With TBR’s Digital Transformation market and competitive intelligence research, gain insight into how technology and services firms are investing, going to market, partnering and more as they help enterprises transition to digital solutions.

Learn how IT and business buyers approach digital applications, platforms and services within the context of disruptive market trends and emerging opportunities. Additionally, examine and dissect IT vendors’ ecosystem management as well as investments, performance and go-to-market strategies in both mature and emerging areas, including blockchain, Industrial IoT, analytics, customer experience and innovation centers, and cloud.

A free trial of TBR’s Insights Center platform gives you access to our entire Digital Transformation research portfolio and the ability to customize and curate reports detailing our analysis based on your company’s specific needs. Start your free trial today!

Trends we’re watching in 2026:

- Customer experience becomes the battleground of AI for growth

- Data as the new (old) currency

- How vendor portfolio offerings evolve to avoid the GIGO (garbage-in-garbage-out) effect when on clients’ site

- Discretionary spend takes a new shape as IT buyers continue to shoulder more risk than the business, presenting an opportunity for vendors to deliver on service-level outcomes enabled by agents

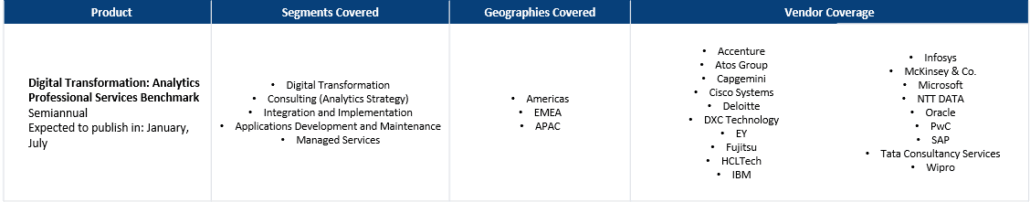

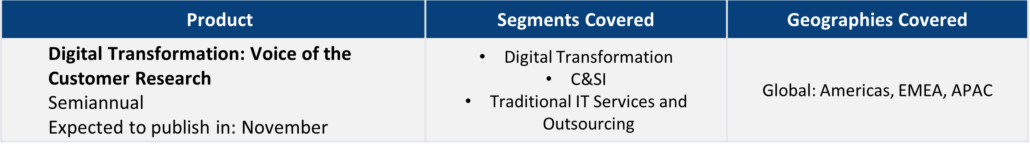

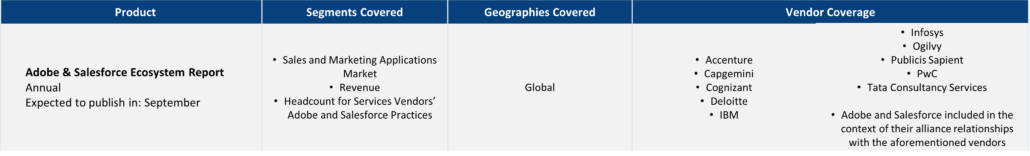

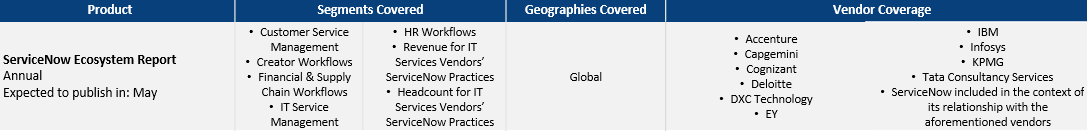

Explore TBR Digital Transformation Coverage

Ready to Level Up Your Insights?

