With TBR’s IT Infrastructure market and competitive intelligence research, gain insights into financial performance, product and partner strategies of the world’s leading infrastructure vendors across server, storage, networking, hyperconverged and quantum computing markets.

TBR evaluates the intersection of infrastructure strategy and how vendors are adapting to broader industry trends, from evolving consumption models to expansion into edge and multicloud markets. Our IT infrastructure vendor analysis is complemented by customer research which details the strategies, priorities and challenges faced by infrastructure decision makers.

A free trial of TBR’s Insights Center platform gives you access to our entire IT Infrastructure research portfolio and the ability to customize and curate reports detailing our analysis based on your company’s specific needs. Start your free trial today!

Trends we’re watching in 2026:

- AI adoption at the edge

- Platform and network innovations advancing hybrid cloud and multicloud

- Supply chain impact on pricing and profitability

Explore TBR IT Infrastructure Coverage

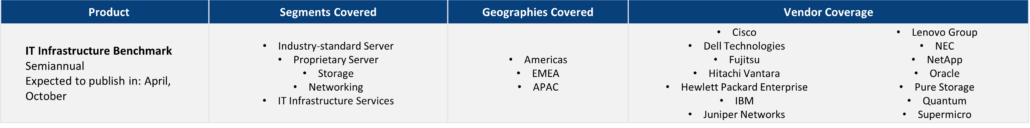

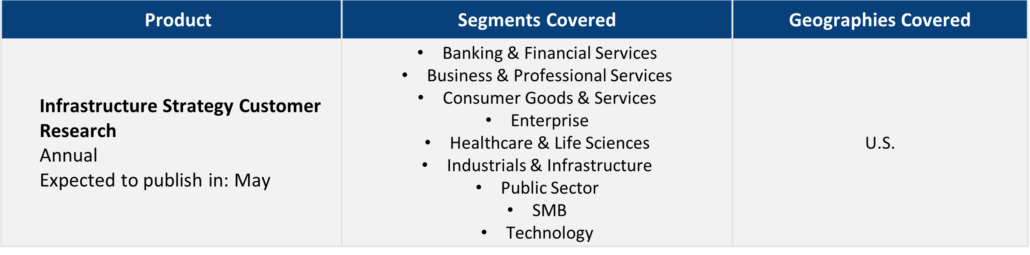

