With TBR’s Digital Transformation market and competitive intelligence research, gain insight into how technology and services firms are investing, going to market, partnering and more as they help enterprises transition to digital solutions.

Learn how IT and business buyers approach digital applications, platforms and services within the context of disruptive market trends and emerging opportunities. Additionally, examine and dissect IT vendors’ ecosystem management as well as investments, performance and go-to-market strategies in both mature and emerging areas, including blockchain, Industrial IoT, analytics, customer experience and innovation centers, and cloud.

A free trial of TBR’s Insights Center platform gives you access to our entire Digital Transformation research portfolio and the ability to customize and curate reports detailing our analysis based on your company’s specific needs. Start your free trial today!

Trends we’re watching in 2026:

- Customer experience becomes the battleground of AI for growth

- Data as the new (old) currency

- How vendor portfolio offerings evolve to avoid the GIGO (garbage-in-garbage-out) effect when on clients’ site

- Discretionary spend takes a new shape as IT buyers continue to shoulder more risk than the business, presenting an opportunity for vendors to deliver on service-level outcomes enabled by agents

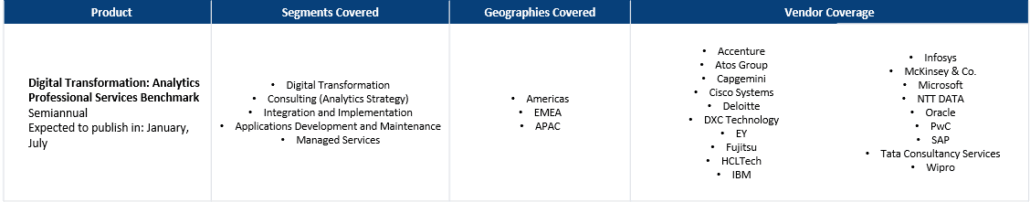

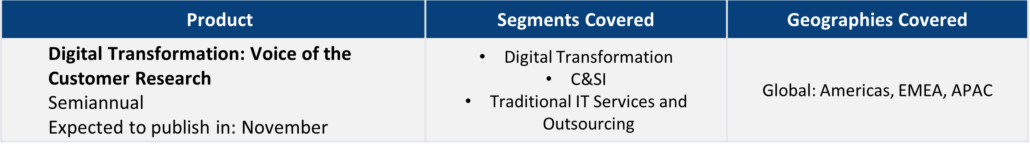

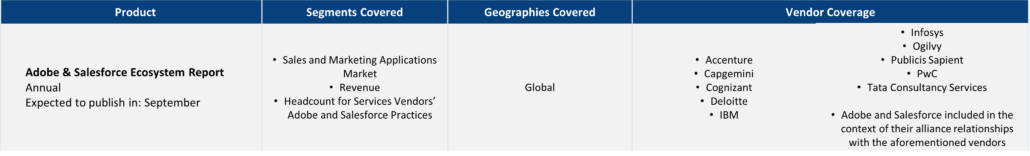

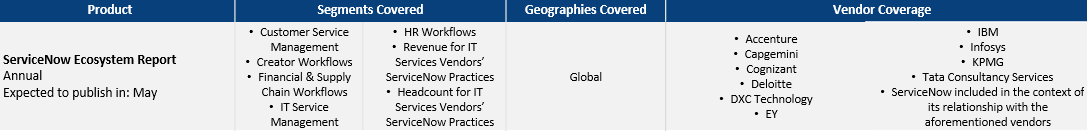

Explore TBR Digital Transformation Coverage

Ready to Level Up Your Insights?

