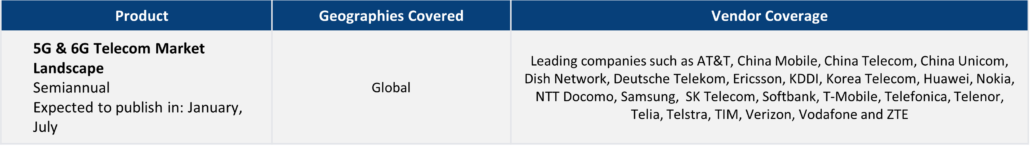

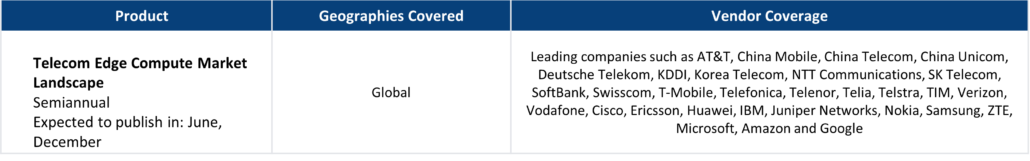

With TBR’s Telecom market and competitive intelligence research, examine telecom operator and telecom vendor markets as well as key industrywide trends and developments, such as 5G, edge computing, private networks, and the encroachment of hyperscalers into the telecom industry.

Understand operator business models, capital expenditure, subscriber metrics and next-generation technology adoption, with coverage spanning wireless, wireline, cable and enterprise markets. Access vendor customer demand analysis, portfolio analysis and competitive benchmarking.

Additionally, we are the leading resource for telecom infrastructure services (TIS) market research.

A free trial of TBR’s Insights Center platform gives you access to our entire Telecom research portfolio and the ability to customize and curate reports detailing our analysis based on your company’s specific needs. Start your free trial today!

Trends we’re watching in 2025:

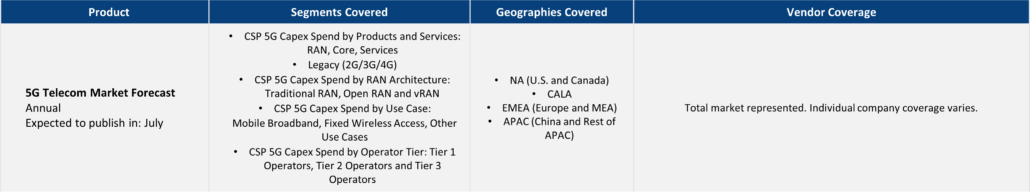

- Evolution of cellular networks to 5G SA (stand-alone) and 5G-Advanced and how communication service providers (CSPs) will adopt these technologies

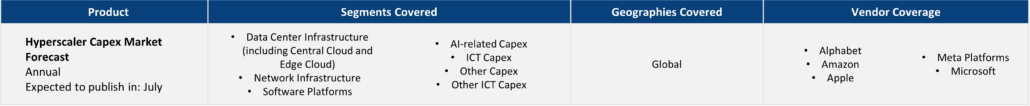

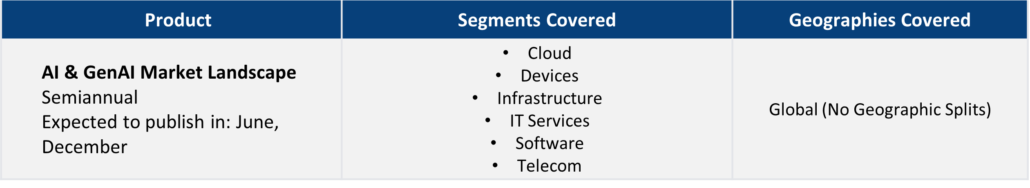

- Evolution of the AI market from the training phase to the inferencing phase and what this means for edge computing and the telecom industry

