Objective Data to Measure the World’s Leading Tech Companies

TBR clients have access to over $3 trillion in benchmarked revenue and 4-plus million unique data points across cloud and software, IT infrastructure, devices, professional services, management consulting, digital transformation, and telecom industries updated quarterly. With our proprietary data your team can highlight apple-to-apple comparisons of the leading vendors, by business unit, across all critical segments of the global ICT landscape; create data visualizations and qualitative analysis on vendor performance across key business metrics (e.g., revenue, expense, margin) by business unit, geo and industry vertical, and more.

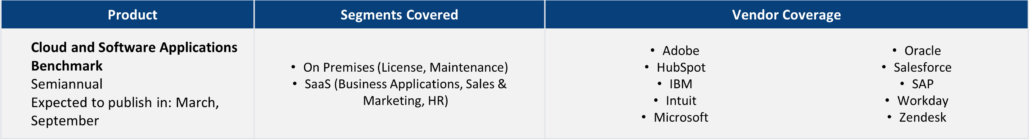

Market and competitor benchmarks provide a comparison of vendor performance in a market, including analysis on vendor strategies, financial performance, go-to-market and resource management. The research graphically portrays comparisons of vendors by myriad metrics, calling out leaders, laggards and business models. Defensible, data-informed views of market opportunity and operational best practices are highlighted in each publication. TBR also provides benchmark data in Excel pivot tables.

Current Market & Competitor Benchmarks:

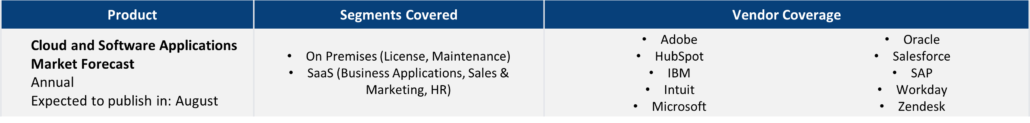

- Cloud and Software Applications Benchmark

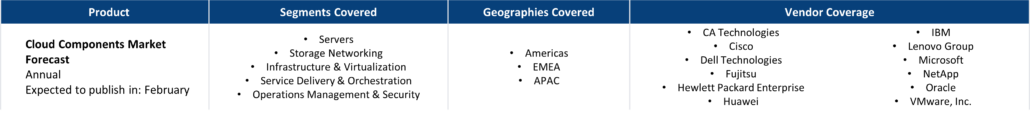

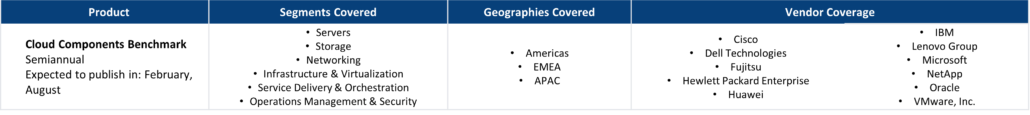

- Cloud Components Benchmark

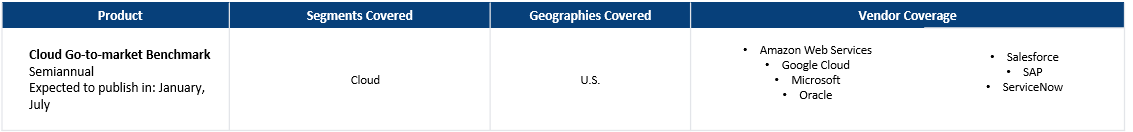

- Cloud Go-to-market Benchmark

- Cloud Infrastructure & Platforms Benchmark

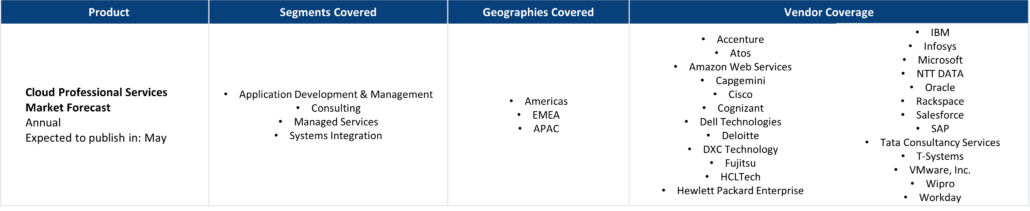

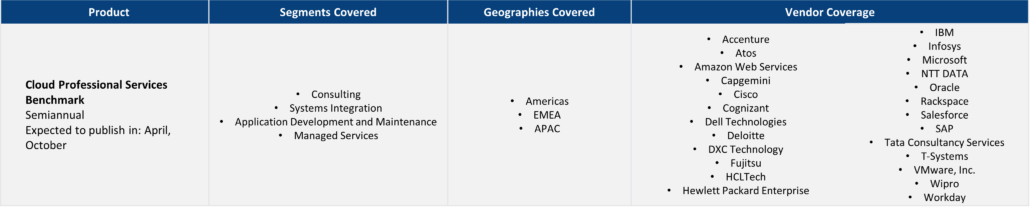

- Cloud Professional Services Benchmark

- Colocation Benchmark

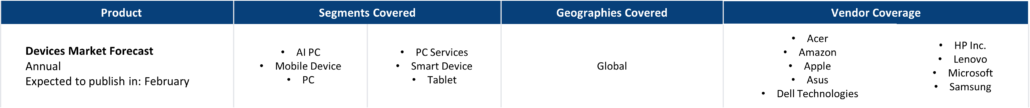

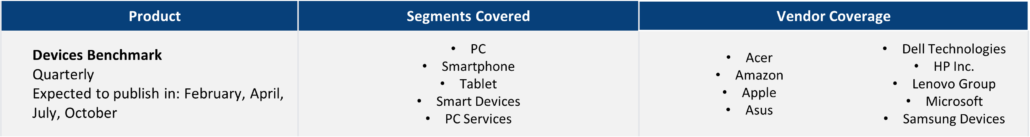

- Devices Benchmark

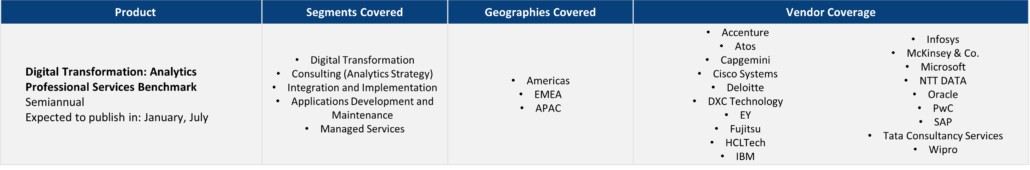

- Digital Transformation: Analytics Professional Services Benchmark

- Digital Transformation: Digital Marketing Services Benchmark

