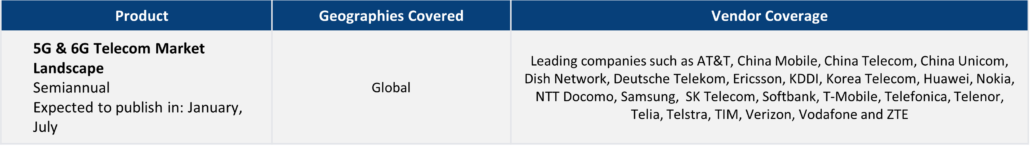

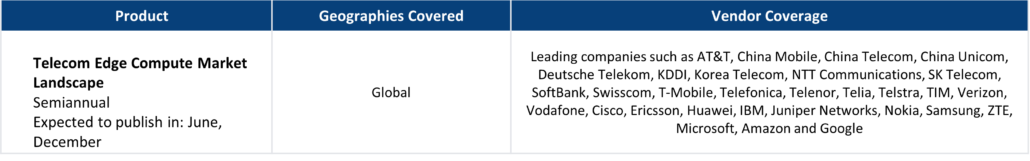

With TBR’s Telecom market and competitive intelligence research, examine telecom operator and telecom vendor markets as well as key industrywide trends and developments, such as 5G, edge computing, private networks, and the encroachment of hyperscalers into the telecom industry.

Understand operator business models, capital expenditure, subscriber metrics and next-generation technology adoption, with coverage spanning wireless, wireline, cable and enterprise markets. Access vendor customer demand analysis, portfolio analysis and competitive benchmarking.

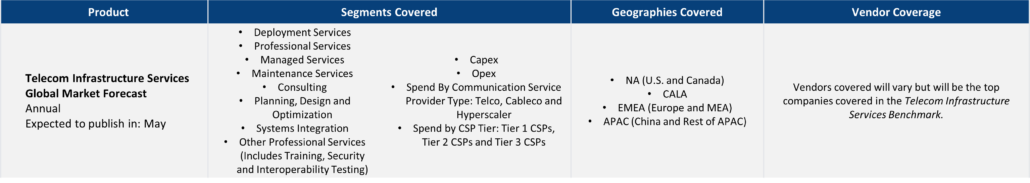

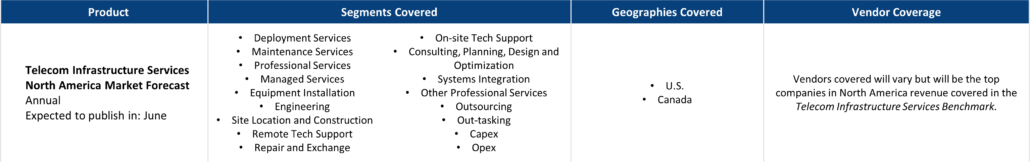

Additionally, we are the leading resource for telecom infrastructure services (TIS) market research.

A free trial of TBR’s Insights Center platform gives you access to our entire Telecom research portfolio and the ability to customize and curate reports detailing our analysis based on your company’s specific needs. Start your free trial today!

Trends we’re watching in 2026:

