With TBR’s Federal IT Services market and competitive intelligence research, understand and build strategies around industry trends to maximize addressable opportunity and minimize disruption as a core industry undergoes unprecedented change.

Gain insight into how defense contractors are going to market, forming alliances, planning for the future and more as they provide solutions and services tailored to customer objectives ranging from night vision goggles and underwater sensors to F-35s and Low-Earth Orbit satellite constellations.

Learn how federal contractors are approaching Joint All Domain Command and Control (JADC2), hypersonic technology, the new age space race, digital engineering and the evolving international defense scene.

A free trial of TBR’s Insights Center platform gives you access to our entire Federal IT Services research portfolio and the ability to customize and curate reports detailing our analysis based on your company’s specific needs. Start your free trial today!

Trends we’re watching in 2026:

- The new normal, post-government shutdown and the future of federal It modernization

- Impact of disruption in the federal civilian market and uncertain recovery timeline

- Increased partnership activity

Explore TBR Federal IT Services Coverage

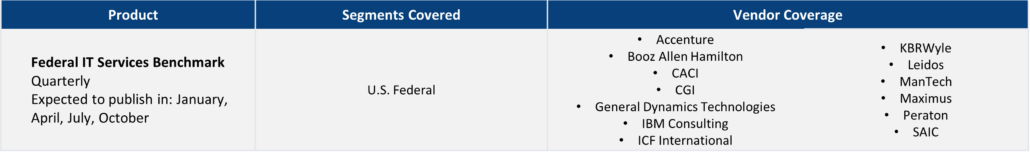

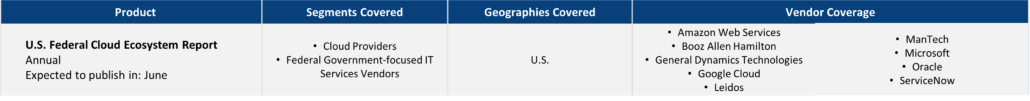

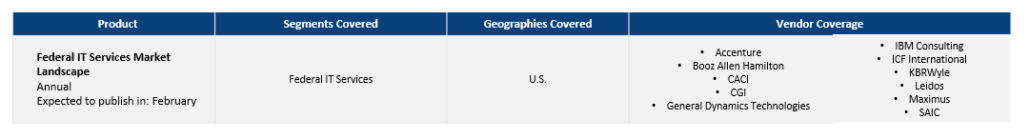

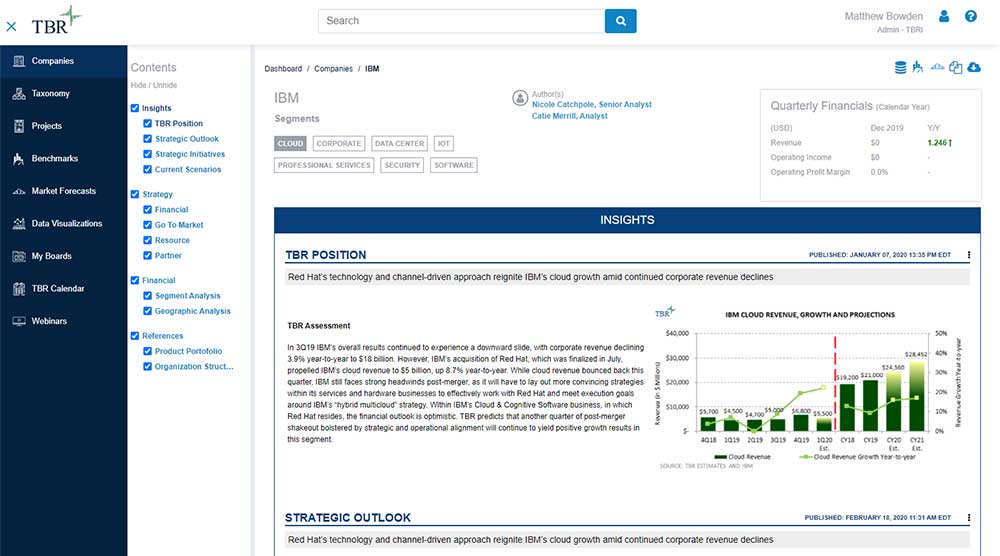

Market and competitor benchmarks provide a comparison of vendor performance in a market, including analysis on vendor strategies, financial performance, go-to-market and resource management. The research graphically portrays comparisons of vendors by myriad metrics, calling out leaders, laggards and business models. Defensible, data-informed views of market opportunity and operational best practices are highlighted in each publication. TBR also provides benchmark data in Excel pivot tables.