- Federal IT Services Benchmark

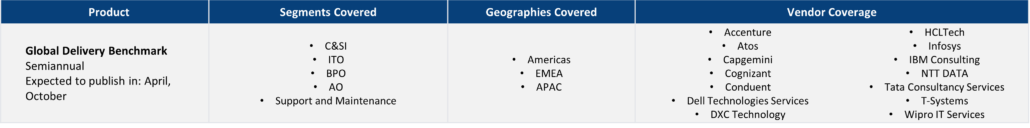

- Global Delivery Benchmark

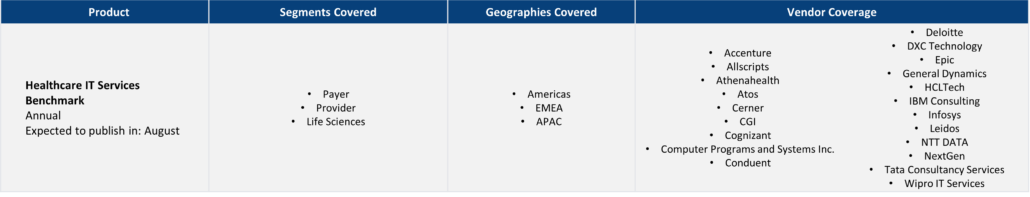

- Healthcare IT Services Benchmark

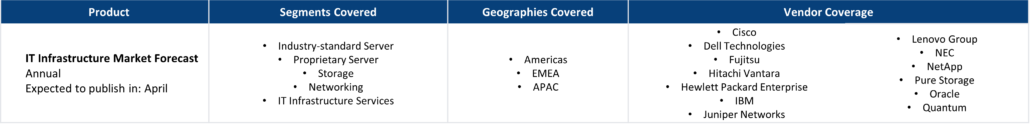

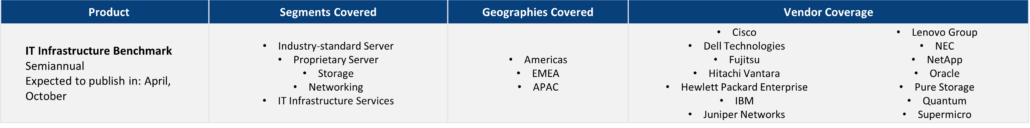

- IT Infrastructure Benchmark

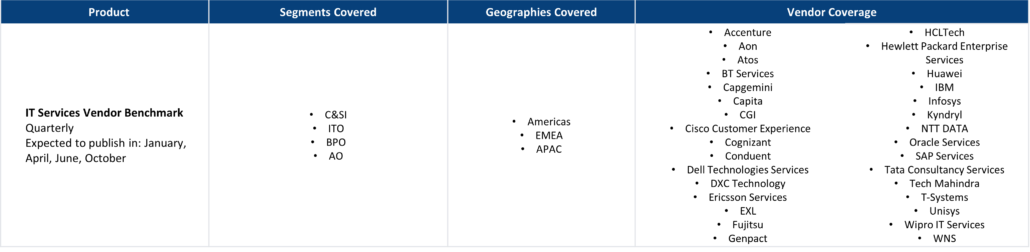

- IT Services Vendor Benchmark

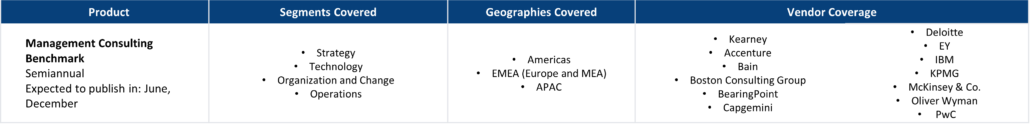

- Management Consulting Benchmark

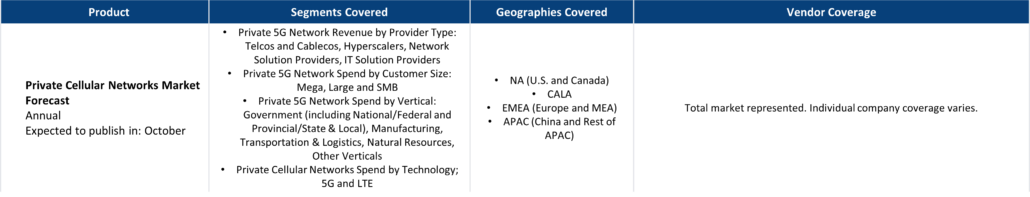

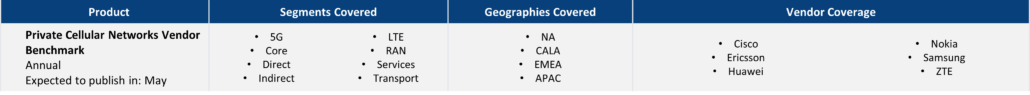

- Private Cellular Networks Vendor Benchmark

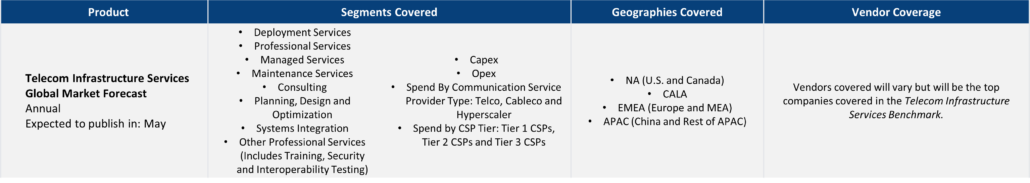

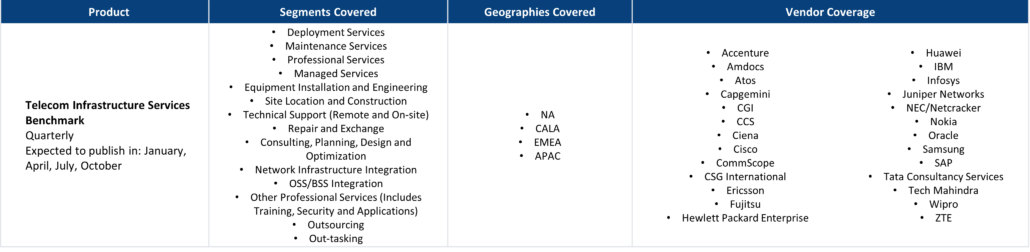

- Telecom Infrastructure Services Benchmark