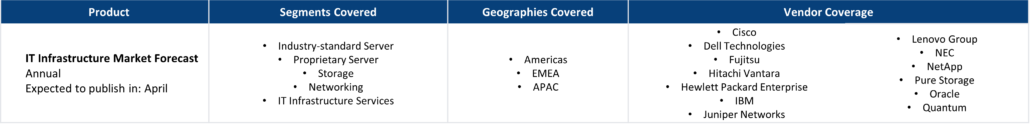

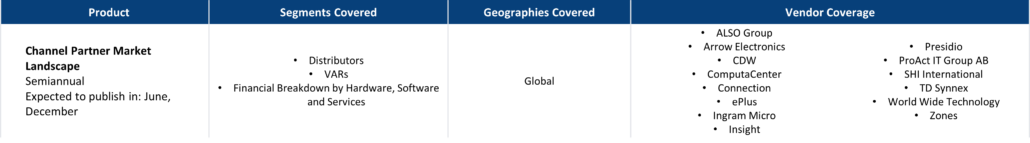

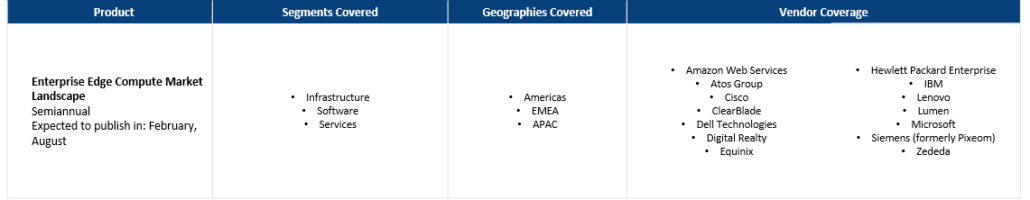

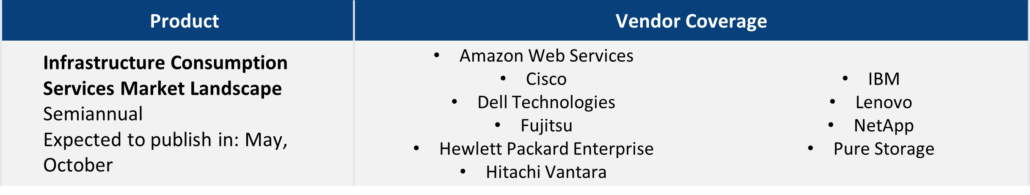

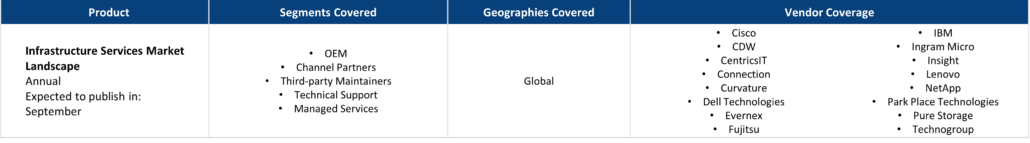

Market and competitor benchmarks provide a comparison of vendor performance in a market, including analysis on vendor strategies, financial performance, go-to-market and resource management. The research graphically portrays comparisons of vendors by myriad metrics, calling out leaders, laggards and business models. Defensible, data-informed views of market opportunity and operational best practices are highlighted in each publication. TBR also provides benchmark data in Excel pivot tables.

Current Market & Competitor Benchmarks:

- IT Infrastructure Benchmark

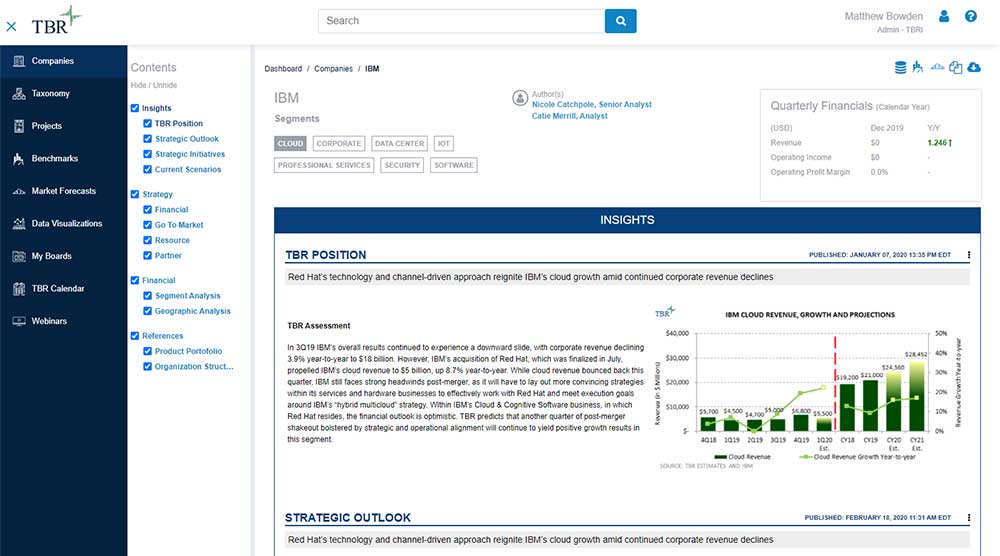

TBR’s vendor reports, snapshots and profiles provide deep-dive analysis of a single vendor across corporate strategies, tactics, SWOT analysis, financials, go-to-market strategies and resource strategies. Vendor performance is put in the context of market opportunity and competitive environment and our assessment shows where a vendor will success and its future market position.

Ready to Level Up Your Insights?