Current Market & Competitor Benchmarks:

- Federal IT Services Benchmark

TBR’s vendor reports, snapshots and profiles provide deep-dive analysis of a single vendor across corporate strategies, tactics, SWOT analysis, financials, go-to-market strategies and resource strategies. Vendor performance is put in the context of market opportunity and competitive environment and our assessment shows where a vendor will success and its future market position.

Ready to Level Up Your Insights?

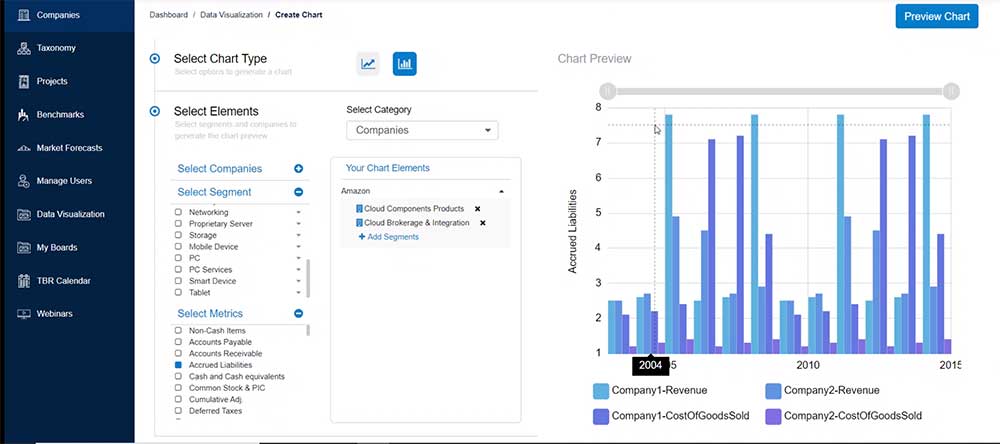

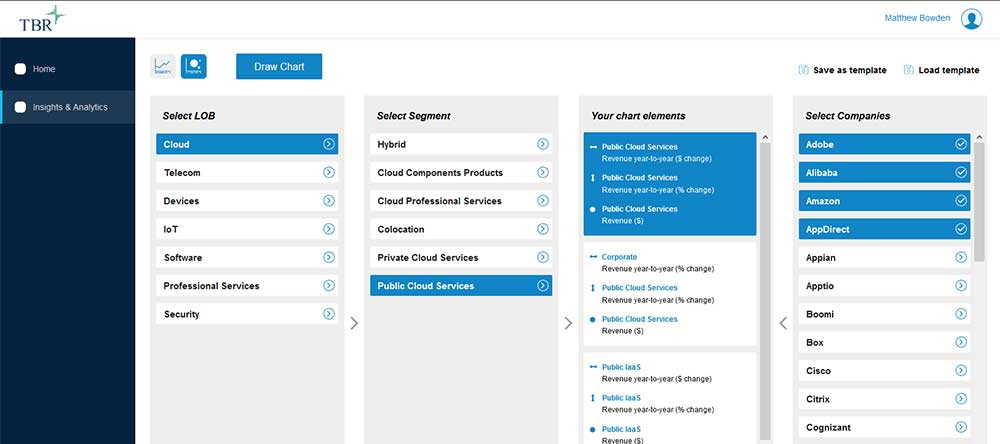

TBR’s digital-first competitive intelligence platform, TBR Insight Center™, allows for configured & customized views into IT markets, vendors, alliances and ecosystems.

Benefits delivered through TBR Insight Center™ include:

- Dynamic, configurable platform for TBR’s objective, independent and validated data and analysis

- Customizable views of millions of data points to match your specific needs

- Simple download functionality for customized views of analysis and feeds of data, saving staff dozens of hours per month

- Updates for market disruptions and emerging trends

Already a TBR Classic client but don’t have access to TBR Insight Center yet? Request access today.

Supply Chain Threatens the Rise of AI PC in 2026

/by Angela Lambert, Principal Analyst and Practice ManagerAI PC Ambitions Face an Unforgiving Reality of Memory Constraints and Budget Pressure For the PC industry, 2025 was the year that the end of Windows 10 support would drive a massive PC refresh cycle. As part of this refresh, AI PCs, devices with neural processing units (NPUs) designed to execute AI and machine learning […]

Alliances Will Extend Beyond Core Offerings as AI-driven Sales and Marketing Reshape Ecosystems

/by Bozhidar Hristov, Principal AnalystIT services companies have their limits, and clients have preferred technology vendors, leading IT services companies to look to alliances to drive new growth. We have seen this pattern before, but in 2026 we will see IT services companies extend those alliances into devices, connectivity and even silicon, requiring a multiparty alliance approach that will strain commercial models, sales strategies and alliance leaders across the ecosystem.