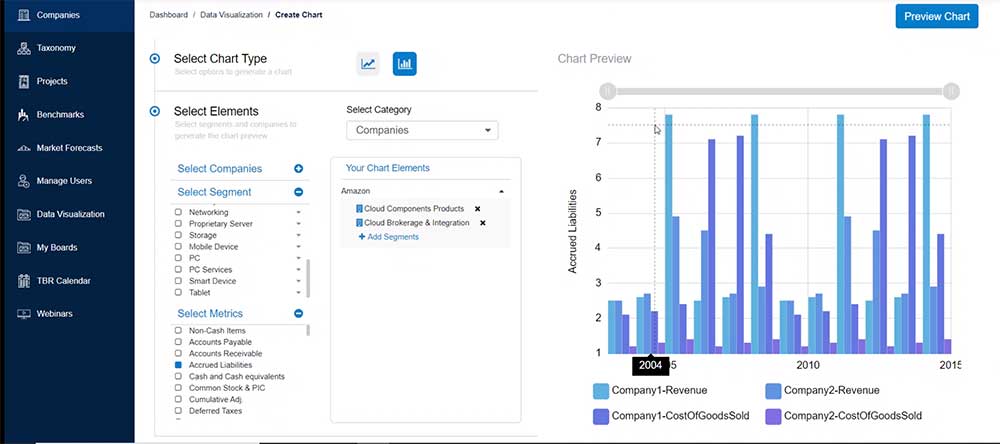

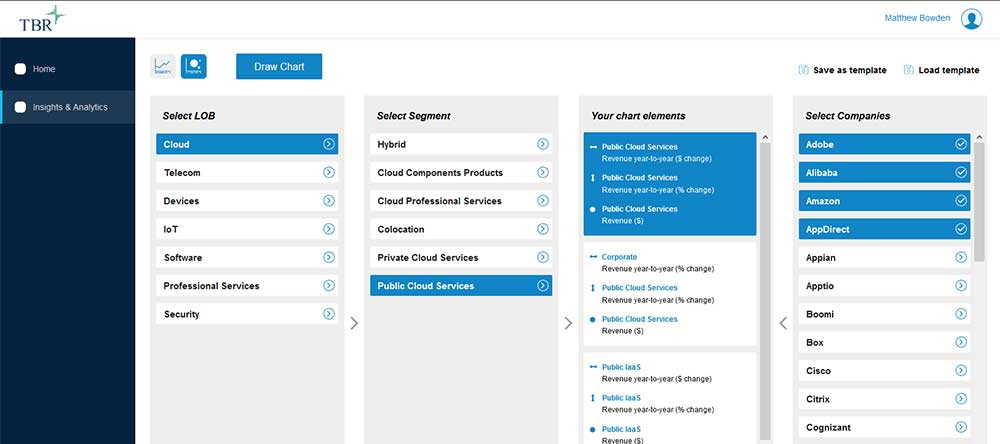

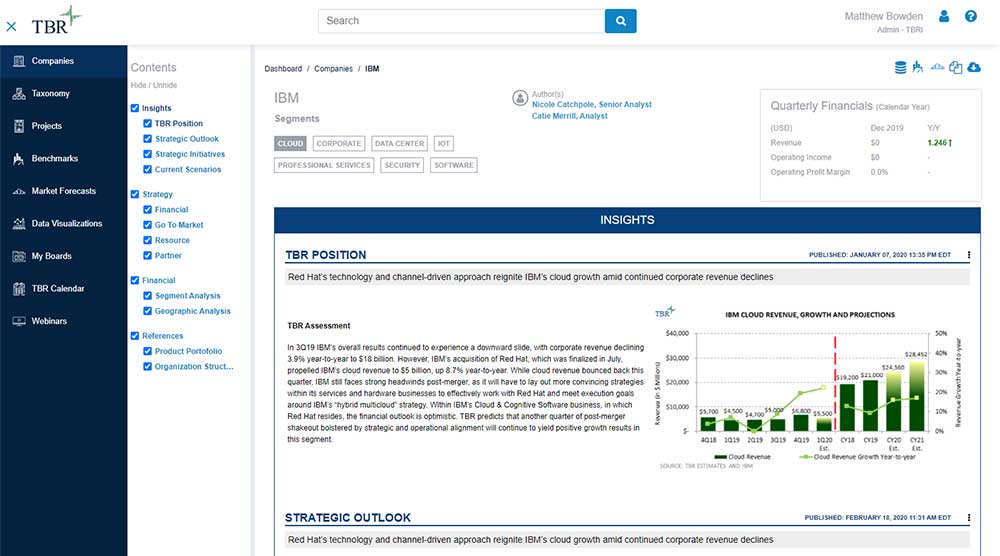

TBR’s digital-first competitive intelligence platform, TBR Insight Center™, allows for configured & customized views into IT markets, vendors, alliances and ecosystems.

Benefits delivered through TBR Insight Center™ include:

- Dynamic, configurable platform for TBR’s objective, independent and validated data and analysis

- Customizable views of millions of data points to match your specific needs

- Simple download functionality for customized views of analysis and feeds of data, saving staff dozens of hours per month

- Updates for market disruptions and emerging trends

Already a TBR Classic client but don’t have access to TBR Insight Center yet? Request access today.

Supply Chain Threatens the Rise of AI PC in 2026

/by Angela Lambert, Principal Analyst and Practice ManagerAI PC Ambitions Face an Unforgiving Reality of Memory Constraints and Budget Pressure For the PC industry, 2025 was the year that the end of Windows 10 support would drive a massive PC refresh cycle. As part of this refresh, AI PCs, devices with neural processing units (NPUs) designed to execute AI and machine learning […]

Alliances Will Extend Beyond Core Offerings as AI-driven Sales and Marketing Reshape Ecosystems

/by Bozhidar Hristov, Principal AnalystIT services companies have their limits, and clients have preferred technology vendors, leading IT services companies to look to alliances to drive new growth. We have seen this pattern before, but in 2026 we will see IT services companies extend those alliances into devices, connectivity and even silicon, requiring a multiparty alliance approach that will strain commercial models, sales strategies and alliance leaders across the ecosystem.