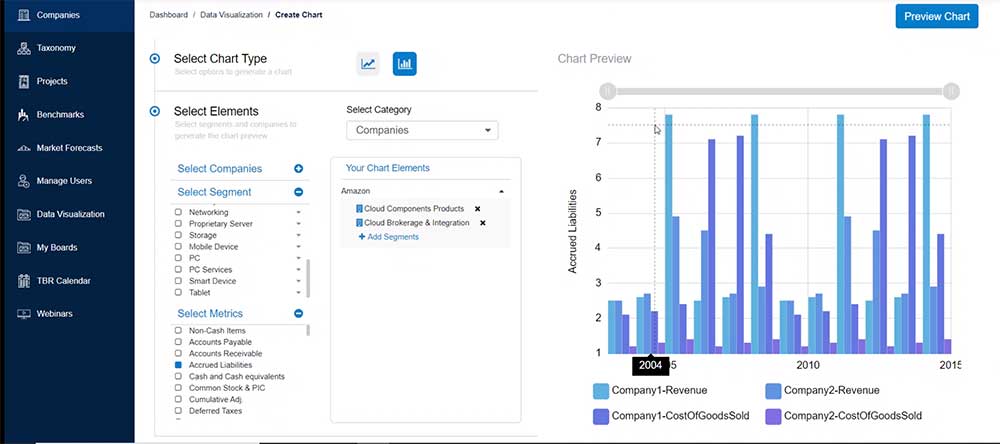

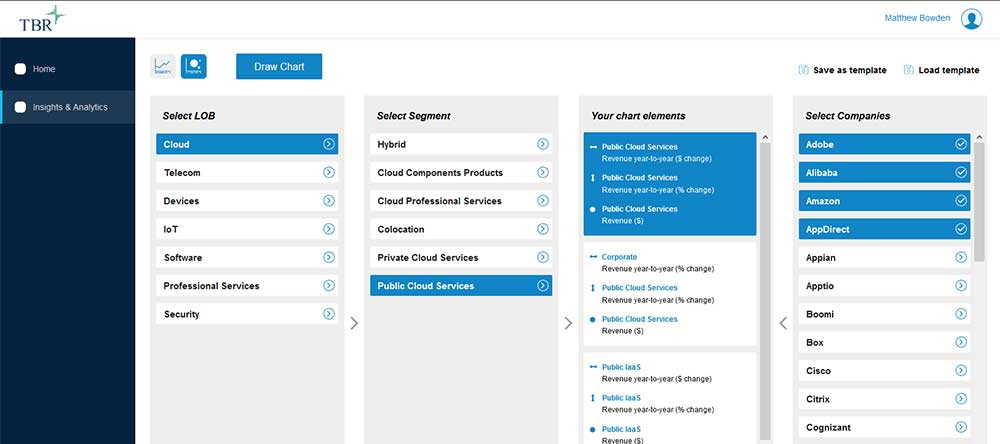

TBR’s digital-first competitive intelligence platform, TBR Insight Center™, allows for configured & customized views into IT markets, vendors, alliances and ecosystems.

Benefits delivered through TBR Insight Center™ include:

- Dynamic, configurable platform for TBR’s objective, independent and validated data and analysis

- Customizable views of millions of data points to match your specific needs

- Simple download functionality for customized views of analysis and feeds of data, saving staff dozens of hours per month

- Updates for market disruptions and emerging trends

Already a TBR Classic client but don’t have access to TBR Insight Center yet? Request access today.

DOGE drives civil sector slowdown; defense contractors gear up as Trump’s budget shifts billions to military priorities

/by John Caucis, Senior AnalystThe Trump administration’s recent “skinny” budget proposal for FFY26 suggests that nondefense spending will fall from around $720 billion in FFY25 to approximately $557 billion in FFY26, representing a 23% decline. Contractors with any level of exposure to the civilian sector can expect agency reorganizations, layoffs, budget reductions and in-depth contract reviews within civil agencies for the remainder of FFY25 and likely into at least the first half of FFY26. The pace of new awards has already slowed significantly at some civilian agencies, as has the rate of new bookings on existing civilian engagements.

Fujitsu Eyes Americas Growth with Alliances and Innovation

/by Patrick Heffernan, Practice Manager and Principal AnalystOn June 5 and 6, 2025, Fujitsu hosted around 25 analysts and advisers for an Executive Analyst Day event in Santa Clara, Calif. Fujitsu leaders from across the globe spoke on various parts of the company’s business and Fujitsu subject matter experts demonstrated solutions currently in research development or recently piloted with a few Fujitsu clients. This special report includes insights from the event and analysis based on TBR’s ongoing research around Fujitsu and the broader IT services sector.