- Impact of K-shaped economy on telecom market

- Why a price war is coming to the broadband market

- How telcos will adjust to meet AI’s timetable

- Ways in which the network needs to adjust for the AI economy

Explore TBR Telecom Coverage

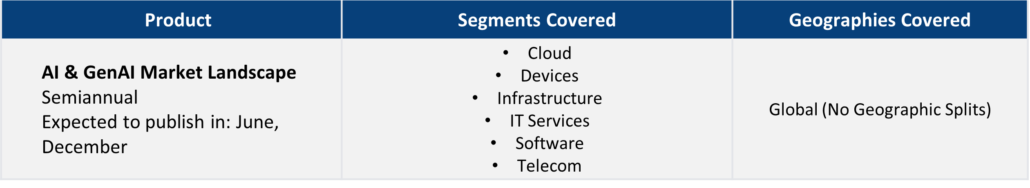

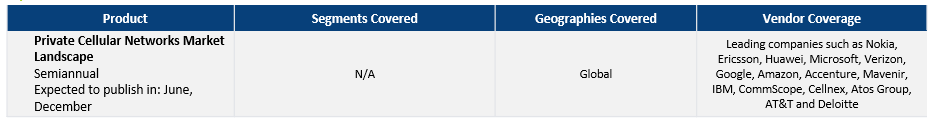

Market and competitor benchmarks provide a comparison of vendor performance in a market, including analysis on vendor strategies, financial performance, go-to-market and resource management. The research graphically portrays comparisons of vendors by myriad metrics, calling out leaders, laggards and business models. Defensible, data-informed views of market opportunity and operational best practices are highlighted in each publication. TBR also provides benchmark data in Excel pivot tables.

Current Market & Competitor Benchmarks:

