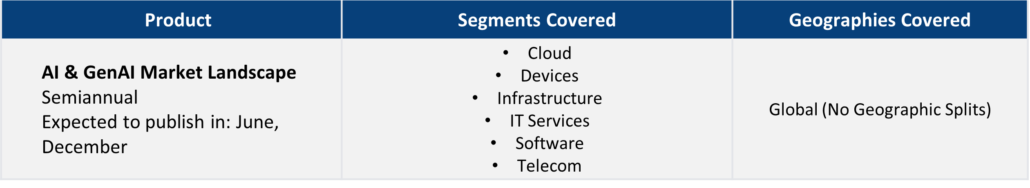

- Evolution of the AI market from the training phase to the inferencing phase and what this means for edge computing and the telecom industry

- How the market for private 5G networks is developing and when to expect greater scale in this market

- How the new political landscape in the U.S. and parts of Europe will impact the telecom industry

- Which GenAI use cases CSPs will prioritize to commercially deploy, and why

- How the telecom landscape will change from a new round of consolidation

Explore TBR Telecom Coverage

Market and competitor benchmarks provide a comparison of vendor performance in a market, including analysis on vendor strategies, financial performance, go-to-market and resource management. The research graphically portrays comparisons of vendors by myriad metrics, calling out leaders, laggards and business models. Defensible, data-informed views of market opportunity and operational best practices are highlighted in each publication. TBR also provides benchmark data in Excel pivot tables.

Current Market & Competitor Benchmarks:

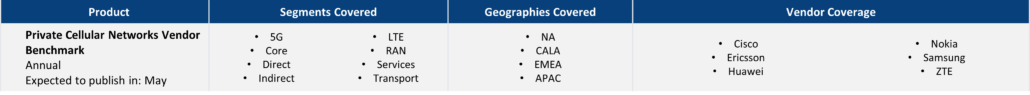

- Private Cellular Networks Vendor Benchmark

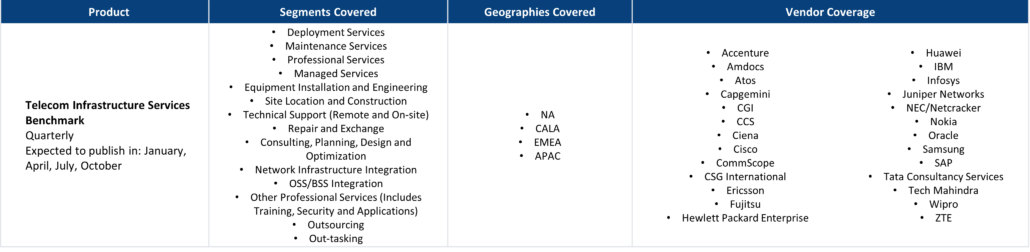

- Telecom Infrastructure Services Benchmark

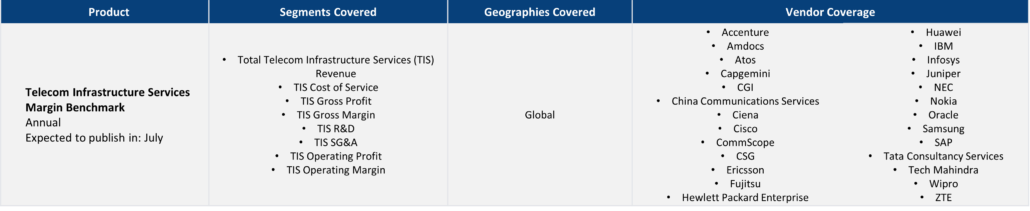

- Telecom Infrastructure Services Margin Benchmark

- U.S. Mobile Operator Benchmark

- U.S. Telecom Enterprise Operator Benchmark

- U.S. Telecom Operator Public Sector Benchmark

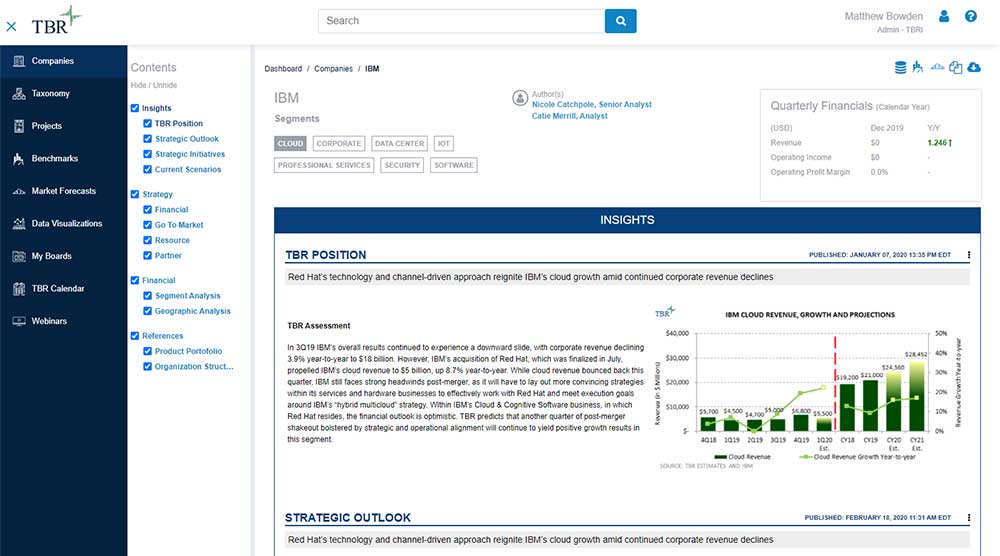

TBR’s vendor reports, snapshots and profiles provide deep-dive analysis of a single vendor across corporate strategies, tactics, SWOT analysis, financials, go-to-market strategies and resource strategies. Vendor performance is put in the context of market opportunity and competitive environment and our assessment shows where a vendor will success and its future market position.

