With TBR’s Telecom market and competitive intelligence research, examine telecom operator and telecom vendor markets as well as key industrywide trends and developments, such as 5G, edge computing, private networks, and the encroachment of hyperscalers into the telecom industry.

Understand operator business models, capital expenditure, subscriber metrics and next-generation technology adoption, with coverage spanning wireless, wireline, cable and enterprise markets. Access vendor customer demand analysis, portfolio analysis and competitive benchmarking.

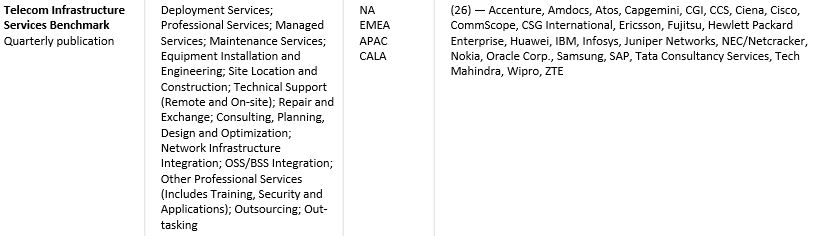

Additionally, we are the leading resource for telecom infrastructure services (TIS) market research.

A free trial of TBR’s Insights Center platform gives you access to our entire Telecom research portfolio and the ability to customize and curate reports detailing our analysis based on your company’s specific needs. Start your free trial today!

Trends we’re watching in 2024:

- New round of M&A and bolder combinations are likely to be allowed by regulators.

- Cash flow management becomes priority due to increase in cost of capital and other headwinds.

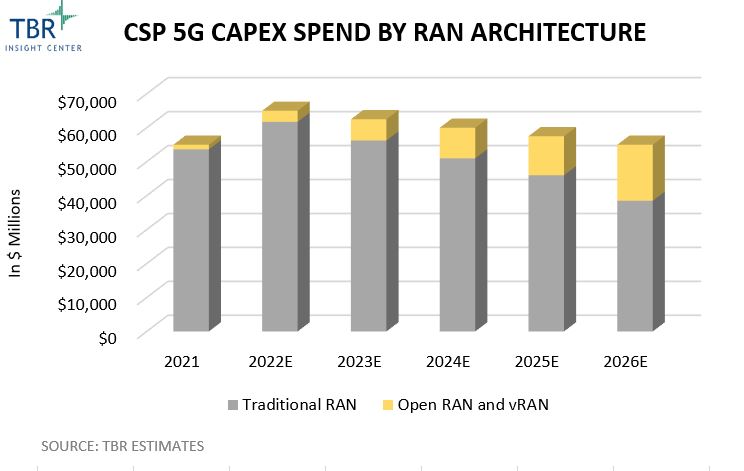

- Open RAN will not be ready for mainstream adoption in 2024.

Benchmark

TBR’s Telecom benchmark research provides clients a comparison of vendor performance in a market, including analysis on vendor strategies, financial performance, go-to-market and resource management. The research graphically portrays comparisons of vendors by myriad metrics, calling out leaders, laggards and business models.

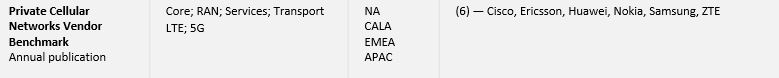

Private Cellular Networks Vendor Benchmark

Telecom Infrastructure Services Benchmark

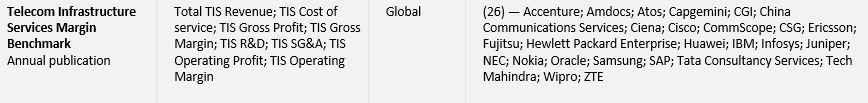

Telecom Infrastructure Services Margin Benchmark

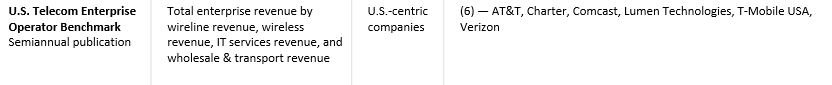

U.S. Telecom Enterprise Operator Benchmark

U.S. Telecom Operator Public Sector Benchmark

U.S. Mobile Operator Benchmark![]()