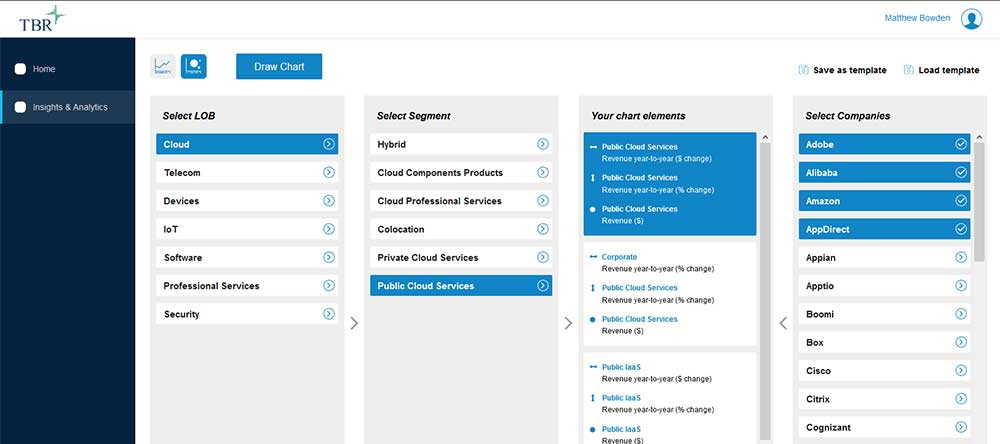

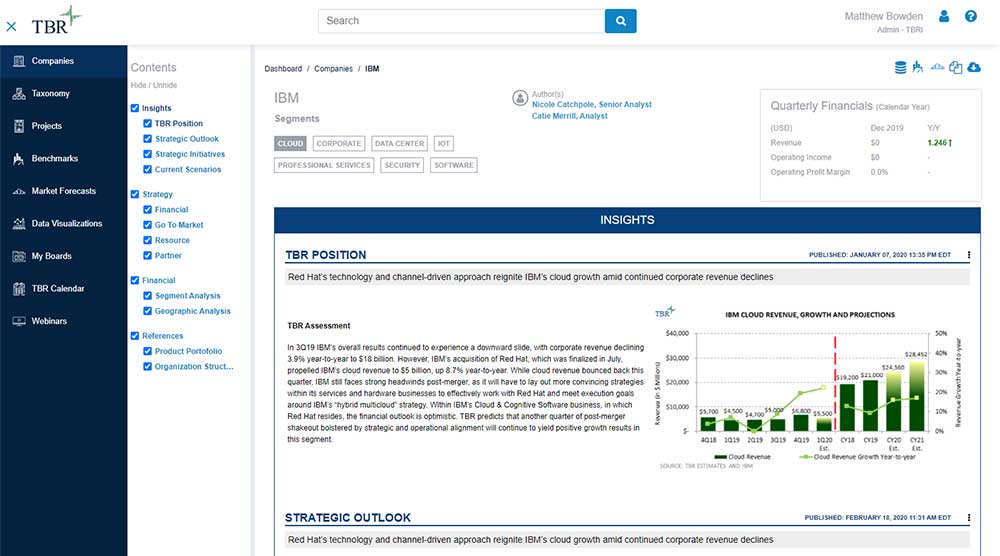

TBR’s digital-first competitive intelligence platform, TBR Insight Center™, allows for configured & customized views into IT markets, vendors, alliances and ecosystems.

Benefits delivered through TBR Insight Center™ include:

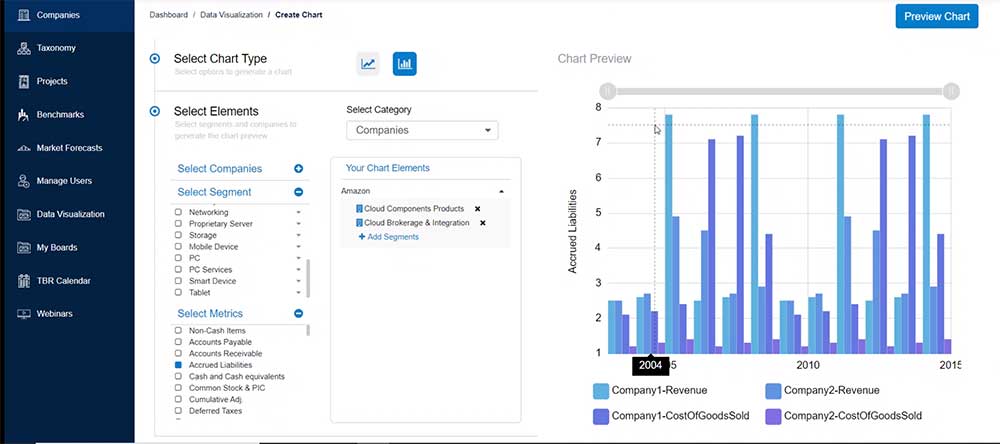

- Dynamic, configurable platform for TBR’s objective, independent and validated data and analysis

- Customizable views of millions of data points to match your specific needs

- Simple download functionality for customized views of analysis and feeds of data, saving staff dozens of hours per month

- Updates for market disruptions and emerging trends

Already a TBR Classic client but don’t have access to TBR Insight Center yet? Request access today.

5 Key Questions on Big Four Evolution and Strategy

/by Patrick Heffernan, Practice Manager and Principal AnalystThe Big Four professional services firms — Deloitte, EY, KPMG and PwC — have all been undergoing organizational changes in the last couple years. TBR regularly hears five questions about how these firms manage themselves, grow and change. Taking a longitudinal view allows TBR to see that recent restructurings, layoffs and offerings all reflect how these firms are trying to address the following: who gets the best talent, who decides what’s next, who sells, how everyone in a firm knows what everyone else does, and what role will managed services play.

Cloud Opportunity Expected to Increase Once DOGE Disruption Subsides

/by Allan Krans, Practice Manager and Principal AnalystRolling pockets of chaos and an overall cloud of uncertainty may be the best way to describe the first two months of the new Trump administration. One upside to federal contracts is that they tend to be long-term in nature, which provides some stability for all types of vendors with existing contracts. However, the current transition has been rocky, to say the least, as contracts are getting canceled, agency staffing is reduced, and the existence of entire agencies is called into question.