- AT&T

- Comcast

- Cisco Systems

- T-Mobile USA

- Verizon

- Ericsson

- Huawei

- Nokia

Ready to Level Up Your Insights?

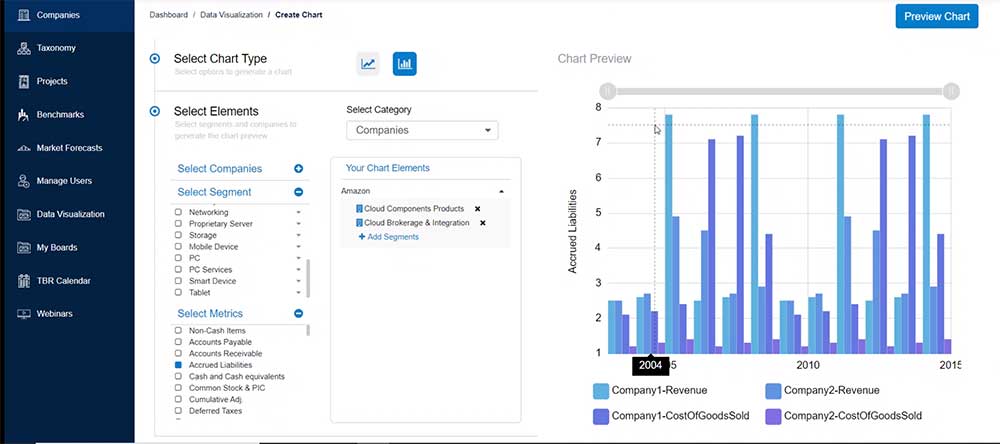

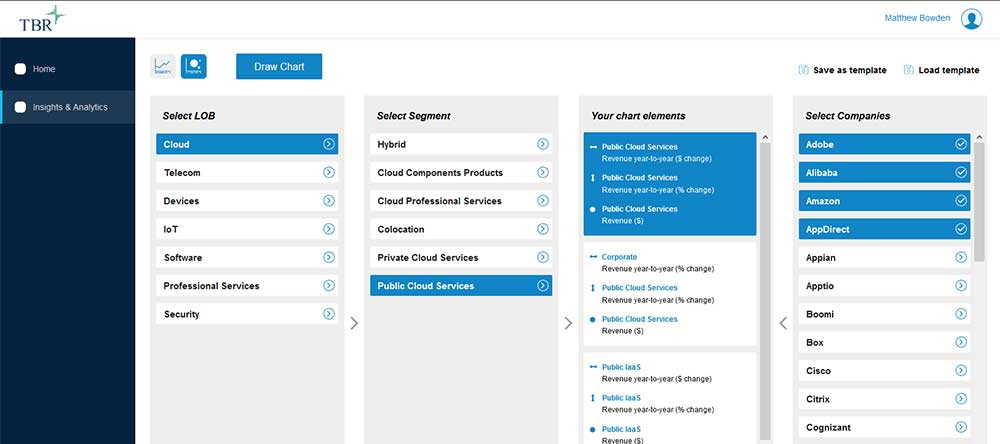

TBR’s digital-first competitive intelligence platform, TBR Insight Center™, allows for configured & customized views into IT markets, vendors, alliances and ecosystems.

Benefits delivered through TBR Insight Center™ include:

- Dynamic, configurable platform for TBR’s objective, independent and validated data and analysis

- Customizable views of millions of data points to match your specific needs

- Simple download functionality for customized views of analysis and feeds of data, saving staff dozens of hours per month

- Updates for market disruptions and emerging trends

Already a TBR Classic client but don’t have access to TBR Insight Center yet? Request access today.

AI Buzz Sparks IT Infrastructure Shifts, but Privacy and Strategic Challenges Are Impacting Adoption

/by Ben Carbonneau, Senior Data AnalystThe industry enthusiasm surrounding AI has quickly led to shifts in organizations’ strategic priorities and expected investments such as demand for servers. Despite the hype, few organizations have operationalized GenAI to date. Instead, most are focused on overcoming initial barriers to adoption, including understanding the business implications of this new technology frontier.

GenAI, IT Modernization and Strategic M&A Drive Infrastructure as a Service and Platform as a Service Growth

/by Catie Merrill, Senior AnalystTop hyperscalers Amazon Web Services (AWS) and Microsoft are capturing legacy Oracle and SAP workloads as customers continue to migrate to the cloud to not only outsource their IT operations but also drive lasting business value. Though the geopolitical outlook is increasingly uncertain, we expect customers will continue to prioritize more traditional “lift and shift” migrations, and steps vendors are taking to deliver more integrated solutions could help.