With TBR’s Digital Transformation market and competitive intelligence research, gain insight into how technology and services firms are investing, going to market, partnering and more as they help enterprises transition to digital solutions.

Learn how IT and business buyers approach digital applications, platforms and services within the context of disruptive market trends and emerging opportunities. Additionally, examine and dissect IT vendors’ ecosystem management as well as investments, performance and go-to-market strategies in both mature and emerging areas, including blockchain, Industrial IoT, analytics, customer experience and innovation centers, and cloud.

A free trial of TBR’s Insights Center platform gives you access to our entire Digital Transformation research portfolio and the ability to customize and curate reports detailing our analysis based on your company’s specific needs. Start your free trial today!

Trends we’re watching in 2026:

- Customer experience becomes the battleground of AI for growth

- Data as the new (old) currency

- How vendor portfolio offerings evolve to avoid the GIGO (garbage-in-garbage-out) effect when on clients’ site

- Discretionary spend takes a new shape as IT buyers continue to shoulder more risk than the business, presenting an opportunity for vendors to deliver on service-level outcomes enabled by agents

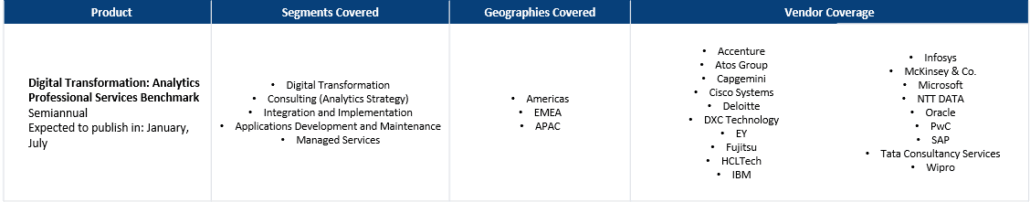

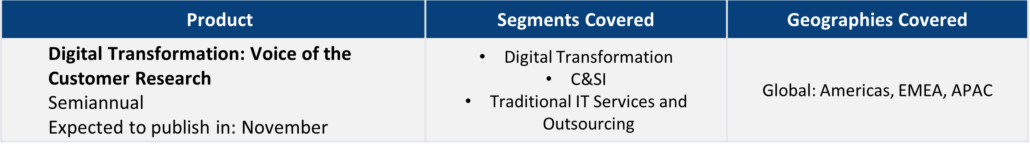

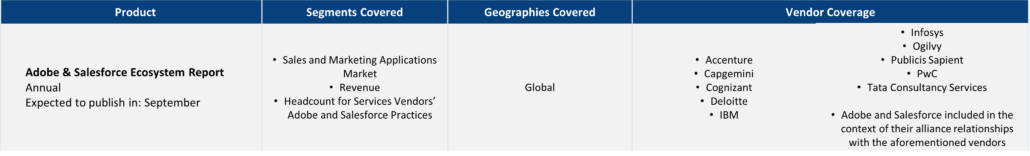

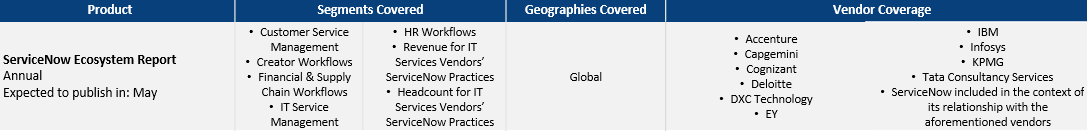

Explore TBR Digital Transformation Coverage

Ready to Level Up Your Insights?

