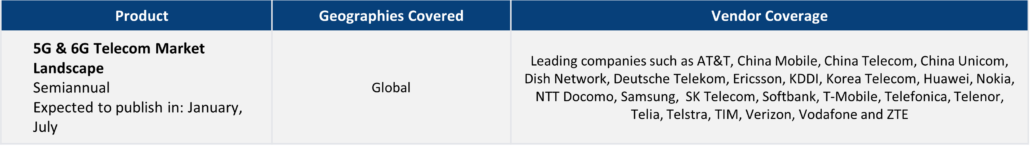

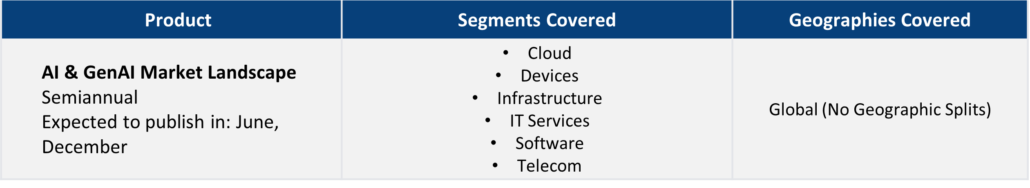

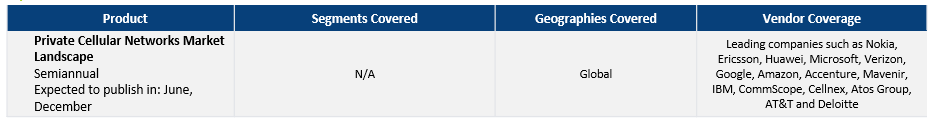

With TBR’s Telecom market and competitive intelligence research, examine telecom operator and telecom vendor markets as well as key industrywide trends and developments, such as 5G, edge computing, private networks, and the encroachment of hyperscalers into the telecom industry.

Understand operator business models, capital expenditure, subscriber metrics and next-generation technology adoption, with coverage spanning wireless, wireline, cable and enterprise markets. Access vendor customer demand analysis, portfolio analysis and competitive benchmarking.

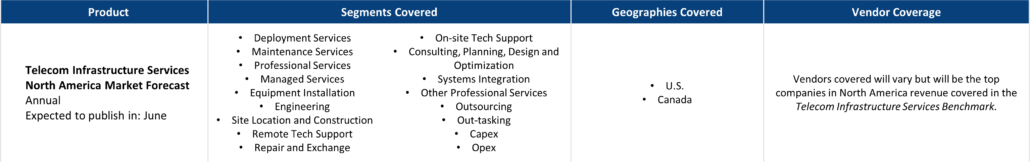

Additionally, we are the leading resource for telecom infrastructure services (TIS) market research.

A free trial of TBR’s Insights Center platform gives you access to our entire Telecom research portfolio and the ability to customize and curate reports detailing our analysis based on your company’s specific needs. Start your free trial today!

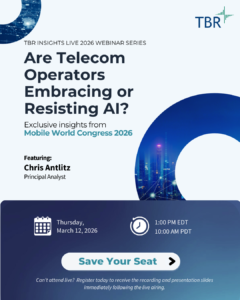

Trends we’re watching in 2026:

- Impact of K-shaped economy on telecom market

- Why a price war is coming to the broadband market

- How telcos will adjust to meet AI’s timetable

- Ways in which the network needs to adjust for the AI economy

Explore TBR Telecom Coverage

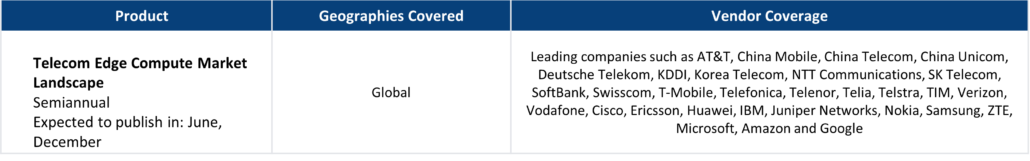

Market and competitor benchmarks provide a comparison of vendor performance in a market, including analysis on vendor strategies, financial performance, go-to-market and resource management. The research graphically portrays comparisons of vendors by myriad metrics, calling out leaders, laggards and business models. Defensible, data-informed views of market opportunity and operational best practices are highlighted in each publication. TBR also provides benchmark data in Excel pivot tables.

