With TBR’s Professional Services market and competitive intelligence research, understand the vendor strategies that are resulting in market-leading performance.

Examine portfolios, go-to-market strategies, services delivery, and revenue and profitability around IT services; strategy, operations, technology and organizational practices of management consulting firms; and vendor investment, divestment and portfolio repositioning of public sector vendors, focusing on professional, technical and IT services.

A free trial of TBR’s Insights Center platform gives you access to our entire Professional Services research portfolio and the ability to customize and curate reports detailing our analysis based on your company’s specific needs. Start your free trial today!

Trends we’re watching in 2025:

- Talent pyramid restructuring will challenge consultancies’ and IT services’ companies margins and HR management

- Generative AI revenues will shift from road-maps and MVPs to GRC and scale

- Political and macroeconomic uncertainty will fuel new consulting demand

Explore TBR Professional Services Coverage

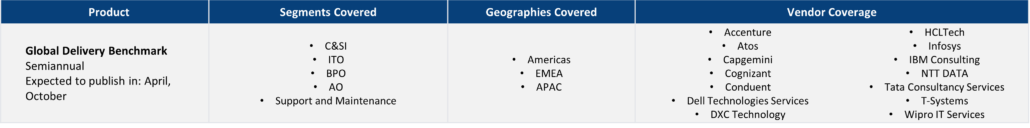

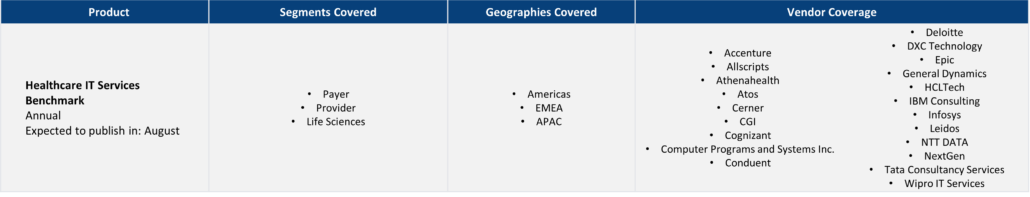

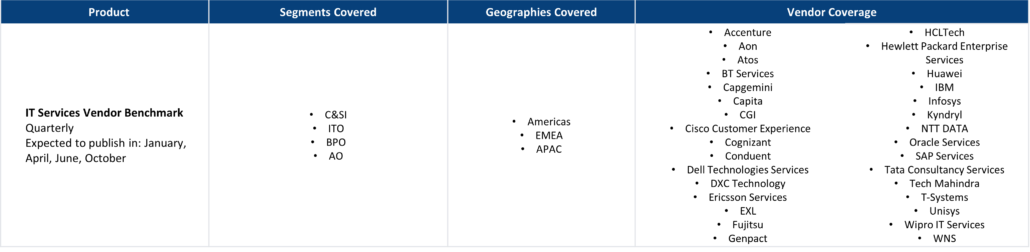

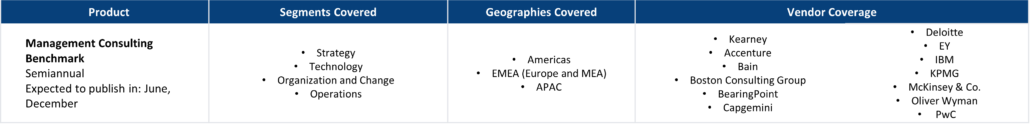

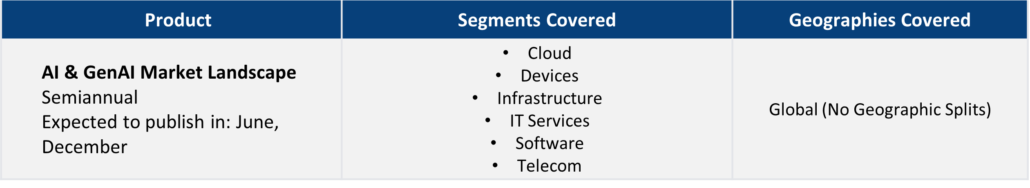

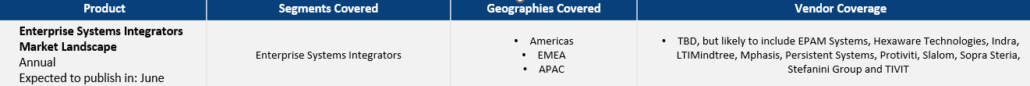

Market and competitor benchmarks provide a comparison of vendor performance in a market, including analysis on vendor strategies, financial performance, go-to-market and resource management. The research graphically portrays comparisons of vendors by myriad metrics, calling out leaders, laggards and business models. Defensible, data-informed views of market opportunity and operational best practices are highlighted in each publication. TBR also provides benchmark data in Excel pivot tables.

Current Market & Competitor Benchmarks:

- Global Delivery Benchmark

- Healthcare IT Services Benchmark

- IT Services Vendor Benchmark

- Management Consulting Benchmark

TBR’s vendor reports, snapshots and profiles provide deep-dive analysis of a single vendor across corporate strategies, tactics, SWOT analysis, financials, go-to-market strategies and resource strategies. Vendor performance is put in the context of market opportunity and competitive environment and our assessment shows where a vendor will success and its future market position.

Ready to Level Up Your Insights?