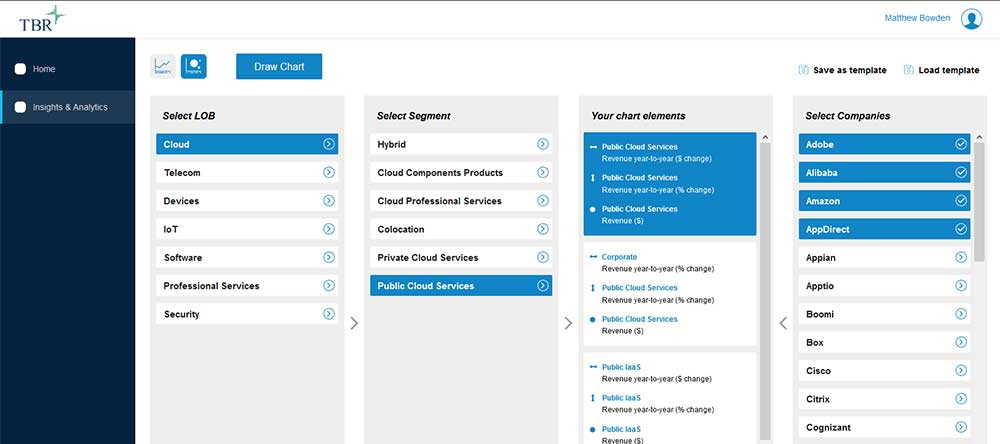

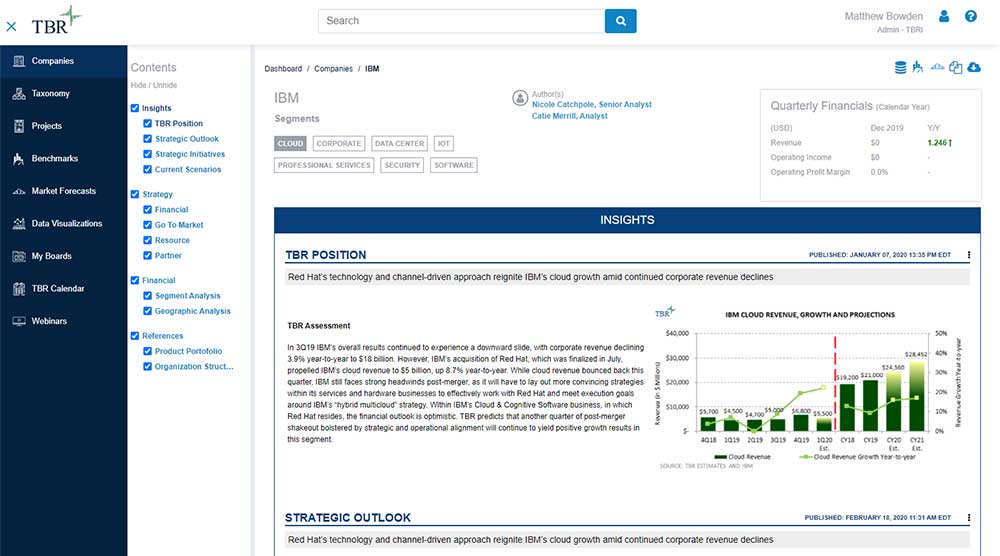

TBR’s digital-first competitive intelligence platform, TBR Insight Center™, allows for configured & customized views into IT markets, vendors, alliances and ecosystems.

Benefits delivered through TBR Insight Center™ include:

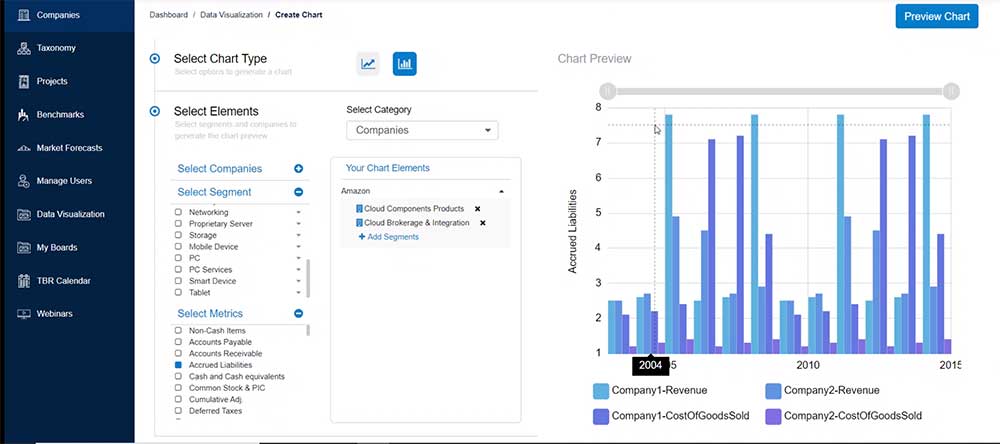

- Dynamic, configurable platform for TBR’s objective, independent and validated data and analysis

- Customizable views of millions of data points to match your specific needs

- Simple download functionality for customized views of analysis and feeds of data, saving staff dozens of hours per month

- Updates for market disruptions and emerging trends

Already a TBR Classic client but don’t have access to TBR Insight Center yet? Request access today.

India-centric IT Vendors Leverage Partnerships for Technology Expansion and Market Reach

/by Kelly Lesiczka, Senior AnalystThe India-centric vendors leverage partnerships to expand their technology capabilities and scale while also bringing in industry knowledge to strengthen the value of their portfolios. Although these partnerships do not vary significantly from those of other IT services vendors, the India-centric vendors each bring different benefits, such as price competitiveness and low cost of scale, that can enhance other vendors’ go-to-market strategies and ability to reach underpenetrated markets while also bringing in portfolio expertise. Understanding how similar companies bring different capabilities and strengths to their technology alliance partners highlights opportunities for other ecosystem players, such as smaller software companies, OEMs and niche consultancies, that are looking to expand with the India-centric vendors.

Informatica’s Alliance Strategy: Powering GSIs, Scaling AI and Strengthening the Data Ecosystem

/by Patrick Heffernan, Practice Manager and Principal AnalystAn increasing amount of research and analysis time at TBR is focused on ecosystem intelligence, which applies a set of questions and frameworks to extend traditional market intelligence and competitive intelligence approaches in an effort to better understand a market. Recently, TBR analysts spoke with Informatica’s Richard Ganley, Senior Vice President, Global Partners, and his insights into the actions the company is taking to enhance its alliance relationships with nine key partners stood out to the team.