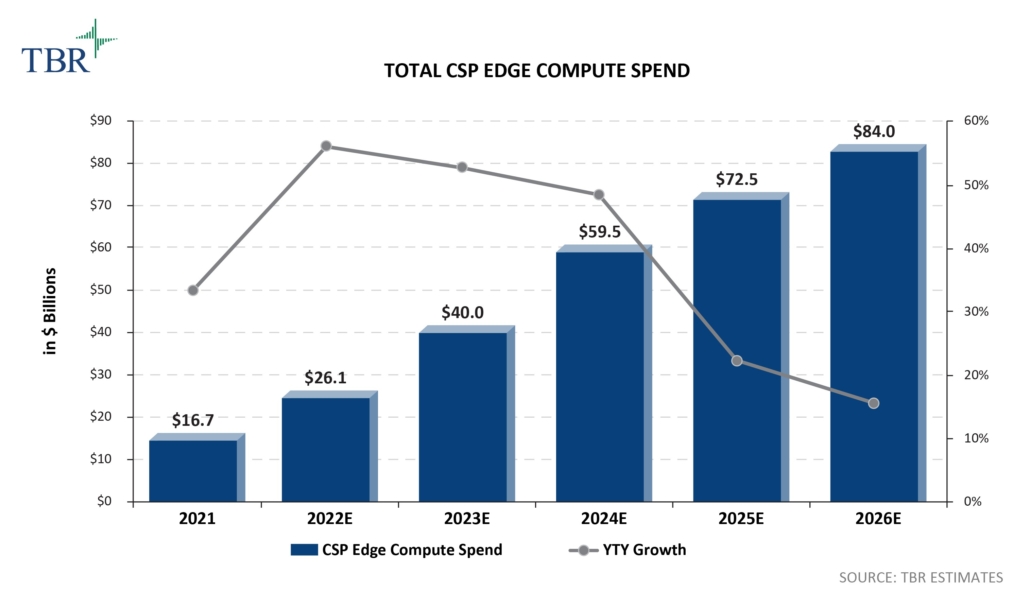

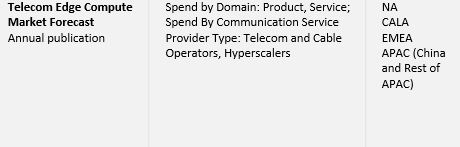

TBR expects continued supply-side and geopolitical disruption in the post-pandemic global economy, but these market challenges will push out rather than reduce total CSP edge compute spend. Digital transformation remains a secular trend that will only be accelerated by ongoing economic and geopolitical gyrations, and edge computing is a key enabling technology for realizing outcomes such as Industry 4.0.

Market Forecast

TBR’s Telecom market forecast research provide analysis of market opportunity as well as current market sizing and five-year forecasts, including analysis on growth drivers, top trends and leading market players.

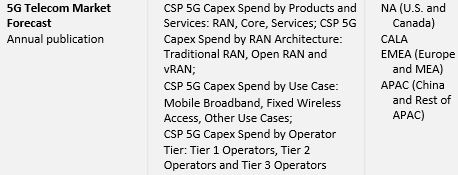

5G Telecom Market Forecast

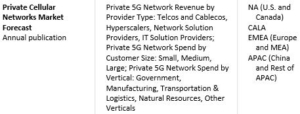

Private Cellular Networks Market Forecast

Telecom Edge Compute Market Forecast

Telecom Infrastructure Services Global Market Forecast

Telecom Infrastructure Services North America Market Forecast

Hyperscaler Capex Market Forecast

Market landscape

Telecom market landscape research includes analysis of an emerging or disruptive market segment or technology, including insight into how vendors and customers address the emerging technology as well as market sizing, vendor positioning, strategies, acquisitions, alliances and customer adoption trends.

