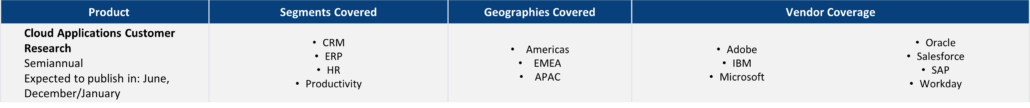

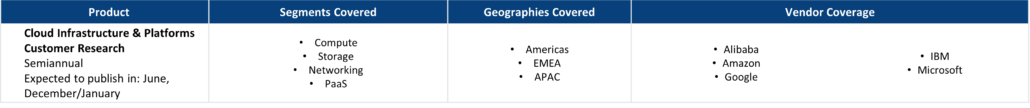

With TBR’s Cloud & Software market and competitive intelligence research, gain a true understanding of how technology and business strategies are being used by leading vendors to address the growing desire for cloud-enabled solutions. Our unique research in this space includes financial data that goes beyond just reported data, revenue and growth benchmarks, go-to-market analysis, ecosystem and partnership teardowns, and market sizing and forecasting.

Receive in-depth financial and business model analysis of the leading vendors in the cloud, rounded out with marketwide perspectives and direct insight from end-customer primary research. This combination of perspectives allows TBR to quantify the financial returns being generated from leading vendor strategies and identify where the market is headed based on feedback from customers making cloud investment decisions.

A free trial of TBR’s Insights Center platform gives you access to our entire Cloud and Software research portfolio and the ability to customize and curate reports detailing our analysis based on your company’s specific needs.

Start your free trial today!

Trends we’re watching in 2026:

- How vendors fare in the pivot from traditional SaaS to AI strategies

- Partial displacement of large language models

- From which vendors we’ll see strong PaaS portfolios and credible SLM roadmaps

- Partnership impact for Microsoft, Salesforce and SAP

Explore TBR Cloud & Software Vendor Coverage

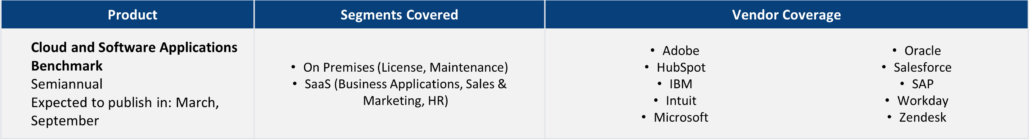

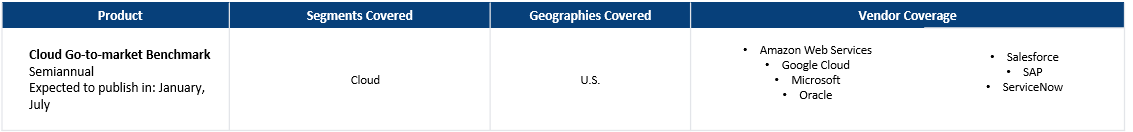

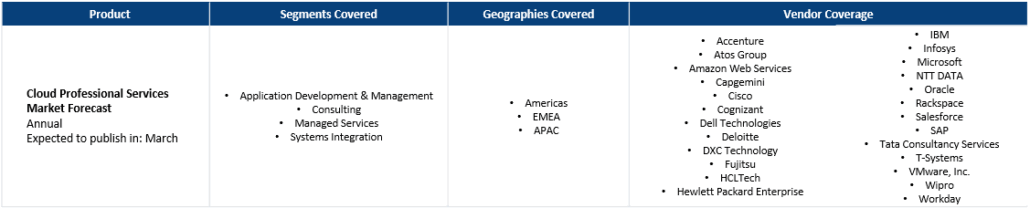

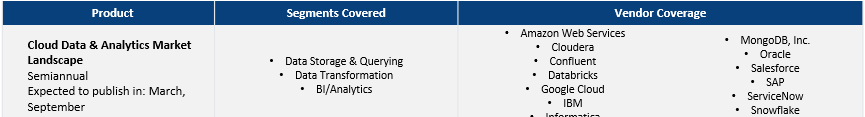

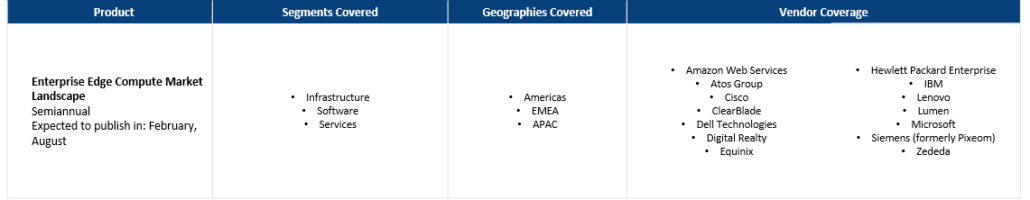

Market and competitor benchmarks provide a comparison of vendor performance in a market, including analysis on vendor strategies, financial performance, go-to-market and resource management. The research graphically portrays comparisons of vendors by myriad metrics, calling out leaders, laggards and business models. Defensible, data-informed views of market opportunity and operational best practices are highlighted in each publication. TBR also provides benchmark data in Excel pivot tables.

Current Market & Competitor Benchmarks:

- Cloud and Software Applications Benchmark

- Cloud Go-to-market Benchmark

- Cloud Infrastructure & Platforms Benchmark

- Colocation Benchmark

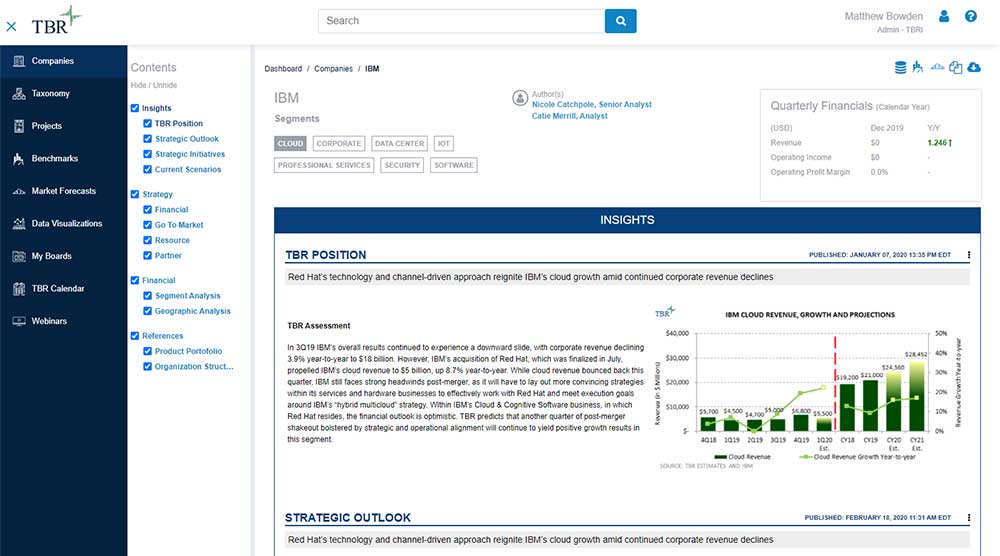

TBR’s vendor reports, snapshots and profiles provide deep-dive analysis of a single vendor across corporate strategies, tactics, SWOT analysis, financials, go-to-market strategies and resource strategies. Vendor performance is put in the context of market opportunity and competitive environment and our assessment shows where a vendor will success and its future market position.

Ready to Level Up Your Insights?