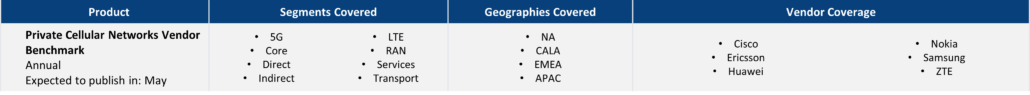

- Private Cellular Networks Vendor Benchmark

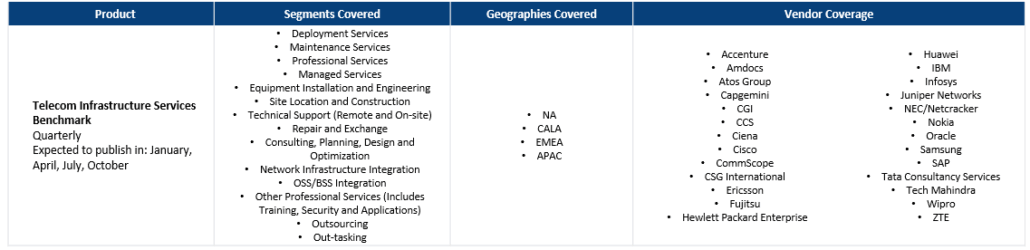

- Telecom Infrastructure Services Benchmark

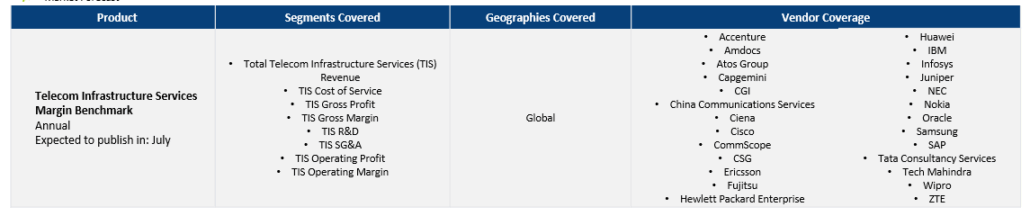

- Telecom Infrastructure Services Margin Benchmark

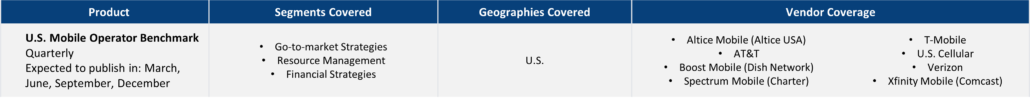

- U.S. Mobile Operator Benchmark

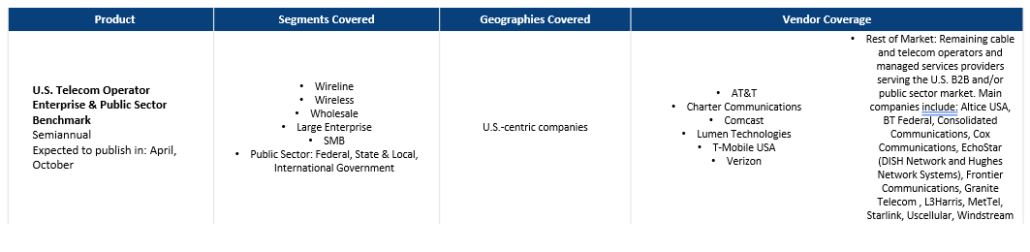

- U.S. Telecom Operator Enterprise & Public Sector Benchmark

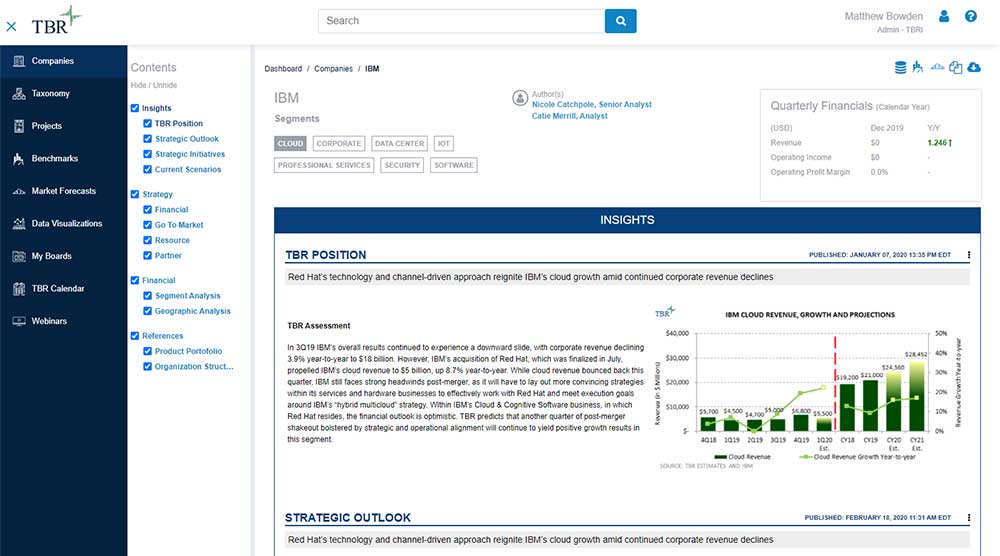

TBR’s vendor reports, snapshots and profiles provide deep-dive analysis of a single vendor across corporate strategies, tactics, SWOT analysis, financials, go-to-market strategies and resource strategies. Vendor performance is put in the context of market opportunity and competitive environment and our assessment shows where a vendor will success and its future market position.

- AT&T

- Cisco Systems

- T-Mobile USA

- Verizon

- Ericsson

- Nokia

Ready to Level Up Your Insights?