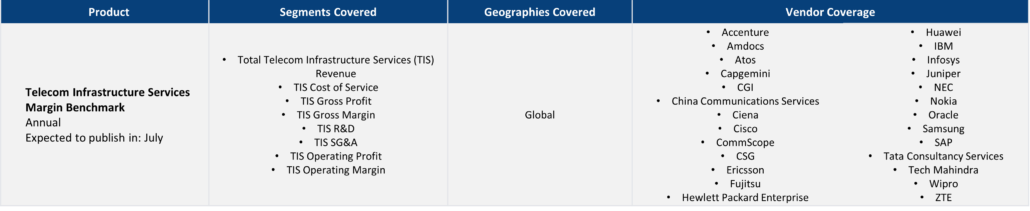

- Telecom Infrastructure Services Margin Benchmark

- U.S. Mobile Operator Benchmark

- U.S. Telecom Enterprise Operator Benchmark

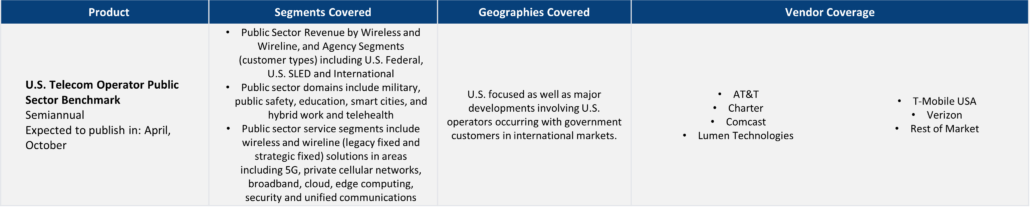

- U.S. Telecom Operator Public Sector Benchmark

Explore TBR Vendor Coverage

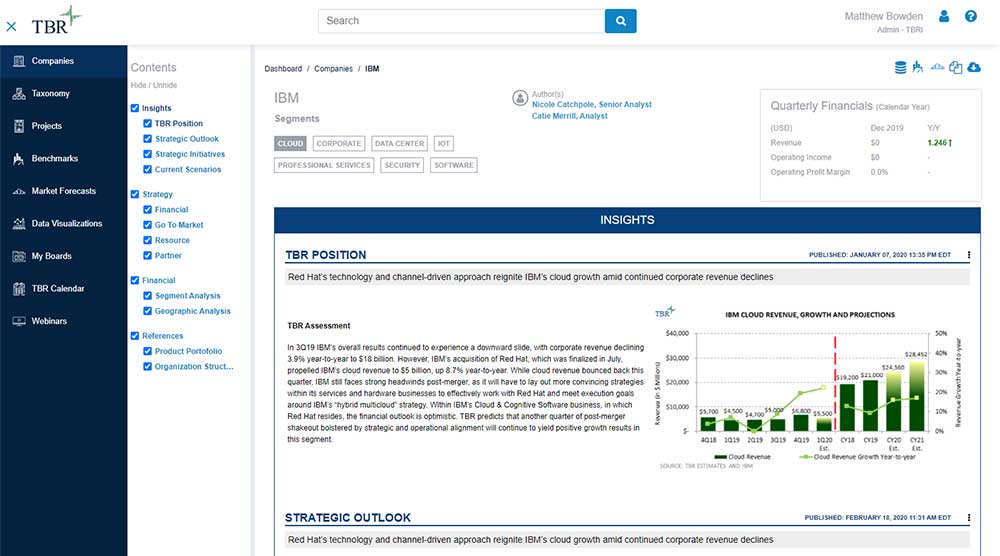

TBR’s vendor reports, snapshots and profiles provide deep-dive analysis of a single vendor across corporate strategies, tactics, SWOT analysis, financials, go-to-market strategies and resource strategies. Vendor performance is put in the context of market opportunity and competitive environment and our assessment shows where a vendor will success and its future market position.