Current Market & Competitor Benchmarks:

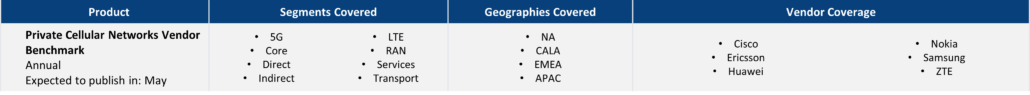

- Private Cellular Networks Vendor Benchmark

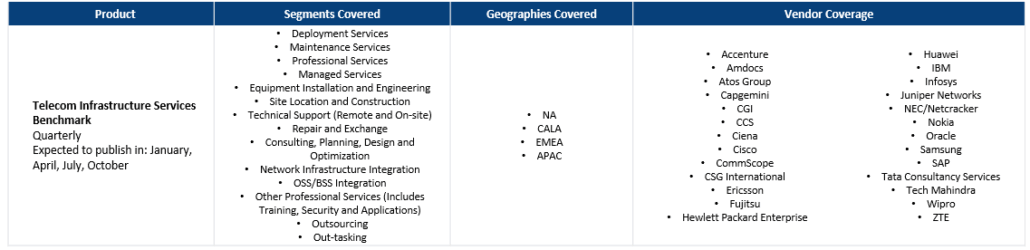

- Telecom Infrastructure Services Benchmark

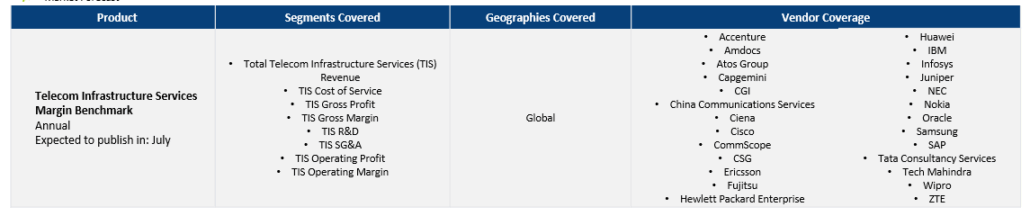

- Telecom Infrastructure Services Margin Benchmark

- U.S. Mobile Operator Benchmark

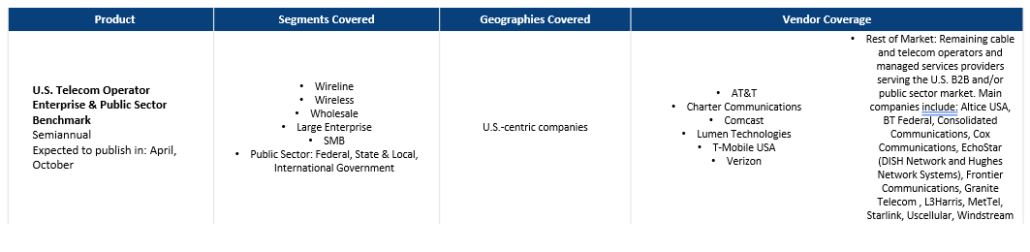

- U.S. Telecom Operator Enterprise & Public Sector Benchmark

TBR’s vendor reports, snapshots and profiles provide deep-dive analysis of a single vendor across corporate strategies, tactics, SWOT analysis, financials, go-to-market strategies and resource strategies. Vendor performance is put in the context of market opportunity and competitive environment and our assessment shows where a vendor will success and its future market position.

- AT&T

- Cisco Systems

- T-Mobile USA

- Verizon

- Ericsson

- Nokia

Ready to Level Up Your Insights?