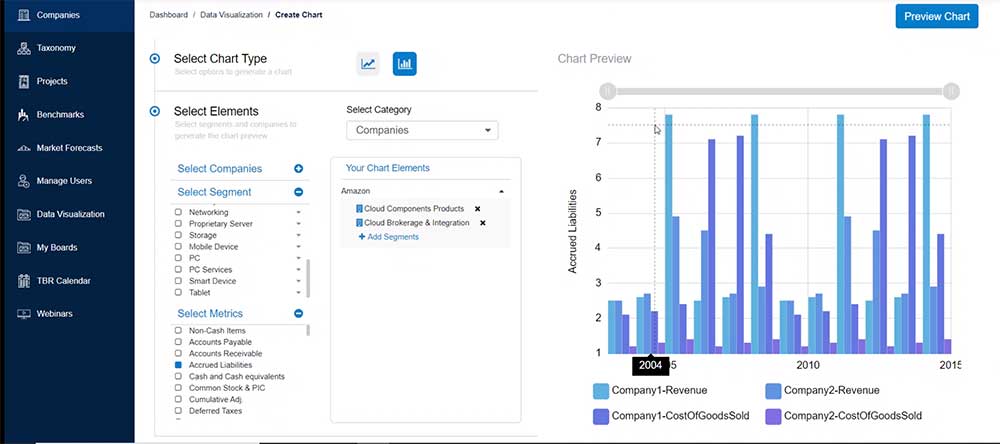

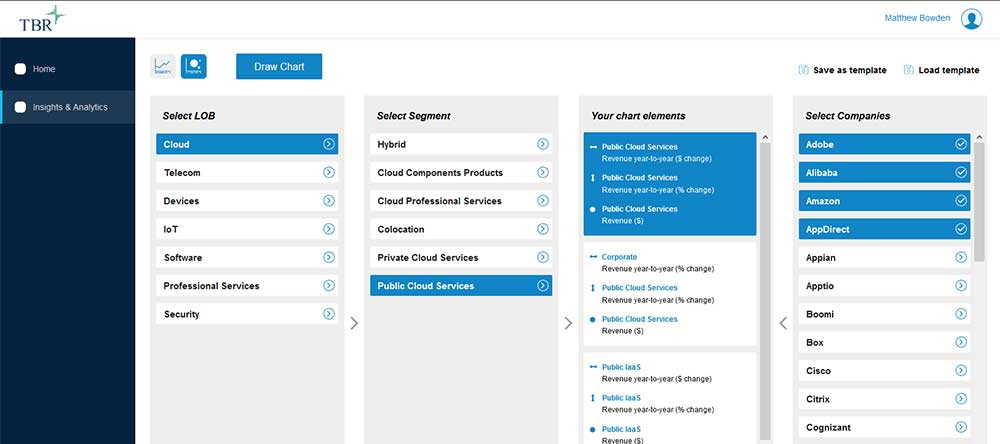

TBR’s digital-first competitive intelligence platform, TBR Insight Center™, allows for configured & customized views into IT markets, vendors, alliances and ecosystems.

Benefits delivered through TBR Insight Center™ include:

- Dynamic, configurable platform for TBR’s objective, independent and validated data and analysis

- Customizable views of millions of data points to match your specific needs

- Simple download functionality for customized views of analysis and feeds of data, saving staff dozens of hours per month

- Updates for market disruptions and emerging trends

Already a TBR Classic client but don’t have access to TBR Insight Center yet? Request access today.

Cloud Market Share in 2025: GenAI Spurs Growth but Does Not Promise Vendors Long-term Gains

/by Allan Krans, Practice Manager and Principal AnalystThe revenue generated from generative AI (GenAI) offset some of the impact of cost-saving and expense-reduction efforts that defined the IT and cloud market in 2024. We expect some of that luster to fade in 2025, however, as the lack of a clear ROI from GenAI solutions will be a sticking point that slows investment in the coming year.

6G’s Fate Depends on the Level of Government Intervention

/by Chris Antlitz, Principal Analyst6G will ultimately happen, and commercial deployment of 6G-branded networks will likely begin in the late 2020s (following the ratification of 3rd Generation Partnership Project [3GPP] Release 21 standards, which is tentatively slated to be complete in 2028). However, it remains to be seen whether 6G will be a brand only or a legitimate set of truly differentiated features and capabilities that bring broad and significant value to CSPs and the global economy.

Federal IT Spending Will Remain Robust in FFY25 Amid AI Prioritization

/by John Caucis, Senior AnalystSince coming into office, the Biden administration has fueled an unprecedented federal IT bull market. While the White House’s proposed federal civilian technology budget of $75.1 billion for federal fiscal year 2025 (FFY25) is the smallest increase in several years (up less than 1% compared to $74.5 billion in FFY24), it is still an increase of more than 14% from $65.8 billion in FFY23, and up 25% from $60.1 billion in FFY21, the last year of the prior administration. FFY25 has started with a continuing resolution (CR), as have most of the last several fiscal year. The impact of the latest CR on the largest federal systems integrators may be limited to shorter-cycle programs in their order books, but some disruptions to larger, longer-term engagements are not out of the question.