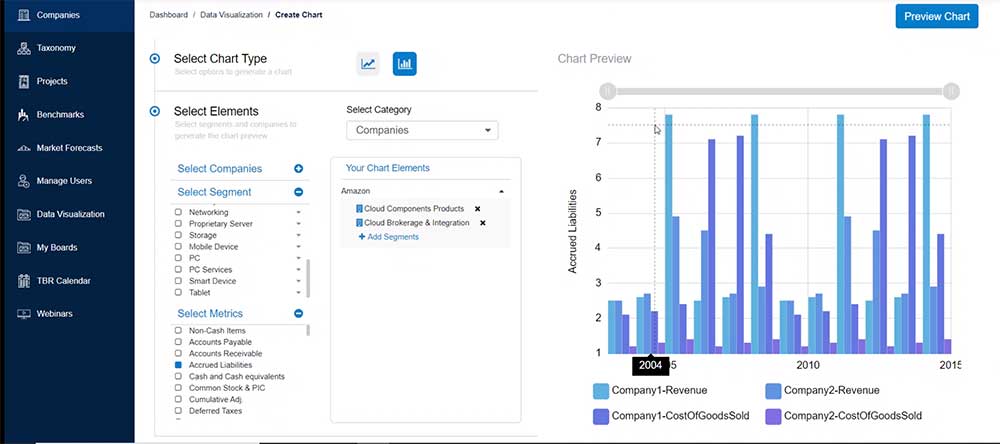

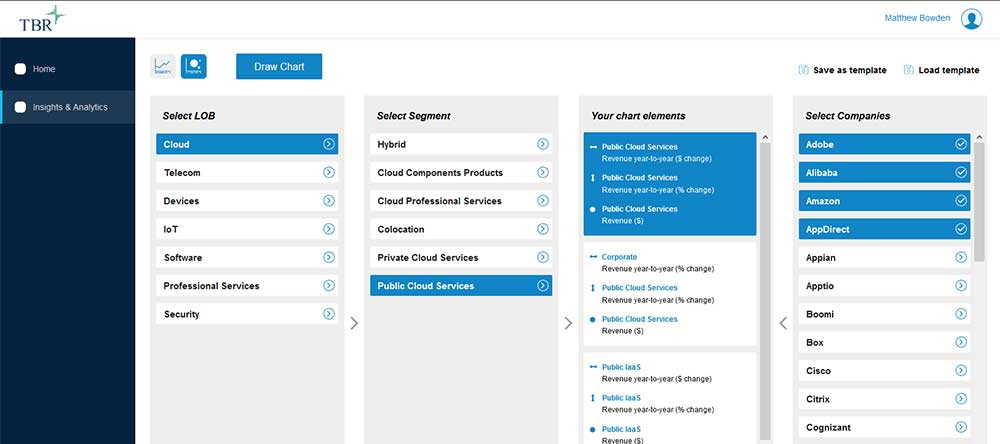

TBR’s digital-first competitive intelligence platform, TBR Insight Center™, allows for configured & customized views into IT markets, vendors, alliances and ecosystems.

Benefits delivered through TBR Insight Center™ include:

- Dynamic, configurable platform for TBR’s objective, independent and validated data and analysis

- Customizable views of millions of data points to match your specific needs

- Simple download functionality for customized views of analysis and feeds of data, saving staff dozens of hours per month

- Updates for market disruptions and emerging trends

Already a TBR Classic client but don’t have access to TBR Insight Center yet? Request access today.

IBM unveils 5-year full-stack quantum road map

/by adminIBM’s quantum road map includes dynamic circuits in 2022 IBM (NYSE: IBM) spent the second half of the 2010s laying the foundation for its quantum business. This foundation predominantly focused on hardware development and hardening until the available quantum systems at IBM supported more sophisticated software capabilities. In the 2020s, IBM is now able to […]

Government stimulus and enterprise digital transformation will accelerate 5G deployments

/by Michael Soper, Senior AnalystGovernment stimulus will accelerate 5G rollouts An increasing number of governments worldwide are becoming directly and/or indirectly involved in ensuring new technologies, such as 5G, are widely deployed in their respective countries. This spend is, in many cases, tied to economic recovery packages to counter the impact of the COVID-19 crisis and is being justified […]