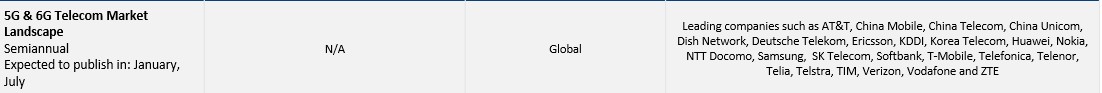

5G & 6G Telecom Market Landscape

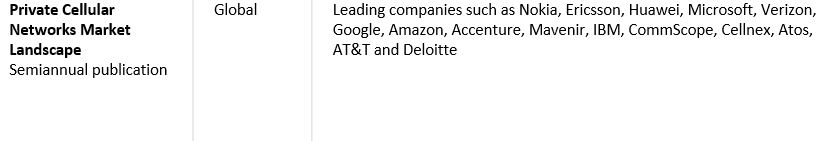

Private Cellular Networks Market Landscape

Telecom Edge Compute Market Landscape

Hyperscaler Digital Ecosystem Market Landscape

Telecom AI Market Landscape

Join TBR’s Telecom principal analyst for an exclusive review of TBR’s 2024 Telecom Predictions special report, Telecom Industry Retrenches in Response to Macroeconomic Pressures.

In this FREE session you’ll learn:

- How companies in the telecom industry are responding to macroeconomic and industry-specific challenges

- Why and how CSPs are prioritizing cash flow management

- Why open RAN will not be ready for mainstream adoption in 2024

Vendor Analysis

TBR’s Telecom vendor reports, profiles and snapshots provide deep-dive analysis into a single vendor across corporate strategies, tactics, SWOT analysis, financials, go-to-market strategies and resource strategies.

Ericsson’s earnings were buoyed by the favorable resolution of its patent dispute with Apple and accelerated rollout of 5G RAN in India, but market headwinds such as inflation and slowing 5G rollouts in the U.S. will continue to place downward pressure on financial metrics throughout 2023.

Alphabet (Google)

Alphabet Telecom Vendor Snapshot

Altice Vendor Snapshot

Amazon Telecom Vendor Snapshot

Amdocs Vendor Snapshot

Apple Telecom Vendor Snapshot

AT&T

AT&T Global Public Sector Vendor Profile

BCE Vendor Profile

Charter Communications Vendor Profile

China Communications Services Vendor Snapshot

Ciena Vendor Profile

Cisco Systems

Comcast

CommScope Vendor Snapshot

CSG International Vendor Snapshot

DISH Network Vendor Profile

Ericsson

Huawei

Juniper Networks Vendor Snapshot

Meta Platforms Telecom Vendor Snapshot

Microsoft Telecom Vendor Snapshot

Nokia

Rakuten Telecom Vendor Snapshot

Rogers Vendor Profile

Samsung Vendor Profile

T-Mobile USA

UScellular Vendor Profile

Verizon

Verizon Public Sector Vendor Profile

ZTE Vendor Profile

The Telecom Industry Faces a Reckoning: Overarching Takeaways from Mobile World Congress 2024

One of the most interesting takeaways TBR analysts observed from MWC24 was how little 5G, 5G-Advanced and 6G were discussed. While AI/GenAI, network APIs and private networks dominated mindshare at the event, as was widely expected, the lack of content about cellular technology market development was striking and underscores the challenges the telecom industry continues to face with revenue growth and ROI. This lack of discussion also underscores how CSPs are loathe to make further investments in 5G, especially 5G-Advanced, pending measurable ROI, and that vendors see this and are concerned 5G-Advanced will not generate significant revenue.

Preparing for the Future: Navigating the Transition to 6G Networks

The telecom industry is on the cusp of the 6G era, with the first set of specifications expected to be established in 2028 and initial commercial deployments projected by 2030. Governments and industry players are actively preparing for this transition, with initiatives ranging from spectrum identification to use case exploration. While there is cautious optimism about the potential of 6G, there are also concerns about the high investment costs and limited monetization opportunities that characterized the 5G era. However, with advancements in AI/ML capabilities, energy efficiency and the promise of transformative use cases, 6G is expected to offer significant benefits, including cost efficiencies and improved network performance.