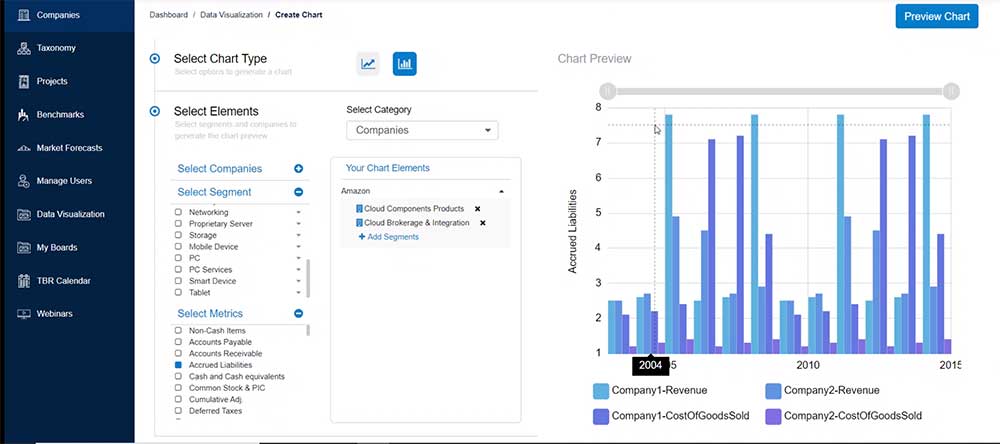

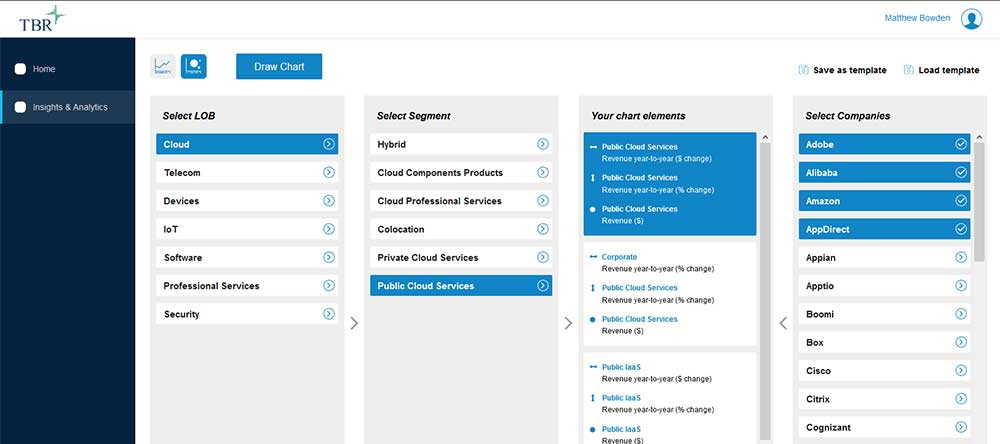

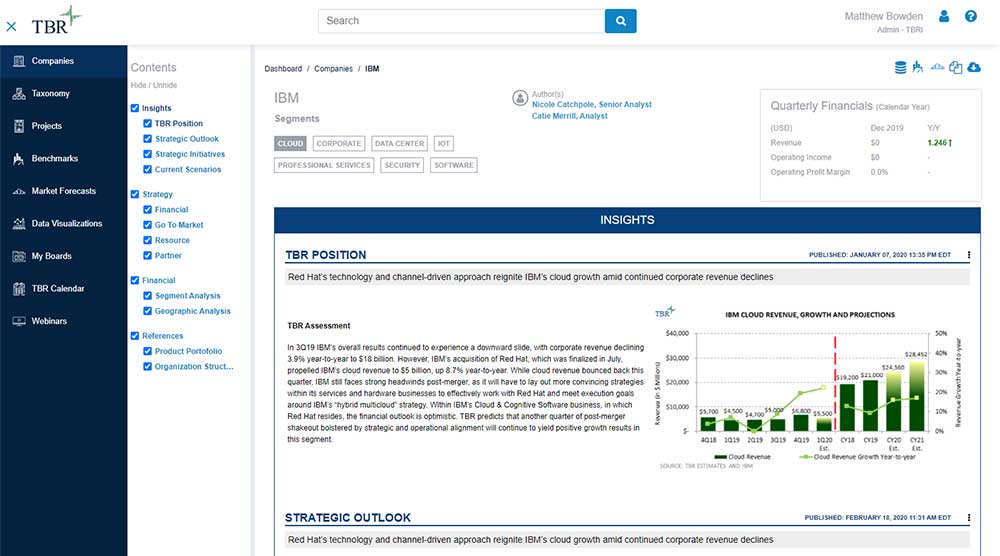

TBR’s digital-first competitive intelligence platform, TBR Insight Center™, allows for configured & customized views into IT markets, vendors, alliances and ecosystems.

Benefits delivered through TBR Insight Center™ include:

- Dynamic, configurable platform for TBR’s objective, independent and validated data and analysis

- Customizable views of millions of data points to match your specific needs

- Simple download functionality for customized views of analysis and feeds of data, saving staff dozens of hours per month

- Updates for market disruptions and emerging trends

Already a TBR Classic client but don’t have access to TBR Insight Center yet? Request access today.

SAP Sapphire 2025: Legacy Application Leader Moving Confidently Into a Data and AI Future

/by Alex Demeule, Senior AnalystSapphire 2025 marked a turning point, not because SAP introduced a radically new vision but because the company finally appears ready to execute on the one it has been quietly building for years. The narrative has matured, the tools are in place, and the platform is coherent. And the partners, customers and product ecosystem are starting to move together. Some heavy lifting remains, such as around migrations, data harmonization and partner fluency, but if SAP can stay focused on delivering scalable value through agentic AI, integrated data platforms and partner-enabled execution, the next chapter of the company’s growth story will look a lot less like catching up to the cloud and a lot more like leading in it.

DOGE Federal IT Vendor Impact Series: Maximus

/by John Caucis, Senior AnalystPartnerships will be integral as vendors across the federal IT market look to quickly demonstrate their value to the new administration. While Maximus has historically been quiet regarding its alliance activity, this could change as the vendor aims to avoid falling behind. For example, Maximus recently announced a partnership with Salesforce to augment its CX as a Service efforts. The Maximus Total Experience Management solution is being augmented with the Agentforce platform to provide clients with AI agents tailored to their needs that use data to adapt to citizens’ needs and simplify interactions.