- Accenture

- Adobe

- Alibaba

- Amazon Web Services

- Atos

- Capgemini

- IBM

- Infor

- Informatica

- Intuit

- Microsoft

- Oracle

- Sage

- Salesforce

- SAP

- ServiceNow

- Snowflake

- UKG

- VMware by Broadcom

Ready to Level Up Your Insights?

TBR’s digital-first competitive intelligence platform, TBR Insight Center™, allows for configured & customized views into IT markets, vendors, alliances and ecosystems.

Benefits delivered through TBR Insight Center™ include:

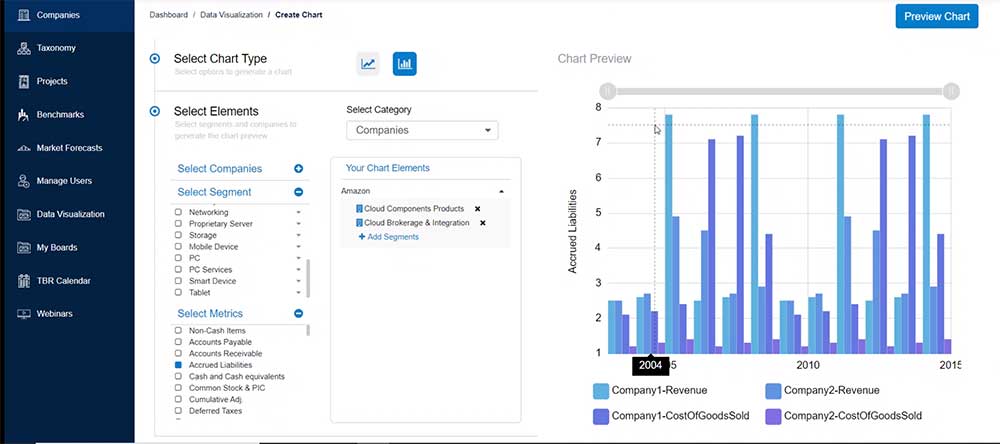

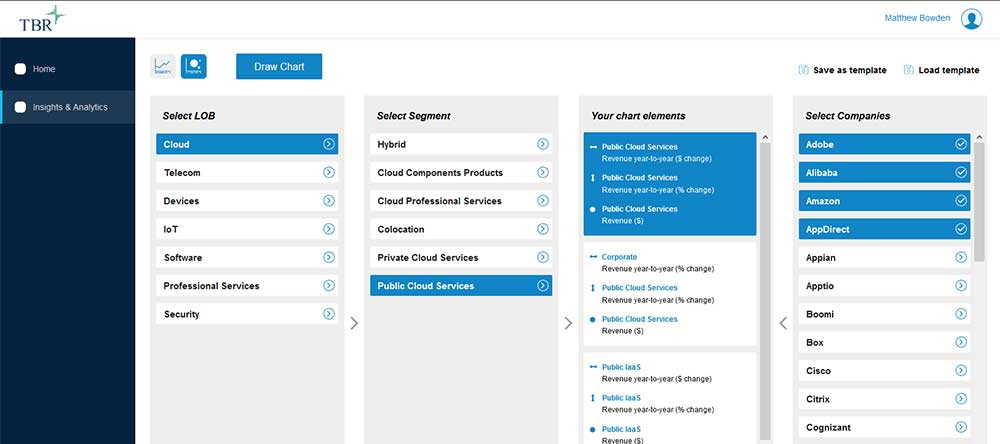

- Dynamic, configurable platform for TBR’s objective, independent and validated data and analysis

- Customizable views of millions of data points to match your specific needs

- Simple download functionality for customized views of analysis and feeds of data, saving staff dozens of hours per month

- Updates for market disruptions and emerging trends