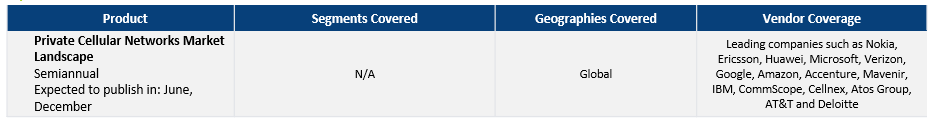

- How the market for private 5G networks is developing and when to expect greater scale in this market

- How the new political landscape in the U.S. and parts of Europe will impact the telecom industry

- Which GenAI use cases CSPs will prioritize to commercially deploy, and why

- How the telecom landscape will change from a new round of consolidation

Explore TBR Telecom Coverage

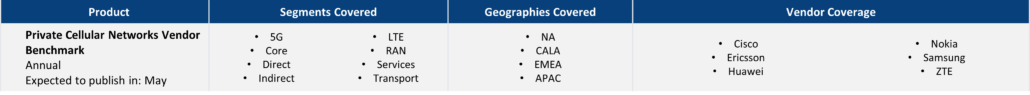

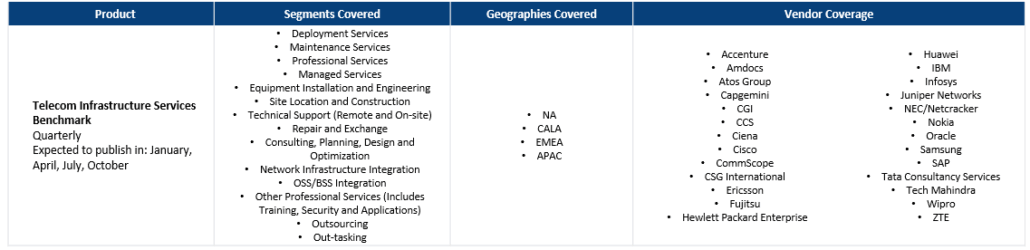

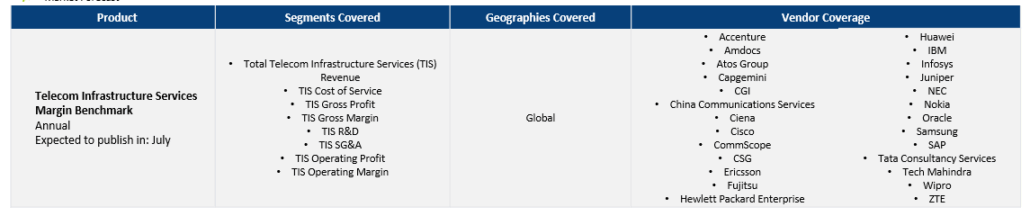

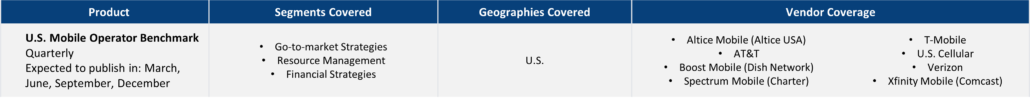

Market and competitor benchmarks provide a comparison of vendor performance in a market, including analysis on vendor strategies, financial performance, go-to-market and resource management. The research graphically portrays comparisons of vendors by myriad metrics, calling out leaders, laggards and business models. Defensible, data-informed views of market opportunity and operational best practices are highlighted in each publication. TBR also provides benchmark data in Excel pivot tables.

Current Market & Competitor Benchmarks:

- Private Cellular Networks Vendor Benchmark

- Telecom Infrastructure Services Benchmark

- Telecom Infrastructure Services Margin Benchmark

- U.S. Mobile Operator Benchmark

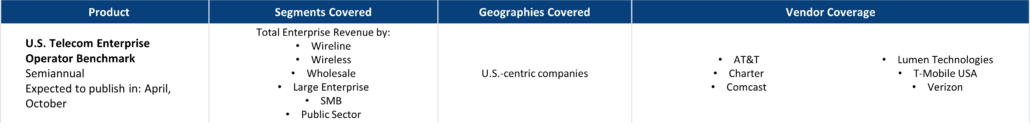

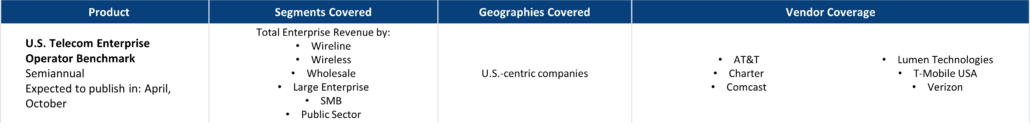

- U.S. Telecom Enterprise Operator Benchmark

- U.S. Telecom Operator Public Sector Benchmark

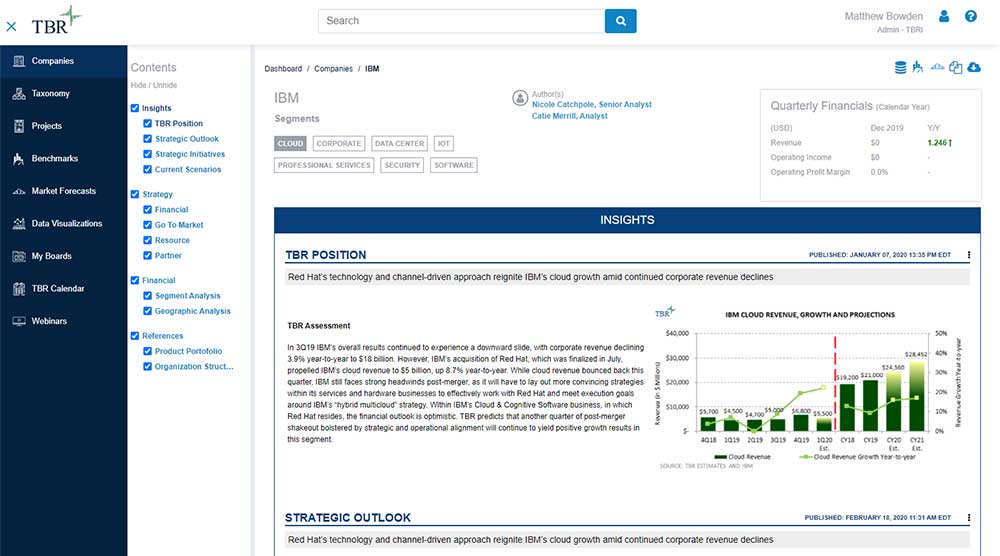

TBR’s vendor reports, snapshots and profiles provide deep-dive analysis of a single vendor across corporate strategies, tactics, SWOT analysis, financials, go-to-market strategies and resource strategies. Vendor performance is put in the context of market opportunity and competitive environment and our assessment shows where a vendor will success and its future market position.

- AT&T

- Comcast

- Cisco Systems

- T-Mobile USA

- Verizon

- Ericsson

- Huawei

- Nokia

Ready to Level Up Your Insights?

TBR’s digital-first competitive intelligence platform, TBR Insight Center™, allows for configured & customized views into IT markets, vendors, alliances and ecosystems.

Benefits delivered through TBR Insight Center™ include:

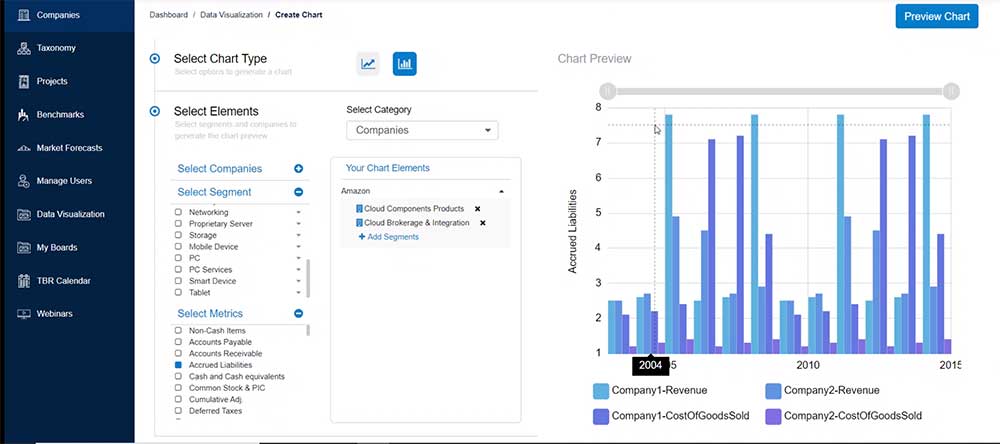

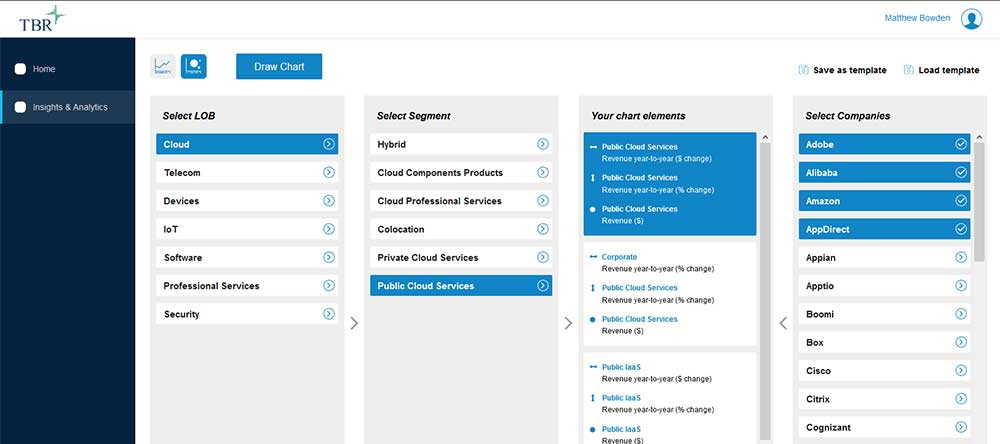

- Dynamic, configurable platform for TBR’s objective, independent and validated data and analysis

- Customizable views of millions of data points to match your specific needs

- Simple download functionality for customized views of analysis and feeds of data, saving staff dozens of hours per month

- Updates for market disruptions and emerging trends

Already a TBR Classic client but don’t have access to TBR Insight Center yet? Request access today.

Shutdown Ends, but Federal Contractors Face a Slow Return to Normal

/by John Caucis, Senior AnalystThe 43-day U.S. federal government shutdown, the longest in history, came to a welcome end on Nov. 13, 2025, but for some federal systems integrators (FSIs), the shutdown’s impact could linger well into federal fiscal year 2026 (FFY26). According to the Professional Services Council, the national trade association for federal technology and professional services contractors, it will take three to five days for agency functions to return to normal for each day of the shutdown, implying that operations at some agencies may not return to normal until March 2026.

Agentic AI Becomes a Federal Priority, Reshaping the IT Services Value Chain for 2026

/by TBRTBR anticipates AI-led modernization will take center stage in the federal IT market in FFY26, after the disruption from DOGE and the 43-day federal shutdown that began the fiscal year subsides. Federal agencies are increasingly embracing AI technologies to automate IT management and ensure mission success. Health and human services agencies will leverage AI to enhance benefits processing, while agencies in the Department of Defense (DOD) will use AI to streamline and secure defense supply chains and enhance battlefield operations.

HCLTech Heads into 2026 with AI Advantages

/by Jill CookinhamAligning alliance, acquisition and industry strategies around AI and then executing on that alignment should be one of HCLTech’s strengths. Taking full advantage of the breadth and depth of HCLTech’s AI Foundry should be another. HCLTech’s efforts in these areas have positioned it well in a wildly fluctuating market. TBR has written extensively about challenges in the AI space, particularly for IT services companies and consultancies. Based on TBR’s research, 2026 should be a pivotal year for HCLTech.