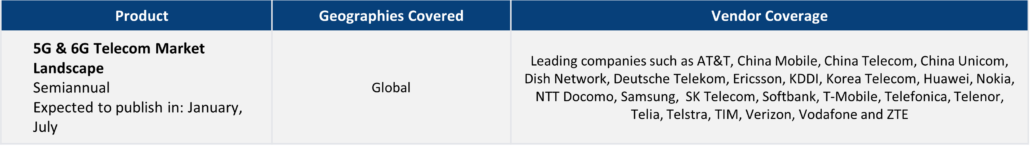

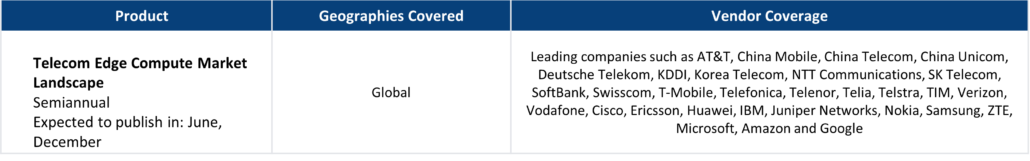

With TBR’s Telecom market and competitive intelligence research, examine telecom operator and telecom vendor markets as well as key industrywide trends and developments, such as 5G, edge computing, private networks, and the encroachment of hyperscalers into the telecom industry.

Understand operator business models, capital expenditure, subscriber metrics and next-generation technology adoption, with coverage spanning wireless, wireline, cable and enterprise markets. Access vendor customer demand analysis, portfolio analysis and competitive benchmarking.

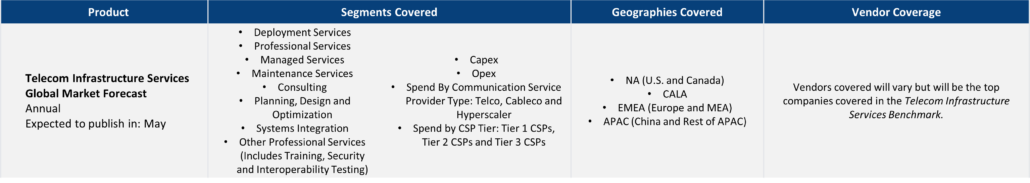

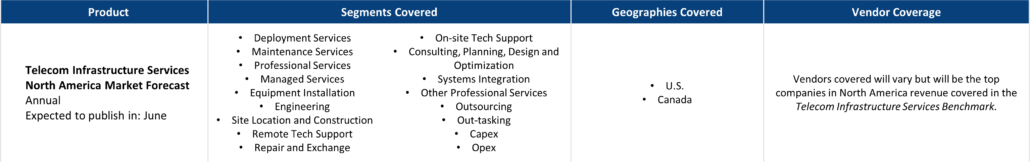

Additionally, we are the leading resource for telecom infrastructure services (TIS) market research.

A free trial of TBR’s Insights Center platform gives you access to our entire Telecom research portfolio and the ability to customize and curate reports detailing our analysis based on your company’s specific needs. Start your free trial today!

Trends we’re watching in 2026:

- Impact of K-shaped economy on telecom market

- Why a price war is coming to the broadband market

- How telcos will adjust to meet AI’s timetable

- Ways in which the network needs to adjust for the AI economy

Explore TBR Telecom Coverage

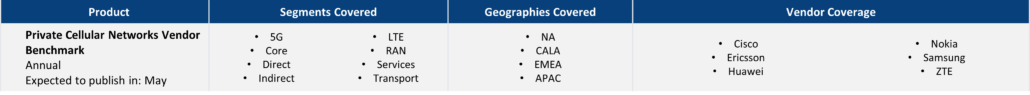

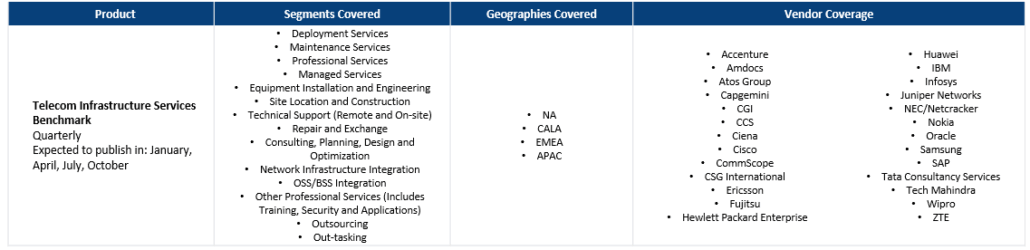

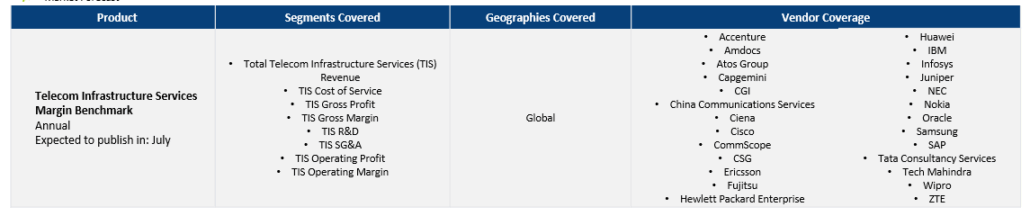

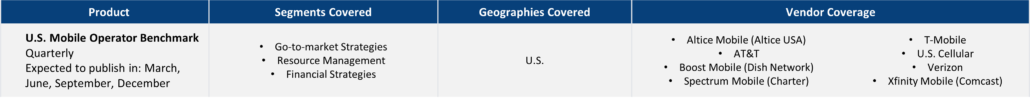

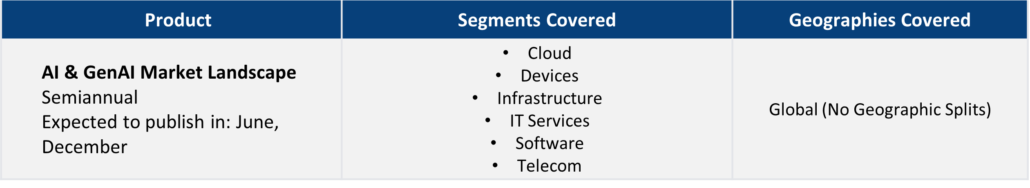

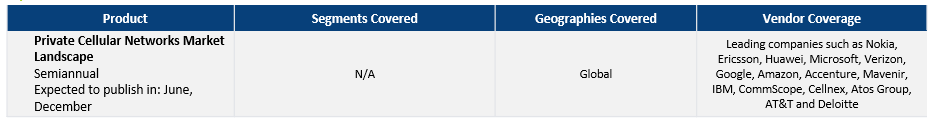

Market and competitor benchmarks provide a comparison of vendor performance in a market, including analysis on vendor strategies, financial performance, go-to-market and resource management. The research graphically portrays comparisons of vendors by myriad metrics, calling out leaders, laggards and business models. Defensible, data-informed views of market opportunity and operational best practices are highlighted in each publication. TBR also provides benchmark data in Excel pivot tables.

Current Market & Competitor Benchmarks:

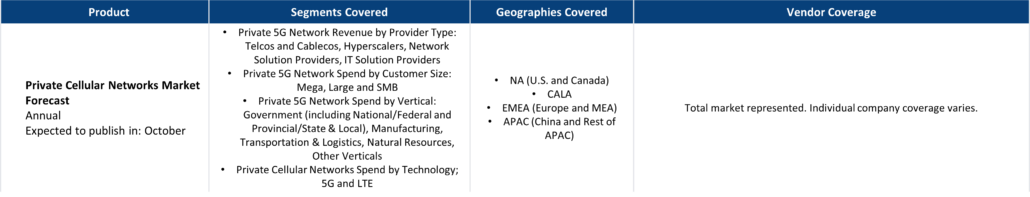

- Private Cellular Networks Vendor Benchmark

- Telecom Infrastructure Services Benchmark

- Telecom Infrastructure Services Margin Benchmark

- U.S. Mobile Operator Benchmark

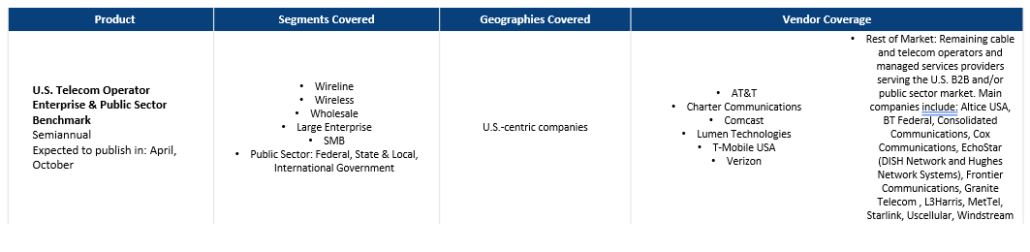

- U.S. Telecom Operator Enterprise & Public Sector Benchmark

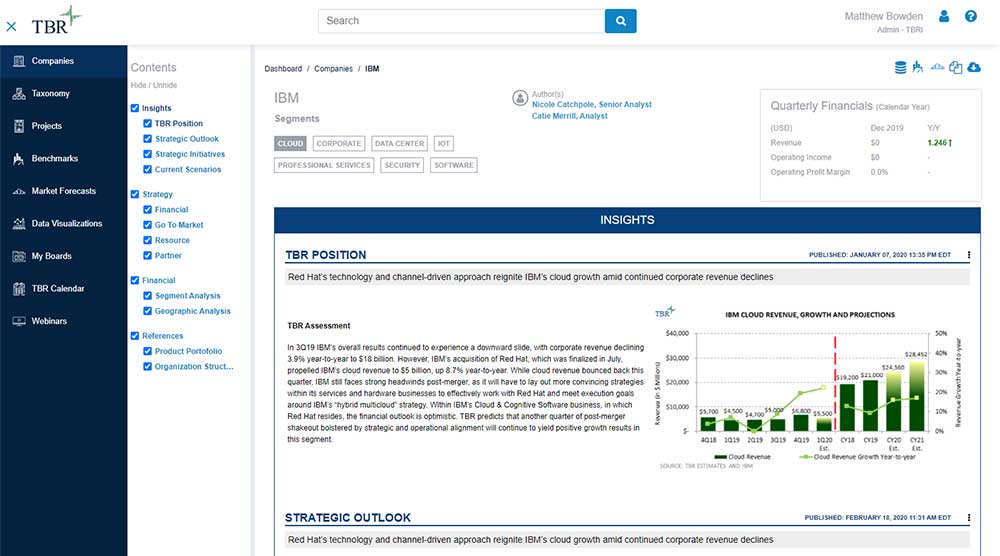

TBR’s vendor reports, snapshots and profiles provide deep-dive analysis of a single vendor across corporate strategies, tactics, SWOT analysis, financials, go-to-market strategies and resource strategies. Vendor performance is put in the context of market opportunity and competitive environment and our assessment shows where a vendor will success and its future market position.

- AT&T

- Cisco Systems

- T-Mobile USA

- Verizon

- Ericsson

- Nokia

Ready to Level Up Your Insights?

TBR’s digital-first competitive intelligence platform, TBR Insight Center™, allows for configured & customized views into IT markets, vendors, alliances and ecosystems.

Benefits delivered through TBR Insight Center™ include:

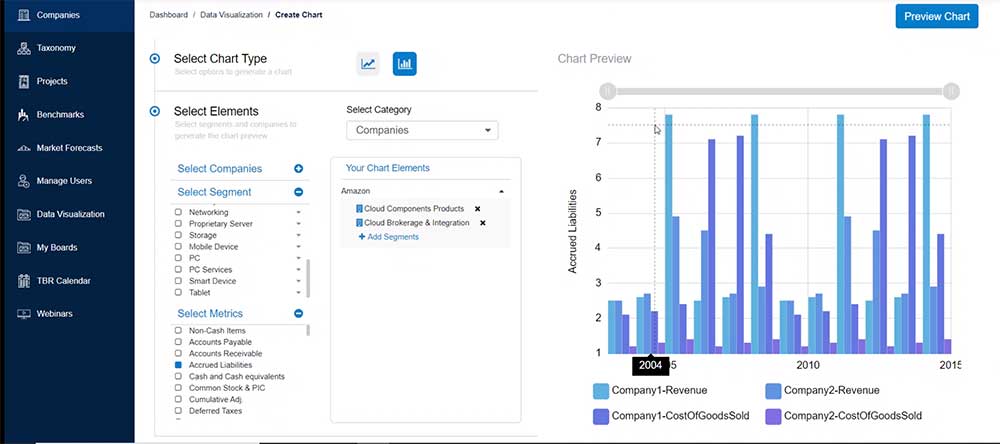

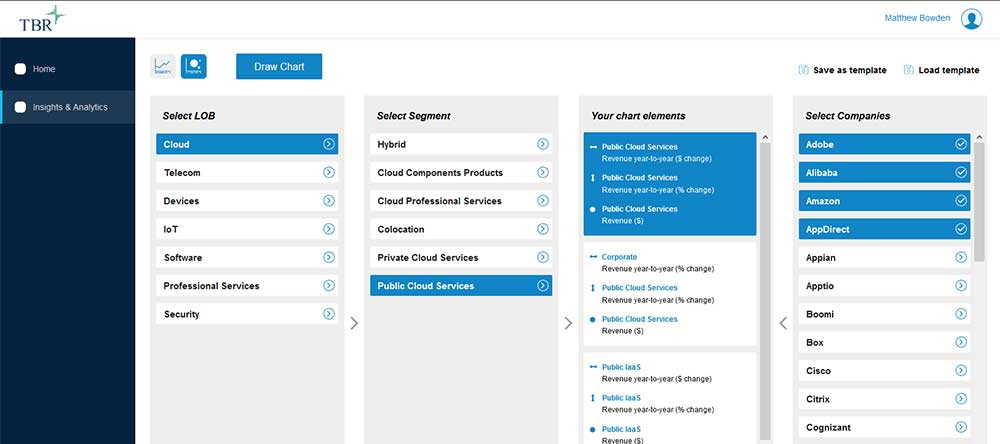

- Dynamic, configurable platform for TBR’s objective, independent and validated data and analysis

- Customizable views of millions of data points to match your specific needs

- Simple download functionality for customized views of analysis and feeds of data, saving staff dozens of hours per month

- Updates for market disruptions and emerging trends

Already a TBR Classic client but don’t have access to TBR Insight Center yet? Request access today.

Skills Shortage Will Challenge the Scaling of Sovereign AI in 2026

/by Allan Krans, Practice Manager and Principal AnalystAI-related skills will remain scarce across both buyers and ecosystem partners as the rapid pace of innovation and the technical complexity required to enable sovereign AI continue to hinder adoption. These challenges, combined with a lack of clearly defined and compliant use cases among sovereign customers, gaps in sovereign cloud infrastructure availability and steep AI learning curve faced by ecosystem partners, will constrain meaningful investment and implementation of sovereign AI throughout 2026.

PaaS Revenue Will Outpace SaaS Revenue for Cloud Software Vendors

/by Alex Demeule, Senior AnalystEnterprise customers are prioritizing the modernization of their existing SaaS estates rather than adding new applications, driven by market saturation, accumulated technical debt, and a growing imperative to become AI-ready. As IT buyers shift their focus toward modern platforms, traditional SaaS leaders should expect their PaaS segments to continue significantly outperforming their core SaaS businesses in revenue growth.

Supply Chain Threatens the Rise of AI PC in 2026

/by Angela Lambert, Principal Analyst and Practice ManagerAI PC Ambitions Face an Unforgiving Reality of Memory Constraints and Budget Pressure For the PC industry, 2025 was the year that the end of Windows 10 support would drive a massive PC refresh cycle. As part of this refresh, AI PCs, devices with neural processing units (NPUs) designed to execute AI and machine learning […]