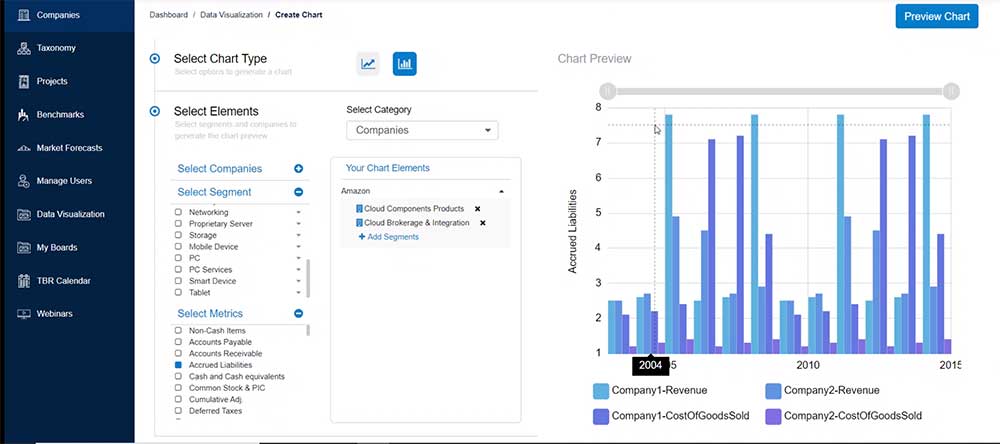

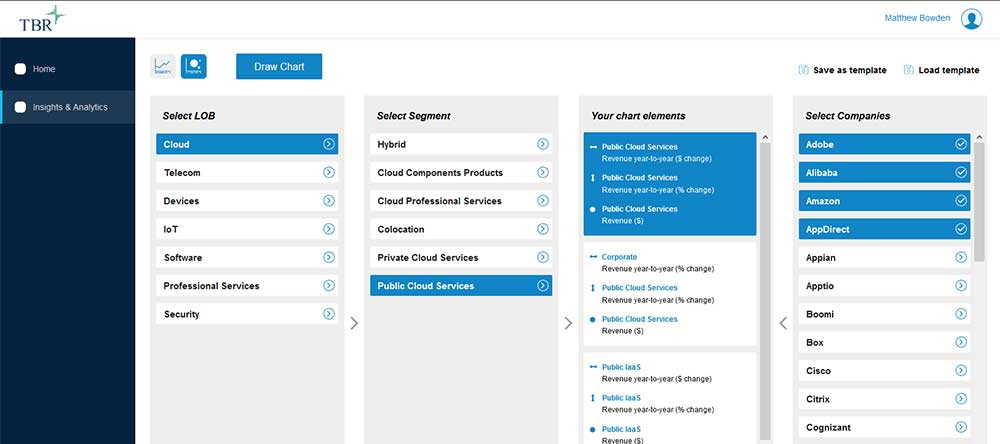

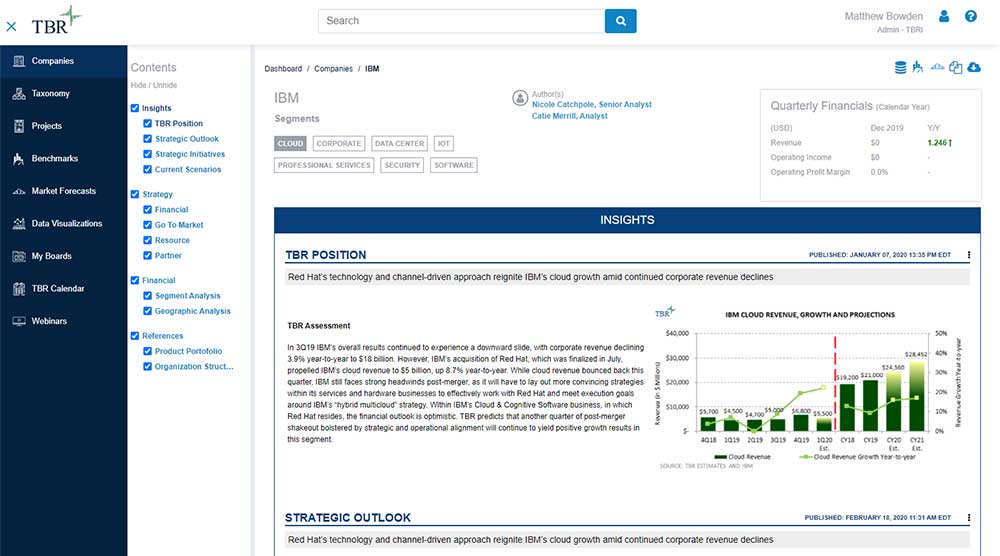

TBR’s digital-first competitive intelligence platform, TBR Insight Center™, allows for configured & customized views into IT markets, vendors, alliances and ecosystems.

Benefits delivered through TBR Insight Center™ include:

- Dynamic, configurable platform for TBR’s objective, independent and validated data and analysis

- Customizable views of millions of data points to match your specific needs

- Simple download functionality for customized views of analysis and feeds of data, saving staff dozens of hours per month

- Updates for market disruptions and emerging trends

Already a TBR Classic client but don’t have access to TBR Insight Center yet? Request access today.

Here Comes KPMG: Client Trust, Alliance Focus and Tech-enabled Strategy Emphasized at 2025 Global Analyst Summit

/by Patrick Heffernan, Practice Manager and Principal AnalystOne could argue that many of KPMG’s steps, including launching partner-enabled industry IP, reinforcing trust, developing regionally organized operations, outlining a select few strategic partners, and investing in platform-enabled service delivery capabilities, resonate with the moves taken by many of its Big Four and large IT services peers. We see two differences: KPMG is laser-focused on exactly which of the strategies above to amplify, rather than taking a trial-and-error approach, and KPMG has an opportunity to ride the wave of a once-in-a-century professional services market transformation.

Comcast Business Nears $10B in Annual Revenue and Accelerates Enterprise Growth but Faces Headwinds from Competitive and Macroeconomic Pressures

/by Steve Vachon, Senior Analyst2025 Comcast Business Analyst Conference, Philadelphia, April 2-3, 2025 — A select group of industry analysts gathered at the Comcast Center in Philadelphia to hear from Comcast Business leaders about the unit’s progress and success with its sales and go-to-market strategies. The central theme of the event was “Everything, Everywhere, All at Once,” which reflects […]

Sheer Scale of GTC 2025 Reaffirms NVIDIA’s Position at the Epicenter of the AI Revolution

/by Ben Carbonneau, Senior Data AnalystTo support the burgeoning demands of AI, NVIDIA is staying true to the playbook through which it has already derived so much success — investing in platform innovation and the support of its growing partner ecosystem to drive the adoption of AI technology across all industries.